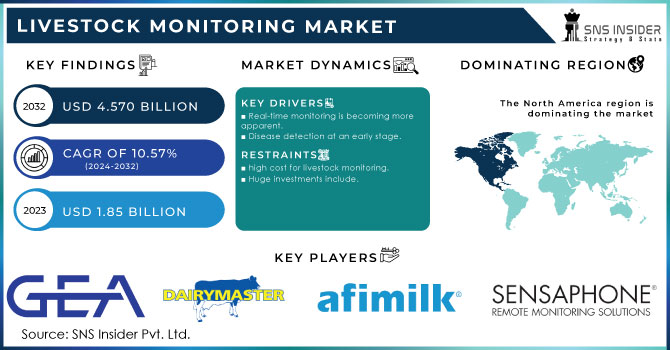

The Livestock Monitoring Market Size was valued at USD 2.78 billion in 2023 and is expected to reach USD 6.40 billion by 2032, growing at a CAGR of 9.75% over the forecast period 2024-2032. Enhanced technology adoption across all scales of farms is driving the growth of the Livestock Monitoring Market. There is an upward trend in adoption as farmers make use of IoT, artificial intelligence (AI), and sensor-based systems for health monitoring and productivity optimization. With AI solutions that analyze data for advertising and direct response marketing decisions becoming popular, hardware and software segments are booming in the current market. Moreover, these optimized sensors are gathering more accurate information on livestock health and behavior, and are performing better. It also includes the rise of cross-technology use in which integrated systems merge monitoring with on-farm management tools to optimize overall operational performance.

Get more information on Livestock Monitoring Market - Request Sample Report

Key Drivers:

Driving Growth in Livestock Monitoring Market through Automation Precision Farming and Advanced Disease Detection Solutions

The growth of the livestock monitoring market is primarily driven by robust demand for automation and precision farming in the agricultural sector. As the world consumes more and more meat and dairy, farmers are looking for smart technologies IoT-based sensors, AI-powered analytics, and wearable trackers that can drive productivity and improve animal health. In addition, rising apprehensions regarding livestock diseases along with the rising requirements for early disease detection are propelling the adoption of health and behavioral monitoring solutions. Moreover, the digital transformation of agriculture supported by government initiatives and rising investments in AgTech startups will drive the market in the upcoming years.

Restrain:

Restrain in Livestock Monitoring Market Include High Costs Technological Barriers Connectivity Issues and Data Security Concerns

The high-cost investment to adopt an advanced monitoring system is one of the restraining factors for the market. IoT technology, automated milking machines, AI-based monitoring, or sensors for tracking livestock herds are too costly for many small and medium-sized farmers, especially in less developed countries. There is also a low level of technological awareness and digital literacy among farmers that minimizes large-scale adoption. These remote and rural areas have extensive connectivity issues, making it challenging to collect and analyze data in real-time, thus contrasting the effectiveness of precision livestock management. A further challenge is that the use of cloud-based and AI-driven monitoring solutions puts those farms in the firing line of cyber threats and data breaches, raising concerns over data security and privacy.

Opportunity:

Opportunities in Livestock Monitoring Market Grow with AI Blockchain Smart Farms and Rising Consumer Demand

As the livestock supply chain embraces AI-driven Predictive Analytics and Blockchain for traceability, opportunities in this market have blossomed. In the era of connected farms and smart dairy solutions, the opportunities for sophisticated livestock management systems are also increasing. Increasing consumer demand for organic and antibiotic-free meat is also promoting precision feeding and breeding technologies so that farmers can produce food of high quality to meet sustainable production targets. Emerging markets of Asia-Pacific and Latin America are estimated to own high growth opportunities; growing livestock farming activities accompanied with government policies that support smart animal agriculture.

Challenges:

Challenges in Livestock Monitoring Market Include Integration Issues Environmental Impact Resistance to Technology Adoption

The challenge is the integration and interoperability across various environmental monitoring systems. The challenge is that different manufacturers offer livestock monitoring solutions that use proprietary technologies, which makes it hard to build a unified digital farm-management platform that could be as widely adopted as the smartphone. Further, environmental factors can impact the accuracy and reliability of data, resulting in wrong insights and decisions. Market penetration is further prevented due to resistance to technology adoption amongst conventional farmers and scantily skilled personnel to effectively operate and manage these digital solutions. Addressing these challenges will need greater awareness, funding, and the development of affordable, simple, and scalable solutions for smallholder farmers.

By Component

The livestock monitoring market was led by hardware with a 40.7% share in 2023 since tools are foundational monitoring devices that include wearable sensors, RFIDs, automated milking systems, and GPS-enabled tracking devices. These hardware solutions play a vital role in collecting real-time data on livestock health, behavior, and productivity. Hardware demand has also been driven by the rising adoption of smart collars, ear tags, and biometric sensors that allow for disease detection and performance tracking. Further, depending upon the infrastructure such as cameras, the weighing system proves helpful in the management of the farm, which is why it contributes a significant share of the market.

Software will likely experience the highest CAGR from 2024-2032, because of the rising demand for data analytics, cloud integration, and AI-powered decisions. Due to huge quantities of data produced by IoT sensors on farms, software solutions to predictive analytics, automated alerts, and precision livestock management are essential. Quick software adoption facilitated by the trend towards AI-enabled herd management and blockchain-based traceability solutions is making it possible for farmers to maximize output and increase productivity.

By Type

In 2023, the bovine segment accounted for the largest share of 48.2% of the livestock monitoring market. This is attributed to the economic significance of dairy and beef cattle farming. The growing global consumption of milk, meat, and other dairy products has led to huge investments in sophisticated monitoring solutions for herd health, breeding, and milking productivity. Technologies such as RFID tags, automated milking systems, and wearable health trackers are widely adopted by farmers to increase productivity and mitigate disease-related losses. Moreover, the domination of the bovine sector is further supplemented by government policies for smart dairy farming and precision livestock management.

The poultry segment is predicted to register the highest CAGR during the forecast period from 2024-2032, owing to the increase in poultry consumption, globally, and the growing demand for effective production control. Automation-based monitoring of poultry, AI-enabled disease detection, and precision feeding solutions for enhanced yield and biosecurity are rapidly being accepted in the poultry sector. Software-driven poultry monitoring is becoming a major focus as well, due to the increasing integration of cloud-based platforms for real-time tracking and predictive analytics in large-scale poultry farms, and this also contributes to the rapid growth of the market.

By Application

Milking management held the largest market share of 21.7% in the livestock monitoring market in 2023 owing to the rising demand for automated milking solutions in dairy farms. As the world consumes more milk, dairy farmers are adopting precision technologies, including robotic milking systems, automatic milk analyzers, and IoT-enabled monitoring devices, to increase milk production, productivity, and quality. This trend is further strengthening the market position of the segment, due to the rapidly increasing implementation of sensors for udder health tracking and real-time milk production analysis. In addition, smart dairy farming and precision livestock management promoted by various governments also improved the uses of the milking management system.

The behavioral monitoring segment is projected to dominate the growth from 2024-2032 with the growth owing to rising demand for livestock welfare and disease detection at an early stage. Farmlog provides ranchers a way to track livestock on farms that are near the head, making tracking livestock movement easier along with the use of AI-driven track systems tracking wearable sensors, and smart cameras for monitoring livestock feeding and stress. The increase in demand for predictive analytics in animal health management and stringent animal welfare regulations is resulting in the fast adoption of behavioral monitoring solutions.

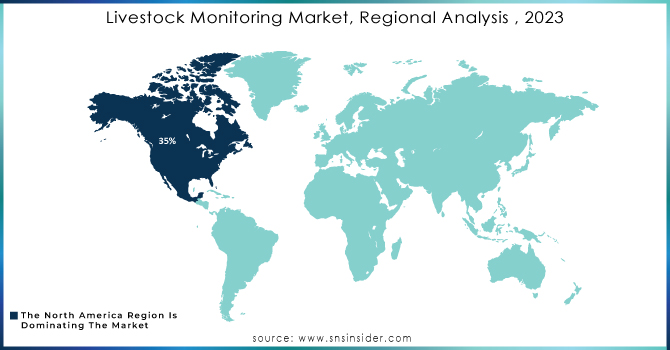

The livestock monitoring market in North America accounted for a 30.4% share in 2023, owing to the high adoption of precision livestock farming technologies in the region. Market growth has been driven by established dairy and meat industries and strong government support for smart farming. IoT-based livestock monitoring has made its way into the U.S. and Canada, as are automated milking and AI-based health monitoring solutions. Take Connecterra a U.S.-based AgTech company that offers a suite of AI-powered dairy monitoring services to dairy farmers to help them optimize their milk production and early detect diseases. Moreover, some firms including Allflex, a subsidiary of Merck, have introduced several RFID and biometric tracking hardware systems that are also popularized among the cattle industries around the region.

Asia-Pacific is projected to be the fastest-growing region during the forecast period (2024–2032) owing to rising livestock farming in countries such as China, India, and Australia. Increased demand for dairy and meat products along with the growing population in the region is driving the need for advanced livestock monitoring solutions. To increase profitability and contain outbreaks of disease, both governments and agribusinesses are investing heavily in smart farming technologies. Chinese tech giant Alibaba, for instance, has launched AI-powered smart farming solutions that allow farmers to monitor livestock health and behavior in real-time. Meanwhile in India, Stellapps is transforming the dairy industry with IoT-based monitoring solutions that enable farmers to create a maximum milk yield and monitor herd health, playing a key role in the significant growth of the market in the region.

Need any customization research on Livestock Monitoring Market - Enquiry Now

Some of the major players in the Livestock Monitoring Market are:

DeLaval (VMS V300 Milking System, Herd Navigator)

GEA Farm Technologies (DairyRobot R9500, CowScout)

Afimilk Ltd. (Afimilk MCS, AfiAct II)

Allflex Livestock Intelligence (SenseHub, RS420 Stick Reader)

Lely International NV (Lely Astronaut A5, Lely Vector)

BouMatic (Gemini UP Milking Robot, SmartDairy Activity System)

Nedap Livestock Management (CowControl, Pig Performance Testing)

SCR Engineers Ltd. (Heatime HR System, HealthyCow24 App)

BioChek (Poultry Immunoassay Kits, Swine PCR Kits)

Smartbow GmbH (SMARTBOW Ear Tag, Cow Positioning System)

Milkline (ML Activity Collars, ML Rumination Sensors)

Moocall (Moocall Calving Sensor, Moocall HEAT)

Dairymaster Ltd. (Swiftflo Commander, MooMonitor+)

HID Global Corporation (Livestock RFID Tags, ID Card Printers)

Fancom BV (eYeGrow Pig Weighing System, Fancom Climate Controllers)

In December 2024, DeLaval announced the Milking Automation (MA) Series, featuring advanced automation, real-time data insights, and cloud connectivity to enhance conventional parlor milking efficiency.

In November 2024, GEA introduced an AI-driven Body Condition Scoring (BCS) system using CattleEye technology to autonomously assess cow health, optimize feeding, and enhance dairy farm efficiency.

In May 2024, Nedap introduced a heat stress detection feature in its CowControl system, helping farmers monitor cow health and optimize conditions to maintain productivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.78 Billion |

| Market Size by 2032 | USD 6.40 Billion |

| CAGR | CAGR of 9.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Type (Bovine, Poultry, Swine, Other Animals) • By Application (Milking Management, Breeding Management, Feeding Management, Health Monitoring, Behavioral Monitoring, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DeLaval, GEA Farm Technologies, Afimilk Ltd., Allflex Livestock Intelligence, Lely International NV, BouMatic, Nedap Livestock Management, SCR Engineers Ltd., BioChek, Smartbow GmbH, Milkline, Moocall, Dairymaster Ltd., HID Global Corporation, Fancom BV. |

Ans: The Livestock Monitoring Market is expected to grow at a CAGR of 9.75% during 2024-2032.

Ans: Livestock Monitoring Market size was USD 2.78 billion in 2023 and is expected to Reach USD 6.40 billion by 2032.

Ans: The major growth factor of the Livestock Monitoring Market is the increasing demand for advanced technologies like IoT, AI, and data analytics to improve livestock health, productivity, and farm efficiency.

Ans: The Milking Management segment dominated the Livestock Monitoring Market in 2023.

Ans: North America dominated the Livestock Monitoring Market in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates

5.2 Growth Rate by Segment

5.3 Data Accuracy and Performance

5.4 Cross-Technology Use

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Livestock Monitoring Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Livestock Monitoring Market Segmentation, By Type

8.1 Chapter Overview

8.2 Bovine

8.2.1 Bovine Market Trends Analysis (2020-2032)

8.2.2 Bovine Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Poultry

8.3.1 Poultry Market Trends Analysis (2020-2032)

8.3.2 Poultry Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Swine

8.4.1 Swine Market Trends Analysis (2020-2032)

8.4.2 Swine Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Other Animals

8.5.1 Other Animals Market Trends Analysis (2020-2032)

8.5.2 Other Animals Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Livestock Monitoring Market Segmentation, By Application

9.1 Chapter Overview

9.2 Milking Management

9.2.1 Milking Management Market Trends Analysis (2020-2032)

9.2.2 Milking Management Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Breeding Management

9.3.1 Breeding Management Market Trends Analysis (2020-2032)

9.3.2 Breeding Management Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Feeding Management

9.4.1 Feeding Management Market Trends Analysis (2020-2032)

9.4.2 Feeding Management Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Health Monitoring

9.5.1 Health Monitoring Market Trends Analysis (2020-2032)

9.5.2 Health Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Behavioral Monitoring

9.6.1 Behavioral Monitoring Market Trends Analysis (2020-2032)

9.6.2 Behavioral Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Other Applications

9.7.1 Other Applications Market Trends Analysis (2020-2032)

9.7.2 Other Applications Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Livestock Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.4 North America Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.5 North America Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.6.2 USA Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.6.3 USA Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.7.2 Canada Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.7.3 Canada Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.8.2 Mexico Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Livestock Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Livestock Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.7.2 France Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.7.3 France Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.8.2 UK Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Livestock Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.4 Asia Pacific Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.6.2 China Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.6.3 China Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.7.2 India Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.7.3 India Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.8.2 Japan Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.8.3 Japan Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.9.2 South Korea Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.11.2 Singapore Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.12.2 Australia Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.12.3 Australia Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Livestock Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.4 Middle East Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Livestock Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.4 Africa Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.5 Africa Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Livestock Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.4 Latin America Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.5 Latin America Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.6.2 Brazil Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.7.2 Argentina Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.8.2 Colombia Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Livestock Monitoring Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Livestock Monitoring Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Livestock Monitoring Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 DeLaval.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 GEA Farm Technologies

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Afimilk Ltd

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Allflex Livestock Intelligence

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Lely International NV

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 BouMatic

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Nedap Livestock Management

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 SCR Engineers Ltd.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 BioChek

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Smartbow GmbH

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Hardware

Software

Services

By Type

Bovine

Poultry

Swine

Other Animals

By Application

Milking Management

Breeding Management

Feeding Management

Health Monitoring

Behavioral Monitoring

Other Applications

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Climate Adaptation Market Size was valued at USD 24.58 billion in 2023 and is expected to grow at a CAGR of 9.46% to reach USD 55.44 billion by 2032.

The Smart Retail Market Size was valued at USD 39.92 billion in 2023 and is expected to grow at a CAGR of 26.45% to reach USD 329.03 billion by 2032.

The Medical Sensors Market Size was valued at USD 43.21 billion in 2023 and is expected to grow at a CAGR of 19.22% to reach USD 209.70 billion by 2032.

The Sports Optic Market Size was valued at USD 2.24 billion in 2023 and is projected to reach USD 3.01 billion by 2032, at a CAGR of 3.35 % from 2024 to 2032

The Teleprotection Market was valued at USD 34.67 billion in 2023 and is expected to grow at a CAGR of 25.46% to reach USD 265.95 billion by 2032.

The Vertical Farming Market Size was valued at USD 5.81 Billion in 2023. It is estimated to grow at a CAGR of 22.42% to reach USD 35.76 Billion by 2032

Hi! Click one of our member below to chat on Phone