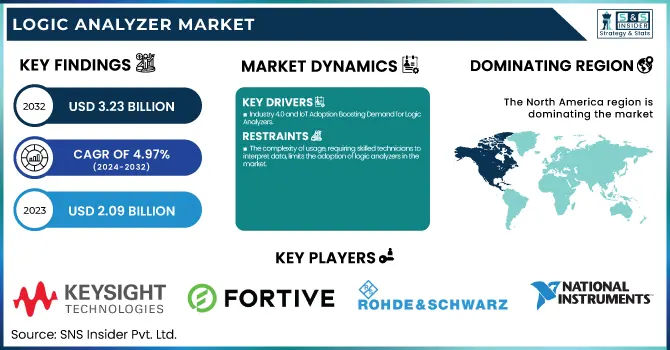

The Logic Analyzer Market Size was valued at USD 2.09 billion in 2023 and is projected to reach USD 3.23 billion by 2032, growing at a CAGR of 4.97% from 2024 to 2032. Key factors driving the market growth include the rising demand for cloud-based logic analyzers, the influences of Industry 4.0 and IoT, and the trends towards energy efficiency and sustainability. Development of advanced logic analyzers is further expedited through innovations and intense R&D efforts. Additionally, the U.S. market is seeing steady growth, with the country's market size projected to grow from USD 0.49 billion in 2023 to USD 0.63 billion by 2032, with a CAGR of 2.86%.

To Get more information on Logic Analyzer Market - Request Free Sample Report

As industries like automotive, telecommunications, and aerospace continue to evolve, the demand for more sophisticated and efficient testing tools, such as logic analyzers, is on the rise in the U.S., with a focus on improving product design, performance, and reliability. The shift towards cloud-based testing solutions and the integration of automation in testing processes are also contributing to the growth in the region.

Drivers:

Industry 4.0 and IoT Adoption Boosting Demand for Logic Analyzers

The growing adoption of Industry 4.0 and IoT technologies is a key driving factor for the Logic Analyzer market. Although only 10% of all manufacturing companies have converted to extensive use of these technologies but the demand for advanced testing and debugging instruments is extremely high; the demand for automation and connectivity testing tools such as logic analyzers to optimize connected systems and automated processes. In addition, it offers flexibility — enabling not just bulk processing, but product customization in discrete manufacturing. But many Industry 4.0 components, including machine learning and IoT, are nascent. These benefits stretch from increased efficiency, like the 25% increase Mercedes achieved in its S-class assembly, to significant cost savings such as the $1.5 billion annually that Total Energies aims to realize by 2025 through digital transformation initiatives. With the maturation of these technologies, the industries from different sectors will have to rely on logic analyzers at an increasing level to ensure that their advanced systems operate as expected and are reliable, thus driving the market growth.

Restraints:

The complexity of usage, requiring skilled technicians to interpret data, limits the adoption of logic analyzers in the market.

The complexity of using logic analyzers is one of the significant restraints in the market. These advanced tools often require skilled engineers or technicians to operate effectively. The steep learning curve associated with understanding and interpreting the data captured by logic analyzers can be a considerable challenge for businesses. Small and medium-sized enterprises (SMEs), in particular, may lack the necessary expertise or resources to fully leverage the capabilities of these devices. As a result, the perceived difficulty of operation can deter potential users, limiting market adoption and slowing down the widespread implementation of logic analyzers in certain industries. Consequently, organizations may opt for more user-friendly alternatives, such as software-based solutions, which can be easier to learn and integrate into their workflows.

Opportunities:

The Growing Role of Logic Analyzers in Telecommunication Testing

The rapid rollout of 5G networks worldwide is creating a significant demand for advanced testing and optimization tools to ensure the reliability and performance of telecommunication systems. Logic analyzers are crucial in this process as they facilitate the analysis of high-speed signals and data transmission, which is essential for the successful deployment and operation of 5G infrastructure. These tools enable engineers to diagnose and resolve issues in real-time, improving the efficiency of network design and maintenance. As 5G technology continues to expand, the need for precise and robust testing solutions will increase, positioning logic analyzers as an integral component of the telecommunication industry’s evolution, driving further growth in their adoption and development.

