LED Driver IC Market Size & Overview:

Get More Information on LED Driver IC Market - Request Sample Report

The LED Driver IC Market Size was valued at USD 3.79 Billion in 2023 and is expected to reach USD 16.05 Billion by 2032, growing at a CAGR of 17.46% over the forecast period 2024-2032.

The LED driver IC market has seen remarkable growth in recent years, driven by the escalating demand for energy-efficient lighting solutions across residential, commercial, and industrial sectors. One of the key applications of LED driver ICs is within the general lighting industry, covering a vast range of environments, including homes, offices, warehouses, and factories. In the United States alone, approximately 5.9 billion commercial buildings rely on various types of indoor lighting, with linear, low, and high bay fixtures consuming up to 91% of indoor lighting energy across commercial and industrial sectors. Even as LED technology advances, fluorescent lighting systems still account for about 31% of lighting energy use, particularly within linear fixture submarkets. However, as cities and municipalities increasingly adopt LED street lighting to boost energy efficiency and cut operational costs, the demand for high-performance, reliable LED driver ICs has surged. These drivers are crucial for optimizing voltage and current to meet lighting requirements and offer critical features like dimming, thermal management, and protection against over-voltage and over-current conditions, which are essential for outdoor lighting where environmental factors can heavily influence performance.

The rise of smart home technology and the expansion of connected devices are further driving demand for advanced LED driver ICs. Home automation systems increasingly incorporate smart LED lighting that can be controlled via mobile applications or voice commands. This shift calls for next-generation driver ICs that seamlessly integrate with smart home platforms to support features like remote dimming, color changing, and scheduling. The adoption of smart lighting not only elevates the user experience but also drives energy savings, supporting global sustainability goals.

LED Driver IC Market Dynamics

Drivers

-

The shift towards energy efficiency has become a global imperative, and the demand for energy-efficient lighting solutions is a significant driver for the LED Driver IC market.

The lighting sector is changing as more consumers, businesses, and governments acknowledge the importance of decreasing energy usage and related expenses. LED lighting is leading the way because of its higher energy efficiency in comparison to traditional incandescent and fluorescent lighting. Compared to incandescent, LED lamps offer 80-90% energy savings. This effectiveness results in decreased electricity costs and also aids in decreasing greenhouse gas emissions. The increase in demand for LED driver ICs, crucial for powering LED lights, is anticipated to rise due to regulations and incentives supporting energy-efficient technologies. Advancements in technology improving performance and lifespan are driving the adoption of LEDs. LED Driver ICs play a vital role in controlling the power needs of LED lighting systems, allowing them to function effectively. These integrated circuits guarantee efficient power conversion, control output current, and offer essential dimming features, leading to enhanced LED system performance. As the global lighting market moves towards LED technologies, the demand for dependable LED driver ICs is increasing, leading to ongoing market expansion.

-

Government initiatives and regulations promoting energy efficiency and reducing carbon emissions are significant drivers of the LED Driver IC market.

Several countries have implemented regulations to eliminate outdated lighting technologies, such as incandescent and fluorescent bulbs, and replace them with energy-efficient options like LEDs. In addition to these regulatory initiatives, governments are providing financial inducements such as rebates and tax credits to encourage businesses and consumers to switch to energy-efficient lighting options. In the United States, utility companies and local governments provide discounts for switching to LED lighting in commercial buildings. In the commercial sector, these incentives have a significant impact, as they can lead to substantial savings on energy costs, motivating businesses to purchase LED systems that utilize LED driver ICs. In addition, efforts to create smart cities are promoting the use of LED technologies. Advanced, networked lighting solutions using LEDs and sophisticated driver ICs are frequently integrated into smart city projects to improve energy efficiency and enhance public safety. An example is Barcelona, which has introduced smart street lighting that adjusts brightness according to traffic and weather conditions, saving energy and improving visibility.

Restraints

-

Compatibility issues with existing lighting systems can be a significant restraint for the LED Driver IC market.

As many consumers and businesses have traditional lighting infrastructures in place, integrating LED solutions with these systems may require modifications or upgrades. This integration process can be complex and costly, deterring potential customers from adopting LED driver ICs. For example, some LED driver ICs may not be compatible with older dimming controls or power supplies, necessitating additional adjustments to ensure proper functionality. This issue is particularly challenging in commercial and industrial environments where large-scale lighting systems are in use. The need to replace or retrofit existing components to accommodate LED drivers can increase the overall costs and complexity of the transition.

LED Driver IC Market Segmentation Analysis

by Type

The step down (buck LED driver IC) has solidified its position as the top segment in the LED Driver IC industry, capturing a sizable 37% market share in 2023. Buck converters have high efficiency and are created to lower voltage from a higher input to a lower output, which makes them perfect for powering LEDs with lower voltage requirements. Their effectiveness guarantees minimal energy waste, resulting in extended longevity for both the drivers and the LED components. Companies such as Texas Instruments and NXP Semiconductors use buck converters in their LED driver solutions to provide trustworthy, energy-saving performance in various products, including smart home and advanced vehicle lighting systems.

The inductorless (charge pump LED driver IC) segment is expected to experience the most rapid growth rate from 2024 to 2032. These drivers use capacitors, not inductors, to control voltage and current for LED uses, resulting in benefits like a smaller size and simpler circuit designs. This makes them especially appropriate for small devices like cell phones, wearable tech, and other battery-powered equipment where space and energy efficiency are important. For instance, Analog Devices and Microchip Technology are utilizing charge pump technologies to develop versatile solutions that improve the performance of portable consumer electronics and innovative lighting applications, fueling growth in this sector.

by Application

The consumer electronics sector dominated the market, holding a significant 41% market share. The prevalence of LED technology in products like TVs, phones, computers, and smart home devices is the main factor behind this dominance. The rise in consumer need for energy-saving lighting options and improved display capabilities is a major factor driving the growth of this sector. Prominent corporations like Samsung and LG incorporate cutting-edge LED Driver ICs into their TVs and monitors to enhance color precision and save energy.

The automotive is projected to become the fastest-growing segment in the LED Driver IC market between 2024-2032. As the automotive sector places more emphasis on improving vehicle safety, appearance, and fuel efficiency, the need for LED lighting systems in vehicles is growing. Regulations advocating for energy efficiency and sustainability have made LED technology a common feature in headlights, interior lighting, and exterior signaling. Tesla and Audi are at the forefront, using advanced LED Driver ICs to offer adaptive lighting solutions and advanced driver assistance systems (ADAS).

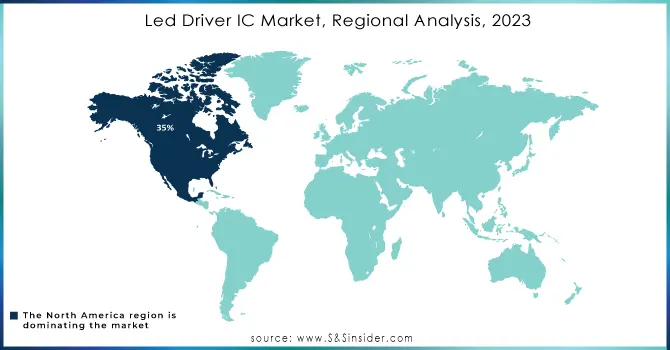

LED Driver IC Market Regional Outlook

North America dominated with a 35% market share in 2023 because of its strong technological infrastructure and widespread use of advanced lighting solutions. The area is known for having a mature electronics manufacturing industry and a high need for energy-saving lighting systems, especially for commercial and residential uses. Key players in this market include Texas Instruments, Analog Devices, and Infineon Technologies, providing a variety of LED driver IC solutions for sectors like automotive lighting, smart homes, and industrial automation. Significant research and development activities play a critical role in driving innovation in LED technologies, strengthening North America's leadership position.

Asia-Pacific is anticipated to have major expansion regionally during 2024-2032 with a rapid CAGR, propelled by fast industrialization, urbanization, and rising consumer interest in energy-efficient lighting options. Nations such as China, India, and Japan are leading the way in this expansion, backed by substantial investments in infrastructure advancements and smart urban initiatives. Prominent corporations such as ROHM Semiconductor, NXP Semiconductors, and ON Semiconductor are making significant investments in the area to create cutting-edge LED driver ICs for various uses, including street lighting and home automation systems.

Need Any Customization Research On LED Driver IC Market - Inquiry Now

Key Players

The major key players in the LED Driver IC Market are:

-

Texas Instruments (TPS92515, LM3409)

-

STMicroelectronics (LED2000, HVLED001A)

-

ON Semiconductor (NCL30051, NCL30160)

-

Analog Devices (LT3952, LT3795)

-

Infineon Technologies (ILD8150, ILD6150)

-

Microchip Technology (MIC4802, HV9921)

-

NXP Semiconductors (SSL5301T, SSL4101T)

-

Maxim Integrated (MAX16832, MAX16834)

-

Diodes Incorporated (AL1791, BCR431U)

-

Rohm Semiconductor (BD18347EFV-M, BD18336NUF-M)

-

Panasonic Corporation (AN34025A, AN34042A)

-

Samsung Electronics (S2LM301A, S2LM302A)

-

Toshiba Corporation (TB62D901, TB62D902)

-

Renesas Electronics (ISL1904, ISL97634)

-

Power Integrations (LYTSwitch-5, LYTSwitch-6)

-

Semtech Corporation (SC5010, SC5026)

-

Mean Well (LDD-700L, LCM-60)

-

Philips Lumileds (Xitanium LED drivers, Fortimo LED drivers)

-

Osram Opto Semiconductors (OTi DALI, OT FIT 75/220-240/2A0 CS)

-

Broadcom Inc. (ACPL-K30T, ACPL-K34T)

8-10 Suppliers for Raw Materials/Components for LED Driver ICs

-

BASF

-

Nichia Corporation

-

Dow Corning

-

Sumitomo Chemical

-

Avago Technologies

-

Wolfspeed (Cree Inc.)

-

Henkel

-

DuPont

-

Mitsubishi Chemical Corporation

-

Shin-Etsu Chemical Co., Ltd.

Recent Development

-

October 2024: Anax launched the PM-Gen1 and PM-Gen2 options for driver ICs utilized in Mini LED backlight modules. The company has been enhancing its technology to meet client demands and has just released a new solution called AM-Gen3.

-

August 2024: The LED current for the AL58221 is determined by three external resistors for RGB master control, allowing each channel's average output current to be individually adjusted through the digital interface. It includes a 10MHz dual-edge triggered data clock input to decrease EMI.

-

January 2023: Nichia Corporation and Infineon Technologies AG revealed a collaborative effort to create a high-definition (HD) light engine containing over 16,000 micro-LEDs for headlight use. Both companies are now introducing the industry's initial fully integrated micro-LED light engine for HD adaptive driving beam uses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.79 Billion |

| Market Size by 2032 | USD 16.05 Billion |

| CAGR | CAGR of 17.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Buck-Boost, Current Sink, Inductorless (Charge Pump), Step-Down (Buck), Others) • By Application (Consumer Electronics, Healthcare, IT & ITES, Automotive, Telecommunication, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Texas Instruments, STMicroelectronics, ON Semiconductor, Analog Devices, Infineon Technologies, Microchip Technology, NXP Semiconductors, Maxim Integrated, Diodes Incorporated, Rohm Semiconductor, Panasonic Corporation, Samsung Electronics, Toshiba Corporation, Renesas Electronics, Power Integrations, Semtech Corporation, Mean Well, Philips Lumileds, Osram Opto Semiconductors, Broadcom Inc. |

| Key Drivers | • The shift towards energy efficiency has become a global imperative, and the demand for energy-efficient lighting solutions is a significant driver for the LED Driver IC market. • Government initiatives and regulations promoting energy efficiency and reducing carbon emissions are significant drivers of the LED Driver IC market. |

| RESTRAINTS | • Compatibility issues with existing lighting systems can be a significant restraint for the LED Driver IC market. |