Get More Information on Liquid Ring Vacuum Pumps Market - Request Sample Report

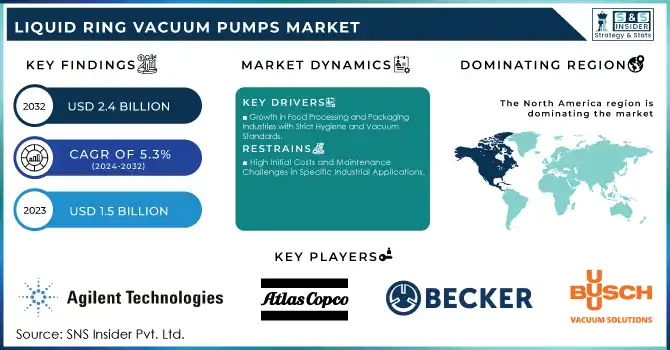

The Liquid Ring Vacuum Pumps Market Size was valued at USD 1.5 billion in 2023 and is expected to reach USD 2.4 billion by 2032 and grow at a CAGR of 5.3% over the forecast period 2024-2032.

The liquid ring vacuum pumps market is experiencing continuous advancements driven by technology and various applications across sectors such as food packaging, chemical processing, and wastewater treatment. A key factor in the liquid ring vacuum pump market's growth is the increasing demand for energy-efficient and low-maintenance solutions that can help industries meet operational and environmental standards. Innovations such as variable-speed drive technology are transforming the landscape of liquid ring vacuum pumps, providing optimized energy use and enhancing performance. For instance, in February 2019, Atlas Copco launched its variable-speed drive liquid ring vacuum pump, a technology designed to provide more efficient and flexible operation, allowing industries to reduce their energy consumption while maintaining high performance. This innovative solution addresses the growing pressure on companies to reduce energy costs and improve sustainability in their operations.

The adoption of these pumps is also evident in industries that require specialized solutions. For example, in April 2024, Atlas Copco’s vacuum pump systems were installed at a Norwegian fish packaging facility, enhancing operational efficiency and reducing waste in the food packaging sector. This development highlights the adaptability of liquid ring vacuum pumps to highly regulated industries and demonstrates their ability to meet the specific needs of food preservation and packaging. These recent advancements by Atlas Copco exemplify how companies are not only meeting industry demands for energy-efficient solutions but are also playing a pivotal role in driving sustainability within critical sectors such as food and beverage production. Through such innovations, the liquid ring vacuum pumps market is poised for continued growth, driven by technological progress and the rising demand for sustainable, high-performance solutions across diverse industries.

Drivers:

Rising Demand for Energy-Efficient Solutions to Minimize Industrial Operational Costs and Environmental Footprints

The increasing emphasis on reducing energy consumption in industrial processes has spurred demand for energy-efficient liquid ring vacuum pumps. These systems are particularly valuable in applications requiring high reliability and low energy usage, such as chemical processing and wastewater treatment. Industries worldwide are under pressure to comply with stringent environmental regulations, driving manufacturers to innovate pumps that are both efficient and environmentally friendly. Advances in variable-speed drives and enhanced material technology ensure better energy optimization, significantly lowering operational costs while meeting regulatory requirements. This trend is crucial as industries focus on balancing operational efficiency with sustainability.

Growth in Food Processing and Packaging Industries with Strict Hygiene and Vacuum Standards

Expanding Applications in the Pharmaceutical Industry for Sterile and Safe Production Environments

Restraint:

High Initial Costs and Maintenance Challenges in Specific Industrial Applications

Opportunity:

Integration of IoT and Smart Technologies in Vacuum Systems for Real-Time Monitoring and Efficiency Optimization

The integration of IoT and smart technologies into liquid ring vacuum pumps presents significant growth opportunities. Real-time monitoring capabilities allow for predictive maintenance, reducing downtime, and improving system efficiency. Smart-enabled pumps can also optimize performance by adjusting operations based on process requirements, making them highly attractive to industries aiming for automation and improved productivity.