Challenges:

Challenges in Integrating Logic Analyzers with Other Test and Measurement Equipment

Logic analyzers, particularly older or less advanced models, may struggle with seamless integration into existing test and measurement setups. Many industries rely on a range of tools such as oscilloscopes, signal generators, and spectrum analyzers to perform comprehensive testing. This integration challenge is particularly problematic in complex environments like automotive or telecommunications, where multi-tool setups are common. The lack of interoperability can lead to inefficiencies, extended testing times, and increased costs for companies that need to ensure accurate and synchronized data across multiple platforms.

By Technology

The Digital Logic Analyzers segment held the largest revenue share of around 50% in the logic analyzer market in 2023. The popularity of digital logic analyzers in diverse industrial domains, as well as the fact that they provide the ability to analyze and debug complex digital logic circuits, can be attributed to this dominance. High-precision signal analyzers are widely used in telecommunications, automotive, and consumer electronics to capture, interpret, and debug digital signals. With these sectors traditionally using high-speed communication techniques and digital systems, the need for digital logic analyzers has been on the rise. Thanks to technological innovations such as higher bandwidth and deeper memory, their versatility allows engineers to conduct more detailed analyses, which in its turn has been leading to an increased market share.

The Mixed Signal Analyzers segment is expected to be the fastest-growing segment in the logic analyzer market from 2024 to 2032. This trend is fueled by the increasing complexity of contemporary electronic systems, which now integrate both digital and analog components. MSAs are vital for industries such as automotive, telecommunications, and consumer electronics, where devices need both analog and digital signal analysis simultaneously. With the ability to capture and analyze digital and analog waveforms simultaneously, these analyzers provide an efficient way to troubleshoot and optimize performance of integrated systems. The growth potential for the Mixed Signal Analyzers market is large and growing, driven by the increasing demand for complex and multifunctional devices.

By Channel

The Online Sales segment held the largest revenue share of approximately 51% in the logic analyzer market in 2023 and is projected to be the fastest-growing segment during the forecast period from 2024 to 2032. This growth is being fueled by the increasing use of e-commerce platforms on the back of convenience, competitive pricing, and evaluating several brands and models. Moreover, online sales give worldwide demography for regional customers to easily obtain logic analyzers. The accelerated adoption of digital technologies, remote work and the rise of industrial automation add fuel to the online sales growth. The online sales channel will continue to be instrumental to market growth, with digital distribution networks and the demand for hassle-free shopping only expanding.

By Application

The Consumer Electronics segment dominated the logic analyzer market with a revenue share of around 30% in 2023. The growth of this segment is attributed to the rising demand for advanced electronics along with a need for efficient testing and debugging tools to drive innovations in consumer devices. With the evolution of consumer electronics propelled by smart devices, wearables, and home automation systems, logic analyzers are increasingly in demand to validate the performance, reliability, and quality of such devices. Logic analyzers are essential for testing circuits and troubleshooting signal processing, as well as ensuring the quality of electronic components in consumer products. As consumer electronics is an industry that is constantly changing, enabling rapid and innovative technological advancements - playwrights of constant revenue generation for the logic analyzer market.

The Automotive segment is the fastest-growing in the logic analyzer market over the forecast period from 2024 to 2032. This growth is largely driven by the increasing integration of advanced electronics and embedded systems in modern vehicles, including electric vehicles (EVs), autonomous driving systems, and infotainment technologies. As automotive systems become more complex, with innovations such as advanced driver-assistance systems (ADAS) and in-car connectivity, the need for precise testing and debugging of electronic components becomes crucial. Logic analyzers are essential tools for engineers to verify signal integrity, debug communication protocols, and ensure system reliability. With the automotive industry's rapid transformation towards electric and connected vehicles, the demand for logic analyzers in this sector is expected to rise, making it a key growth driver for the market during the forecast period.

By End Use

The Manufacturing segment dominated the largest share of revenue in the logic analyzer market, accounting for approximately 40% in 2023. This is primarily due to the widespread adoption of automation and robotics in manufacturing processes, which require sophisticated testing and debugging tools to ensure the functionality and performance of complex control systems. Logic analyzers are crucial in this context, as they help diagnose issues in electronic circuits, communication systems, and embedded devices used in manufacturing equipment. As industries continue to embrace Industry 4.0 technologies, including IoT and smart factory solutions, the demand for precise and efficient testing tools like logic analyzers is expected to grow, solidifying the segment’s dominance in the market.

The Research and Development (R&D) segment is expected to be the fastest-growing in the logic analyzer market over the forecast period from 2024 to 2032. The demand for accurate testing as well as debugging tools in verticals such as telecom, automotive, customer electronics is on the rise due to the growing emphasis on innovation and advancement of technologies within sectors. Logic analyzers are a vital part of R&D for engineers to troubleshoot and debug complex electronic systems, prototypes, and communication networks. As companies allocate more of their resources on R&D of next-gen products, the demand for advanced logic analyzers to optimize the development process and guarantee maximum performance will drive the growth of this segment.

North America dominated the largest share of revenue in the logic analyzer market, accounting for approximately 40% in 2023. The region’s leadership can be attributed to the strong presence of key technology players, extensive industrial sectors, and high adoption of advanced testing and debugging tools. With a robust demand for logic analyzers in industries such as telecommunications, automotive, aerospace, and electronics, North America continues to be a hub for technological innovation. The growing emphasis on R&D, particularly in the U.S., along with the increasing deployment of advanced systems like 5G, is expected to further fuel market growth. Additionally, the presence of leading companies in the region continues to contribute significantly to the development and integration of logic analyzers into various applications.

The Asia-Pacific region is experiencing the fastest growth in the logic analyzer market during the forecast period from 2024 to 2032. The organic demand for electronics manufacturing combined with soaring industrialization and an uptick in the implementation of cutting-edge technologies including IoT, 5G, and AI has presented significant potential for the industry. Countries such as China, Japan, and India are increasing their tech sector and aiming for semiconductor manufacturing and mobile innovation are some of the key factors contributing to this growth. Additionally, increasing research and development in the region, coupled with huge investments in telecommunications and consumer electronics, is another key growth factor for the logic analyzer market in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the Major Players in Logic Analyzer Market along with their product:

Keysight Technologies (US) - Infiniium Series Oscilloscopes, UXR Series Oscilloscopes, 16900 Series Logic Analyzers.

Fortive (US) - Tektronix TLA Series Logic Analyzers, DPO/DSA Series Oscilloscopes, MSO Series Mixed Signal Oscilloscopes.

Rohde & Schwarz (Germany) - R&S RTM Series Oscilloscopes, R&S RTO Series Oscilloscopes, R&S FPC1000 Spectrum Analyzer.

National Instruments (US) - PXI-based Logic Analyzers, NI Digital Pattern Generators, LabVIEW-based Signal Analyzers.

Yokogawa Electric (Japan) - DL9000 Series Oscilloscopes, DLM Series Mixed Signal Oscilloscopes.

Teledyne (US) - LeCroy WaveRunner Series Oscilloscopes, Teledyne SP Devices Logic Analyzers.

Advantest Corporation (Japan) - T2000 Logic Analyzer, V93000 Series Automated Test Systems.

ARM Limited (UK) - ARM Development Tools, ARM Debugger (for logic analysis).

GAO Tek (Canada) - GAO 2600 Series Logic Analyzers, GAO Tek Signal Generators.

Rigol Technologies (China) - MSO5000 Series Mixed Signal Oscilloscopes, DS1000Z Series Digital Oscilloscopes.

Saleae, Inc (US) - Saleae Logic Pro 16, Saleae Logic 8.

Good Will Instrument Co., Ltd. (Taiwan) - GDS Series Oscilloscopes, GDS-2000A Series Logic Analyzers.

Zeroplus Technology Co., Ltd. (Taiwan) - Zeroplus Logic Analyzers (e.g., ZL30/40 Series).

Qingdao Hantek Electronic Co., Ltd. (China) - DSO Series Digital Oscilloscopes, Hantek Logic Analyzers (e.g., 6022BE).

NCI Logic Analyzers (US) - NCI Model 9000 Series Logic Analyzers, NCI Series Data Acquisition Systems.

Scientech Technologies Pvt. Ltd. (India) - Scientech Digital Logic Analyzers, Scientech Oscilloscopes.

OWON Technology (China) - OWON XDS Series Oscilloscopes, OWON Logic Analyzers.

IKALOGIC (France) - iMSO Series Mixed Signal Oscilloscopes, iLogic Series Logic Analyzers.

Red Pitaya (Europe) - STEMlab Series (includes logic analysis functionality), Red Pitaya Digital Oscilloscope.

GSAS Micro Systems Pvt Ltd. (India) - GSAS Digital Logic Analyzers, GSAS Signal Generators.

List of Suppliers who Provide Raw Material and Component in Logic Analyzer Market:

Texas Instruments

Analog Devices

NXP Semiconductors

Infineon Technologies

Broadcom

STMicroelectronics

Microchip Technology

Keysight Technologies

Rohde & Schwarz

Xilinx

On November 13, 2024, Rohde & Schwarz introduced the R&S RTB 2, a versatile 10-in-1 instrument combining an oscilloscope, protocol analyzer, logic analyzer, and waveform generator. With a 25 MHz waveform generator and built-in education mode, it offers enhanced functionality, making it ideal for engineers, students, and hobbyists in space-constrained environments.

On March 11, 2025, Red Pitaya announced the STEMlab 125-14 Gen 2, a next-generation upgrade to its software-defined instrumentation platform, offering enhanced performance, improved RF input, USB-C connectivity, and modularity for industrial, scientific, and educational applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.09 Billion |

| Market Size by 2032 | USD 3.23 Billion |

| CAGR | CAGR of 4.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Digital Logic Analyzers, Mixed Signal Analyzers, Analog Logic Analyzers) • By Channel (Online Sales, Offline Sales, Distributors, Value-Added Resellers) • By Application (Automotive, Consumer Electronics, Telecommunications, Aerospace, Industrial Automation) • By End Use (Research and Development, Manufacturing, Maintenance and Repair, Education and Training) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Keysight Technologies (US), Fortive (US), National Instruments (US), Yokogawa Electric (Japan), Teledyne (US), Advantest Corporation (Japan), ARM Limited (UK), GAO Tek (Canada), Rigol Technologies (China), Saleae, Inc (US), Good Will Instrument Co., Ltd. (Taiwan), Zeroplus Technology Co., Ltd. (Taiwan), Qingdao Hantek Electronic Co., Ltd. (China), NCI Logic Analyzers (US), Scientech Technologies Pvt. Ltd. (India), OWON Technology (China), IKALOGIC (France), Red Pitaya (Europe), GSAS Micro Systems Pvt Ltd. (India). |

Ans: The Logic Analyzer Market is expected to grow at a CAGR of 4.97% during 2024-2032.

Ans: The Logic Analyzer Market was USD 2.09 Billion in 2023 and is expected to Reach USD 3.23 Billion by 2032.

Ans: Increasing demand for advanced testing solutions, the rise of complex electronic systems, growth in the automotive and telecommunications sectors, and the need for efficient debugging and signal analysis.

Ans: The “Digital Logic Analyzers” segment dominated the Logic Analyzer Market.

Ans: North America dominated the Logic Analyzer Market in 2023

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption by Region

5.2 Adoption of Cloud-based Logic Analyzers

5.3 Impact of Industry 4.0 and IoT

5.4 Energy Efficiency and Sustainability Trends

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Logic Analyzer Market Segmentation, by Technology

7.1 Chapter Overview

7.2 Digital Logic Analyzers

7.2.1 Digital Logic Analyzers Market Trends Analysis (2020-2032)

7.2.2 Digital Logic Analyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Mixed Signal Analyzers

7.3.1 Mixed Signal Analyzers Market Trends Analysis (2020-2032)

7.3.2 Mixed Signal Analyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Analog Logic Analyzers

7.4.1 Analog Logic Analyzers Market Trends Analysis (2020-2032)

7.4.2 Analog Logic Analyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Logic Analyzer Market Segmentation, by Channel

8.1 Chapter Overview

8.2 Online Sales

8.2.1 Online Sales Market Trends Analysis (2020-2032)

8.2.2 Online Sales Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Offline Sales

8.3.1 Offline Sales Market Trends Analysis (2020-2032)

8.3.2 Offline Sales Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Distributors

8.4.1 Distributors Market Trends Analysis (2020-2032)

8.4.2 Distributors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Value-Added Resellers

8.5.1 Value-Added Resellers Market Trends Analysis (2020-2032)

8.5.2 Value-Added Resellers Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Logic Analyzer Market Segmentation, by Application

