Legal Technology Market Report Scope & Overview:

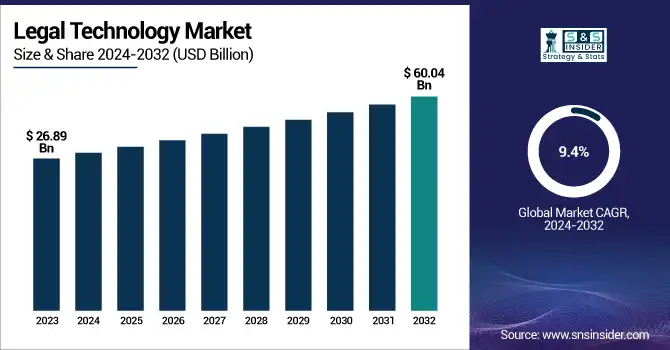

The Legal Technology Market Size was valued at USD 26.89 Billion in 2023 and is expected to reach USD 60.04 Billion by 2032 and grow at a CAGR of 9.4% over the forecast period 2024-2032.

To Get more information on Legal Technology Market - Request Free Sample Report

The market is growing rapidly, driven by digital transformation, regulatory complexity, and workflow automation. Law firms and corporate legal departments are adopting AI, cloud computing, blockchain, and automation for contract management, e-discovery, compliance tracking, and document review. The shift to cloud-based SaaS platforms enhances accessibility and security, with companies like DocuSign and Clio leading in automated legal solutions. AI-powered legal analytics and research tools are revolutionizing case predictions and decision-making. Rising data privacy regulations (GDPR, CCPA) further fuel demand for secure legal tech solutions, positioning the market for sustained growth and innovation in legal services.

Legal Technology Market Dynamics

Key Drivers:

-

Growing Adoption of AI, Automation, and Cloud-Based Solutions Drives the Legal Technology Market Growth

The Legal Technology Market is expanding rapidly due to the increasing adoption of AI, automation, and cloud-based solutions in legal operations. Law firms and corporate legal departments are leveraging artificial intelligence (AI) for contract analysis, predictive analytics, and legal research, enhancing efficiency and accuracy. Automation tools streamline workflows, reducing manual labor and improving turnaround time for case management, e-discovery, and compliance tracking. The shift toward cloud-based legal solutions offers improved accessibility, data security, and real-time collaboration. Companies like DocuSign and Clio are leading innovation in contract lifecycle management and legal practice automation, demonstrating the rising industry demand.

Moreover, the legal sector’s increasing reliance on AI-powered chatbots, virtual legal assistants, and blockchain-based smart contracts further accelerates market growth. The need for cost-effective, technology-driven legal services is also prompting law firms and corporate legal teams to invest in digital transformation. Additionally, regulatory compliance requirements, such as GDPR and CCPA, are pushing firms to adopt secure legal tech solutions to ensure data protection and risk mitigation. With the continued advancement of machine learning, NLP (natural language processing), and cloud infrastructure, the Legal Technology Market is expected to witness significant expansion in the coming years.

Restrain:

-

High Implementation Costs and Cybersecurity Concerns Restrain the Growth of the Legal Technology Market

Despite its rapid growth, the Legal Technology Market faces significant challenges due to high implementation costs and cybersecurity concerns. Many small and mid-sized law firms struggle to adopt AI-driven legal tools and cloud-based platforms due to budget constraints and high initial investment costs. Advanced legal analytics, document management, and contract automation tools require significant financial resources for deployment, training, and integration with existing systems.

Moreover, cybersecurity risks pose a major concern as legal technology platforms handle sensitive client data, contracts, and case information. Data breaches, hacking attempts, and compliance violations can expose confidential legal documents, leading to financial and reputational damage for law firms and corporate legal teams. The implementation of strong encryption, multi-factor authentication, and regulatory compliance measures increases operational costs, further limiting adoption. Additionally, some traditional legal professionals resist adopting AI-powered legal solutions due to concerns about job displacement and the accuracy of automated decision-making. The lack of standardized regulations for AI-driven legal tech also creates uncertainty in implementation. While the Legal Technology Market continues to expand, addressing cost barriers and cybersecurity threats remains essential for sustained growth and wider adoption.

Opportunities:

-

Expanding LegalTech Applications in Compliance and Regulatory Risk Management Creates Lucrative Market Opportunities

The rising complexity of regulatory frameworks and compliance mandates is driving demand for LegalTech solutions, creating lucrative market opportunities. Businesses across industries must navigate an increasing number of legal and regulatory requirements, including GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), AML (Anti-Money Laundering) laws, and ESG (Environmental, Social, and Governance) compliance. This growing need has led to the widespread adoption of AI-driven compliance management solutions, risk assessment software, and automated regulatory reporting tools. Law firms and corporate legal teams are integrating LegalTech platforms to ensure real-time compliance tracking, document verification, and audit management, minimizing legal risks and penalties. Companies such as LexisNexis and Knovos are investing in AI-powered regulatory compliance solutions, offering tools for automated policy monitoring and risk analysis. The expansion of blockchain-based legal contracts is also enabling secure and tamper-proof record-keeping, further enhancing compliance practices.

Additionally, the demand for cross-border legal compliance solutions is rising as companies expand globally, increasing reliance on LegalTech providers. With governments continuously updating data protection, corporate governance, and financial compliance laws, the Legal Technology Market is set to experience significant opportunities in the compliance and risk management segment.

Challenges:

-

Integration Challenges and Resistance to Technology Adoption Hinder Legal Technology Market Growth

The Legal Technology Market faces major challenges due to integration issues and resistance to technology adoption by legal professionals. Many traditional law firms and corporate legal departments rely on legacy systems and paper-based workflows, making the transition to AI-driven legal software, cloud platforms, and automation tools difficult. The integration of new LegalTech solutions with existing case management and document storage systems requires extensive customization, training, and IT infrastructure upgrades, leading to delays and additional costs. Furthermore, many legal professionals resist adopting AI-powered tools due to concerns about accuracy, reliability, and potential job displacement. Lawyers and legal teams often prefer manual legal research and contract analysis over automated solutions, questioning AI’s ability to interpret complex legal nuances.

Additionally, the lack of standardization in LegalTech tools makes interoperability between different platforms challenging, further discouraging adoption. Companies must focus on user-friendly interfaces, seamless integration capabilities, and legal industry-specific AI training models to address these concerns. As the legal sector gradually shifts towards digital transformation, overcoming resistance to automation and improving integration flexibility will be critical for driving Legal Technology Market growth and innovation.

Legal Technology Market Segments Analysis

By Solution

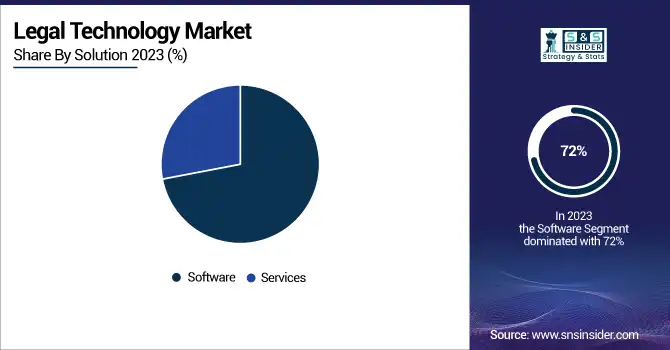

The Software segment held the largest share in the Legal Technology Market, accounting for 72% of revenue in 2023, driven by the increasing adoption of cloud-based and AI-powered legal solutions. Legal firms and corporate legal departments are rapidly shifting towards automated contract management, e-discovery, legal research, compliance tracking, and document automation to improve efficiency and reduce manual workloads. The growing demand for secure, scalable, and cost-efficient legal tech solutions is further accelerating SaaS-based legal software adoption, allowing firms to operate remotely with enhanced collaboration.

For instance, Clio expanded its cloud-based practice management software, integrating AI capabilities to streamline legal documentation and billing. Similarly, DocuSign enhanced its Agreement Cloud platform, introducing AI-based contract analytics and automated compliance tools.

The Services segment in the Legal Technology Market is experiencing the fastest CAGR of 10.35% during the forecasted period, driven by the increasing need for consulting, implementation, support, and managed legal services. As law firms and corporate legal teams adopt AI, cloud computing, and automation, they require specialized services to integrate, optimize, and maintain these technologies.

For example, Filevine launched AI-enhanced consulting services to assist law firms in optimizing their workflow automation and data security compliance. Similarly, Everlaw introduced advanced litigation support services, enabling seamless integration of AI-driven case management and document review.

By End User

The Law Firms segment accounted for the largest revenue share of 47% in the Legal Technology Market in 2023, driven by the increasing adoption of AI-powered legal research, contract automation, and practice management software. Law firms are leveraging cloud-based legal solutions, AI-driven case analysis tools, and digital billing platforms to enhance productivity and reduce operational costs. Companies such as Clio, LexisNexis, and Everlaw have launched advanced legal technology platforms tailored specifically for law firms.

For instance, Clio expanded its cloud-based legal practice management software, integrating AI-driven billing automation and document management to streamline legal operations. Similarly, LexisNexis introduced AI-powered legal analytics tools, enabling law firms to improve case predictions and risk assessments.

The Corporate Legal Departments segment is growing at the fastest CAGR of 10.31% during the forecast period, driven by the increasing need for regulatory compliance, contract lifecycle management (CLM), and AI-driven legal analytics. As corporations face complex legal and regulatory requirements, they are investing in automated legal solutions to streamline contract management, risk assessment, and compliance tracking. Companies such as Icertis, DocuSign, and Knovos have introduced innovative legal technology solutions to cater to corporate legal teams.

Additionally, businesses are leveraging blockchain-based smart contracts and legal analytics platforms to optimize dispute resolution and regulatory adherence. As corporations continue to prioritize cost-effective legal operations, risk mitigation, and automation-driven legal compliance, the Corporate Legal Departments segment will remain a key driver of growth in the Legal Technology Market.

By Type

The Contract Lifecycle Management (CLM) segment held the largest revenue share in the Legal Technology Market in 2023, driven by the increasing adoption of AI-powered contract automation, compliance tracking, and risk management solutions. Businesses and law firms are leveraging CLM software to streamline contract drafting, negotiation, execution, and renewal processes, reducing human errors and improving efficiency. Companies like Icertis, DocuSign, and Knovos are leading the CLM market with advanced cloud-based and AI-driven contract management solutions.

Additionally, the integration of blockchain technology in CLM solutions has enhanced contract security and transparency, further accelerating adoption. As corporations seek cost-effective, AI-driven contract management solutions, the Contract Lifecycle Management segment will continue to dominate the Legal Technology Market, driving innovation and operational efficiency across industries.

The Analytics segment is growing at the fastest CAGR in the forecast period, fueled by the rising demand for AI-driven legal insights, predictive analytics, and risk assessment tools. Legal professionals and corporate legal departments are increasingly adopting legal analytics platforms to analyze case trends, optimize decision-making, and improve litigation strategies. Companies such as LexisNexis, Everlaw, and Casetext have launched advanced AI-powered legal analytics solutions, transforming the way legal professionals interpret case law, predict outcomes, and assess risks.

The increasing use of machine learning and natural language processing (NLP) in legal analytics is helping organizations automate legal research and risk evaluations more efficiently. Additionally, the integration of big data analytics in legal decision-making is enhancing regulatory compliance, fraud detection, and case outcome predictions.

Regional Analysis

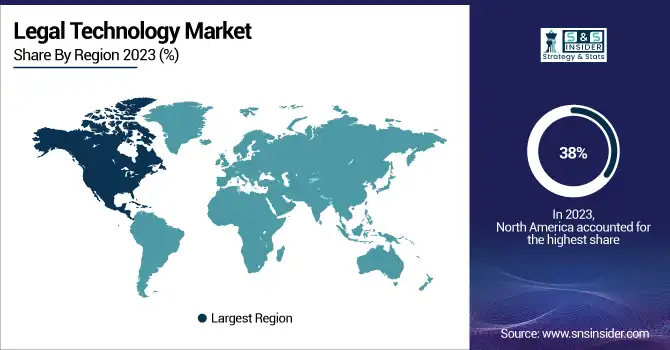

In 2023, North America held the largest market share in the Legal Technology Market, driven by the widespread adoption of AI-powered legal solutions, cloud-based contract management, and advanced litigation analytics. The region accounted for approximately 38% of the global market share, supported by well-established legal firms, increasing regulatory complexities, and strong investments in legal technology. Major legal tech companies such as DocuSign, Clio, LexisNexis, and Everlaw are headquartered in North America, leading the development of automated compliance tracking, legal analytics, and contract lifecycle management solutions.

For example, Clio expanded its cloud-based practice management software, enhancing AI-driven document automation for law firms. Similarly, DocuSign strengthened its AI-powered Agreement Cloud platform, enabling enterprises to streamline contract workflows.

The Asia Pacific region is witnessing the fastest growth in the Legal Technology Market, with an estimated CAGR of 11.2% during the forecast period. This rapid growth is fueled by rising legal complexities, increasing digital adoption in corporate legal departments, and government-led initiatives for legal automation. Countries such as China, India, Japan, and Australia are experiencing a surge in demand for AI-powered legal research tools, e-discovery solutions, and compliance automation software. The increasing presence of multinational corporations, cross-border transactions, and evolving data protection laws (such as India’s Personal Data Protection Bill and China’s Cybersecurity Law) are further driving legal tech adoption. Additionally, the growth of startups specializing in AI-driven legal solutions and government-backed digitization initiatives are accelerating market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Legal Technology Market are:

-

Icertis, Inc. (Icertis Contract Intelligence, Icertis Contract Lifecycle Management)

-

Filevine Inc. (Filevine Case Management, Lead Docket)

-

DocuSign, Inc. (DocuSign eSignature, DocuSign CLM)

-

Casetext Inc. (Casetext AI Legal Research, Compose Brief Drafting)

-

ProfitSolv, LLC (Rocket Matter, CosmoLex)

-

Knovos, LLC (Knovos eDiscovery, Knovos Arbitrate)

-

Mystacks, Inc. (Mystacks Legal Document Management, Mystacks Case Collaboration)

-

Practice Insight Pty Ltd (WiseTime) (WiseTime Automatic Time Tracking, WiseTime Legal Billing)

-

TimeSolv Corporation (TimeSolv Legal Billing, TimeSolv Legal Project Management)

-

Themis Solutions Inc. (Clio) (Clio Manage, Clio Grow)

-

Everlaw, Inc. (Everlaw eDiscovery Platform, Everlaw Litigation Management)

-

LexisNexis Legal & Professional Company (Lexis+ Legal Research, LexisNexis CounselLink)

Recent Trends

-

In June 2024, Filevine introduced a new document management system named Docs by Filevine. This platform was designed to enhance legal document handling by integrating seamlessly with Filevine's existing case management software, offering features such as real-time collaboration, advanced search capabilities, and secure cloud storage. The launch aimed to streamline document workflows for legal professionals, reducing reliance on disparate tools and improving overall efficiency.

-

In February 2025, Clio, a legal technology firm based in Burnaby, announced a $3 million donation to the University of British Columbia's Sauder School of Business for its Powerhouse Project.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 26.89 Billion |

| Market Size by 2032 | US$ 60.04 Billion |

| CAGR | CAGR of 9.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Software [Cloud-based, On-Premises], Services [Consulting Services, Support Services, Others]) • By Type (E-discovery, Legal Research, Practice Management, Analytics, Compliance, Document Management, Contract Lifecycle Management, Time-Tracking & Billing, Others) • By End Users (Law Firms, Corporate Legal Departments, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Icertis, Inc., Filevine Inc., DocuSign, Inc., Casetext Inc., ProfitSolv, LLC, Knovos, LLC, Mystacks, Inc., Practice Insight Pty Ltd (WiseTime), TimeSolv Corporation, Themis Solutions Inc. (Clio), Everlaw, Inc., LexisNexis Legal & Professional Company. |