Growing Investments in Renewable Energy and Green Technologies across Global Markets

Expanding Role in Emerging Wastewater Treatment Applications for Industrial and Municipal Systems

Challenge:

Competition from Alternative Technologies Offering Enhanced Performance and Lower Costs

Industry Adoption Trends of Liquid Ring Vacuum Pumps in 2023: A Sector-wise Overview

In 2023, the adoption of liquid ring vacuum pumps was most prominent in the petrochemical and chemical industries, accounting for 30% of the market share. This was followed by food and beverage processing, reflecting the increasing demand for reliable packaging and processing solutions in these sectors. The water treatment industry also contributed a significant amount of the adoption, driven by the need for efficient and sustainable systems in wastewater management. Pharmaceutical and oil & gas industries accounted for a significant percentage of adoption respectively, as these sectors increasingly rely on vacuum pumps for critical operations such as evaporation, distillation, and gas compression.

By Type

The single-stage segment dominated the liquid ring vacuum pumps market in 2023, accounting for approximately 60% of the market share. This segment's dominance is due to its simplicity, cost-effectiveness, and reliability in handling applications requiring moderate vacuum levels. Single-stage pumps are extensively used in industries like chemical processing, food packaging, and water treatment, where medium-range vacuum levels suffice. For instance, these pumps are ideal for degassing and distillation processes in chemical plants. Their lower maintenance requirements compared to multi-stage pumps also add to their popularity, especially in industries seeking efficiency and cost savings.

By Material Type

The cast iron segment dominated the liquid ring vacuum pumps market in 2023, holding around 45% of the total share. Cast iron's durability and ability to withstand high-pressure conditions make it a preferred choice for heavy-duty applications. It is widely used in sectors such as oil and gas, petrochemicals, and pulp and paper, where robust material is crucial for prolonged operational life. For example, cast iron pumps are commonly deployed in vacuum filtration in the pulp and paper industry. Although stainless steel is gaining traction due to its corrosion resistance, cast iron remains dominant for cost-sensitive and heavy-duty scenarios.

By Rate

The 600–3,000 m³/h rate segment dominated the liquid ring vacuum pumps market in 2023, accounting for about 40% of the market share. These pumps are favored in medium to large-scale industrial processes, including chemical processing, pharmaceuticals, and food manufacturing. Their versatility and efficiency in managing both vacuum generation and fluid handling make them suitable for diverse applications such as vacuum drying and steam condensation. This capacity range offers an ideal balance of performance and cost, appealing to industries requiring reliable operation in medium-scale setups.

By Application

The chemical and petrochemical segment dominated the liquid ring vacuum pumps market in 2023, capturing over 30% of the market share. These industries heavily rely on liquid ring vacuum pumps for critical applications such as distillation, evaporation, and extraction. The pumps' ability to handle wet and corrosive gases without compromising efficiency makes them indispensable in chemical processes. For instance, their use in vacuum distillation and solvent recovery ensures safety and operational efficiency, driving their adoption across chemical manufacturing plants globally. Other industries, such as pharmaceuticals and food processing, also contribute significantly to demand, albeit to a lesser extent.

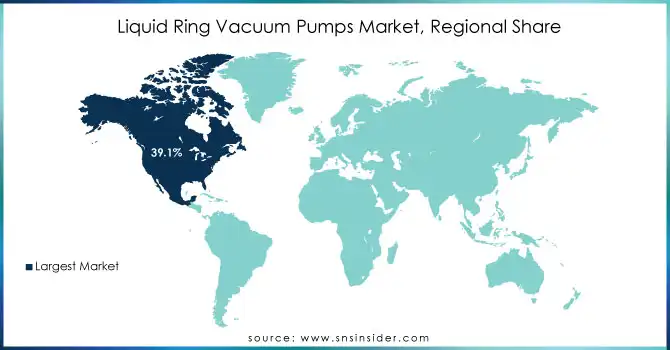

In 2023, North America dominated the liquid ring vacuum pumps market, capturing a market share of approximately 39.1%. This leadership is primarily attributed to the region's significant industrial activities, particularly in sectors like oil and gas, chemical processing, and food manufacturing. The oil and gas industry in North America, with significant reserves and ongoing investments in exploration and refining, relies heavily on liquid ring vacuum pumps for vapor recovery and gas compression. For example, the United States has been a key contributor, with its vast chemical manufacturing facilities driving demand for these pumps due to their ability to handle volatile and corrosive gases effectively. Similarly, Canada has seen notable adoption in its oil sands operations, further bolstering the market's dominance in the region. The region's advanced technological infrastructure and emphasis on energy efficiency have also enhanced the adoption of innovative pump designs by leading manufacturers like Flowserve and Busch Vacuum Solutions.

On the other hand, the Asia-Pacific region emerged as the fastest-growing market in 2023, with a CAGR of 5.7% in the forecast period. Rapid industrialization and urbanization in countries like China and India have been major growth drivers. China leads the regional demand due to its extensive investments in chemical processing and water treatment industries, while India shows substantial growth in pharmaceutical and food manufacturing applications. For example, China's environmental regulations for industrial wastewater treatment have spurred the adoption of liquid ring vacuum pumps, which excel in moisture-laden environments. Additionally, Japan's technological advancements in manufacturing and South Korea's automotive sector have further fueled regional demand. This growth trajectory is supported by regional manufacturers focusing on cost-effective solutions and increasing local production capabilities, positioning Asia-Pacific as a critical player in the global market.

Get Customized Report as per your Business Requirement - Request For Customized Report

April 2024: Atlas Copco's liquid ring vacuum pumps were implemented by a Norwegian fish packaging facility to enhance efficiency and maintain product freshness. These pumps supported critical processes, such as vacuum packaging, ensuring extended shelf life and adherence to hygiene standards. The deployment highlights the technology's role in supporting sustainable practices within the food industry, particularly in cold-chain logistics.

Agilent Technologies Inc. (PHD-4 Leak Detector, DS 302 Rotary Vane Pump)

Atlas Copco Airpower N.V. (AWS Single-Stage Pumps, LRP 700 VSD+)

Becker Pump Corporation (SV Series Liquid Ring Pumps, O-Series Rotary Vane Pumps)

Busch Vacuum Technics Inc (Panda Vacuum Pump, Dolphin Liquid Ring Vacuum Pump)

Dekker Vacuum Technologies Inc. (Vmax Oil-Sealed Liquid Ring Pump, AquaSeal Water-Sealed Vacuum Pump)

Edwards Limited (nXDS Dry Scroll Pumps, EH Booster Pumps)

Ebara Corporation (LSE Series, A Series Liquid Ring Vacuum Pumps)

Flowserve Corporation (SIHI LPH Series, SIHI Compact Pump)

Gardner Denver Holdings Inc. (Elmo Rietschle Liquid Ring Pumps, NASH Series)

Graham Corporation (CL Series, Ejector-Liquid Ring Combination Systems)

Kinney Vacuum Company Inc. (KLRC Series, KT Series Liquid Ring Pumps)

Kashiyama Industries Ltd. (SDE Series, KMB Series)

Pfeiffer Vacuum GmbH (OktaLine Series, OnTool Booster Pumps)

Pompetravaini S.p.A. (TRS Series, TRV Series)

PPI Pumps Pvt. Ltd. (Two-Stage Liquid Ring Pumps, Single-Stage Monoblock Pumps)

Robuschi S.p.A. (RVS Liquid Ring Pumps, Robox Series Blowers)

Sterling SIHI GmbH (LPH Series, Sterling T Range)

Tsurumi Manufacturing Co., Ltd. (LSP Series, HSZ Series Pumps)

ULVAC Inc. (GHD Series, LR Series)

Zibo Zhaohan Vacuum Pump Co., Ltd. (2BE Series, 2BV Series)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.5 Billion |

| Market Size by 2032 | US$ 2.4 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Single-stage, Multi-stage) •By Material Type (Cast Iron, Stainless Steel, Others) •By Rate (25 – 600 M3H, 600 – 3,000 M3H, 3,000 – 12,000 M3H, Over 12,000 M3H) •By Application (Petrochemical & Chemical, Pharmaceutical, Food Manufacturing, Aircraft, Automobile, Water Treatment, Oil & Gas, Power Generation, EPS and Plastics, Pulp & Paper, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco Airpower N.V., Busch Vacuum Technics Inc., Dekker Vacuum Technologies Inc., Flowserve Corporation, PPI Pumps Pvt. Ltd., Tsurumi Manufacturing Co., Ltd., Pompetravaini S.p.A., Edwards Limited, Gardner Denver Holdings Inc., Graham Corporation and other key players |

| Key Drivers | • Rapid Industrialization in Emerging Economies Driving Investments in Infrastructure and Processing Plants • Adoption of Advanced Materials and Technologies to Improve Pump Performance and Longevity |

| RESTRAINTS | • High Initial Costs and Maintenance Challenges in Specific Industrial Applications |

Ans: Keeping to strict standards of quality and Effects of COVID-19 on the Market for Liquid Ring Vacuum Pumps and Compressors are the challenges faced by the Liquid Ring Vacuum Pumps Market.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Busch Vacuum Technics Inc., Recent Developments, Graham Corp., Tuthill Vacuum & Blower Systems, Product Portfolio, Future Plans, Dekker Vacuum Technologies Inc., Financial Performance, Company Overview and Key Strategies.

Ans: Long imports into Japan and South Korea are going down and Water conservation problems are getting worse are the restraints for Liquid Ring Vacuum Pumps Market.

Ans: The Liquid Ring Vacuum Pumps Market Size was valued at USD 1.5 billion in 2023 and is expected to reach USD 2.4 billion by 2032.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID 19 Impact Analysis

4.2 Impact of Ukraine-Russia War

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8.Liquid Ring Vacuum Pumps Market Segment, By Type

8.1 Single-stage

8.2 Two-stage

9.Liquid Ring Vacuum Pumps Market Segment, By Material Type

9.1 Cast Iron

9.2 Stainless Steel

9.3 Others

10.Liquid Ring Vacuum Pumps Market Segment, By Rate

10.1 25 – 600 M3H

10.2 600 – 3,000 M3H

10.3 3,000 – 12,000 M3H

10.4 Over 12,000 M3H

11.Liquid Ring Vacuum Pumps Market Segment, By Application

11.1 Petrochemical & Chemical

11.2 Pharmaceutical

11.3 Food Manufacturing

11.4 Aircraft

11.5 Automobile

11.6 Water Treatment

11.7 Oil & Gas

11.8 Power Generation

11.9 EPS and Plastics

11.10 Pulp & Paper

11.11 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 USA

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Italy

12.3.5 Spain

12.3.6 The Netherlands

12.3.7 Rest of Europe

12.4 Asia-Pacific

12.4.1 Japan

12.4.2 South Korea

12.4.3 China

12.4.4 India

12.4.5 Australia

12.4.6 Rest of Asia-Pacific

12.5 The Middle East & Africa

12.5.1 Israel

12.5.2 UAE

12.5.3 South Africa

12.5.4 Rest

12.6 Latin America

12.6.1 Brazil

12.6.2 Argentina

12.6.3 Rest of Latin America

13. Company Profile

13.1 Busch Vacuum Technics Inc.

13.1.1 Financial

13.1.2 Products/ Services Offered

13.1.3 SWOT Analysis

13.1.4 The SNS view

13.2 Recent Developments

13.3 Graham Corp.

13.4 Tuthill Vacuum & Blower Systems

13.5 Product Portfolio

13.6 Future Plans

13.7 Dekker Vacuum Technologies Inc.

13.8 Financial Performance

13.9 Company Overview

13.10 Key Strategies

14.Competitive Landscape

14.1 Competitive Benchmark

14.2 Market Share analysis

14.3 Recent Developments

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Single-stage

Multi-stage

By Material Type

Cast Iron

Stainless Steel

Others

By Rate

25 – 600 M3H

600 – 3,000 M3H

3,000 – 12,000 M3H

Over 12,000 M3H

By Application

Petrochemical & Chemical

Pharmaceutical

Food Manufacturing

Aircraft

Automobile

Water Treatment

Oil & Gas

Power Generation

EPS and Plastics

Pulp & Paper

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Copper Fungicides Market size was valued at USD 385.45 million in 2023. It is expected to grow to USD 587.34 million by 2032 and grow at a CAGR of 4.79% over the forecast period of 2024-2032.

The Organosilicon Polymers Market was USD 1.8 billion in 2023 and is expected to reach USD 2.7 billion by 2032, growing at a CAGR of 4.3% over the forecast period of 2024-2032.

The Chrome Plating Market Size was USD 17.9 billion in 2023 and is expected to reach USD 26.53 billion by 2032, growing at a CAGR of 4.49% by 2024-2032.

The High-Performance Fibers Market Size was valued at USD 13.42 Billion in 2023 and is expected to reach USD 26.53 Billion by 2032 and grow at a CAGR of 7.90% over the forecast period 2024-2032.

The Dolomite Market Size was valued at USD 1.92 billion in 2023 and is expected to reach USD 3.42 billion by 2032 and grow at a CAGR of 7.61% from 2024-2032.

The Epoxy Adhesives Market Size was valued at USD 9.6 billion in 2023 and is expected to reach USD 14.8 billion by 2032 and grow at a CAGR of 4.9% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone