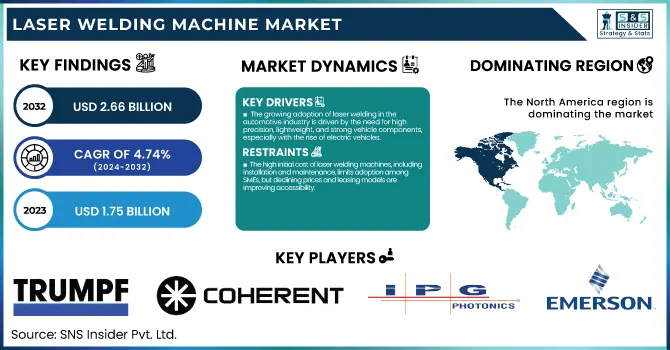

The Laser Welding Machine Market Size was estimated at USD 1.75 billion in 2023 and is expected to arrive at USD 2.66 billion by 2032 with a growing CAGR of 4.74% over the forecast period 2024-2032.

To Get more information on Laser Welding Machine Market - Request Free Sample Report

This report provides a unique perspective on the Laser Welding Machine Market by examining production trends across key regions and industry-specific utilization rates, offering insights into efficiency and demand patterns. It explores technological advancements and adoption trends, highlighting the rise of AI-driven precision welding and automation. A focus on maintenance and operational downtime sheds light on performance optimization strategies. Additionally, export/import analysis by region uncovers shifting global trade dynamics. To enhance its uniqueness, the report includes supply chain disruptions, evolving material compatibility, and sustainability-driven innovations shaping the industry.

The U.S. is projected to experience steady growth in the Centrifuge Market over the next decade. In 2023, the market value stood at approximately USD 0.56 billion, and it is expected to reach around USD 0.82 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.35%. This growth trajectory indicates a steady demand for centrifuge technology across various industries such as pharmaceuticals, food processing, and biotechnology. With increasing applications in medical diagnostics and industrial processes, the U.S. market is poised for significant development as the demand for advanced separation techniques continues to rise.

Drivers

The growing adoption of laser welding in the automotive industry is driven by the need for high-precision, lightweight, and strong vehicle components, especially with the rise of electric vehicles.

The growing adoption of laser welding machines in the automotive industry is driven by the increasing demand for lightweight, high-strength vehicle components to enhance fuel efficiency and meet stringent emission regulations. Automakers are also transitioning toward advanced materials like aluminum and high-strength steel, prompting the need for accurate, high-quality welding solutions. Laser welding provides stronger, cleaner, and more efficient joints while minimizing material and production time wastage. The increasing dominance of electric vehicles (EVs) is also fuelling demand because laser welding is essential for battery enclosures, motor components, and electrical connections. Moreover, automation and Industry 4.0 adoption are improving process productivity and quality assurance. It is also being driven by trends like hybrid laser welding, AI-powered welding solutions, and real-time quality tracking, while you are increasing productivity and reducing defects. As the technology continues to advance, so does the preference towards laser welding in automotive manufacturing, leading to the overall market growth over the estimated timeframe.

Restraint

The high initial cost of laser welding machines, including installation and maintenance, limits adoption among SMEs, but declining prices and leasing models are improving accessibility.

The high initial investment cost remains a significant barrier to the widespread adoption of laser welding machines, particularly for small and medium enterprises (SMEs). A significant amount of capital is required for the acquisition, installation, and integration of these machines into pre-existing manufacturing plants. Moreover, outlays associated with upkeep, operator training, and advanced safety functions continue to drive up costs. These investments can usually be justified for large companies, as higher production volumes and improved efficiencies quickly pay for the capital investment, however, SMEs cannot afford the technology and therefore use conventional welding methods. But affordability is improving with continued developments in fiber laser technology, lower prices of laser elements, and the emergence of leasing or pay-per-use models. A trend towards automation and AI-integrated welding systems that enhance precision and reduce operational costs is being observed in the market. With demand increasing in automotive, aerospace, electronics, and other industries, manufacturers are looking for ways to reduce the costs of laser welding technology, making it more accessible to small players.

Opportunities

The growing renewable energy sector is driving demand for laser welding in battery production, solar panels, and wind turbines due to its precision, efficiency, and durability.

The expansion of the renewable energy sector is fueling the demand for laser welding technology in battery production, solar panels, and wind turbine components. Pointing the way to sustainable energy solutions, industries are looking for precision welding methods to enhance efficiency, durability, and cost-effectiveness. Battery Performance: Improvements in laser welding in battery manufacturing enable lighter, stronger, and defect-free connections, improving performance in both electric vehicles and energy storage. Laser welding produces excellent connections between photovoltaic cells for solar panel production, which results in better conductivity and longer-lived components. Laser welding is used in the assembly of large, high-strength components with low heat distortion in a wind turbine manufacturing process, increasing structural stability. Laser welding is fast and can be automated, which saves cost and increases production efficiency. The growing global investment in clean energy infrastructure development will increase the demand for laser welding in renewable energy applications, which offers lucrative opportunities for laser welding manufacturers and technology providers.

Challenges

Supply chain disruptions in the laser welding machine market lead to production delays, increased costs, and logistical challenges due to raw material shortages and global trade constraints.

Supply chain disruptions pose a significant challenge in the laser welding machine market, affecting both manufacturing and distribution. Changes in the availability of essential raw materials like high-quality laser diodes, optical components, and rare metals can cause production delays and increased costs. Supply chain constraints are compounded by global events, geopolitical tensions, and trade restrictions that make it harder for manufacturers to keep steady production. Meanwhile, transportation logjams and semiconductor shortages hinder the delivery of vital parts on time, delaying assembly lines. The industry is also exposed to currency fluctuations and inflation due to reliance on global suppliers, which further impacts pricing and profitability. In response to these challenges, companies are paying growing attention to regional sourcing, supply chain diversification, and the strategic stockpiling of essential materials. This can include enabling digital supply chain solutions and predictive analytics to anticipate disruptions and maintain uninterrupted operations in an unpredictable market environment.

By Technology

The Fiber lasers segment dominated with a market share of over 38% in 2023, owing to their enhanced efficiency, precision, and economical nature. Their very good beam quality allows for high-speed welding with very small heat-affected zones, minimizing material distortion. They are an attractive solution for sectors (automotive, aerospace, electronics, etc.) that require extremely high precision combined with low maintenance, in addition to their energy efficiency. Furthermore, fiber lasers provide more power density and higher adaptability for automation to meet the demand from Industry 4.0 trends. Further improving their standing in the market is their proficiency in welding various materials, specifically high-strength alloys. However, fiber lasers have made significant strides in the market due to the greater need for automation and newer technology, as manufacturers are in the constant pursuit of better, more reliable, and cost-effective welding solutions.

By End-Use

The automotive segment dominated with a market share of over 32% in 2023, mainly due to increasing demand for precision welding in the manufacture of new generation vehicles. To improve fuel efficiency and meet safety regulations, automakers have sought to use lighter materials such as aluminum and high-strength steel , which results in higher strength-to-weight ratios, which can only be joined with advanced welding processes, such as laser welding. Moreover, the growing penetration of electric vehicles (EVs) has increased demand for laser welding in battery packs, powertrain components, and electronic systems. Adoption is further propelled by automakers integrating automation and robotics into automotive production lines that continue to rise, where laser welding will deliver higher processing speeds, less distortion of base materials, and create joints with superior strength. This is a combined effect of these factors contributing to making automotive the major revenue contributor in the laser welding machine market.

By Distribution Channel

The Direct segment dominated with a market share of over 64% in 2023, as manufacturers prioritize direct sales to key industries like automotive, aerospace, and electronics. Such an approach allows them to provide technologies that meet different industrial applications and offers adequate technical support and after-sales services. By removing intermediaries and minimizing buyers' procurement costs while ensuring direct communication between manufacturers and end-users, direct sales soar in providing cost efficiency as well. So, this remains a channel preferred by a particular type of company, like the large enterprises whose customers are the complexity of the laser welding systems, which need specialized installation and training to operate. In addition, enhanced distribution is creating a solid foundation for long-term collaboration with suppliers and industrial customers, reinforcing reliability, quality assurance, and the integration of laser welding technology into production facilities.

The North America region dominated with a market share of over 42% in 2023, owing to factors such as advanced industrial automation and a well-established manufacturing base in the region. The demand for precision welding equipment has drastically increased due to automotive, aerospace, electronics, and other prominent industries in this region. Due to the increasing need for automation, precision in various industries, the laser welding equipment market in the region is spearheading its adoption as a process in precision, complex, and difficult laser welding applications. Moreover, the increasing emphasis on smart manufacturing and Industry 4.0 initiatives has driven the growth of laser welding machines. Strong investments in automated welding solutions are emerging across the U.S. and Canada as companies look for increased production capability. Moreover, the presence of leading laser welding machine manufacturers and rapid technological advancements is boosting the market growth in the region.

Asia-Pacific is the fastest-growing region in the laser welding machine market, driven by rapid industrialization and technological advancements. Countries such as China, Japan, and India are leading this trend by investing heavily in automation and precision manufacturing. The growth of the automotive segment, especially concerning electric vehicles (EVs), is fueling demand for high-precision welding solutions. The growth of the market is also being driven by the growth of the electronics industry, including semiconductor and consumer electronics manufacturing. These factors are supported by government measures for the adoption of smart manufacturing & Industry 4.0 to accelerate the growth of the market. Moreover, the increasing acceptance of laser welding and its applications in the aerospace, construction, and heavy machinery sectors has further fueled the region's growth and established Asia-Pacific as a significant region in the global laser welding machine market.

Get Customized Report as per Your Business Requirement - Enquiry Now

TRUMPF (TruLaser Weld Series, TruDisk Lasers)

IPG Photonics (LightWELD Handheld Laser Welder, YLS Series)

Coherent (Highlight FL-ARM, ExactWeld Series)

Emerson Electric (Branson Laser Welding Systems)

Han's Laser Technology Industry Group (Han’s Laser Welding Machines, Fiber Laser Welders)

Jenoptik (JENOPTIK-VOTAN W Series, JENscan Welding Systems)

Precitec (ScanWelder, WeldMaster 4.0)

Huagong Laser Engineering (HGLASER Fiber Laser Welding Machines)

Penta Laser (High-Power Fiber Laser Welding Systems)

KEYENCE (ML-Z Series Laser Welding Machines)

CHIRON Group (CHIRON Laser Welding Solutions)

Laser Technologies (Automated Laser Welding Systems)

Laser Star Technologies (iWeld Laser Welding Systems, FiberStar Welders)

Laser line (Fiber Laser Welding Systems)

AMADA Weld Tech (ML Series Laser Welders, WL Series)

Miyachi Unitek (Amada Miyachi) (ML-7350C, ML-8150A)

OR Laser (Coherent subsidiary) (EVO Mobile, ORLAS Creator Weld)

Alpha Laser (ALFlak Series, ALM Series)

TLM Laser (Fiber Laser Welding Systems, Nd: YAG Welding Machines)

MacGregor Welding Systems (Micro-Precision Laser Welding Systems)

Suppliers for (High-precision laser welding solutions for industrial and medical applications) on the Laser Welding Machine Market

Coherent Inc.

Amada Weld Tech

IPG Photonics

TRUMPF

Han's Laser

Jenoptik

LaserStar Technologies

ALPHA LASER

Baison Laser

Kirin Laser

In May 2024, IPG Photonics introduced the Light Weld 2000XR as part of its handheld laser welding and cleaning product range. This new model offers high production speeds, promising to boost productivity.

In March 2024, Penta Laser unveiled a versatile four-in-one laser welding machine, set to drive high-quality development in the Chinese manufacturing sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.75 Billion |

| Market Size by 2032 | USD 2.66 Billion |

| CAGR | CAGR of 4.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Fiber Lasers, CO2 Lasers, Diode Lasers, Others) • By End Use (Automotive, Medical, Electronics, Aerospace & Defense, Jewelry, Others) • By Distribution Channel (Direct, Indirect) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TRUMPF, IPG Photonics, Coherent, Emerson Electric, Han's Laser Technology Industry Group, Jenoptik, Precitec, Huagong Laser Engineering, Penta Laser, KEYENCE, CHIRON Group, Laser Technologies, Laser Star Technologies, Laser line, AMADA Weld Tech, Miyachi Unitek (Amada Miyachi), OR Laser (Coherent subsidiary), Alpha Laser, TLM Laser, MacGregor Welding Systems. |

Ans: The Laser Welding Machine Market is expected to grow at a CAGR of 4.74% from 2024-2032.

Ans: The Laser Welding Machine Market was USD 1.75 billion in 2023 and is expected to reach USD 2.66 billion by 2032.

Ans: The growing adoption of laser welding in the automotive industry is driven by the need for high-precision, lightweight, and strong vehicle components, especially with the rise of electric vehicles.

Ans: The “Fiber lasers” segment dominated the Laser Welding Machine Market.

Ans: North America dominated the Laser Welding Machine Market in 2023

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trend Reporting

5.1 Production Volume, by Region (2020-2023)

5.2 Utilization Rates, by Industry (2020-2023)

5.3 Technological Advancements & Adoption Trends

5.4 Maintenance & Operational Downtime Metrics

5.5 Export/Import Data, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Laser Welding Machine Market Segmentation, By Technology

7.1 Chapter Overview

7.2 Fiber Lasers

7.2.1 Fiber Lasers Market Trends Analysis (2020-2032)

7.2.2 Fiber Lasers Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 CO2 Lasers

7.3.1 CO2 Lasers Market Trends Analysis (2020-2032)

7.3.2 CO2 Lasers Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Diode Lasers

7.4.1 Diode Lasers Market Trends Analysis (2020-2032)

7.4.2 Diode Lasers Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Others

7.5.1 Other Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Laser Welding Machine Market Segmentation, By End Use

8.1 Chapter Overview

8.2 Automotive

8.2.1 Automotive Market Trends Analysis (2020-2032)

8.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Medical

8.3.1 Medical Market Trends Analysis (2020-2032)

8.3.2 Medical Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Electronics

8.4.1 Electronics Market Trends Analysis (2020-2032)

8.4.2 Electronics Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Aerospace & defense

8.5.1 Aerospace & Defense Market Trends Analysis (2020-2032)

8.5.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Jewelry

8.6.1 Jewelry Market Trends Analysis (2020-2032)

8.6.2 Jewelry Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Others

8.7.1 Other Market Trends Analysis (2020-2032)

8.7.2 Other Market Size Estimates and Forecasts to 2032 (USD Million)

9. Laser Welding Machine Market Segmentation, By Distribution Channel

9.1 Chapter Overview

9.2 Direct

9.2.1 Direct Market Trends Analysis (2020-2032)

9.2.2 Direct Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Indirect

9.3.1 Indirect Market Trends Analysis (2020-2032)

9.3.2 Indirect Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Laser Welding Machine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.2.4 North America Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.2.5 North America Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.2.6.2 USA Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.2.6.3 USA Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.2.7.2 Canada Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.2.7.3 Canada Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.2.8.2 Mexico Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.2.8.3 Mexico Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Laser Welding Machine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.1.6.2 Poland Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.6.3 Poland Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.1.7.2 Romania Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.7.3 Romania Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.1.8.2 Hungary Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.8.3 Hungary Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.1.9.2 Turkey Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.9.3 Turkey Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe High-Pressure Seals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe High-Pressure Seals Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.4 Western Europe High-Pressure Seals Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.5 Western Europe High-Pressure Seals Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.6.2 Germany Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.6.3 Germany Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.7.2 France Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.7.3 France Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.8.2 UK Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.8.3 UK Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.9.2 Italy Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.9.3 Italy Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.10.2 Spain Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.10.3 Spain Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.13.2 Austria Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.13.3 Austria Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Laser Welding Machine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia-Pacific Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.4 Asia-Pacific Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.5 Asia-Pacific Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.6.2 China Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.6.3 China Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.7.2 India Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.7.3 India Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.8.2 Japan Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.8.3 Japan Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.9.2 South Korea Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.9.3 South Korea Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.10.2 Vietnam Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.10.3 Vietnam Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.11.2 Singapore Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.11.3 Singapore Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.12.2 Australia Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.12.3 Australia Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.4.13.2 Rest of Asia-Pacific Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.4.13.3 Rest of Asia-Pacific Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Laser Welding Machine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.1.4 Middle East Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.5 Middle East Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.1.6.2 UAE Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.6.3 UAE Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.1.7.2 Egypt Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.7.3 Egypt Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.1.9.2 Qatar Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.9.3 Qatar Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Laser Welding Machine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.2.4 Africa Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2.5 Africa Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.2.6.2 South Africa Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2.6.3 South Africa Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Laser Welding Machine Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.6.4 Latin America Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.5 Latin America Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.6.6.2 Brazil Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.6.3 Brazil Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.6.7.2 Argentina Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.7.3 Argentina Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.6.8.2 Colombia Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.8.3 Colombia Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Laser Welding Machine Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Laser Welding Machine Market Estimates and Forecasts, By End Use (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Laser Welding Machine Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Million)

11. Company Profiles

11.1 Laser Technologies

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Laser Star Technologies

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 TRUMPF

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Huagong Laser Engineering

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Emerson Electric

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Penta Laser

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 IPG Photonics

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Jenoptik

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 CHIRON Group

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Laser line

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technology

Fiber Lasers

CO2 Lasers

Diode Lasers

Others

By End Use

Automotive

Medical

Electronics

Aerospace & defense

Jewelry

Others

By Distribution Channel

Direct

Indirect

Request for Segment Customization as per your Business Requirement: Segment Customization Request

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Spray Dryer Market Size was valued at USD 5.55 Billion in 2023 and is now anticipated to grow to USD 8.83 Billion by 2032, displaying a compound annual growth rate of 5.29% during the forecast Period 2024 - 2032.

The Coordinate Measuring Machine (CMM) Market size was valued at USD 4.13 Billion in 2023 and is anticipated to grow to USD 8.25 Billion by 2032, displaying a compound annual growth rate (CAGR) of 8.00% during the forecast Period 2024-2032.

The Industrial Automation Market Size was valued at USD 182.1 Billion in 2023 and is expected to reach USD 377.9 Billion by 2032 and grow at a CAGR of 8.45% over the forecast period 2024-2032.

The Ball Bearing Market Size was estimated at USD 10.66 billion in 2023 and is expected to arrive at USD 19.01 billion by 2032 with a growing CAGR of 6.64% over the forecast period 2024-2032.

Chemical Processing Equipment Market was valued at $ 63.60 billion in 2023 and is expected to reach $ 103.82 billion by 2032, at a CAGR of 5.60% from 2024-2032.

The Pipeline Monitoring System Market Size was USD 15.85 Billion in 2023 and will reach USD 31.05 Billion by 2032 and grow at a CAGR of 7.80% by 2024-2032.

Hi! Click one of our member below to chat on Phone