Get more information on Low-Voltage Circuit Breakers Market - Request Sample Report

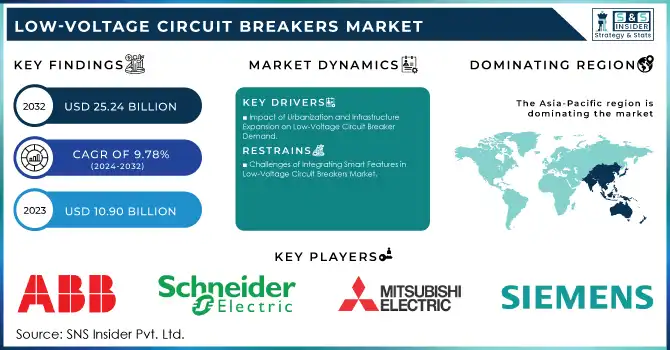

The Low-Voltage Circuit Breakers Market Size was valued at USD 10.90 billion in 2023 and is expected to reach USD 25.24 billion by 2032 and grow at a CAGR of 9.78 % over the forecast period 2024-2032.

The Low-Voltage Circuit Breakers Market is experiencing significant growth, driven by the increasing demand for electrical safety across various industries. As electricity consumption rises in residential, commercial, and industrial sectors, the need for efficient protection systems becomes increasingly vital. Low-voltage circuit breakers play an essential role in safeguarding against electrical faults, overloads, and short circuits, ensuring both the longevity of equipment and the safety of users. This market growth is further amplified by the rapid expansion of urban infrastructure and the integration of renewable energy sources such as solar and wind power. With the widespread adoption of renewable energy solutions, like photovoltaic and wind power generation, low-voltage circuit breakers are crucial in managing fluctuating power levels and maintaining grid stability. Technological advancements in these breakers, particularly the integration of digital and smart technologies, are boosting market demand. The rise of the Internet of Things (IoT) in power management systems has revolutionized electrical safety, enabling remote monitoring and control. These smart breakers enhance operational efficiency and real-time monitoring, making them indispensable for modern power management solutions focused on automation and energy efficiency. One key feature contributing to the market's growth is the short-time delay characteristic of low-voltage circuit breakers. This feature, which ranges from 6 to 30 cycles, ensures coordination with other protective devices. During testing, a current of 1.5 to 2.5 times the short-time pickup is injected, and the trip time is recorded, validated by manufacturer time-current curves. Ground fault pickup settings are another critical aspect, typically set between 20% to 60% of the continuous current rating of the overcurrent protection device, ensuring the breaker activates only when the current exceeds a safe level. These innovations and market trends highlight the increasing demand for smart, reliable, and efficient low-voltage circuit breakers.

Drivers

Impact of Urbanization and Infrastructure Expansion on Low-Voltage Circuit Breaker Demand

The rapid expansion of urban infrastructure and urbanization is a significant driver behind the growing demand for low-voltage circuit breakers. As cities grow, there is a rising need for electricity in residential, commercial, and industrial buildings. This surge in power demand makes low-voltage circuit breakers essential to ensure the safety and reliability of electrical systems in new developments. These breakers are critical in protecting circuits from overloads, short circuits, and electrical faults, thereby preventing damage to equipment and reducing fire risks. Increased urbanization leads to more construction of residential complexes, commercial facilities, and public infrastructure, all of which rely heavily on electrical systems. Low-voltage circuit breakers play a vital role in these settings by preventing electrical issues that can disrupt power supply or damage costly equipment. Additionally, the growing trend of smart cities, which integrate digital technologies into urban infrastructure, boosts the need for advanced, smart circuit breakers capable of managing electricity flows, ensuring grid stability, and offering real-time monitoring. The development of renewable energy sources like solar and wind also influences the demand for these breakers, as these systems require protection against fluctuating power outputs. As electrical systems become more complex, driven by automation and smart technologies, the need for efficient and reliable low-voltage circuit breakers will continue to rise, contributing to the market’s growth. This trend underscores the critical role these devices play in enhancing the safety and efficiency of modern urban electrical infrastructures.

Restraints

Challenges of Integrating Smart Features in Low-Voltage Circuit Breakers Market

Integrating smart features such as remote monitoring, fault detection, and IoT capabilities into low-voltage circuit breakers poses significant technical challenges, especially in older electrical infrastructures. Retrofitting these systems requires compatibility between new technologies and existing setups, often necessitating costly upgrades. The installation process becomes even more complex when considering the seamless integration of smart breakers with other network components like sensors and control units. Additionally, these advanced systems require specialized skills and training for technicians, as their complexity exceeds that of traditional circuit breakers. Without proper expertise, the safety benefits of features like real-time fault detection may not be fully realized, potentially undermining the effectiveness of the technology. Despite their advantages in safety, automation, and energy efficiency, these smart circuit breakers introduce integration difficulties and increased costs, creating barriers to widespread adoption.

by Type

In 2023, the Miniature Circuit Breaker (MCB) segment accounted for approximately 50% of the revenue in the low-voltage circuit breakers market, highlighting its dominance. This can be attributed to its widespread application across residential, commercial, and small-scale industrial sectors. MCBs are highly valued for their ability to provide reliable protection against overloads and short circuits, ensuring operational safety and equipment longevity. Their compact design, ease of installation, and cost-effectiveness make them the preferred choice for modern electrical systems, particularly in urbanizing regions with increasing demand for residential and commercial construction. Furthermore, advancements in smart MCBs, including features like remote monitoring and IoT compatibility, have further enhanced their adoption, aligning with the global trend toward automation and energy efficiency.

by Application

In 2023, the Energy Allocation segment dominated the low-voltage circuit breakers market, capturing approximately 57% of the total revenue. This growth is driven by the increasing need for efficient power distribution in both renewable energy systems and traditional electrical grids. Energy allocation applications rely heavily on low-voltage circuit breakers to ensure the stable and safe transfer of electricity across networks, protecting systems from overloads and short circuits. The rise of renewable energy sources, such as solar and wind power, further boosts demand for these breakers, as they are essential in managing fluctuating power levels and maintaining grid stability. Additionally, the growing focus on smart grids and automated power distribution has increased the adoption of advanced circuit breakers with energy-efficient features.

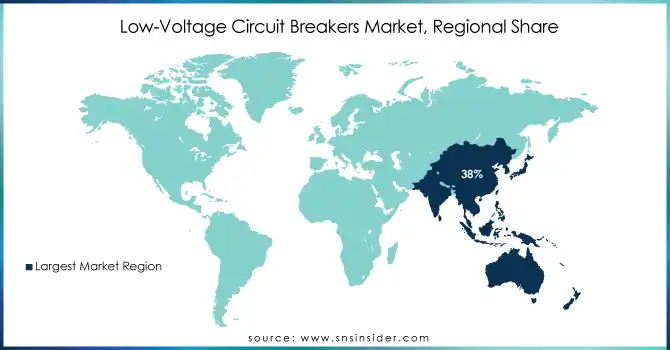

In 2023, Asia-Pacific dominated the low-voltage circuit breakers market, capturing approximately 38% of global revenue. The region's leadership is driven by rapid industrialization, urbanization, and infrastructure development in economies like China, India, and Southeast Asia. High electricity consumption in residential, commercial, and industrial sectors has fueled the adoption of advanced safety systems. China’s investments in renewable energy projects, including solar and wind power, have amplified the demand for low-voltage circuit breakers to manage variable power levels. Similarly, India’s smart cities initiatives and power grid upgrades have boosted the market. Furthermore, the growing deployment of electric vehicle (EV) charging infrastructure across the region has reinforced demand for reliable and efficient energy distribution solutions.

North America is projected to be the fastest-growing region in the low-voltage circuit breakers market from 2024 to 2032. The region's growth is fueled by significant investments in renewable energy, smart grid projects, and advanced infrastructure. The United States, in particular, leads the market with extensive developments in renewable energy integration, such as solar and wind power, which require sophisticated low-voltage circuit breakers to manage variable loads and ensure grid stability. Canada is also contributing to the market's growth through initiatives focused on modernizing power distribution systems and expanding electric vehicle (EV) charging infrastructure. As EV adoption accelerates, the demand for reliable energy allocation solutions grows, driving the need for advanced circuit breakers. Furthermore, advancements in industrial automation and IoT-based energy management systems in the region are promoting the adoption of smart and digital low-voltage circuit breakers, ensuring enhanced operational efficiency and safety.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the Major Players in Low-Voltage Circuit Breakers Market including their product offerings:

