Lighting Control System Market Size & Growth:

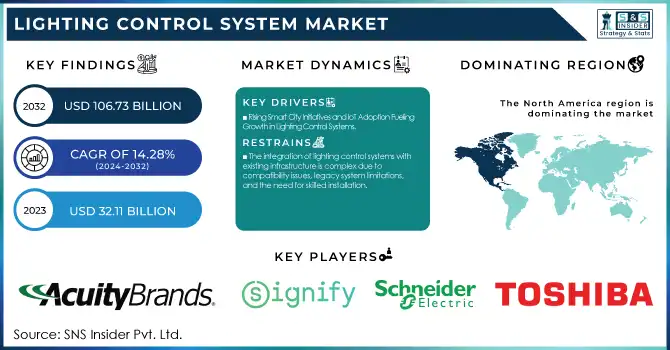

The Lighting Control System Market Size was valued at USD 32.11billion in 2023 and is expected to reach USD 106.73 billion by 2032 and grow at a CAGR of 14.28 % over the forecast period 2024-2032. The market is driven by the increasing adoption of smart lighting solutions, with a rising smart lighting integration rate across residential, commercial, and industrial sectors. Advancements in wireless connectivity, AI-driven automation, and IoT-based controls are enhancing the efficiency and flexibility of lighting systems.

To get more information on Lighting Control System Market - Request Free Sample Report

Moreover, the demand for energy-efficient solutions is fueling the adoption of lighting controls that optimize energy consumption through daylight harvesting and occupancy sensors. Governments worldwide are promoting smart city initiatives and offering incentives for sustainable lighting solutions, further propelling market growth. Additionally, the focus on reducing carbon emissions and cutting electricity costs is pushing businesses and consumers toward advanced dimming, scheduling, and cloud-based control systems. The market also benefits from innovations in hybrid wired-wireless solutions and the growing penetration of edge-based AI processing in smart lighting ecosystems.

Lighting Control System Market Dynamics:

Drivers:

-

Rising Smart City Initiatives and IoT Adoption Fueling Growth in Lighting Control Systems

The expansion of smart cities and advancements in wireless lighting technologies are driven by the spread of smart cities and the evolution of wireless lighting technologies. IoT solutions powered by ZigBee and Bluetooth allow integrated urban infrastructure with peak energy efficiency. Another government initiative that has spurred market growth is Australia’s 2018 reform, which replaced halogen lamps with LED lighting. [B1] Cities account for 78% of the world’s energy consumption, according to the United Nations, and increased urbanization might push 66% of the population globally to live in cities by 2050, one reason sensor-based, automated lighting systems are in demand. Although some challenges, such as high costs and wireless reliability, need to be overcome, the lighting control systems are becoming the backbone of smart city ecosystems, contributing to sustainability, connectivity, and energy management.

Restraints:

-

The integration of lighting control systems with existing infrastructure is complex due to compatibility issues, legacy system limitations, and the need for skilled installation.

Integrating lighting control systems with existing infrastructure, especially in retrofitting projects, presents significant challenges due to compatibility issues and technical complexities. Many older buildings were not designed with smart lighting in mind, making it difficult to incorporate modern control systems without extensive rewiring or additional hardware. Legacy electrical systems may not support advanced lighting protocols such as ZigBee, DALI, or Bluetooth Mesh, requiring costly adapters or infrastructure upgrades. Additionally, ensuring seamless communication between different brands and technologies can be challenging due to the lack of standardization in lighting control protocols. Skilled professionals are needed to configure and optimize these systems, increasing labor costs and installation time. These integration hurdles slow adoption, particularly in large-scale projects where downtime must be minimized.

Opportunities:

-

Rising Smart City Investments Drive IoT-Integrated Lighting Solutions

The growing number of smart city projects is one of the key factors driving demand for advanced lighting control systems integrated with IoT and automation. Several countries around the world are spending big on greening urban infrastructure to improve energy efficiency and sustainability. To illustrate, the U.S. International Development Finance Corporation (DFC) has pledged USD 267 million to modernize Rio de Janeiro’s public lighting system, seeking to decrease energy consumption by 60% and decrease carbon emissions by 70,000 tons per year. This initiative will also offer better infrastructure to communities, including over 5,000 public Wi-Fi access points and over 6,000 smart traffic lights. Such investments mirror smart lighting solution implementations around the world as related to creating smarter, more connected, and sustainable cities.

Challenges:

-

IoT-enabled lighting control systems face cybersecurity risks, requiring strong security measures to protect data and system integrity.

Lighting control systems are increasingly connected to IoT and cloud systems, but are also exposed to cybersecurity risks. Security and functionality can be compromised due to unauthorized access, data breaches, and system disruptions, resulting in potential operational failures. Hackers can exploit vulnerabilities in smart lighting networks to gain control over lighting infrastructure, manipulate energy usage, or even access connected systems in smart buildings. For instance, weak encryption, outdated firmware, and unsecured communication protocols can create entry points for cyber threats. To mitigate these risks, robust cybersecurity measures such as end-to-end encryption, multi-factor authentication, regular software updates, and network segmentation are essential. Additionally, compliance with international cybersecurity standards like ISO/IEC 27001 ensures enhanced protection against potential attacks, safeguarding both data and infrastructure integrity.

Lighting Control System Market Segment Analysis:

By Component

In 2023, the hardware segment dominated the lighting control system market, accounting for approximately 59% of the total market share. Increasing demand for smart lighting automation components, such as sensors, dimmers, switches and control modules, is expected to drive the market growth in the segment. Further, the increasing requirement for energy-efficient lighting and integration with IoT-based systems have boosted the aforementioned component's adoption. Moreover, evolved wireless communication technologies such as ZigBee and Bluetooth have reduced the effort of installation, thus making smart lighting more prevalent for both commercial and residential environments. While software solutions are growing and competing with hardware solutions, hardware is at the core of lighting control systems for its essential contributions to the functionality, reliability, and performance optimization of a lighting control system.

The software segment is the fastest-growing segment in the lighting control system market over the forecast period 2024-2032. This growth is being fueled by the rising implementation of cloud-based and artificial intelligence-powered lighting management platforms that allow for real-time monitoring, automation, and energy optimization. Smart lighting software works collaboratively with IoT and building management systems, enabling users to remotely control lighting using mobile apps and central dashboards. Improved adaptive lighting enables it to perform more efficiently while contributing to an improved user experience, powered by advancements in AI and machine learning. Furthermore, the growing emphasis on sustainability and regulatory mandates to conserve energy further increases the demand for intelligent lighting software. The software segment is also poised for further rapid expansion, as businesses and households focus on automation and energy savings.

By Communication Protocol

The Wired segment dominated the Lighting Control System Market, accounting for approximately 69.5% of the market share in 2023. Wired communication networks are more reliable, more stable, and have lower latency than wireless ones, which explains their dominance. Multi pair wired systems, like DALI (Digital Addressable Lighting Interface), KNX and BACnet are accustomed to commercial and industrial applications where continuity of performance and resistance to interference are essential. These systems can be easily integrated with conventional electrical systems, so they are often a go-to for large cities. Wired lighting control systems are also less subject to cyber threats and loss of connectivity, making them also more desirable in high security facilities. Although the wireless segment is gaining momentum, the wired segment is at its peak owing to its robustness and the preferred solution for critical operations with no loss of connectivity.

The Wireless segment is the fastest-growing in the Lighting Control System Market over the forecast period 2024-2032. Factors contributing to its growth include an increasing number of smart lighting solutions enabled by IoT, technological advancements in wireless communication technologies like ZigBee, Bluetooth, and Wi-Fi, as well as a growing demand for flexible and cost-effective lighting control systems. Historically, wireless solutions have minimized wiring requirements, therefore lowering installation costs and facilitating integration into complex smart buildings and upgrade sites. Furthermore, government programs to promote energy efficiency and smart city development accelerate adoption. With growing interest in automation and increasing adoption of remote-controlled lighting systems at homes and business facilities, wireless segment is projected to experience exponential growth, generating robust revenue for the global lighting control market.

By End Use

The indoor segment dominated the lighting control system market, accounting for approximately 59% of the revenue share in 2023. This is attributed to the growing penetration of smart lighting technology in commercial buildings, offices, retail and residential spaces. The growth of indoor lighting control systems has been driven by energy efficiency regulations, as well as a demand for automation and ambient lighting applications. As well, increasing adoption of IoT-based controls and sensor-based lighting solutions improve energy savings and operational efficiency. The indoor segment is likely to remain dominant in the market growth due to smart buildings and growing workplace automation trend.

The outdoor segment is the fastest-growing in the lighting control system market over the forecast period 2024-2032 , Various governments and municipalities are increasingly deploying IoT-enabled street lighting, automated traffic signals, and sensor-driven outdoor lighting to improve energy savings and lower operational costs. The growth of connected outdoor lighting networks and the implementation of adaptive lighting technologies are also fueling market expansion. Further demand for intelligent systems for outdoor lighting control in urban and commercial spaces is being driven by the increasing focus on sustainability and carbon footprint reduction.

Lighting Control System Market Regional Analysis:

North America dominated the lighting control system market with a 44% share in 2023, driven by strong infrastructure development, rapid adoption of smart technologies, and government initiatives promoting energy efficiency. The region’s leadership is fueled by high investments in smart buildings and smart city projects, particularly in the U.S. and Canada, where IoT-enabled lighting solutions are widely integrated into commercial and residential spaces. Stringent energy regulations, such as those set by the U.S. Department of Energy (DOE) and California’s Title 24, further accelerate market growth by mandating the use of automated and energy-efficient lighting systems. Additionally, the presence of key industry players and advancements in wireless lighting control technologies contribute to North America's continued dominance in the sector.

Asia-Pacific is the fastest-growing region in the lighting control system market over the forecast period 2024-2032, due to rapid urbanization, smart city initiatives, and increasing adoption of energy-efficient technologies. China, India, and Japan are supporting the demand for IoT-enabled lighting solutions by investing in smart infrastructure. The additional market growth drivers include government guidelines designed to encourage energy conservation, and increasing construction activities in both the commercial and residential sectors. Further, decreasing ln LED lighting and an ever-growing evolution in wireless control tech are allowing for smart lighting to be more feasible as well. Its rapid expansion is aided by the presence of large manufacturers and technological innovation across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Lighting Control System Market Key Players:

Some of the major Players in Lighting Control System Market along with their product:

-

Acuity Brands Lighting, Inc. (USA – Smart Lighting & Controls)

-

Signify Holding (Netherlands – LED Lighting & IoT-Based Systems)

-

General Electric Company (USA – Industrial & Commercial Lighting)

-

Schneider Electric (France – Energy-Efficient Lighting Solutions)

-

Toshiba (Japan – LED & Fluorescent Lighting Systems)

-

Eaton Corporation PLC (Ireland – Emergency & Industrial Lighting)

-

Honeywell International Inc. (USA – Smart Building Lighting Solutions)

-

Schneider Electric (France – Digital & Connected Lighting Systems)

-

Digital Lumens Inc. (USA – Intelligent LED & Sensor-Based Lighting)

-

Casambi (Finland – Wireless Lighting Control Systems)

-

MaxLite (USA – Energy-Efficient LED Lighting Solutions)

-

Lutron Electronics Co. Inc. (USA – Smart Dimmers & Lighting Controls)

List of Suppliers Who Provide Raw Material and Component In Lighting Control System Market:

-

OSRAM Licht AG

-

Nichia Corporation

-

Cree LED

-

Seoul Semiconductor

-

Bridgelux Inc.

-

ROHM Semiconductor

-

Texas Instruments

-

Infineon Technologies

-

NXP Semiconductors

-

Analog Devices, Inc.

Recent Development

-

November 6, 2024 – Casambi Launches Salvador 3016 in the US for Wired Lighting Control Casambi has introduced the Salvador 3016, a wired lighting controller designed for the North American market, enabling seamless integration with the Casambi ecosystem. The device allows up to 16 DALI drivers to connect, supporting hybrid wired-wireless networks and simplifying retrofits. It ensures compliance with ASHRAE 90.1-2022 energy efficiency regulations, offering a cost-effective, scalable, and vendor-independent lighting control solution.

-

March 26, 2024 – MaxLite Launches MaxLiteHome, Expanding Beyond LightingMaxLite has introduced MaxLiteHome™, a new residential product line featuring smart lighting, power strips, plugs, and air purifiers. The ENERGY STAR-certified line includes Wi-Fi-enabled devices that integrate with Amazon Alexa and Google Assistant for remote control. Consumers can monitor real-time energy usage via the Tuya app, making home management more efficient and cost-effective.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.11 Billion |

| Market Size by 2032 | USD 106.73 Billion |

| CAGR | CAGR of 14.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Communication Protocol (Wired, Wireless) • By End Use (Indoor Outdoor) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acuity Brands Lighting, Inc. (USA), Signify Holding (Netherlands), General Electric Company (USA), Schneider Electric (France), Toshiba (Japan), Eaton Corporation PLC (Ireland), Honeywell International Inc. (USA), Schneider Electric (France), Digital Lumens Inc. (USA), Casambi (Finland), MaxLite (USA), Lutron Electronics Co. Inc. (USA). |