Laser Sensor Market Size & Growth:

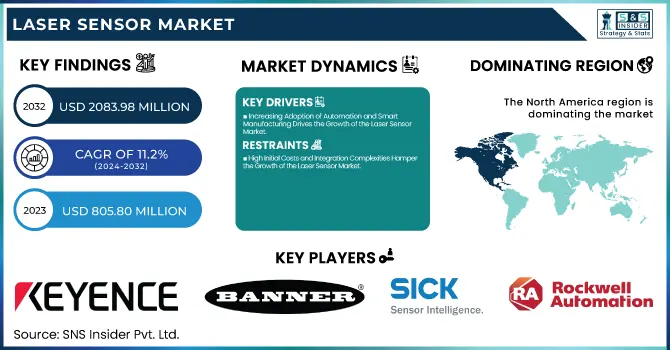

The Laser Sensor Market Size was valued at USD 805.80 Million in 2023 and is expected to reach USD 2083.98 Million by 2032 and grow at a CAGR of 11.2% over the forecast period 2024-2032. The Laser Sensor Market is growing rapidly, driven by increasing adoption in industrial automation, automotive, and healthcare for precision measurement, quality control, and surveillance. Advancements in 3D laser scanning, fiber optic sensors, and AI-integrated IoT-enabled solutions are enhancing efficiency across industries. Rising demand for non-contact measurement systems and Industry 4.0 investments further boost growth. While North America and Europe lead in innovation, Asia-Pacific is emerging due to industrialization. Challenges include high costs and integration complexity, but continuous R&D investments and cost-effective developments are expected to sustain long-term market expansion.

To Get more information on Laser Sensor Market - Request Free Sample Report

Laser Sensor Market Dynamics

Key Drivers:

-

Increasing Adoption of Automation and Smart Manufacturing Drives the Growth of the Laser Sensor Market

The rising demand for automation and smart manufacturing is a key driver for the Laser Sensor Market. Industries such as automotive, aerospace, healthcare, and consumer electronics are increasingly integrating laser sensors for precision measurement, process monitoring, and quality control. The adoption of Industry 4.0 technologies, IoT-enabled devices, and AI-powered laser sensors is further fueling market expansion.

Additionally, non-contact sensing solutions are gaining traction in manufacturing and industrial applications due to their high accuracy, efficiency, and reduced operational costs. The use of laser sensors in robotics, autonomous vehicles, and industrial safety applications is also growing. As companies strive for higher efficiency, lower wastage, and improved product quality, the demand for high-precision laser sensors is expected to rise. Moreover, governments worldwide are supporting industrial automation through investments and regulatory incentives, further propelling the market. These factors collectively drive the widespread adoption of laser sensors across various industries.

Restrain:

-

High Initial Costs and Integration Complexities Hamper the Growth of the Laser Sensor Market

The Laser Sensor Market is the high initial cost and complexity of integration. Laser sensors, especially high-precision 3D laser scanners and fiber optic sensors, come with significant costs related to manufacturing, installation, and calibration. This makes them less accessible for small and medium-sized enterprises (SMEs), which may lack the capital for such investments.

Additionally, integrating laser sensors into existing industrial machinery, automation systems, and IoT ecosystems can be challenging due to compatibility issues, technical expertise requirements, and software-hardware synchronization. Companies often face downtime and increased maintenance costs during integration, which affects overall productivity. Furthermore, in sectors like automotive and aerospace, compliance with stringent safety and regulatory standards adds another layer of complexity, increasing the total implementation cost.

Opportunities:

-

Advancements in AI-Powered and IoT-Enabled Laser Sensors Create New Growth Opportunities for the Market

The emergence of AI-powered and IoT-enabled laser sensors presents a significant opportunity for market growth. The integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is enhancing the capabilities of laser sensors, making them more intelligent, automated, and efficient. These advanced sensors can now self-calibrate, detect anomalies, and optimize industrial processes in real time, reducing human intervention and operational errors.

Additionally, the ability to remotely monitor and control laser sensors via cloud-based platforms is expanding their applications across industrial automation, logistics, and smart infrastructure. Companies investing in AI-integrated laser sensors are gaining a competitive edge by improving accuracy, cost-efficiency, and decision-making. As AI and IoT technologies continue to evolve, the laser sensor market is expected to experience rapid expansion in new and existing industrial domains.

Challenges:

-

Limited Awareness and Skilled Workforce Shortages Pose Challenges for the Laser Sensor Market

Despite technological advancements, limited awareness and a shortage of skilled professionals remain key challenges for the Laser Sensor Market. Many industries, particularly small-scale manufacturers and developing regions, lack the necessary knowledge about laser sensor functionalities, integration techniques, and long-term benefits. The absence of training programs and skilled professionals in the field of laser-based measurement, automation, and AI-driven sensor technologies further hampers adoption.

Additionally, operating and maintaining high-precision laser sensors require specialized expertise, as improper handling can lead to calibration errors, inaccurate readings, and equipment failures. Companies often struggle with resource allocation for employee training and upskilling, limiting the widespread adoption of advanced laser sensors. To address this challenge, industry players and governments need to invest in skill development programs, awareness campaigns, and educational initiatives that promote the adoption and efficient utilization of laser sensor technologies in various applications.

Laser Sensor Market Segments Analysis

By Component

The hardware segment holds the largest market share in the Laser Sensor Market, accounting for 62% of the total revenue in 2023. This dominance is driven by the increasing adoption of high-performance laser sensors, including laser displacement sensors, laser photoelectric sensors, and laser scanners, across industrial automation, automotive, and healthcare sectors. The growing demand for non-contact measurement solutions in smart factories, Industry 4.0, and autonomous systems is further propelling the hardware segment. With advancements in miniaturization, multi-sensor integration, and enhanced durability, laser sensor hardware continues to be a critical driver of market growth, ensuring high accuracy and real-time data collection for various industrial applications.

The software segment in the Laser Sensor Market is projected to grow at the highest CAGR of 12.2% during the forecast period, driven by the increasing adoption of AI-powered data processing, real-time monitoring, and IoT-enabled analytics. As industries move towards smart manufacturing and predictive maintenance, the role of software in data interpretation, sensor calibration, and automation control is expanding.

For Instance, OMRON Corporation launched its Sysmac AI Controller, which integrates laser sensor data analytics with AI-driven predictive maintenance, reducing downtime in industrial automation. Similarly, Schneider Electric introduced its EcoStruxure Machine Advisor, a cloud-based software that leverages laser sensor data for real-time equipment monitoring.

By Application

The Process Monitoring and Quality Control segment accounted for 33% of the total revenue in the Laser Sensor Market in 2023, making it the largest application segment. This growth is fueled by the rising need for high-precision inspection, defect detection, and automated quality assurance in industries such as automotive, electronics, food & beverages, and pharmaceuticals. Laser sensors play a crucial role in ensuring product consistency, dimensional accuracy, and defect-free manufacturing. With increasing emphasis on zero-defect manufacturing and regulatory compliance, laser sensors are becoming integral to non-contact measurement systems, AI-powered quality analytics, and smart factory integration. The demand for faster, more accurate, and automated inspection solutions continues to drive this segment, ensuring enhanced efficiency, cost savings, and reduced product recalls across industries.

The Manufacturing Plant Management segment is projected to grow at the highest CAGR of 12.4% during the forecast period, driven by the increasing adoption of Industry 4.0, smart factories, and AI-driven automation. Laser sensors are widely used in real-time monitoring, predictive maintenance, and automated production line management, optimizing operational efficiency and reducing downtime.

Additionally, Schneider Electric launched its AVEVA Manufacturing Execution System, leveraging laser sensor technology for real-time production tracking and plant performance analysis. The integration of IoT-enabled sensors, cloud computing, and digital twins is transforming manufacturing plant management, enabling remote monitoring, automated diagnostics, and data-driven decision-making. As industries strive for higher productivity, reduced waste, and improved sustainability, the adoption of laser sensor-based smart plant solutions is expected to surge, further strengthening market growth in this segment.

By Type

The Laser Displacement Sensors segment led the Laser Sensor Market in 2023, holding the largest revenue share, driven by the increasing need for high-precision measurement, thickness monitoring, and surface inspection in industries such as automotive, electronics, and manufacturing. These sensors offer non-contact, high-accuracy measurement capabilities, making them ideal for quality control, dimensional inspection, and robotic guidance applications. With the growing demand for miniaturized components, high-speed manufacturing, and defect-free production, laser displacement sensors are becoming an essential part of smart factories and Industry 4.0 initiatives.

The Laser Scanners segment is projected to grow at the highest CAGR during the forecast period, driven by the increasing adoption of autonomous vehicles, security surveillance, and industrial automation. These scanners offer high-resolution 3D imaging, fast scanning speeds, and precise object detection, making them essential for applications like robot navigation, smart infrastructure, and warehouse automation. The rising demand for AI-powered LiDAR solutions in autonomous systems and the integration of IoT-based real-time monitoring are fueling the growth of laser scanners. As industries transition toward AI-driven automation and digital transformation, laser scanners are becoming a cornerstone technology for enhanced precision, faster processing, and improved safety across multiple sectors.

By End-Use

The Automotive segment led the Laser Sensor Market in 2023, holding the largest revenue share, driven by the increasing demand for autonomous driving, advanced driver-assistance systems (ADAS), and precision manufacturing. Laser sensors play a crucial role in collision detection, lane-keeping assistance, and automated parking systems, ensuring enhanced safety and performance in modern vehicles. Additionally, laser sensors are widely used in robotic welding, surface inspection, and dimensional measurement in automotive production lines. With the rapid adoption of electric vehicles (EVs), LiDAR-based navigation systems, and Industry 4.0 in automotive plants, the demand for high-performance laser sensors continues to surge. These sensors enable automated quality control, reduce defects, and enhance safety, solidifying their critical role in the automotive industry's digital transformation.

The Healthcare segment is projected to grow at the fastest CAGR during the forecast period, driven by advancements in medical imaging, diagnostics, and laser-based surgical equipment. Laser sensors are widely used in biomedical imaging, patient monitoring, and precision surgery, enabling non-invasive and high-accuracy medical applications. The increasing adoption of laser-based optical sensors in wearable health devices and robotic-assisted surgeries is further fueling market expansion.

Additionally, Leuze electronic GmbH launched its high-accuracy laser distance sensors, used in medical robotics and laboratory automation. The rising demand for remote healthcare solutions, AI-driven diagnostics, and minimally invasive treatments is driving the integration of laser sensors in advanced medical technologies. As healthcare systems worldwide adopt AI-powered laser-based monitoring and surgical tools, the laser sensor market is poised for substantial growth in the medical and biotechnology sectors.

Laser Sensor Market Regional Analysis

The Asia-Pacific region held the largest market share of approximately 40% in the Laser Sensor Market in 2023, driven by rapid industrial automation, increasing adoption of smart manufacturing, and high demand for precision measurement technologies. Countries like China, Japan, and South Korea are at the forefront of this growth, with strong investments in automotive, electronics, and semiconductor industries.

For instance, Keyence Corporation (Japan) continues to expand its laser displacement sensors and vision-based inspection systems, which are widely used in electronics assembly and semiconductor wafer inspection. Similarly, Panasonic Corporation has been actively developing high-speed laser sensors for robotics and industrial automation applications.

The North American region is projected to grow at the highest CAGR of approximately 11.5% in the Laser Sensor Market, driven by the increasing adoption of autonomous vehicles, LiDAR-based technologies, and smart healthcare solutions. The United States and Canada are witnessing strong demand for laser sensors in security surveillance, aerospace, and industrial automation. Companies like Rockwell Automation and SICK AG have been expanding their laser sensor portfolios to cater to manufacturing process optimization and smart factory applications.

Additionally, the rise of LiDAR-based ADAS systems in self-driving cars has accelerated market growth, with automotive giants like Tesla, Waymo, and General Motors investing heavily in laser-based navigation solutions. The healthcare sector is also a major contributor, with laser sensors being widely used in medical imaging, robotic-assisted surgeries, and AI-powered diagnostics. The growing emphasis on precision, automation, and IoT-driven monitoring makes North America the fastest-growing region in the laser sensor industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Laser Sensor Market are:

-

Keyence Corporation (LR-Z Series, IX Series 2D Displacement Sensors)

-

Banner Engineering (Q4X Series Laser Distance Sensors, L-GAGE LT7 Long-Range Sensors)

-

SICK AG (DT50 Laser Distance Sensor, LMS100 Laser Scanner)

-

Rockwell Automation (42JT VisiSight Photoelectric Laser Sensor, Allen-Bradley 45LMS Laser Measurement Sensor)

-

OMRON Corporation (ZX-GT Smart Laser Micrometer, E3NC-L Compact Laser Sensor)

-

Baumer Group (OADM Laser Distance Sensors, PosCon 3D Laser Edge Sensor)

-

Panasonic Corporation (HG-C Laser Displacement Sensor, PM2-L Laser Photoelectric Sensor)

-

Leuze electronic GmbH (ODS 9 Optical Distance Sensor, RSL 400 Safety Laser Scanner)

-

Schneider Electric (OsiSense XU Laser Sensors, Preventa XUSL Laser Scanner)

-

Schmitt Industries Inc (Acuity AR100 Laser Distance Sensor, AccuRange 2000 Laser Sensor)

-

SmartRay GmbH (ECCO 75+ 3D Laser Sensor, ECCO 95+ High-Resolution Sensor)

Recent Trends

-

In 2025, Keyence Corporation released a high-power version of its LR-Z Series self-contained CMOS laser sensor, enhancing detection reliability and expanding application possibilities in various industrial settings.

-

In February 2025, Banner Engineering collaborated with RS to make Industry 4.0 more accessible by offering an extensive portfolio of advanced industrial automation sensors, including non-contact photoelectric and laser distance measurement sensors.

-

In 2023, SICK AG expanded its portfolio of high-resolution 3D streaming cameras by introducing the Ruler3002, 3004, and 3010 models, designed for challenging image processing applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 805.80 Million |

| Market Size by 2032 | USD 2083.98 Million |

| CAGR | CAGR of 11.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Type (Laser Displacement Sensors, Laser Photoelectric Sensors, Laser Scanners, Others) • By Application (Security & Surveillance, Motion & Guidance, Process Monitoring and Quality Control, Distance Measurement, Manufacturing Plant Management, Others) • By End-Use (Automotive, Aerospace & Defense, Food & Beverages, Consumer Electronics, Chemical, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Keyence Corporation, Banner Engineering, SICK AG, Rockwell Automation, OMRON Corporation, Baumer Group, Panasonic Corporation, Leuze Electronic GmbH, Schneider Electric, Schmitt Industries Inc, SmartRay GmbH. |