ABB – (S200, Tmax XT, Emax 2)

Schneider Electric – (Masterpact, Acti9, Easy9)

Mitsubishi Electric Corporation – (NA Series, NF Series)

Siemens AG – (Sentron, 3VA, 5SY)

Eaton Corporation – (Series C, Power Defense)

Shanghai Liangxin Electrical Co., Ltd – (LX Series)

DELIXI – (MCB, MCCB)

Hangshen Electric – (MCCB, MCB)

CHINT Group – (MCCB, MCB)

Hyundai Electric and Energy Systems Co., Ltd – (HB Series)

Fuji Electric FA Component and Systems Co., Ltd – (DS Series, S3D)

Changsu Switchgear Mfg Co., Ltd. – (MCB, MCCB)

Hager Group – (DX3, DXL, P30)

People Electric Appliance Group Co., Ltd – (MCB, MCCB)

Panasonic Corporation – (MCBs, MCCBs)

Danfoss – (Circuit Breakers, Fused Switches)

Rockwell Automation, Inc. – (Bulletin 140M)

Circutor SA – (Circuit Breakers, Power Control)

Lovato Electric S.P.A. – (MCB, MCCB)

WEG Group – (MCB, MCCB, Surge Protection)

Carling Technologies, Inc. – (Circuit Breakers, Thermal Magnetic)

Britec Electric – (MCBs, MCCBs)

Key suppliers for raw materials and components in the low-voltage circuit breakers market include global manufacturers of critical components such as insulating materials, metal contacts, and electronics. Here are some prominent companies:

Raw Materials and Insulating Components

DuPont - Provides specialized polymers like nylon and thermoplastics for insulating components.

BASF - Supplies advanced engineering plastics and resins used in circuit breaker housing.

SABIC - Offers high-performance thermoplastics and composite materials.

Metal Contacts and Conductive Materials

Aurubis AG - Supplies copper and silver for high-conductivity contacts.

Mitsui Mining & Smelting - Provides precious and base metals for electrical contacts.

Jiangxi Copper Corporation - A leading provider of copper-based materials for contacts.

Electronic Components

Infineon Technologies - Manufactures semiconductors and smart modules for intelligent circuit breakers.

NXP Semiconductors - Supplies microcontrollers and sensors for smart monitoring features.

Analog Devices, Inc. - Develops signal processing and power management ICs for breakers.

Standard and Smart Circuit Breaker Assemblies

Eaton Corporation - Sources components globally for integrated low-voltage solutions.

ABB Ltd. - Partners with multiple suppliers to produce both traditional and smart circuit breakers.

Schneider Electric - Combines in-house and outsourced components for advanced breaker manufacturing.

Recent Development

February 3, 2024: ABB Electrification Service launched a new initiative to replace outdated circuit breakers with intelligent digital versions, boosting energy capacity by up to 20% and cutting operational costs by 30%, while extending the equipment’s lifespan by 30 years.

March 6, 2024: Schneider Electric introduced the MasterPacT MTZ Active, a cutting-edge low voltage air circuit breaker at Data Centre World in London. This innovative product enables real-time power monitoring, enhances energy efficiency, and accelerates sustainability goals for critical industries like data centers, offering a QR code solution for quick issue identification and resolution.

May 24, 2024: Mitsubishi Electric has announced the establishment of a joint venture, Mitsubishi Electric FP Automation Vietnam Co., Ltd., to manufacture low-voltage circuit breakers, including air circuit breakers, starting in January 2025. The new factory in Vietnam will enhance Mitsubishi Electric's production capabilities to meet the growing demand for factory automation products across ASEAN countries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.90 Billion |

| Market Size by 2032 | USD 25.24 Billion |

| CAGR | CAGR of 9.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Miniature Circuit Breaker, Molded Case Circuit Breaker, Air Circuit Breaker) • By Application(Energy Allocation, Shut off Circuit, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Schneider Electric, Mitsubishi Electric Corporation, Siemens AG, Eaton Corporation, Shanghai Liangxin Electrical Co., Ltd, DELIXI, Hangshen Electric, CHINT Group, Hyundai Electric and Energy Systems Co., Ltd, Fuji Electric FA Component and Systems Co., Ltd, Changsu Switchgear Manufacturing Co., Ltd., Hager Group, People Electric Appliance Group Co., Ltd, Panasonic Corporation, Danfoss, Rockwell Automation, Inc., Circutor SA, Lovato Electric S.P.A., WEG Group, Carling Technologies, Inc., and Britec Electric. |

| Key Drivers | • Impact of Urbanization and Infrastructure Expansion on Low-Voltage Circuit Breaker Demand. |

| Restraints | • Challenges of Integrating Smart Features in Low-Voltage Circuit Breakers Market. |

Ans: The market size for the Low-Voltage Circuit Breakers Market was valued at USD 10.90 billion in 2023.

Ans: The expected CAGR of the Low-Voltage Circuit Breakers Market is 9.78% during the forecast period 2024-2032.

Ans: Asia-Pacific region dominated the Low-Voltage Circuit Breakers Market.

Ans: Increasing demand for reliable electrical safety solutions in residential, commercial, and industrial sectors due to growing infrastructure development and stringent safety regulations.

Ans: Miniature Circuit Breaker is dominating in Low-Voltage Circuit Breakers Market in 2023

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Sales and Production Volumes

5.2 Pricing Trends 2023

5.3 Technology Adoption

5.4 Consumer Preferences, by Region

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Low-Voltage Circuit Breakers Market Segmentation, by Type

7.1 Chapter Overview

7.2 Miniature Circuit Breaker

7.2.1 Miniature Circuit Breaker Market Trends Analysis (2020-2032)

7.2.2 Miniature Circuit Breaker Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Molded Case Circuit Breaker

7.3.1 Molded Case Circuit Breaker Market Trends Analysis (2020-2032)

7.3.2 Molded Case Circuit Breaker Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Air Circuit Breaker

7.3.1 Air Circuit Breaker Market Trends Analysis (2020-2032)

7.3.2 Air Circuit Breaker Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Low-Voltage Circuit Breakers Market Segmentation, by Application

8.1 Chapter Overview

8.2 Energy Allocation

8.2.1 Energy Allocation Market Trends Analysis (2020-2032)

8.2.2 Energy Allocation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Shut off Circuit

8.3.1Shut off Circuit Market Trends Analysis (2020-2032)

8.3.2Shut off Circuit Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1Others Market Trends Analysis (2020-2032)

8.4.2Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Low-Voltage Circuit Breakers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 ABB

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Schneider Electric

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Mitsubishi Electric Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Siemens AG

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Eaton Corporation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Shanghai Liangxin Electrical Co., Ltd

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Shanghai Liangxin Electrical Co., Ltd

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Hangshen Electric

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 CHINT Group

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Hyundai Electric and Energy Systems Co., Ltd

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Miniature Circuit Breaker

Molded Case Circuit Breaker

Air Circuit Breaker

By Application

Energy Allocation

Shut off Circuit

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The AI in Networks Market Size was valued at USD 8.33 Billion in 2023 and is expected to reach USD 101.29 Billion by 2032, at 32.14% CAGR, during 2024-2032

The Inverter Duty Motor Market Size was valued at USD 5.16 billion in 2023 and is expected to grow at a CAGR of 10.22% to reach USD 12.35 billion by 2032.

Insulation Monitoring Systems Market was valued at USD 741.7 Million in 2023 and is projected to grow at 5.23% CAGR to reach USD 1173.3 Million by 2032.

The 5G Device Testing Market was valued at USD 1.40 billion in 2023 and is expected to reach USD 2.59 billion by 2032, growing at a CAGR of 7.10% over the forecast period 2024-2032.

The Power Quality Equipment Market Size was valued at USD 34.20 billion in 2023 and is expected to grow at 6.21% CAGR to reach USD 58.81 billion by 2032.

The Multilayer Ceramic Capacitor Market Size was valued at USD 13.17 Billion in 2023 and is expected to grow at a CAGR of 5.72% During 2024-2032.

Hi! Click one of our member below to chat on Phone