9.1 Chapter Overview

9.2 Automotive

9.2.1 Automotive Market Trends Analysis (2020-2032)

9.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Consumer Electronics

9.3.1 Consumer Electronics Market Trends Analysis (2020-2032)

9.3.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Telecommunications

9.4.1 Telecommunications Market Trends Analysis (2020-2032)

9.4.2 Telecommunications Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Aerospace

9.5.1 Aerospace Market Trends Analysis (2020-2032)

9.5.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Industrial Automation

9.6.1 Industrial Automation Market Trends Analysis (2020-2032)

9.6.2 Industrial Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Logic Analyzer Market Segmentation, by End Use

10.1 Chapter Overview

10.2 Research and Development

10.2.1 Research and Development Market Trends Analysis (2020-2032)

10.2.2 Research and Development Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Manufacturing

10.3.1 Manufacturing Market Trends Analysis (2020-2032)

10.3.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Maintenance and Repair

10.4.1 Maintenance and Repair Market Trends Analysis (2020-2032)

10.4.2 Maintenance and Repair Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Education and Training

10.5.1 Education and Training Market Trends Analysis (2020-2032)

10.5.2 Education and Training Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Logic Analyzer Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.4 North America Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.2.5 North America Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.6 North America Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.7.2 USA Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.2.7.3 USA Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.4 USA Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.8.2 Canada Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.2.8.3 Canada Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.4 Canada Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.9.2 Mexico Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.2.9.3 Mexico Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Logic Analyzer Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.7.2 Poland Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.1.7.3 Poland Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.8.2 Romania Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.1.8.3 Romania Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Logic Analyzer Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.4 Western Europe Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.5 Western Europe Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.7.2 Germany Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.7.3 Germany Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.8.2 France Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.8.3 France Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.4 France Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.9.2 UK Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.9.3 UK Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.10.2 Italy Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.10.3 Italy Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.11.2 Spain Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.11.3 Spain Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.14.2 Austria Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.14.3 Austria Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Logic Analyzer Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.4 Asia Pacific Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.5 Asia Pacific Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.7.2 China Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.7.3 China Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.4 China Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.8.2 India Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.8.3 India Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.4 India Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.9.2 Japan Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.9.3 Japan Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.4 Japan Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.10.2 South Korea Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.10.3 South Korea Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.11.2 Vietnam Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.11.3 Vietnam Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.12.2 Singapore Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.12.3 Singapore Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.13.2 Australia Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.13.3 Australia Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.4 Australia Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Logic Analyzer Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.4 Middle East Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.1.5 Middle East Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.7.2 UAE Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.1.7.3 UAE Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Logic Analyzer Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.4 Africa Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.2.5 Africa Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.6 Africa Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Logic Analyzer Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.4 Latin America Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.6.5 Latin America Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.6 Latin America Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.7.2 Brazil Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.6.7.3 Brazil Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.8.2 Argentina Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.6.8.3 Argentina Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.9.2 Colombia Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.6.9.3 Colombia Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Logic Analyzer Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Logic Analyzer Market Estimates and Forecasts, by Channel (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Logic Analyzer Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Logic Analyzer Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Keysight Technologies

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Fortive

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 National Instruments

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Yokogawa Electric

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Teledyne

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Advantest Corporation

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 ARM Limited

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 GAO Tek

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Rigol Technologies

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Saleae, Inc

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technology

Digital Logic Analyzers

Mixed Signal Analyzers

Analog Logic Analyzers

By Channel

Online Sales

Offline Sales

Distributors

Value-Added Resellers

By Application

Automotive

Consumer Electronics

Telecommunications

Aerospace

Industrial Automation

By End Use

Research and Development

Manufacturing

Maintenance and Repair

Education and Training

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Non-Destructive Inspection Equipment Market was valued at USD 3.2 Billion in 2023 and is expected to reach USD 5.7 Billion by 2032, growing at a CAGR of 6.04% from 2024-2032.

The Automated Passenger Counting and Information System Market Size was valued at USD 7.98 Billion in 2023 and is expected to reach USD 18.21 Billion by 2032 and grow at a CAGR of 9.7% over the forecast period 2024-2032.

The Smart Appliances Market Size was valued at USD 43.80 billion in 2023 and is expected to grow at a CAGR of 15.64% to reach USD 161.44 billion by 2032.

The Acoustic Microscopy Market Size was valued at USD 1.27 billion in 2023 and is expected to grow at a CAGR of 5.62% to reach USD 2.06 billion by 2032.

The X-ray Inspection System Market was valued at USD 0.76 billion in 2023 and is expected to reach USD 1.22 billion by 2032, growing at a CAGR of 5.42% over the forecast period 2024-2032.

Data Center Interconnect Market Size was valued at USD 11.45 billion in 2023 and is expected to reach USD 37.53 billion by 2032 and grow at a CAGR of 14.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone