Get more information on Lighting as a Service Market - Request Sample Report

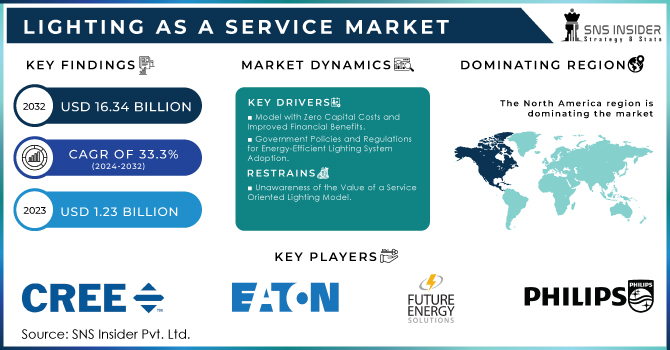

The Lighting As a Service Market Size was valued at USD 1.23 Billion in 2023 and is expected to reach USD 16.34 Billion by 2032 and grow at a CAGR of 33.3% over the forecast period 2024-2032.

The Lighting as a Service (LaaS) market is witnessing significant growth, driven by the rising emphasis on energy efficiency, cost savings, and sustainability across various sectors. Government mandates, corporate sustainability goals, and technological advancements are all contributing to the widespread adoption of Lighting as Service solutions. According to the U.S. Department of Energy (DOE), recently finalized efficiency standards for lightbulbs are set to save American households billions of dollars in energy costs over the next decade. This policy shift is pushing both the residential and commercial sectors towards more energy-efficient lighting systems, which in turn drives the demand for Lighting as a Service.

In addition to regulatory drivers, government agencies are actively promoting energy-efficient lighting in federal buildings. The General Services Administration (GSA) has provided clear guidance on procuring and using LED lighting systems and advanced lighting controls in federal infrastructure. This guidance is expected to accelerate the deployment of energy-efficient lighting solutions, with a particular focus on smart lighting systems that are often offered through Lighting as a Service business models. The GSA’s emphasis on reducing energy consumption and upgrading federal buildings to meet the latest efficiency standards further bolsters the LaaS market.

The core value proposition of Lighting as a Service is its ability to reduce upfront costs for organizations while delivering long-term savings on energy expenditures. LaaS typically operates on a subscription-based model, enabling companies to avoid the significant initial capital investment required for upgrading to LED and smart lighting systems. Research indicates that energy-efficient technologies like LED lighting consume up to 75% less energy than traditional incandescent lighting. This reduction in energy usage translates to significant cost savings, which are a major factor driving the adoption of Lighting as a Service especially for businesses looking to cut operational costs.

The LaaS model also incorporates advanced control systems and IoT-enabled lighting that allow for real-time monitoring, remote management, and automation of lighting systems. This technology enables businesses to optimize energy consumption by adjusting lighting based on occupancy and natural light levels, further increasing energy efficiency. Energy efficiency is becoming a top priority for many industries in the U.S., with businesses and households alike adopting efficient lighting solutions as part of broader efforts to reduce carbon emissions.

Urban areas around the world are integrating smart street lighting as part of larger efforts to improve public infrastructure and reduce energy consumption. These smart systems can be upgraded and maintained through LaaS, making it a convenient option for city planners and municipal governments. Smart lighting, when coupled with IoT-enabled technologies, can provide dynamic lighting solutions that respond to environmental conditions, such as extreme weather events, thereby reducing energy wastage and improving safety.

the Lighting as a Service market is supported by government incentives aimed at promoting the use of energy-efficient technologies. In the U.S., several states offer tax credits, rebates, and other incentives for businesses and homeowners who adopt energy-efficient lighting solutions, including those available through LaaS contracts. These incentives are expected to play a crucial role in accelerating market growth as organizations seek to capitalize on financial benefits while meeting regulatory requirements.

One of the key advantages of LaaS is its scalability. Companies of all sizes, from small businesses to large corporations, can adopt LaaS solutions tailored to their specific needs. For large-scale organizations, LaaS provides an efficient way to upgrade multiple facilities across different regions while ensuring consistency in lighting performance and energy savings. For small businesses, the model offers a cost-effective way to adopt the latest in LED lighting and smart controls without the financial burden of upfront costs.

The Lighting as a Service (LaaS) market is poised for robust growth over the next decade. Regulatory pressures, technological advancements, and economic benefits are driving the widespread adoption of LED lighting systems, smart controls, and IoT-based lighting technologies. With both private and public sectors increasingly focusing on sustainability and cost efficiency, LaaS is becoming a key player in the global energy efficiency market. As businesses, governments, and consumers continue to prioritize energy savings and carbon reduction, the demand for LaaS solutions is expected to increase significantly, contributing to the global effort to create more sustainable and energy-efficient environments.

Drivers

Innovative Technological Advancements Driving the Lighting as a Service Market

Technological advancements are a key driver of growth in the Lighting as a Service (LaaS) market. The rapid evolution of lighting technologies, including IoT-enabled smart lighting and advanced control systems, has made Lighting as a Service (LaaS) market solutions increasingly attractive to businesses. Innovations such as smart sensors and energy management software allow organizations to optimize their energy consumption effectively. For instance, smart lighting systems can reduce energy usage by up to 60% compared to traditional lighting solutions, leading to substantial cost savings on electricity bills. Moreover, the integration of data analytics enables real-time monitoring and adaptive lighting solutions, further enhancing energy efficiency. The adoption of LED technology continues to gain momentum, with estimates suggesting that global LED usage will surpass 85% by 2025. As companies increasingly focus on sustainability and operational efficiency, LaaS provides a scalable solution that aligns with their objectives. The ongoing advancements in lighting technology not only support environmental goals but also enhance the overall user experience by creating flexible and customizable lighting environments. These trends highlight the transformative impact of technology on the Lighting as a Service (LaaS) market, emphasizing its potential to shape the future of lighting solutions across various sectors.

Restraints

Overcoming Limited Awareness A Barrier to Growth in the Lighting as a Service Market

Limited awareness remains a significant restraint in the Lighting as a Service (LaaS) market, preventing many organizations from fully realizing the benefits of this innovative approach. A considerable number of businesses still lack knowledge about how Lighting as a Service can enhance energy efficiency, optimize operational costs, and reduce carbon footprints. This unawareness is concerning, especially as governments worldwide implement energy efficiency mandates and standards aimed at reducing energy consumption. For instance, the recent initiatives by various municipalities to promote awareness of energy-efficient lighting highlight the urgent need for organizations to adopt modern solutions. Additionally, industry reports indicate that about 60% of companies are not actively pursuing upgrades to their lighting systems, often due to misconceptions surrounding costs and complexity. As a result, potential customers may hesitate to transition from traditional lighting solutions, ultimately slowing market growth. Addressing this knowledge gap through educational campaigns and informative resources is crucial for stimulating demand and encouraging the adoption of LaaS. Increasing awareness will not only help businesses make informed decisions but also support broader sustainability goals, thereby propelling the LaaS market forward.

By Components

The Lighting as a Service (LaaS) market is significantly influenced by its key components, particularly luminaries and control systems, which accounted for approximately 55% of the market share in 2023. This dominance stems from various factors. Firstly, there is a growing demand for energy-efficient solutions as organizations aim to reduce energy consumption and carbon footprints. Advanced LED luminaries are increasingly popular due to their energy-saving features, while control systems optimize energy use by adjusting lighting levels based on occupancy and natural light. Secondly, innovations in smart lighting technology, including IoT-enabled devices, facilitate better integration with building management systems, enabling real-time monitoring and data analytics. Furthermore, the high degree of customization and flexibility offered by these luminaries and controls allows businesses to tailor solutions to their specific needs, enhancing user experience. Regulatory support and sustainability goals also play a crucial role, as energy efficiency mandates incentivize organizations to upgrade their lighting systems. Additionally, the LaaS model reduces upfront capital expenditures, making advanced technologies more accessible through subscription-based services. Overall, the luminaries and control segment is poised for continued growth, driven by energy efficiency, innovation, customization, regulatory support, and cost-effectiveness, solidifying its leading position in the Lighting as a Service market.

By Installation

Installation types heavily influence the Lighting as a Service (LaaS) market, with indoor installations accounting for an impressive revenue share of around 71% in 2023. This dominance stems from several key factors favoring indoor applications. First, organizations are placing a growing emphasis on energy efficiency, leading to heightened demand for advanced indoor lighting solutions in environments such as offices, retail spaces, and educational institutions. These smart lighting systems not only help reduce energy costs but also enhance ambiance and productivity. Additionally, the integration of smart building technologies has boosted the indoor segment, allowing for seamless connections between lighting systems and building management systems, thus enhancing operational efficiency and occupant comfort. The versatility and customization offered by indoor installations enable businesses to tailor lighting solutions for various applications, further driving adoption. Compliance with increasingly stringent energy efficiency regulations also plays a role in this growth, as organizations upgrade their lighting to meet sustainability goals. Lastly, the subscription-based model of LaaS alleviates the financial burden of upfront capital expenditures, making advanced indoor lighting solutions more accessible. As awareness of these benefits continues to rise, the indoor installation segment is poised for significant growth in the Lighting as a Service market.

North America is at the forefront of the Lighting as a Service (LaaS) market, capturing approximately 44% of the total market share in 2023. This leadership stems from several factors, including significant investments in energy efficiency, technological innovations, and a growing commitment to sustainability. North American governments have launched various initiatives promoting energy efficiency, with the U.S. Department of Energy establishing standards that encourage the adoption of advanced lighting technologies like LEDs and smart solutions. The integration of Internet of Things (IoT) technologies into smart building systems has further enhanced the appeal of LaaS, allowing for real-time energy usage monitoring and optimization. Key industry players, such as Philips Lighting and General Electric, have introduced innovative LaaS solutions tailored for commercial and industrial applications, thus improving energy efficiency and user experience. The increasing emphasis on sustainability has led organizations to seek eco-friendly lighting options, evidenced by numerous partnerships aimed at developing such solutions. In the U.S., cities like New York and San Francisco are implementing smart city initiatives that drive LaaS adoption across various sectors. Meanwhile, Canada is also seeing growth through provincial programs that incentivize businesses to upgrade their lighting systems. Overall, North America's proactive strategies are expected to sustain its leadership in the Lighting as a Service market.

Asia Pacific is rapidly emerging as the fastest-growing region in the Lighting as a Service (LaaS) market, propelled by swift urbanization, heightened awareness of energy efficiency, and government initiatives promoting sustainable lighting solutions. The region’s urban growth is driving cities to invest in smart infrastructure, necessitating advanced lighting technologies to enhance energy efficiency and improve urban quality. Countries such as China and India are leading the way with extensive urban development projects focusing on smart lighting systems. Government initiatives play a critical role, with programs like India's "Street Light National Program," which aims to replace traditional streetlights with smart LED systems, significantly boosting demand for LaaS. Meanwhile, Japan and Australia are implementing stringent energy efficiency standards that foster the adoption of innovative lighting solutions. Technological advancements, particularly the integration of Internet of Things (IoT) and artificial intelligence (AI) in lighting systems, are also enhancing the appeal of Lighting as a Service by enabling real-time monitoring and adaptive lighting. growing awareness of environmental sustainability is prompting organizations to seek greener lighting solutions. With active investments in research and development, along with rising collaborations, Asia Pacific is poised for significant growth in the Lighting as a Service market, solidifying its position as a leader in innovative lighting solutions.

Need any customization research on Lighting as a Service Market - Enquiry Now

Philips Lighting (Signify) (Connected LED lighting, smart street lighting, lighting management systems)

General Electric (GE) (Smart LED solutions, control systems, energy management software)

Osram Licht AG (Smart lighting systems, connected controls, LED lighting)

Acuity Brands, Inc. (Indoor and outdoor LED lighting, lighting controls, intelligent building solutions)

Cree, Inc. (LED luminaires, smart lighting controls, outdoor lighting solutions)

Schneider Electric (Lighting management systems, energy efficiency solutions, smart building technologies)

Honeywell (Smart building controls, energy management systems, connected lighting solutions)

Signify (formerly Philips Lighting) (IoT-enabled lighting solutions, smart indoor and outdoor lighting)

Legrand (Smart lighting control systems, occupancy sensors, energy management solutions)

Zumtobel Group (LED lighting solutions, intelligent lighting management systems)

Lutron Electronics (Lighting control systems, energy-efficient lighting solutions, automated shading systems)

Fagerhult Group (Indoor lighting, intelligent lighting systems, energy-efficient solutions)

Eaton (LED fixtures, connected lighting, intelligent lighting controls)

Royal Philips (Smart LED lighting, connected lighting solutions for homes and businesses)

Trane Technologies (Integrated building solutions, energy management systems, smart lighting controls)

Belden Inc. (Networking solutions for smart buildings, lighting controls)

Groupe Cahors (Smart street lighting solutions, energy management systems)

Sylvania (LEDVANCE) (Smart LED bulbs, connected lighting solutions, outdoor and indoor lighting systems)

Philips Lighting (Signify)

General Electric (GE)

Osram Licht AG

Acuity Brands, Inc.

Cree, Inc.

Schneider Electric

Honeywell

Zumtobel Group

Legrand

Lutron Electronics

Fagerhult Group

Eaton

Royal Philips

Trane Technologies

Belden Inc.

Groupe Cahors

Sylvania (LEDVANCE)

Hubbell Lighting

Siemens AG

Ameresco, Inc.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.23 Billion |

| Market Size by 2032 | US$ 16.34 Billion |

| CAGR | CAGR of 33.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cree Inc., Eaton Corporation plc, Future Energy Solutions, Igor Inc., Itelecom USA, Koninklijke Philips N.V., Lunera Lighting, RCG Lighthouse, SIB Lighting, Zumtobel Group AG |

| Key Drivers | • Model with Zero Capital Costs and Improved Financial Benefits. • Government Policies and Regulations for Energy-Efficient Lighting System Adoption. |

| Market Opportunity | • Internet of Things and Lighting System Integration • Smart City Development |

Ans: - The Lighting as a Service Market size was valued at USD 1.23 Bn in 2023.

Ans: - The Lighting as a Service market is to grow at CAGR of 33.3% over the forecast period 2024-2032.

Ans: - North America is likely to be one of the main areas driving the growth of the worldwide market over the forecast period.

Ans: - The major key players are Cree Inc., Eaton Corporation plc, Future Energy Solutions, Igor Inc., Itelecom USA, Koninklijke Philips N.V., Lunera Lighting, RCG Lighthouse, SIB Lighting, Zumtobel Group AG.

Ans: - Key Stakeholders Considered in the study are Raw material vendors, Regulatory authorities, including government agencies and NGOs, Commercial research, and development (R&D) institutions, Importers and exporters, etc.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Lighting as a Service Market Segmentation, by Components

7.1 Chapter Overview

7.2 Luminaries and control

7.2.1 Luminaries and control Market Trends Analysis (2020-2032)

7.2.2 Luminaries and control Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Lighting as a Service Market Segmentation, by Installation

8.1 Chapter Overview

8.2 Indoor Installation

8.2.1 Indoor Installation Market Trends Analysis (2020-2032)

8.2.2 Indoor Installation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Outdoor Installation

8.3.1 Outdoor Installation Market Trends Analysis (2020-2032)

8.3.2 Outdoor Installation Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Lighting as a Service Market Segmentation, by Application

9.1 Chapter Overview

9.2 Commercial

9.2.1 Commercial Market Trends Analysis (2020-2032)

9.2.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Industrial

9.3.1 Industrial Market Trends Analysis (2020-2032)

9.3.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Municipal

9.4.1 Municipal Market Trends Analysis (2020-2032)

9.4.2 Municipal Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Lighting as a Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.2.4 North America Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.2.5 North America Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.2.6.2 USA Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.2.6.3 USA Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.2.7.2 Canada Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.2.7.3 Canada Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.2.8.2 Mexico Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.2.8.3 Mexico Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Lighting as a Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.1.6.2 Poland Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.6.3 Poland Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.1.7.2 Romania Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.7.3 Romania Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Lighting as a Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.4 Western Europe Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.5 Western Europe Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.6.2 Germany Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.6.3 Germany Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.7.2 France Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.7.3 France Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.8.2 UK Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.8.3 UK Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.9.2 Italy Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.9.3 Italy Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.10.2 Spain Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.10.3 Spain Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.13.2 Austria Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.13.3 Austria Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Lighting as a Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.6.2 China Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.6.3 China Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.7.2 India Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.7.3 India Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.8.2 Japan Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.8.3 Japan Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.9.2 South Korea Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.9.3 South Korea Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.10.2 Vietnam Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.10.3 Vietnam Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.11.2 Singapore Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.11.3 Singapore Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.12.2 Australia Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.12.3 Australia Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Lighting as a Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.1.4 Middle East Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.5 Middle East Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.1.6.2 UAE Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.6.3 UAE Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Lighting as a Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.2.4 Africa Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2.5 Africa Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Lighting as a Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.6.4 Latin America Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.5 Latin America Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.6.6.2 Brazil Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.6.3 Brazil Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.6.7.2 Argentina Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.7.3 Argentina Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.6.8.2 Colombia Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.8.3 Colombia Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Lighting as a Service Market Estimates and Forecasts, by Components (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Lighting as a Service Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Lighting as a Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Philips Lighting (Signify)

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 General Electric (GE)

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Osram Licht AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Acuity Brands, Inc.,

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Cree, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Schneider Electric

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Honeywell

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Signify (formerly Philips Lighting)

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Legrand

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Legrand

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Luminaries and control

Software

Services

By Installation

Indoor installation

Outdoor installation

By Application

Commercial

Industrial

Municipal

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Lighting as a Service Market Size was valued at USD 1.23 Billion in 2023 & will reach USD 16.34 Billion by 2032 & grow at a CAGR of 33.3% by 2024-2032.

The Zero Trust Security Market Size was valued at USD 29.01 Billion in 2023 and is expected to reach USD 117.3 Billion by 2032, growing at a CAGR of 16.8% over the forecast period 2024-2032.

Carrier Aggregation Solutions Market was valued at USD 3.92 billion in 2023 and is expected to reach USD 17.77 billion by 2032, growing at a CAGR of 18.35% from 2024-2032.

The Industrial Ethernet Market was valued at USD 11.2 Billion in 2023 and is expected to reach USD 21.9 Billion by 2032, growing at a CAGR of 7.74% from 2024-2032.

The Mobile Wallet Market was valued at USD 9.9 billion in 2023 and is expected to reach USD 89.3 billion by 2032, growing at a CAGR of 27.66% over 2024-2032.

Edge Analytics Market was valued at USD 10.91 billion in 2023 and is expected to reach USD 81.97 billion by 2032, growing at a CAGR of 25.10% from 2024-2032.

Hi! Click one of our member below to chat on Phone