Law Enforcement Software Market Size & Overview:

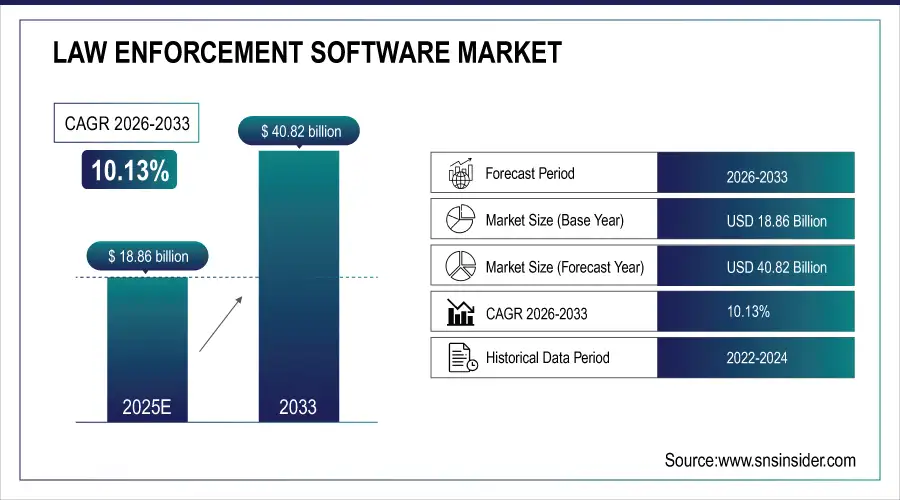

The Law Enforcement Software Market was valued at USD 18.86 billion in 2025E and is expected to reach USD 40.82 billion by 2033, growing at a CAGR of 10.13% from 2026-2033.

The Law Enforcement Software Market is growing due to increasing adoption of digital tools for crime prevention, investigation, and public safety management. Rising demand for advanced data analytics, real-time monitoring, and integrated reporting systems enhances operational efficiency for police and emergency services. Expansion of smart city initiatives, cloud-based solutions, and AI-driven platforms further drives adoption. Growing focus on secure, automated, and centralized law enforcement operations is accelerating investments, supporting overall market growth.

Market Size and Forecast

-

Market Size in 2025E: USD 18.86 Billion

-

Market Size by 2033: USD 40.82 Billion

-

CAGR: 10.13% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Law Enforcement Software Market - Request Sample Report

Law Enforcement Software Market Trends

-

Rising demand for digital transformation in policing and public safety is driving the law enforcement software market.

-

Growing adoption of AI, predictive analytics, and real-time data management is boosting operational efficiency.

-

Expansion of case management, evidence tracking, and incident reporting solutions is fueling market growth.

-

Integration with body-worn cameras, IoT devices, and surveillance systems is enhancing situational awareness.

-

Increasing focus on cybersecurity, data privacy, and compliance is shaping adoption trends.

-

Rising need for community policing and crime prevention analytics is encouraging software deployment.

-

Collaborations between software providers, law enforcement agencies, and technology integrators are accelerating innovation and implementation.

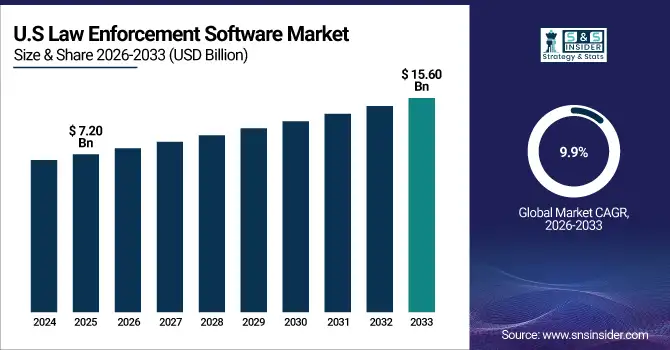

The U.S. Law Enforcement Software market size was valued at an estimated USD 7.20 billion in 2025 and is projected to reach USD 15.60 billion by 2033, growing at a CAGR of 9.9% over the forecast period 2026–2033. Market growth is driven by increasing adoption of digital policing solutions, rising investments in public safety infrastructure, and the need for improved data management and operational efficiency within law enforcement agencies. Growing use of computer-aided dispatch (CAD), records management systems (RMS), evidence management, and crime analytics software is accelerating market expansion. Additionally, advancements in cloud-based platforms, AI-driven predictive policing tools, cybersecurity enhancements, and strong government funding initiatives further strengthen the growth outlook of the U.S. law enforcement software market during the forecast period.

Law Enforcement Software Market Growth Drivers:

-

Growing adoption of digital and automated solutions enhancing operational efficiency in crime prevention, investigation, and public safety management globally

Increasing adoption of digital tools and automated platforms is driving the growth of law enforcement software. Police and public safety agencies are deploying advanced solutions for real-time monitoring, case management, and evidence tracking to enhance operational efficiency. Integration of AI, machine learning, and predictive analytics enables faster decision-making, crime detection, and resource optimization. Cloud-based and mobile-enabled systems allow seamless data access and inter-agency collaboration. As agencies aim to improve public safety outcomes, reduce response times, and enhance investigative accuracy, investment in law enforcement software continues to grow steadily worldwide.

Law Enforcement Software Market Restraints:

-

High implementation costs and ongoing maintenance expenses restricting adoption of advanced law enforcement software solutions

Significant upfront investment in software licenses, infrastructure, training, and customization poses challenges for many law enforcement agencies. Smaller or resource-constrained departments may find it difficult to afford comprehensive digital solutions, delaying adoption. Ongoing costs for system upgrades, cybersecurity measures, and technical support further strain budgets. Integration with existing legacy systems adds complexity and additional expenditure. These financial barriers can slow deployment and limit access to cutting-edge tools, particularly in developing regions. High implementation and maintenance costs remain a critical restraint, affecting the pace at which law enforcement agencies adopt advanced digital software solutions.

Law Enforcement Software Market Opportunities:

-

Expansion of smart city initiatives and public safety digitization driving adoption of advanced law enforcement software solutions

Governments globally are investing in smart city projects to enhance urban security, traffic management, and emergency response. Integration of IoT, sensors, and connected systems creates a growing need for law enforcement software to monitor and analyze real-time data. Software solutions supporting automated reporting, predictive policing, and resource optimization are increasingly essential. Agencies can leverage these platforms to improve situational awareness, coordination, and operational efficiency. As cities adopt digital infrastructure for public safety, opportunities for law enforcement software providers expand, offering potential for innovative solutions and significant market growth across urban centers worldwide.

Law Enforcement Software Market Segment Analysis

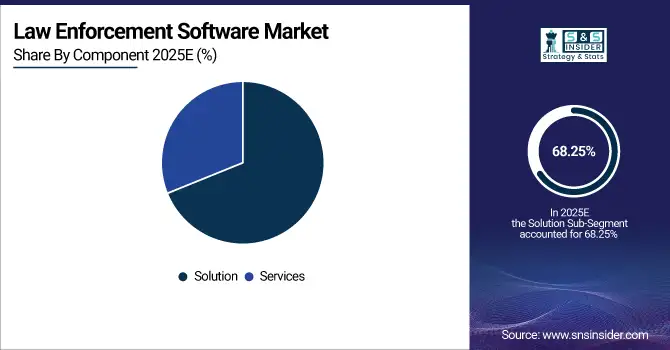

By Component, Solutions segment dominated the Law Enforcement Software Market, while Services are expected to grow at the highest CAGR

In the law enforcement software market, the solutions segment dominated the market and achieved the highest market share, capturing more than 68.25% in 2025. Law enforcement software solutions are being mainly driven to increase operational efficiency and effectiveness with people's changing needs and to gain advanced tools. They include crime analytics, records management, and digital evidence management solutions that help agencies consolidate the workflow and automate data entry to reduce human error.

The services segment is projected to grow at the highest CAGR of 10.57% during the forecast period. The need for continuous support, maintenance, and training for optimal use of these software services is driving the adoption of law enforcement software services. Law enforcement software solutions require seamless implementation and operation and this can be achieved through services such as system integration, technical support, and user training. Moreover, with the fast pace of technology, these systems will need regular updates and upgrades to stay effective and secure.

By Deployment, Cloud segment dominated the Law Enforcement Software Market, with On-Premises expected to grow at the highest CAGR

The cloud segment dominated the market and represented a revenue share more than of 71.48% in 2025. Distributing cloud-based law enforcement software offers numerous advantages such as scalability, cost-efficiency, and accessibility which promotes their adoption. Cloud solutions also let law enforcement agencies expand to meet demand and allocate resources as needed, without a huge upfront hardware investment. This is especially useful for agencies with changing workloads, and those with little budget.

The on-premises segment is expected to grow at a compound annual growth rate (CAGR) of more than 10.63% during the forecast period. On-premise law enforcement software is motivated by Control, Security, and Compliance. Many agencies dealing with extremely sensitive or classified information tend to prefer on-premise solutions for having direct oversight over their data infrastructure. It is a more customizable and integrated approach with existing systems that could provide agencies with tailored solutions that meet their needs for operational requirements.

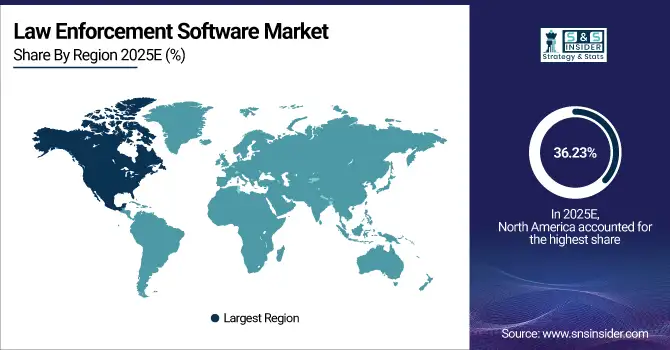

Law Enforcement Software Market Regional Analysis

North America Law Enforcement Software Market Insights

In 2025, North America accounted for more than 36.23% of the law enforcement software market. North America integrates law enforcement software with advanced technologies, including artificial intelligence, machine learning, and Big Data analytics. Agencies are also using other modern tools like predictive policing tools, digital evidence management systems, & data-sharing platforms, to streamline their operations and solve more crimes. Further, increasing incidences of cybercrime and stringent regulatory requirements are raising the emphasis on cybersecurity and data protection.

Do You Need any Customization Research on Law Enforcement Software Market - Enquire Now

Asia Pacific Law Enforcement Software Market Insights

The law enforcement software market in Asia Pacific is growing with the highest CAGR of more than 12.25 % from 2026 to 2033. Asia Pacific is another potential market, which is experiencing fast growth because of the growing urbanization and high demand for advanced public safety solutions. Governments are pouring money into smart city projects like integrated law enforcement software capable of monitoring and managing urban area security. The utilization of AI-powered surveillance systems and automated reporting tools has gained momentum with the increase in the demand for improving situational awareness and response in crowded places.

Europe Law Enforcement Software Market Insights

Europe is witnessing strong adoption of law enforcement software driven by increasing digital transformation, smart city initiatives, and growing focus on public safety. Agencies are implementing integrated platforms for real-time monitoring, crime analytics, and case management to enhance operational efficiency. Rising demand for AI, predictive policing, and cloud-based solutions enables faster decision-making and improved coordination across multiple departments.

Middle East & Africa and Latin America Law Enforcement Software Market Insights

Middle East & Africa and Latin America are gradually adopting law enforcement software due to increasing digitalization and demand for efficient public safety management. Agencies are deploying integrated solutions for real-time monitoring, incident reporting, and analytics to enhance crime prevention and operational efficiency. Growing investments in smart city projects, cloud-based platforms, and AI-driven policing solutions, along with government initiatives to modernize law enforcement operations, are further driving the adoption of advanced software solutions across these regions.

Law Enforcement Software Market Competitive Landscape:

Axon

Axon develops end-to-end public-safety solutions including body-worn cameras, software platforms, AI tools, and connected devices like TASER. The company focuses on integrating law enforcement operations with citizen engagement through secure video sharing, AI analytics, and real-time situational awareness. Axon’s ecosystem supports officers, dispatchers, and communities, combining hardware, cloud software, and AI to improve safety, transparency, and efficiency in policing and emergency-response operations globally.

-

2025: Axon announced new fixed ALPR camera solutions, AI-powered tools, and a partnership with Ring to enable citizens to securely share video with police, expanding its real-time public-safety ecosystem.

Oracle

Oracle provides integrated public-safety solutions combining software, cloud services, and hardware for law enforcement and emergency agencies. Its platform includes mobile, voice, and AI-powered tools to modernize dispatch, records, and field reporting. Oracle emphasizes situational awareness, real-time data analytics, and officer safety while enabling scalable deployments for municipal, county, and state agencies. The company also enhances first-responder decision-making with analytics, connected devices, and secure cloud-based solutions.

-

2025: Oracle enhanced its Public Safety Suite with officer-worn cameras, AI-enabled mobile voice controls, and real-time analytics to improve first-responder situational awareness and decision making.

-

2023: Several US law-enforcement agencies selected Oracle’s unified Public Safety hardware + software suite to modernize dispatch, records, and field reporting, improving real-time situational awareness.

NICE Ltd.

NICE provides AI-powered cloud platforms for public safety, including evidence management, emergency communications, and dispatch solutions. Its systems integrate digital evidence capture, transcription, and analytics to improve operational efficiency and incident reconstruction. NICE platforms support police, emergency services, and investigative agencies worldwide, emphasizing automation, compliance, and scalability. By leveraging AI, NICE enhances decision-making, reduces dispatcher burden, and accelerates response times while managing millions of evidence items and criminal cases globally.

-

2025: NICE’s cloud-based digital evidence management platform Evidencentral surpassed 37 million active criminal cases and 240 million evidence items, marking wide adoption among public-safety agencies.

-

2025: NICE launched NICE Inform AI for emergency-communications centers, providing AI-powered call transcription, search, and incident reconstruction to boost response efficiency and reduce dispatcher workload.

Hexagon Safety & Infrastructure

Hexagon Safety & Infrastructure delivers integrated public-safety platforms combining CAD, records management, dispatch, and AI analytics for law enforcement and emergency-response agencies. Its solutions enhance operational coordination, real-time incident management, and data-driven decision-making. Hexagon emphasizes cloud-based systems, multi-agency interoperability, and AI-powered analytics to improve situational awareness. The company serves municipal, county, and global agencies, supporting safer communities through technology-driven efficiency, transparency, and responsive emergency management.

-

2025: Hexagon’s public-safety platform received the OFFICER Innovation Award, recognizing its AI-driven dispatch, analytics, and real-time incident-management capabilities for law-enforcement agencies worldwide.

-

2025: County and city agencies (e.g., Sunnyvale, CA; Stanly County, NC) selected Hexagon’s cloud-based CAD + records + dispatch systems to modernize emergency response and improve multi-agency coordination.

Siemens AG

Siemens AG provides digital infrastructure and modular data-center solutions tailored for public-safety and first-responder agencies. Its edge and modular data centers integrate scalable compute, storage, and AI capabilities to support real-time analytics, secure communications, and mission-critical operations. Siemens emphasizes rapid deployment, sustainability, and reliability for police, emergency services, and other critical infrastructures, enabling agencies to enhance situational awareness, coordinate multi-agency responses, and manage high volumes of operational data effectively.

-

2025: Siemens, along with partners, unveiled a next-generation modular edge/public-safety data-center solution to improve data infrastructure for police, emergency services, and first-responder agencies.

Key Players

The major key players along with their products are

-

Axon - Axon Evidence

-

Motorola Solutions - CommandCentral

-

Tyler Technologies - New World ERP

-

IBM - IBM i2 Analyst’s Notebook

-

Oracle - Oracle Public Safety Solutions

-

Palantir Technologies - Palantir Gotham

-

NICE Ltd. - NICE Investigate

-

Hexagon Safety & Infrastructure - HxGN OnCall

-

SOMA Global - SOMA Dispatch

-

Omnigo Software - Omnigo Report

-

CentralSquare Technologies - CentralSquare RMS

-

RapidDeploy - Nimbus CAD

-

ShotSpotter - ShotSpotter Connect

-

Mark43 - Mark43 RMS

-

Lexipol - Knowledge Management Platform

-

Genetec - Genetec Clearance

-

Cellebrite - Cellebrite UFED

-

Esri - ArcGIS for Public Safety

-

Visonix - VISIOPAQ

-

Tritech Software Systems - Inform RMS

| Report Attributes | Details |

| Market Size in 2025 | USD 18.86 billion |

| Market Size by 2033 | USD 40.82 Billion |

| CAGR | CAGR of 10.13% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By End-User (Police Departments, Law Enforcement Agencies, Federal and State Agencies, Municipalities, Correctional Facilities) • By Deployment Model (On-premise, Cloud) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Axon, Motorola Solutions, Tyler Technologies, IBM, Oracle, Palantir Technologies, NICE Ltd., Hexagon Safety & Infrastructure, SOMA Global, Omnigo Software, CentralSquare Technologies, RapidDeploy, ShotSpotter. |