Get more information on Location-Based Services Market - Request Sample Report

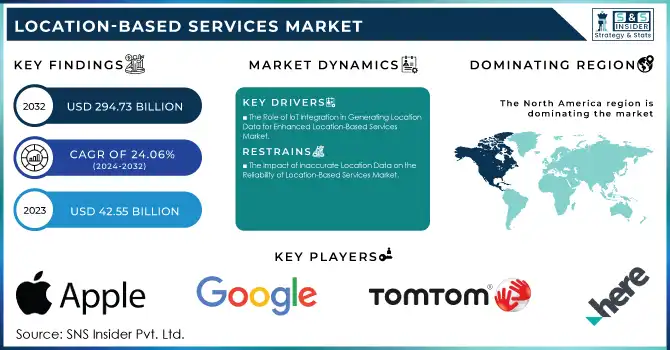

The Location-Based Services Market was valued at USD 42.55 billion in 2023 and is expected to reach USD 294.73 billion by 2032, growing at a CAGR of 24.06% from 2024-2032.

The Location-Based Services market has experienced significant growth in recent years, driven by advancements in technology, particularly GPS and mobile internet connectivity. As smartphone usage continues to rise globally, with approximately 7.21 billion smartphone users, representing about 90% of the world’s population, the demand for location-based services has surged, with consumers seeking personalized, real-time location-based information. 80% of consumers are willing to share their location data in exchange for personalized offers, further fueling the growth of location-based services market. This has led to an increased adoption of LBS across various industries, such as retail, transportation, healthcare, and entertainment, where businesses leverage location data to enhance customer experiences and improve service delivery.

With the rapid growth in consumer demand for location-aware applications, businesses are tapping into new opportunities to create innovative solutions that cater to diverse customer needs. The integration of artificial intelligence, augmented reality, and machine learning with LBS has opened doors for more sophisticated and interactive services. Moreover, as the market expands, there is growing potential for LBS to enable better urban planning, smarter transportation networks, and advanced location-based marketing strategies, contributing to enhanced business efficiencies and customer satisfaction. 85% of brands say location-based marketing has significantly improved their customer experience, and 89% of marketers using location data report higher sales. These statistics highlight how LBS not only drives consumer engagement but also directly impacts business performance and growth.

The future of the Location-Based Services market appears promising, with significant opportunities emerging in the development of 5G technology and the expansion of Internet of Things devices. The number of IoT devices worldwide reached 15.9 billion in 2023, and with over 170 million new 5G connections added in Q3 2024 alone, the increased speed and connectivity of 5G networks will enhance the real-time capabilities of LBS, making them more accurate and responsive. Additionally, as IoT devices become more ubiquitous, the fusion of location data with these devices will unlock new applications, such as predictive analytics for traffic, location-based health monitoring, and more personalized advertising experiences, shaping the future of the LBS market.

DRIVERS

The Role of IoT Integration in Generating Location Data for Enhanced Location-Based Services Market

Integrating Internet of Things devices into daily life plays a pivotal role in driving the Location-Based Services market. With the rise of smart homes, wearable technologies, and connected cars, IoT devices generate vast amounts of real-time location data. In 2033, the highest number of IoT devices will be found in China, with around 8 billion consumer devices, and in the U.S., 60.4 million households actively used smart home devices in 2023. This data can be leveraged for a variety of LBS applications, such as personalized health monitoring, real-time traffic management, and fleet optimization. For example, wearables can track an individual's health metrics while providing location-based insights, while connected cars enable more efficient routing and safety features. As the number of IoT devices grows, the demand for advanced LBS that can interpret and act on location data will expand, enhancing convenience, efficiency, and user experience across various sectors.

The Surge in Location-Based Advertising for Targeted Marketing Campaigns

The growing interest in location-based advertising is transforming the marketing landscape. Advertisers are leveraging location data to deliver personalized, context-aware advertisements, offers, and promotions in real time. By understanding a consumer's physical location, businesses can tailor their messaging to specific regions, shopping habits, or times of day, significantly improving relevance and engagement. 68% of companies have adopted location-based marketing to drive growth. For example, in 2023, Walmart Connect used ad targeting techniques such as purchase data, demographic information, geographic targeting, and lookalike audiences to effectively reach customer segments. This hyper-targeted approach boosts customer experience, increases conversion rates, and strengthens brand loyalty. Retailers, restaurants, and service industries are especially benefiting, using location-based ads to attract nearby customers with special offers.

RESTRAINTS

The Impact of Inaccurate Location Data on the Reliability of Location-Based Services Market

Accurate location data is essential for the effectiveness of Location-Based Services, but several factors can lead to inaccurate or inconsistent data. GPS signal errors, network limitations, or interference from urban structures, such as tall buildings or tunnels, can distort location accuracy. This is particularly problematic for LBS applications in critical areas like emergency services, where precise location data is crucial for timely response, or autonomous vehicles, where small errors can lead to dangerous situations. Inaccurate data reduces the reliability of LBS, leading to potential safety issues and decreased user trust. As a result, businesses and service providers face challenges in ensuring data accuracy, which can limit the adoption and expansion of LBS in certain industries.

Privacy and Security Risks Hindering the Growth of Location-Based Services Market

The collection and use of personal location data in Location-Based Services raise significant privacy and security concerns. Consumers are increasingly wary of surveillance and the potential misuse of their sensitive information. As a result, regulatory frameworks like the GDPR and CCPA impose stringent guidelines on how location data can be collected, stored, and shared. While these regulations aim to protect users, they also restrict the scope of LBS applications, particularly when it comes to cross-border data transfers and user consent. Companies offering LBS must ensure compliance with these regulations, which can result in increased costs and limitations on service offerings. Privacy concerns may also discourage users from fully embracing LBS, impacting adoption and market growth.

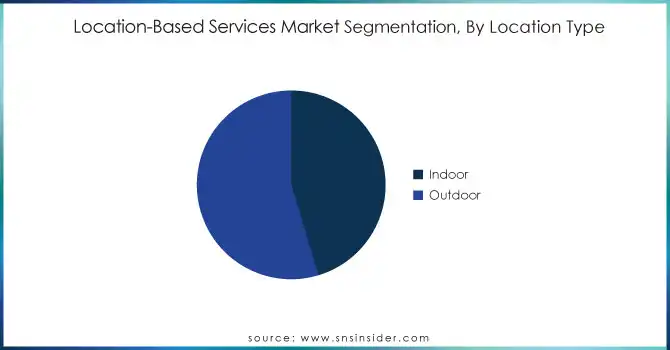

BY LOCATION TYPE

In 2023, the Outdoor segment dominated the Location-Based Services market, accounting for the highest revenue share of approximately 55%. This dominance is primarily attributed to the widespread use of LBS applications for navigation, real-time traffic monitoring, and location-based advertising in outdoor settings. The increasing reliance on GPS-enabled devices in smartphones, vehicles, and wearable tech has led to a surge in demand for accurate outdoor location services, making it the most established and lucrative segment in the market.

The Indoor segment is expected to experience the fastest growth rate, with a CAGR of 27.59% from 2024 to 2032. The rapid development of indoor positioning technologies, such as Wi-Fi and Bluetooth-based systems, is driving this growth. As businesses and consumers seek enhanced navigation within malls, airports, hospitals, and large venues, the need for precise indoor location data is expanding, positioning the indoor segment as the fastest-growing segment in the LBS market.

BY END USER

In 2023, the Transportation and Logistics segment dominated the Location-Based Services market, capturing the largest revenue share of approximately 23%. This dominance is driven by the increasing demand for real-time tracking of goods, fleet management, and route optimization. LBS technologies provide valuable insights into traffic patterns, delivery times, and vehicle locations, enhancing operational efficiency and reducing costs, which has made them integral to the transportation and logistics industries.

The Healthcare and Life Sciences segment is projected to grow at the fastest CAGR of 27.81% from 2024 to 2032. The rising demand for patient monitoring, asset tracking, and emergency response services is fueling this growth. LBS enables precise location data for medical devices, improving patient care and operational efficiency within healthcare facilities. As the sector embraces digital transformation, the need for location-driven solutions to enhance service delivery and patient outcomes is set to expand significantly, driving rapid growth in this segment.

BY COMPONENT

In 2023, the Hardware segment led the Location-Based Services market, capturing the largest revenue share of approximately 44%. This dominance is primarily due to the growing demand for GPS-enabled devices, sensors, and tracking equipment, which are essential for collecting accurate location data. Hardware forms the backbone of LBS solutions, providing the infrastructure required for navigation, real-time tracking, and geospatial analytics across various industries, contributing to its significant market share.

The Services segment is projected to grow at the fastest CAGR of 25.98% from 2024 to 2032. This growth is driven by the increasing need for customized, location-based solutions and the expanding adoption of cloud-based services. As businesses seek to integrate LBS into their operations for better decision-making, data analytics, and customer engagement, the demand for specialized services, such as consulting, system integration, and maintenance, is expected to surge, positioning the Services segment as the fastest-growing in the market.

BY APPLICATION

In 2023, the GIS and Mapping segment led the Location-Based Services market, securing the highest revenue share of approximately 25%. This dominance can be attributed to the critical role that Geographic Information Systems play in delivering accurate, detailed mapping and geospatial analysis. With applications spanning industries like urban planning, environmental monitoring, and infrastructure management, GIS technologies provide essential data for decision-making, boosting their widespread adoption and market share.

The Geo Marketing and Advertising segment is expected to grow at the fastest CAGR of 27.38% from 2024 to 2032. The rise of targeted, location-based advertising is driving this growth, as businesses increasingly leverage real-time location data to deliver personalized marketing messages and offers. As consumers demand more relevant, on-the-go promotions, companies are investing in advanced geo-marketing strategies to enhance customer engagement and maximize ROI, positioning this segment for rapid expansion in the coming years.

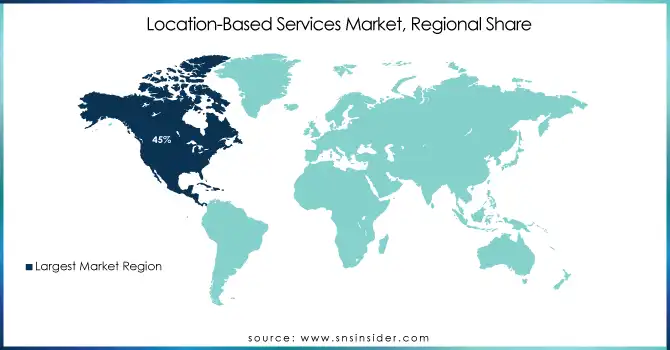

REGIONAL ANALYSIS

In 2023, North America dominated the Location-Based Services market, capturing the largest revenue share of approximately 45%. This leadership is largely due to the advanced technological infrastructure and high adoption rate of LBS applications across various sectors, including transportation, retail, and healthcare. The region benefits from strong investments in IoT, GPS technologies, and cloud-based solutions, further driving the demand for location-based services and solidifying North America's dominant position in the global market.

Asia Pacific is expected to grow at the fastest CAGR of 26.06% from 2024 to 2032. Rapid urbanization, expanding smartphone penetration, and increasing adoption of IoT technologies in countries like China, India, and Japan fuel this growth. As businesses in the region increasingly turn to LBS for targeted marketing, logistics optimization, and smart city development, the demand for these services is set to surge, positioning Asia Pacific as the fastest-growing market in the coming years.

Need any customization research on Location-Based Services Market - Enquiry Now

Apple (Apple Maps, Find My)

Google LLC (Google Maps, Google Earth)

HERE Technologies (HERE Location Services, HERE Maps)

TomTom N.V. (TomTom Navigation, TomTom Traffic)

Foursquare Labs, Inc. (Foursquare for Business, Swarm)

Cisco Systems, Inc. (Cisco Meraki, Cisco Connected Safety and Security)

ESRI (ArcGIS, ArcGIS Online)

IBM Corporation (IBM Watson IoT, IBM Maximo Asset Management)

Microsoft Corporation (Bing Maps, Azure Location Based Services)

Oracle Corporation (Oracle Spatial and Graph, Oracle Cloud Infrastructure Maps)

Qualcomm Inc. (Qualcomm Location Services, Qualcomm Snapdragon X60 5G Modem-RF System)

Telenav, Inc. (Telenav Navigation, Telenav Fleet Management)

Zebra Technologies Corporation (Zebra Real-Time Location System (RTLS), Zebra Location Solutions)

Ericsson AB (Ericsson Location Services, Ericsson IoT Accelerator)

Navigine (Navigine Indoor Navigation, Navigine Asset Tracking)

Navisens (Navisens Indoor Positioning, Navisens Motion Sensing)

AirSage Inc. (AirSage Mobility Analytics, AirSage Traffic Monitoring)

Bluedot Innovation (Bluedot Location Intelligence, Bluedot Geofencing)

Geoloqi (Geoloqi Location Platform, Geoloqi for Mobile Apps)

LocationSmart (LocationSmart Mobile Location Platform, LocationSmart Geofencing)

On May 15, 2024, Google announced new Geospatial AR features at I/O 2024, enhancing the way users interact with locations through augmented reality.

In 2024, HERE Technologies announced its focus on AI-powered mapping and software-defined vehicle innovations at CES 2025, following a milestone year.

On July 15, 2024, TomTom N.V. announced a long-term agreement with Microsoft to deliver location technology and collaborate on AI-driven product innovations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 42.55 Billion |

| Market Size by 2032 | USD 294.73 Billion |

| CAGR | CAGR of 24.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology (GPS, Assisted GPS, Enhanced GPS, Enhanced Observed Time Difference, Observed Time Difference, Cell ID, Wi-Fi, Others) • By Location Type (Indoor, Outdoor) • By Application (GIS and Mapping, Navigation and Tracking, Geo Marketing and Advertising, Social Networking and Entertainment, Fleet Management, Others) • By End User (Banking, Financial Services, and Insurance, IT and Telecommunications, Retail, Transportation and Logistics, Government, Healthcare and Life Sciences, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple, Google LLC, HERE Technologies, TomTom N.V., Foursquare Labs, Inc., Cisco Systems, Inc., ESRI, IBM Corporation, Microsoft Corporation, Oracle Corporation, Qualcomm Inc., Telenav, Inc., Zebra Technologies Corporation, Ericsson AB, Navigine, Navisens, AirSage Inc., Bluedot Innovation, Geoloqi, LocationSmart. |

| Key Drivers | • The Role of IoT Integration in Generating Location Data for Enhanced Location-Based Services Market • The Surge in Location-Based Advertising for Targeted Marketing Campaigns |

| RESTRAINTS | • The Role of IoT Integration in Generating Location Data for Enhanced Location-Based Services Market • The Surge in Location-Based Advertising for Targeted Marketing Campaigns |

Ans: Location-Based Services Market was valued at USD 42.55 billion in 2023 and is expected to reach USD 294.73 billion by 2032, growing at a CAGR of 24.06% from 2024-2032.

Ans: North America led in 2023 with a 45% location-based services market share.

Ans. The GIS and Mapping segment led in 2023, accounting for 25% of the market share.

Ans: The growth of 5G, with over 170 million new connections in Q3 2024, will enhance real-time LBS capabilities.

Ans. The Geo Marketing and Advertising segment is expected to grow at a 27.38% CAGR from 2024 to 2032.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Growth in Smartphone and IoT Device Usage, by Region

5.4 User Demographics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Location-Based Services Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Location-Based Services Market Segmentation, By Technology

8.1 Chapter Overview

8.2 GPS

8.2.1 GPS Market Trends Analysis (2020-2032)

8.2.2 GPS Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Assisted GPS (A-GPS)

8.3.1 Assisted GPS (A-GPS) Market Trends Analysis (2020-2032)

8.3.2 Assisted GPS (A-GPS) Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Enhanced GPS (E-GPS)

8.4.1 Enhanced GPS (E-GPS) Market Trends Analysis (2020-2032)

8.4.2 Enhanced GPS (E-GPS) Market Size Estimates And Forecasts To 2032 (USD Billion)

8.5 Enhanced Observed Time Difference

8.5.1 Enhanced Observed Time Difference Market Trends Analysis (2020-2032)

8.5.2 Enhanced Observed Time Difference Market Size Estimates And Forecasts To 2032 (USD Billion)

8.6 Observed Time Difference

8.6.1 Observed Time Difference Market Trends Analysis (2020-2032)

8.6.2 Observed Time Difference Market Size Estimates And Forecasts To 2032 (USD Billion)

8.7 Cell ID

8.7.1 Cell ID Market Trends Analysis (2020-2032)

8.7.2 Cell ID Market Size Estimates And Forecasts To 2032 (USD Billion)

8.8 Wi-Fi

8.8.1 Wi-Fi Market Trends Analysis (2020-2032)

8.8.2 Wi-Fi Market Size Estimates And Forecasts To 2032 (USD Billion)

8.9 Others

8.9.1 Others Market Trends Analysis (2020-2032)

8.9.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Location-Based Services Market Segmentation, By Location Type

9.1 Chapter Overview

9.2 Indoor

9.2.1 Indoor Market Trends Analysis (2020-2032)

9.2.2 Indoor Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Outdoor

9.3.1 Outdoor Market Trends Analysis (2020-2032)

9.3.2 Outdoor Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Location-Based Services Market Segmentation, By Application

10.1 Chapter Overview

10.2 GIS and Mapping

10.2.1 GIS and Mapping Market Trends Analysis (2020-2032)

10.2.2 GIS and Mapping Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Navigation and Tracking

10.3.1 Navigation and Tracking Market Trends Analysis (2020-2032)

10.3.2 Navigation and Tracking Market Size Estimates And Forecasts To 2032 (USD Billion)

10.4 Geo Marketing and Advertising

10.4.1 Geo Marketing and Advertising Market Trends Analysis (2020-2032)

10.4.2 Geo Marketing and Advertising Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 Social Networking and Entertainment

10.5.1 Social Networking and Entertainment Market Trends Analysis (2020-2032)

10.5.2 Social Networking and Entertainment Market Size Estimates And Forecasts To 2032 (USD Billion)

10.6 Fleet Management

10.6.1 Fleet Management Market Trends Analysis (2020-2032)

10.6.2 Fleet Management Market Size Estimates And Forecasts To 2032 (USD Billion)

10.7 Others

10.7.1 Others Market Trends Analysis (2020-2032)

10.7.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Location-Based Services Market Segmentation, By End User

11.1 Chapter Overview

11.2 Banking, Financial Services, and Insurance (BFSI)

11.2.1 Banking, Financial Services, and Insurance (BFSI) Market Trends Analysis (2020-2032)

11.2.2 Banking, Financial Services, and Insurance (BFSI) Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 IT and Telecommunications

11.3.1 IT and Telecommunications Market Trends Analysis (2020-2032)

11.3.2 IT and Telecommunications Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Retail

11.4.1 Retail Market Trends Analysis (2020-2032)

11.4.2 Retail Market Size Estimates And Forecasts To 2032 (USD Billion)

11.5 Transportation and Logistics

11.5.1 Transportation and Logistics Market Trends Analysis (2020-2032)

11.5.2 Transportation and Logistics Market Size Estimates And Forecasts To 2032 (USD Billion)

11.6 Government

11.6.1 Government Market Trends Analysis (2020-2032)

11.6.2 Government Market Size Estimates And Forecasts To 2032 (USD Billion)

11.7 Healthcare and Life Sciences

11.7.1 Healthcare and Life Sciences Market Trends Analysis (2020-2032)

11.7.2 Healthcare and Life Sciences Market Size Estimates And Forecasts To 2032 (USD Billion)

11.8 Manufacturing

11.8.1 Manufacturing Market Trends Analysis (2020-2032)

11.8.2 Manufacturing Market Size Estimates And Forecasts To 2032 (USD Billion)

11.9 Others

11.9.1 Others Market Trends Analysis (2020-2032)

11.9.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Location-Based Services Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.4 North America Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.5 North America Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.2.6 North America Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.7 North America Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.8.2 USA Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.8.3 USA Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.2.8.4 USA Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.8.5 USA Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.9.2 Canada Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.9.3 Canada Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.2.9.4 Canada Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.9.5 Canada Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.10.2 Mexico Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.10.3 Mexico Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.2.10.4 Mexico Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.10.5 Mexico Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Location-Based Services Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.8.2 Poland Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.8.3 Poland Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.1.8.4 Poland Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8.5 Poland Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.9.2 Romania Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.9.3 Romania Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.1.9.4 Romania Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9.5 Romania Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Location-Based Services Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.4 Western Europe Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.5 Western Europe Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.6 Western Europe Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.7 Western Europe Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.8.2 Germany Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.8.3 Germany Location-Based Services Market Estimates And Forecasts, By Material Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.4 Germany Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8.5 Germany Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.9.2 France Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.9.3 France Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.9.4 France Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9.5 France Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.10.2 UK Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.10.3 UK Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.10.4 UK Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10.5 UK Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.11.2 Italy Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.11.3 Italy Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.11.4 Italy Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11.5 Italy Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.12.2 Spain Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.12.3 Spain Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.12.4 Spain Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Spain Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.15.2 Austria Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.15.3 Austria Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.15.4 Austria Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15.5 Austria Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Location-Based Services Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.4 Asia Pacific Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.5 Asia Pacific Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.6 Asia Pacific Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.7 Asia Pacific Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.8.2 China Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.8.3 China Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.8.4 China Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.8.5 China Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.9.2 India Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.9.3 India Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.9.4 India Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.9.5 India Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.10.2 Japan Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.10.3 Japan Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.10.4 Japan Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.10.5 Japan Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.11.2 South Korea Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.11.3 South Korea Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.11.4 South Korea Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.11.5 South Korea Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.12.2 Vietnam Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.12.3 Vietnam Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.12.4 Vietnam Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.12.5 Vietnam Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.13.2 Singapore Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.13.3 Singapore Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.13.4 Singapore Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.13.5 Singapore Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.14.2 Australia Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.14.3 Australia Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.14.4 Australia Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.14.5 Australia Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Location-Based Services Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.4 Middle East Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.5 Middle East Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.1.6 Middle East Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.7 Middle East Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.8.2 UAE Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.8.3 UAE Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.1.8.4 UAE Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.5 UAE Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Location-Based Services Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.4 Africa Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.5 Africa Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.2.6 Africa Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.7 Africa Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Location-Based Services Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.4 Latin America Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.5 Latin America Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.6.6 Latin America Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.7 Latin America Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.8.2 Brazil Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.8.3 Brazil Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.6.8.4 Brazil Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.8.5 Brazil Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.9.2 Argentina Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.9.3 Argentina Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.6.9.4 Argentina Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.9.5 Argentina Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.10.2 Colombia Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.10.3 Colombia Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.6.10.4 Colombia Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.10.5 Colombia Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Location-Based Services Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Location-Based Services Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Location-Based Services Market Estimates And Forecasts, By Location Type (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Location-Based Services Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Location-Based Services Market Estimates And Forecasts, By End User (2020-2032) (USD Billion)

13. Company Profiles

13.1 Apple

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Google LLC

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 HERE Technologies

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 TomTom N.V.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Foursquare Labs, Inc.

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Cisco Systems, Inc.

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 ESRI

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 IBM Corporation

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Microsoft Corporation

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Oracle Corporation

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

Services

By Technology

GPS

Assisted GPS (A-GPS)

Enhanced GPS (E-GPS)

Enhanced Observed Time Difference

Observed Time Difference

Cell ID

Wi-Fi

Others

By Location Type

Indoor

Outdoor

By Application

GIS and Mapping

Navigation and Tracking

Geo Marketing and Advertising

Social Networking and Entertainment

Fleet Management

Others (Business Intelligence and Analytics, Geospatial Database Development)

By End User

Banking, Financial Services, and Insurance (BFSI)

IT and Telecommunications

Retail

Transportation and Logistics

Government

Healthcare and Life Sciences

Manufacturing

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Digital Workplace Market size was valued at USD 30.3 Billion in 2023 and is expected to grow to USD 200.61 Billion By 2032 and grow at a CAGR of 23.39% over the forecast period of 2024-2032.

The Asset Management Market Size was valued at USD 484.74 Billion in 2023 and will reach USD 7287.15 Billion by 2032 and grow at a CAGR of 35.2% by 2032.

The Virtual Reality (VR) Content Creation Market size was valued at USD 4.80 billion in 2023 and is expected to reach USD 163.8 Billion by 2032, growing at a CAGR of 45.49% from 2024-2032.

The Cinema Camera Market was valued at USD 16.58 Million in 2023 & is expected to reach USD 28.72 Million by 2032, growing at a CAGR of 6.34% by 2024-2032.

Insight Engines Market was valued at USD 1.7 Billion in 2023 and will reach USD 13.9 Billion by 2032 and grow at a CAGR of 26.62% by 2032.

The Private Cloud Services Market size was valued at USD 6.1 Billion in 2023 and will reach USD 31 Billion by 2032 and grow at a CAGR of 19.8% by 2024-2032.

Hi! Click one of our member below to chat on Phone