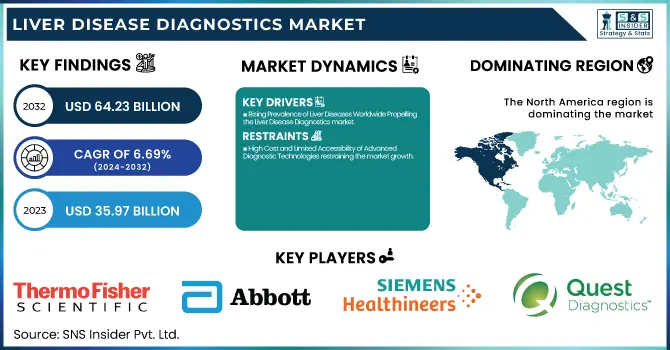

The Liver Disease Diagnostics Market was valued at USD 35.97 billion in 2023 and is expected to reach USD 64.23 billion by 2032, growing at a CAGR of 6.69% from 2024-2032.

To Get more information on Liver Disease Diagnostics Market - Request Free Sample Report

The Liver Disease Diagnostics Market report provides insights by presenting extensive incidence and prevalence data for liver diseases like NAFLD, NASH, fibrosis, cirrhosis, and HCC in prominent regions. We present diagnostic test use trends with the adoption of imaging, lab tests, and biopsies globally. The report also provides regional healthcare expenditure breakup, including government, commercial, private, and out-of-pocket spending. Additionally, we offer adoption rates for sophisticated diagnostic technology, such as AI-based imaging and biomarker-based detection, to provide an exhaustive market evaluation.

Drivers

Rising Prevalence of Liver Diseases Worldwide Propelling the Liver Disease Diagnostics market.

The mounting global burden of liver diseases, such as non-alcoholic fatty liver disease (NAFLD), non-alcoholic steatohepatitis (NASH), fibrosis, cirrhosis, and hepatocellular carcinoma (HCC), is one of the major drivers for the liver disease diagnostics market. Liver diseases are reported to cause nearly 2 million deaths per year globally, with hepatitis B and C viruses contributing to over 1.3 million deaths every year, according to the World Health Organization (WHO). In addition, the growing incidence of metabolic disorders like obesity and diabetes has helped increase cases of NAFLD and NASH, prompting the demand for early and precise diagnostic options. New advances have seen developments in non-invasive diagnostic methods like liquid biopsies, transient elastography, and AI-powered imaging tools, which promote early detection and tracking, enhancing patient outcomes.

Technological Advancements in Diagnostic Tools driving the market growth.

The liver disease diagnostics market is experiencing strong growth with ongoing developments in diagnostic technology, such as biomarkers, imaging technologies, and molecular testing. Conventional liver function tests are increasingly being augmented by newer diagnostic tools like FibroScan, next-generation sequencing (NGS), and multiplex immunoassays that provide better accuracy and quicker results. For example, in 2023, Siemens Healthineers introduced an artificial intelligence-based liver imaging solution for better fibrosis and cirrhosis assessment. Moreover, the increased use of point-of-care testing (POCT) instruments and digital pathology is also increasing the detection of real-time liver diseases. The integration of machine learning-based predictive models has also added to the accuracy of liver disease diagnosis, making it easier for clinicians to customize treatment approaches. These technologies are anticipated to propel diagnostic efficiency, decrease the dependency on biopsies, and propel the entire market forward.

Restraint

High Cost and Limited Accessibility of Advanced Diagnostic Technologies restraining the market growth.

The exorbitant price of cutting-edge diagnostic technology makes them less accessible, especially in low- and middle-income economies. Although newer diagnostic technologies like transient elastography (FibroScan), liquid biopsies, and AI-based imaging are highly accurate, they are expensive, which makes them unaffordable for most healthcare institutions and patients. Moreover, the need for specialized training and equipment also contributes to the economic cost. The expenditure on innovative liver diagnostic processes can vary from a few hundred dollars to thousands of dollars, leading to inequalities in access to early and precise diagnosis. Also, in most areas, particularly rural ones, the absence of proper healthcare facilities and reimbursement problems further inhibit the use of these diagnostic options on a large scale.

