Get More Information on Light Commercial Vehicles Market - Request Sample Report

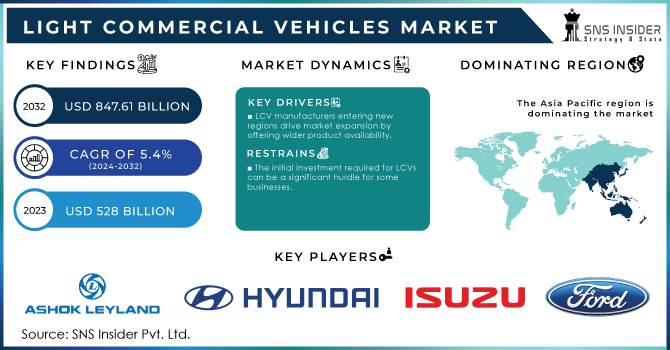

The Light Commercial Vehicles Market size was valued at USD 528 billion in 2023 and is expected to reach USD 847.61 billion by 2032 and grow at a CAGR of 5.4% over the forecast period 2024-2032.

E-commerce, which is an undisputed retail giant has fuelled a 70% increase in demand for last mile delivery solutions resulting in more agile and efficient LCVs. Urbanisation, which accounts for about 35% of world population has intensified intra-city logistics thus increasing the demand for compact and movement LCVs. Strict emission rules have led to a 45% rise in demand for environmentally friendly and electric LCVs as companies aim to minimize their carbon footprint. Moreover, the upswing of construction and infrastructure industries coupled with emergence of small scale enterprises resulted in a 30% increase in LCV purchase indicating that such vehicles are indispensable in work places.

There is an increasing number of electric LCVs that are expected to be electric by 2025, representing about 10% of new LCV sales due to strict emission control measures and government incentives. Moreover, the last mile section of the supply chain is blossoming as a result of which demand for small vans and e-bikes has increased significantly. A noticeable shift in preference towards fuel efficiency and alternative fuels have been noticed with CNG/LPG types occupying a quarter of total market share. Additionally, connected vehicle technology is quickly being integrated into LCVs whereby more than half the recent models have advanced telematics solutions used in fleet management as well as driver safety assistance.

KEY DRIVERS:

LCV manufacturers entering new regions drive market expansion by offering wider product availability.

Rising online shopping fuels demand for efficient last-mile delivery solutions, perfectly suited for LCVs.

The rise in e-commerce has increased the demand for efficient and reliable last-mile delivery services. Light Commercial Vehicles (LCVs) are emerging as the perfect solution due to their inherent advantages. Their compact size and movability allow them to navigate congested streets and tight parking spaces with ease, ensuring timely deliveries even in dense urban environments. Thus, compared to larger trucks, LCVs offer greater fuel efficiency, contributing to a more sustainable delivery ecosystem.

RESTRAINTS:

LCVs have a smaller payload capacity compared to larger trucks, restricting the volume of goods they can transport in a single trip.

The initial investment required for LCVs can be a significant hurdle for some businesses.

The LCVs offer numerous advantages but their adoption can be hindered by the initial investment required. The upfront costs associated with purchasing LCVs can be a significant hurdle for some businesses, particularly smaller operations. This financial barrier can limit their ability to modernize their fleet and embrace the benefits of LCV technology. This financial barrier could potentially slow down the widespread adoption of LCVs in certain sectors.

OPPORTUNITIES:

Growing focus on sustainability creates an opportunity for electric LCVs offering eco-friendly deliveries.

KEY MARKET SEGMENTS:

By Vehicle Type:

Pickup Trucks is the dominating sub-segment in the Light Commercial Vehicles Market by vehicle type holding around 40-45% of market share. Pickup trucks offer a unique combination of cargo capacity and passenger space, making them highly versatile for various applications. They are popular in construction, landscaping, and service industries due to their ability to handle rough terrain and tow equipment.

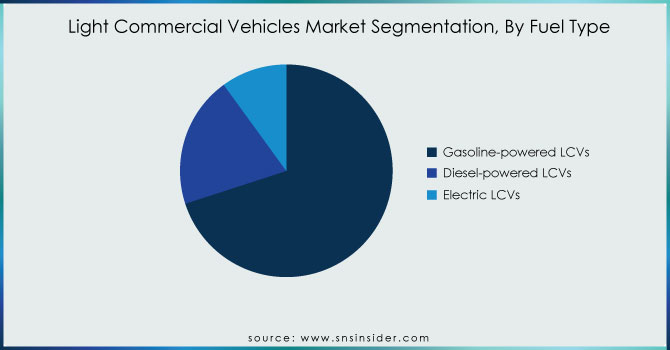

By Fuel Type:

Gasoline-powered LCVs is the dominating sub-segment in the Light Commercial Vehicles Market by fuel type holding around 70-75% of market share. Gasoline remains the dominant fuel type due to its widespread availability, lower upfront vehicle cost compared to electric alternatives, and extensive refuelling infrastructure. However, this trend is expected to shift as electric LCVs become more cost-competitive and government regulations on emissions become stricter.

Get Customized Report as per your Business Requirement - Ask For Customized Report

By End-Use Industry:

Transportation and Logistics is the dominating sub-segment in the Light Commercial Vehicles Market by end-user industry. The ever-growing e-commerce sector and expanding global trade heavily rely on LCVs for efficient last-mile delivery and efficient movement of goods. This segment is expected to maintain its dominance due to the increasing demand for faster and more reliable transportation solutions.

The Asia Pacific is the dominating region in the Light Commercial Vehicle Market holding around 45-50% of market share. This dominance stems from a confluence of factors. The rising economies are fueling demand for goods, necessitating efficient LCVs for transportation and logistics. The rapid urbanization and infrastructure development are creating opportunities for LCVs in construction and service sectors. North America is the second highest region in the Light Commercial Vehicle Market due to its well-established LCV manufacturing base and strong demand from construction, logistics, and service industries. Europe is experiencing the fastest growth driven by stringent emission regulations promoting electric and hybrid LCVs, a growing focus on sustainable transportation, and investments in upgrading aging infrastructure, which necessitates efficient LCVs for maintenance and construction projects.

KEY PLAYERS

The major key players are Ashok Leyland, Hyundai Motor Company, Ford Motor Company, Isuzu Motors, Gaz Group, General Motors, Honda Motor Company, Renault Group, Tata Motors, Toyota Motors and other key players.

RECENT DEVELOPMENT

In March 2023: Rivian teamed up with Morgan Olson to develop electric delivery vehicles. Rivian's advanced tech, including its chassis platform, will be incorporated into custom-made models like the Morgan Olson C250E for Canada Post.

In Oct. 2023: Stellantis is electrifying its commercial vehicle fleet in North America with four electric pickups and five electric vans. This expansion will encompass six brands and offer a total of 15 electric vehicles, including a micro-mobility solution.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 528 Billion |

| Market Size by 2032 | US$ 841.67 Billion |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Vans, Pickup Trucks, Light Trucks) • By Fuel Type (Gasoline-powered LCVs, Diesel-powered LCVs, Electric LCVs) • By End-Use Industry (Transportation and Logistics, Construction and Infrastructure, Agriculture and Farming, Service and Utility, Public Sector and Municipalities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ashok Leyland, Hyundai Motor Company, Ford Motor Company, Isuzu Motors, Gaz Group, General Motors, Honda Motor Company, Renault Group, Tata Motors, and Toyota Motors |

| Key Drivers | • Government tax credits, subsidies, and incentives are driving demand for commercial vehicles. • Expansion of the automotive manufacturing sector. |

| RESTRAINTS | • Stringent CO2 emission laws have an impact on industrial costs. • Emission regulations are stricter. |

Ans: The Light Commercial Vehicles Market was valued at USD 528 billion in 2023.

Ans:- A light commercial vehicle, often known as an LCV, is a type of automobile that has at least four wheels and is designed specifically for the transportation of products.

Ans:- North American region is anticipated to be the primary driver of the market.

Ans:- Yes.

Ans:- Ashok Leyland, Hyundai Motor Company, Ford Motor Company, General Motors, Honda Motor Company, Renault Group, Tata Motors, and Toyota Motors are the most prominent players in the market.

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Light Commercial Vehicles Market Segmentation, by Vehicle Type

7.1 Chapter Overview

7.2 Vans

7.2.1 Vans Market Trends Analysis (2020-2032)

7.2.2 Vans Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Pickup Trucks

7.2.3.1 Pickup Trucks Market Trends Analysis (2020-2032)

7.2.3.2 Pickup Trucks Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Light Trucks

7.2.4.1 Light Market Trends Analysis (2020-2032)

7.2.4.2 Light Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Light Commercial Vehicles Market Segmentation, by Fuel Type

8.1 Chapter Overview

8.2 Gasoline-powered LCVs

8.2.1 Gasoline-powered LCVs Trends Analysis (2020-2032)

8.2.2 Gasoline-powered LCVs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Diesel-powered LCVs

8.3.1 Diesel-powered LCVs Market Trends Analysis (2020-2032)

8.3.2 Diesel-powered LCVs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Electric LCVs

8.3.1 Electric LCVs Market Trends Analysis (2020-2032)

8.3.2 Electric LCVs Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Light Commercial Vehicles Market Segmentation, by End Use

9.1 Chapter Overview

9.2 Transportation & Logistics

9.2.1 Transportation & Logistics Market Trends Analysis (2020-2032)

9.2.2 Transportation & Logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Construction and Infrastructure

9.3.1 Construction and Infrastructure Market Trends Analysis (2020-2032)

9.3.2 Construction and Infrastructure Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Agriculture and Farming

9.4.1 Agriculture and Farming Market Trends Analysis (2020-2032)

9.4.2 Agriculture and Farming Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Service & Utility

9.5.1 Service & Utility Market Trends Analysis (2020-2032)

9.5.2 Service & Utility Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Public Sector & Municipalities

9.6.1 Public Sector & Municipalities Market Trends Analysis (2020-2032)

9.6.2 Public Sector & Municipalities Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Light Commercial Vehicles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.4 North America Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.2.5 North America Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.6.2 USA Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.2.6.3 USA Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.7.2 Canada Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.2.7.3 Canada Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Light Commercial Vehicles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Light Commercial Vehicles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.7.2 France Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.7.3 France Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Light Commercial Vehicles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.6.2 China Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.6.3 China Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.7.2 India Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.7.3 India Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.8.2 Japan Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.8.3 Japan Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.12.2 Australia Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.12.3 Australia Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Light Commercial Vehicles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Light Commercial Vehicles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.4 Africa Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.2.5 Africa Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Light Commercial Vehicles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.4 Latin America Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.6.5 Latin America Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Light Commercial Vehicles Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Light Commercial Vehicles Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Light Commercial Vehicles Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Ashok Leyland

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Hyundai Motor Company

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products / Services Offered

11.2.4 The SNS View

11.3 Ford Motor Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products / Services Offered

11.3.4 The SNS View

11.4 Isuzu Motors

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products / Services Offered

11.4.4 The SNS View

11.5 Gaz Group

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products / Services Offered

11.5.4 The SNS View

11.6 General Motors

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products / Services Offered

11.6.4 The SNS View

11.7 Honda Motor Company

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products / Services Offered

11.7.4 The SNS View

11.8 Renault Group

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products / Services Offered

11.8.4 The SNS View

11.9 Tata Motors

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products / Services Offered

11.9.4 The SNS View

11.10 Others

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products / Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Vehicle Type

Vans

Pickup Trucks

Light Trucks

By Fuel Type

Gasoline-powered LCVs

Diesel-powered LCVs

Electric LCVs

By End-Use Industry

Transportation and Logistics

Construction and Infrastructure

Agriculture and Farming

Service and Utility

Public Sector and Municipalities

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Electric Power Steering Market size was valued at USD 24.1 billion in 2023 and will reach USD 39.50 Bn by 2032 and grow at a CAGR of 4.57% by 2024-2032.

The Advanced Driver Assistance Market Size will reach USD 162.04 billion by 2032, was $56.81 billion in 2023 and will grow at a CAGR of 12.4% by 2024-2032.

The Automotive Retread Tires Market size was valued at USD 7756 million in 2023 and is expected to reach USD 10614.6 million by 2031 and grow at a CAGR of 4% over the forecast period 2024-2031.

The Automotive Wheel Rims Market Size was USD 42.36 billion in 2023 and is expected to hit USD 87.55 billion by 2031 and grow at a CAGR of 9.5% by 2024-2031

The Forklift Market Size was valued at USD 65.20 billion in 2023 and is expected to reach $202.19 billion by 2032 and grow at a CAGR of 13.4% by 2024-2032

The Railway Management System Market size was USD 52.38 billion in 2023 and will Reach USD 104.37 billion by 2031 and grow at a CAGR of 9% by of 2024-2031

Hi! Click one of our member below to chat on Phone