Laminating Adhesives Market Report Scope & Overview:

Get More Information on Laminating Adhesives Market - Request Sample Report

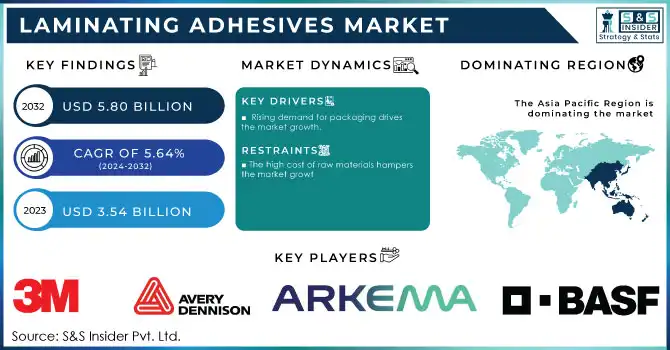

Laminating Adhesives Market Size was valued at USD 3.54 Billion in 2023 and is expected to reach USD 5.80 Billion by 2032 and grow at a CAGR of 5.64% over the forecast period 2024-2032.

The tendency to low-VOC and solvent-free laminating adhesives reflects the growing role of sustainability and workplace safety. It results from the increasing stringency of regulations targeting the reduction of indoor air pollution and the environmental footprint of industrial activity. The developed technologies display this transformation. For example, in 2023, 3M launched a new line of solvent-free laminating adhesives. The development is compliant with the most recent EPA regulations and allows cutting down VOC emissions drastically. In turn, low-VOC laminating adhesives launched by Henkel in 2024, were approved by multiple environmental standards. The U.S. EPA claims that these developments are pivotal for addressing new requirements of the Clean Air Act targeting VOC emissions and ensuring they adhere to the guidelines presented by the registration program.

Meanwhile, the EU’s REACH regulations were also contributing to the popularity of these products due to their stringent limitations on VOC emissions. This environment is beneficial for producers while simultaneously ensuring a greater level of safety and sustainability of workplace environments and products for consumers. This tendency is reflected in the continued increase of these products’ market share as more companies begin to see the benefits of compliance and improved safety and sustainability of their products.

The most progressive change in the laminate adhesive industry is the shift towards low-VOC and solvent-free products. This change is mostly driven by the tightened environmental regulations and the increased concern for health and safety. The new types of products are developed to emit a smaller number of harmful chemicals, which improves the situation with indoor air pollution and safety of working with hazardous substances.

Both of these changes can be achieved by restricting or even eliminating the use of solvents and VOCs help to meet more stringent environmental standards, including those established by the U.S. EPA and the European REACH regulations. Because of these characteristics, the new products can help to achieve better air quality and a safer working environment and contribute to global sustainability goals. However, these changes are not only driven by regulatory pressures because the growing customer and corporate demand for eco-friendly and healthier products has to be accommodated in areas such as packaging, automotive, and construction industries.

For instance, in 2024 SABIC unveiled its solvent-free adhesive solutions as part of its commitment to sustainability. These adhesives are designed to meet emerging environmental standards and are used in various sectors, including automotive and electronics, to improve safety and reduce environmental impact.

Laminating Adhesives Market Dynamics:

Drivers

Rising demand for packaging drives the market growth.

The growing popularity of e-commerce, food, and beverage, snack food packaging,and consumer goods sectors has increased the demand for packaging products. Consumers increasingly demand packaging that is convenient and sustainable. The following recent innovations underline this trend. Firstly, in 2023, Dow launched a new series of sustainable laminating adhesives created specifically for flexible packaging. They have increased recyclability and perfectly fit the growing consumer expectations for eco-friendly packaging. Secondly, the new product launched by Henkel in 2024, low-VOC adhesives for food packaging, takes into consideration stricter safety and environmental standards. Both the earlier ones and the latter ones impose sustainability requirements and innovate new products pushing on better performance and increasing the range of usage.

Moreover, increasing governmental regulations positively impact sustainability demand. According U.S. Environmental Protection Agency, packaging waste was 28.1% of the total of municipal solid waste in 2022. The government is working on increasing efforts in generating and promoting the production of packaging that can be recycled. Similar is the Packaging and Packaging Waste Directive of the European Union, which is set to ensure that all packaging must be reusable or recyclable by 2030. Such policies and trends increase the demand for more advanced laminating adhesives which causes further market growth

Restrain

The high cost of raw materials hampers the market growth.

Fluctuations in crude oil prices, supply chain disruptions, and geopolitical factors significantly impact production costs, making it challenging for manufacturers to maintain competitive pricing. Additionally, the strict environmental regulations regarding VOC emissions and solvent usage, such as those enforced by the U.S. Environmental Protection Agency (EPA) and the European Union's REACH regulations, add compliance costs and complicate product development processes.

Furthermore, the slow adoption of eco-friendly adhesives in certain regions, due to the higher costs of sustainable materials and the need for advanced manufacturing technologies, limits market growth. Lastly, the availability of alternative bonding solutions, such as mechanical fasteners and tapes, presents competition, particularly in price-sensitive industries. These factors collectively restrain the growth potential of the laminating adhesives market, despite increasing demand in various end-use sectors like packaging and automotive.

Laminating Adhesives Market Segmentation

By Resin Type

Polyurethane held the largest market share around 46.34% in 2023. Polyurethane-based laminating adhesives are applicable in such industries as packaging, automotive and construction. Their great adhesion ability and reliable usage in extreme environmental factors such as moisture, temperature variance, and chemicals allow the extensive use in different industries. That is particularly applicable to flexible packaging, which is utilized heavily in different types of food and beverage industries as it significantly reduces the problems associated with transportation and storage. High-performance barrier characteristics allow for extending the usage period of packaged products, including bakery, snacks, and confectionary products. Moreover, elongation is another favorably advantageous characteristic that is plentiful for the packaging industry and particularly the flexible packaging as the substrate accommodates the most stress.

By Technology

Water-based laminating adhesives hold the largest market share due to their eco-friendly nature and compliance with increasingly stringent environmental regulations. Unlike solvent-based adhesives, which emit volatile organic compounds (VOCs), water-based adhesives are formulated using water as a solvent, resulting in significantly lower emissions and safer application conditions. This makes them ideal for industries such as packaging, food and beverage, and healthcare, where sustainability and safety standards are critical. In addition to their environmental benefits, water-based adhesives offer strong bonding capabilities, good heat resistance, and compatibility with a wide range of substrates. Their versatility, combined with reduced health risks for workers and improved air quality in manufacturing facilities, makes them a preferred choice across multiple industries.

By End-use Industry

The packaging industry is leading the laminating adhesives market, primarily due to the growing demand for flexible packaging solutions in sectors such as food and beverages, pharmaceuticals, and consumer goods. As e-commerce expands and consumer preferences shift toward lightweight, durable, and eco-friendly packaging, laminating adhesives have become essential for creating multi-layered packaging materials that offer superior barrier properties and product protection. In particular, food packaging requires high-performance laminating adhesives to ensure freshness, extend shelf life, and prevent contamination, driving their widespread use in the sector.

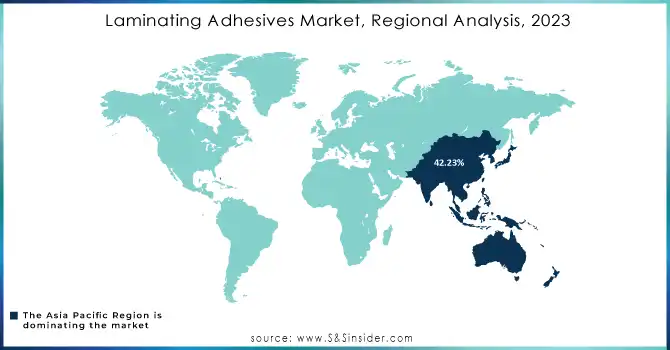

Laminating Adhesives Market Regional Analysis:

Asia Pacific held the largest market share around 42.23% in 2023. Due to the growing manufacturing sector, booming population, and increasing demand for packaged goods, the Asia Pacific region possesses the largest market share in the laminating adhesives market. Such countries like China, India, Japan are the major hubs of the packaging, automotive, electronics industries which heavily depend on laminating adhesives. In addition, the fast-growing middle-class population and expansion of consumer goods, e-commerce, and food and beverage products require more sophisticated packaging solutions. Thus, the use of these adhesives in flexible packaging is considerably increasing not only in China but also in other countries of this region. In 2024, Bostik launched a new range of water-based adhesives for industrial applications, with a focus on reducing environmental impact and enhancing adhesive performance for flexible packaging and industrial laminations.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

-

3M Company (Fastbond Contact Adhesive, Scotch-Weld Lamination Adhesive)

-

Avery Dennison Corporation (Fasson Adhesive Products, Rapid-Roll Lamination Adhesives)

-

Arkema Group (Sartomer Laminating Resins, Plexiglas Adhesive Systems)

-

Ashland Global Holdings Inc. (Purekote Water-Based Laminating Adhesives, Flexcryl Laminating Adhesives)

-

BASF SE (Epotal Water-Based Adhesives, Ultramid-Based Laminating Solutions)

-

Bostik SA (an Arkema Company) (Thermogrip Laminating Adhesives, Herberts High-Performance Adhesives)

-

Coim Group (Novacote Flexible Laminating Adhesives, Coimflex Laminating Systems)

-

Covestro AG (Desmomelt Hot Melt Adhesives, Bayhydrol Water-Based Adhesives)

-

DIC Corporation (DICDRY Solvent-Based Adhesives, Superflex Laminating Adhesives)

-

Dow Inc. (Adcote Laminating Adhesives, Robond Water-Based Adhesives)

-

DuPont de Nemours, Inc. (Surlyn Laminating Films, Bynel Adhesive Resins)

-

Evonik Industries AG (VESTOPLAST Hot Melt Adhesives, POLYCAT Catalysts for Laminating Adhesives)

-

Franklin International (ReacTITE Laminating Adhesives, Multibond Laminating Systems)

-

H.B. Fuller Company (Lunamelt PSA Adhesives, Flextra Fast Laminating Adhesives)

-

Henkel AG & Co. KGaA (Technomelt Laminating Adhesives, Loctite Liofol Adhesives)

-

Jowat SE (Jowatherm Laminating Adhesives, Jowacoll Dispersion Adhesives)

-

Morchem Inc. (MOR-FREE Solvent-Free Adhesives, MOR-THERM Heat Resistant Adhesives)

-

Sika AG (SikaForce Laminating Adhesives, Sikaflex Flexible Adhesives)

-

Toyochem Co., Ltd. (Toyobo Group) (Tomoflex Laminating Adhesives, Toyo-Melt Adhesive Systems)

-

Wacker Chemie AG (VINNAPAS Dispersion Adhesives, SILRES Silicone-Based Laminating Systems)

Recent Development:

- In 2024, Toyochem released its BIOCURE series of laminating adhesives, which are primarily bio-based and designed to meet the growing demand for sustainable products in packaging and industrial applications. This adhesive range offers improved bonding strength and eco-friendly characteristics, appealing to customers seeking greener alternatives.

- In 2023, Avery Dennison developed a new solvent-less laminating adhesive aimed at the automotive and construction sectors. This adhesive provides high durability and heat resistance, making it ideal for applications requiring long-term adhesion in challenging environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.54 Billion |

| Market Size by 2032 | US$ 5.80 Billion |

| CAGR | CAGR of 5.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Polyurethane, Acrylic, Others) • By Technology (Solvent-based, Solvent-less, Water-based, Others) • By End-use Industry (Packaging, Industrial, Automotive & Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Dow Inc., Arkema Group, Ashland Global Holdings Inc., Bostik SA (an Arkema Company), Sika AG, Morchem Inc., DIC Corporation, and other players. |

| Drivers | • Rising demand for packaging drives the market growth. |

| Restraints | • The high cost of raw material hamper the market growth. |