Opportunities

The growing preference for non-invasive diagnostic techniques presents a significant opportunity in the liver disease diagnostics market.

The increasing demand for non-invasive diagnostic methods is a major opportunity in the market for liver disease diagnostics. Conventional procedures like liver biopsies, as effective as they are, are invasive, painful, and associated with complications. Consequently, there is an increasing demand for safer, more effective substitutes like elastography, liquid biopsies, and AI-based imaging. From recent research, non-invasive testing such as FibroScan has proved highly accurate for evaluating liver fibrosis and cirrhosis, minimizing the requirement for invasive interventions. Additionally, the use of AI in diagnosing liver disease has improved imaging analysis and facilitated earlier detection and informed treatment. With regulatory agencies more and more approving non-invasive tests and medical practitioners moving towards patient-friendly diagnosis, the market will see increased innovation and uptake, especially in the developed world.

Challenges

Variability in Diagnostic Accuracy and Standardization challenging the market.

One of the biggest issues facing the liver disease diagnostics market is the heterogeneity of diagnostic performance and the absence of standard procedures across different tests. Though non-invasive diagnostic tests like serum biomarker testing and imaging methods are helpful, their specificity and sensitivity are not always the same, and therefore, they give variable results. For example, elastography-based fibrosis testing can give variable results depending on the level of expertise of the operator or patient-related variables like obesity. Also, tests based on biomarkers do not have universal thresholds, and thus, it becomes challenging to develop standardized diagnostic criteria in various healthcare environments. This discrepancy may result in misdiagnosis or delayed treatment initiation. To counter this challenge, research is continually ongoing to develop more refined diagnostic methods and incorporate AI-based analytics to enhance the accuracy and reliability of results in a wide range of patient populations.

By Technique

The imaging segment dominated the market with a 32.12% market share in 2023 due to its ease of use without invasive procedures, high degree of accuracy, and general availability. Imaging methods such as ultrasound, elastography, CT scans, and MRI are now the accepted methods for diagnosis of liver conditions such as fatty liver, fibrosis, cirrhosis, and hepatocellular carcinoma (HCC). The increasing trend towards the use of transient elastography, including FibroScan, has significantly enhanced early liver fibrosis detection and staging at the expense of invasive procedures. Recent research has shown that ultrasound-based liver screening is over 85% accurate in the detection of liver abnormality and, therefore, has become a favorite among healthcare practitioners. Moreover, ongoing technology advancements in imaging, such as AI-based diagnostics and contrast MRI, have only strengthened the hegemony of this segment in the diagnosis of liver diseases.

The biopsy segment will see the fastest growth with 7.62% CAGR during the forecast period based on its unmatchable accuracy in the diagnosis of liver disorders at the cellular level. Although non-invasive imaging techniques are commonly employed for screening, liver biopsy is still the gold standard for definitive diagnosis in complicated cases of NASH, autoimmune liver diseases, and early hepatocellular carcinoma. The increasing incidence of NASH has fueled the need for liver biopsies to determine disease severity and inform treatment. Also, the increasing use of minimally invasive biopsy methods, including ultrasound-guided and laparoscopic biopsies, has enhanced patient compliance as well as safety. The application of molecular and genomic analysis on biopsy samples further increases diagnostic accuracy, fueling the segment's explosive growth.

By Disease

The Non-Alcoholic Fatty Liver Disease (NAFLD) segment dominated the liver disease diagnostics market with a 24.51% market share in 2023 because of its growing prevalence and heightened awareness among healthcare professionals. NAFLD, which covers about 25% of the world's population, has become the most prevalent liver disorder primarily because of the rising incidence of obesity, diabetes, and metabolic syndrome. Given that an estimated 60–70% of obese patients get NAFLD, the market for early and precise diagnostics skyrocketed.

Technological advancements in diagnostic methods, including non-invasive imaging equipment (FibroScan, MRI-PDFF) and blood biomarkers (ALT, AST, FIB-4 score), have further contributed to the dominance of the segment. Moreover, growing screening programs and the creation of new AI-driven liver evaluation technologies have enhanced the rate of early detection, cementing NAFLD as the top segment for liver disease diagnostics. Pharmaceutical corporations are also keen on creating NAFLD-targeted drugs, encouraging greater investment in diagnostic technologies. Additionally, government-sponsored research initiatives and funding programs are encouraging sophisticated screening methods, further supporting the dominance of the segment.

By End Use

The Hospitals segment dominated the liver disease diagnostics market with 46.32% market share in 2023 as a result of growing patient visits for liver disease diagnosis and treatment. Hospitals are major healthcare facilities for complete liver function testing, providing an array of diagnostic services like imaging (MRI, CT, ultrasound), laboratory tests (ALT, AST, bilirubin), and biopsy procedures all under one umbrella. The availability of advanced diagnostic facilities, experienced healthcare workers, and combined patient care mechanisms boosts the hospitals' role in the management of liver diseases.

Hospitals also deal with a large number of severe and complicated liver disease cases, such as cirrhosis, fibrosis, and hepatocellular carcinoma (HCC), that require accurate and timely diagnosis. Government and private investments in hospital-based liver disease screening initiatives, telemedicine consultation, and artificial intelligence (AI)-based diagnostic tools further increase the dominance of the segment. Additionally, hospitals frequently partner with research institutions and drug firms for clinical trials, which opens up greater access to newer diagnostic technologies and treatments. The availability of insurance coverage and reimbursement schemes for hospital-based diagnostic tests is also a key factor in the market leadership of the segment.

North America dominated the liver disease diagnostics market with a 40.25% market share in 2023 because of the prevalence of liver diseases, well-developed healthcare infrastructure, and robust research activities. The region has experienced a sharp increase in the incidence of non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH) due to rising obesity and metabolic disorders. As per the CDC, close to 25% of the American population is suffering from NAFLD, emphasizing the need for early and precise diagnostic solutions. Moreover, the availability of major diagnostic players, including Abbott, Roche, and Siemens Healthineers, has enabled the swift development and adoption of sophisticated liver disease diagnostic tests. Governmental funding and favorable reimbursement policies further enhance market growth, making the latest diagnostic technologies accessible.

Asia Pacific is experiencing the fastest growth with 7.78% CAGR throughout the forecast period in the liver disease diagnostics market owing to the increasing burden of liver diseases, rising healthcare spending, and growing awareness. The region has high rates of hepatitis B and C infection, and China and India together contribute significantly to global cases. As per WHO, more than 70 million individuals in the Asia Pacific region are affected by chronic hepatitis B, driving the demand for precise diagnostic products. Moreover, the development of healthcare infrastructure, rising disposable incomes, and government-sponsored screening initiatives are boosting market penetration. The use of non-invasive diagnostic techniques, including elastography and liquid biopsies, is also increasing in this region because they are cost-effective and convenient. The speedy growth of diagnostic laboratories and the availability of new biotech companies play a supporting role in the speeded-up growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Abbott Laboratories (ARCHITECT AFP Assay, HBsAg Confirmatory Assay)

F. Hoffmann-La Roche Ltd. (Elecsys HBsAg II, Elecsys Anti-HCV II)

Thermo Fisher Scientific Inc. (AcroMetrix HBV DNA Panel, AcroMetrix HCV RNA Panel)

Siemens Healthineers (ADVIA Centaur HBsAg II Assay, Dimension EXL HCV Antibody Assay)

bioMérieux SA (VIDAS Anti-HCV Assay, VIDAS HBsAg Ultra)

Bio-Rad Laboratories, Inc. (Monolisa HCV Ag-Ab ULTRA, GS HBsAg Confirmatory Assay)

Randox Laboratories Ltd. (Hepatitis B Surface Antigen Test, Hepatitis C Antibody Test)

Fujifilm Corporation (Fujifilm Wako Shikibo Total Bile Acids Test, Liver Fat Assessment)

HORIBA Medical (HELICAB 25 Analyzer, ABX Pentra 400 Clinical Chemistry Analyzer)

Laboratory Corporation of America Holdings (HCV RNA Quantitative Real-Time PCR, HBV DNA Quantitative PCR)

Quest Diagnostics Incorporated (FibroTest-ActiTest, Hepatitis C Antibody with Reflex to HCV RNA)

PerkinElmer Inc. (GSP Neonatal GGT kit, Liver Profile Assay)

Ortho Clinical Diagnostics (VITROS Anti-HCV Assay, VITROS HBsAg Assay)

DiaSorin S.p.A. (LIAISON XL Murex HBsAg Quant, LIAISON XL Murex Anti-HCV)

Grifols S.A. (Procleix Ultrio Elite Assay, Procleix HEV Assay)

AbbVie Inc. (HCV Genotype Test, HBV DNA Quantification Test)

Bristol-Myers Squibb Company (Hepatitis B Surface Antigen Test, Hepatitis C Virus RNA Test)

Gilead Sciences, Inc. (HCV Antibody Test, HBV Surface Antigen Test)

Merck & Co., Inc. (HCV RNA Quantitative Test, HBV Genotype Test)

Novartis AG (HBsAg Quantification Assay, HCV RNA Detection Assay)

Suppliers (These companies offer a range of diagnostic products essential for the detection and management of liver diseases.)

Merck KGaA

Thermo Fisher Scientific Inc.

PerkinElmer Inc.

Bio-Rad Laboratories, Inc.

Fujifilm Wako Pure Chemical Corporation

Randox Laboratories Ltd.

Siemens Healthineers

Roche Diagnostics

Ortho Clinical Diagnostics

DiaSorin S.p.A.

In May 2024, Thermo Fisher introduced a biomarker-based testing service for kidney transplant patients to enhance early rejection detection. This is indicative of the increasing use of biomarker-based diagnostics, which may be applied in liver disease diagnosis for early detection of liver fibrosis, cirrhosis, or transplant rejection.

November 2024, Abbott's FDA clearance of CGMs during imaging procedures underscores the demand for real-time monitoring solutions. In the diagnosis of liver disease, non-invasive imaging methods such as elastography and AI-driven liver scans are increasingly being used, eliminating the need for invasive biopsies while providing real-time liver health monitoring

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 35.97 billion |

| Market Size by 2032 | US$ 64.23 billion |

| CAGR | CAGR of 6.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technique (Laboratory Tests, Imaging, Endoscopy, Biopsy, Others) • By Disease (NAFLD, NASH, Fibrosis, Cirrhosis, HCC, Others) • By End Use (Hospitals, Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Siemens Healthineers, bioMérieux SA, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., Fujifilm Corporation, HORIBA Medical, Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, PerkinElmer Inc., Ortho Clinical Diagnostics, DiaSorin S.p.A., Grifols S.A., AbbVie Inc., Bristol-Myers Squibb Company, Gilead Sciences, Inc., Merck & Co., Inc., Novartis AG, and other players. |

Ans: The Liver Disease Diagnostics Market is expected to grow at a CAGR of 6.69% during 2024-2032.

Ans: The Liver Disease Diagnostics Market was USD 35.97 billion in 2023 and is expected to Reach USD 64.23 billion by 2032.

Ans: Rising Prevalence of Liver Diseases Worldwide Propelling the Liver Disease Diagnostics Market.

Ans: The “Imaging” segment dominated the Liver Disease Diagnostics Market.

Ans: North America dominated the Liver Disease Diagnostics Market in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Liver Diseases (2023)

5.2 Diagnostic Test Utilization Trends (2023), by Region

5.3 Number of Liver Disease Diagnostic Procedures by Region (2020-2032)

5.4 Healthcare Spending on Liver Disease Diagnostics, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

5.5 Adoption Rate of Advanced Liver Diagnostic Technologies (AI-based Imaging, Biomarkers, Liquid Biopsy) (2023-2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Liver Disease Diagnostics Market Segmentation by Technique

7.1 Chapter Overview

7.2 Laboratory Tests

7.2.1 Laboratory Tests Market Trends Analysis (2020-2032)

7.2.2 Laboratory Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Imaging

7.3.1 Imaging Market Trends Analysis (2020-2032)

7.3.2 Imaging Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Endoscopy

7.4.1 Endoscopy Market Trends Analysis (2020-2032)

7.4.2 Endoscopy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Biopsy

7.5.1 Biopsy Market Trends Analysis (2020-2032)

7.5.2 Biopsy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Liver Disease Diagnostics Market Segmentation by Disease

8.1 Chapter Overview

8.2 NAFLD

8.2.1 NAFLD Market Trends Analysis (2020-2032)

8.2.2 NAFLD Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 NASH

8.3.1 NASH Market Trends Analysis (2020-2032)

8.3.2 NASH Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Fibrosis

8.4.1 Fibrosis Market Trends Analysis (2020-2032)

8.4.2 Fibrosis Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Cirrhosis

8.5.1 Cirrhosis Market Trends Analysis (2020-2032)

8.5.2 Cirrhosis Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 HCC

8.6.1 HCC Market Trends Analysis (2020-2032)

8.6.2 HCC Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Liver Disease Diagnostics Market Segmentation by End User

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Laboratories

9.3.1 Laboratories Market Trends Analysis (2020-2032)

9.3.2 Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Laboratories

9.4.1 Laboratories Market Trends Analysis (2020-2032)

9.4.2 Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Liver Disease Diagnostics Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

10.2.3 North America Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.2.4 North America Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.2.5 North America Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.2.6.2 USA Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.2.6.3 USA Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.2.7.2 Canada Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.2.7.3 Canada Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.2.8.2 Mexico Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.2.8.3 Mexico Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.1.6.2 Poland Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.1.6.3 Poland Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.1.7.2 Romania Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.1.7.3 Romania Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.4 Western Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.5 Western Europe Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.6.2 Germany Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.6.3 Germany Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.7.2 France Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.7.3 France Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.8.2 UK Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.8.3 UK Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.9.2 Italy Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.9.3 Italy Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.10.2 Spain Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.10.3 Spain Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.13.2 Austria Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.13.3 Austria Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Liver Disease Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.4 Asia Pacific Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.5 Asia Pacific Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.6.2 China Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.6.3 China Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.7.2 India Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.7.3 India Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.8.2 Japan Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.8.3 Japan Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.9.2 South Korea Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.9.3 South Korea Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.10.2 Vietnam Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.10.3 Vietnam Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.11.2 Singapore Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.11.3 Singapore Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.12.2 Australia Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.12.3 Australia Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Liver Disease Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.1.4 Middle East Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.1.5 Middle East Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.1.6.2 UAE Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.1.6.3 UAE Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Liver Disease Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.2.4 Africa Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.2.5 Africa Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Liver Disease Diagnostics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.6.4 Latin America Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.6.5 Latin America Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.6.6.2 Brazil Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.6.6.3 Brazil Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.6.7.2 Argentina Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.6.7.3 Argentina Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.6.8.2 Colombia Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.6.8.3 Colombia Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Liver Disease Diagnostics Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Liver Disease Diagnostics Market Estimates and Forecasts, by Disease (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Liver Disease Diagnostics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Abbott Laboratories

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 F. Hoffmann-La Roche Ltd.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Siemens Healthineers

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 bioMérieux SA

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Bio-Rad Laboratories, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Randox Laboratories Ltd.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Fujifilm Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 HORIBA Medical

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Laboratory Corporation of America Holdings

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Quest Diagnostics Incorporated

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technique

Laboratory Tests

Imaging

Endoscopy

Biopsy

Others

By Disease

NAFLD

NASH

Fibrosis

Cirrhosis

HCC

Others

By End Use

Hospitals

Laboratories

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Smart Hospitality Market is anticipated to increase at a CAGR of 30% from 2024 to 2032, from a value of USD 17.55 billion in 2023 and expected to reach USD 186.10 billion by 2032.

The Multiple Myeloma Market size was estimated at USD 24.01 Billion In 2023 & is estimated to reach USD 59.45 Billion by 2032 and increase at a compound annual growth rate of 10.6% between 2024 and 2032.

The In Vivo CRO Market was valued at USD 4.7 billion in 2023 and is projected to reach USD 9.2 billion by 2032, growing at a CAGR of 8% from 2024 to 2032.

Veterinary Infusion Pumps Market Size was valued at USD 325.1 million in 2023 and is expected to reach USD 623.8 million by 2032, growing at a CAGR of 7.52% over the forecast period 2024-2032.

The Brain Computer Interface Market size was valued at USD 2.23 billion in 2023 and is expected to reach USD 8.36 billion by 2032 and grow at a CAGR of 15.81% over the forecast period of 2024-2032.

Walking Aids Market Size was valued at USD 2.53 Billion in 2023 and is expected to reach USD 4.77 Billion by 2032, growing at a CAGR of 7.33% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone