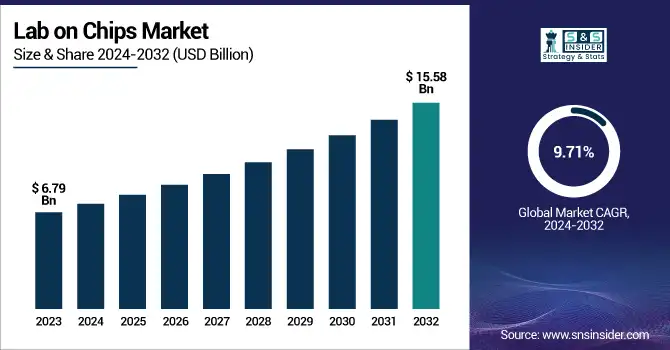

Lab-on-a-Chip Market Size & Growth:

The Lab-on-a-Chip Market size was valued at USD 6.79 Billion in 2023 and is expected to reach USD 15.58 Billion by 2032, growing at a CAGR of 9.71% over the forecast period of 2024-2032. The Lab-on-a-Chip Market analysis highlight how technology innovations with miniaturization, fast analysis, and high sensitivity is developing well and boosting market expansion. Real-time monitoring, data sharing, and remote diagnostics are improved through IoT and automation integration. The Lab on a Chip devices are relatively well-established non-invasive diagnostics that are cost-effective, reliable, and patient-friendly as they involve minimal discomfort.

To Get more information on Lab on Chips Market - Request Free Sample Report

Additionally, increasing emphasis on point-of-care diagnostics is creating the need for portable, easy-to-use Lab on a Chip (LOC) technology systems capable of delivering rapid, onsite results, thereby changing the nature of the diagnostic workflow and allowing healthcare to become more accessible and efficient. The U.S. Lab-on-a-Chip Market was broken out of life science tools that support microfluidics technology and aided national healthcare with a comprehensive healthcare infrastructure. The U.S. government has made significant investments in medical research, allocating more than USD 45 billion in 2023, which exemplifies the U.S. commitment to healthcare innovation. Such an environment has promoted Lab-on-a-Chip device development and integration within rapid diagnostics and personalized medicine applications.

The U.S. Lab-on-a-Chip Market size is estimated to be USD 2.50 Billion in 2023 and is projected to grow at a CAGR of 9.76%.

The U.S. Lab-on-a-Chip Market growth is driven by innovations in healthcare technologies, growing demand for rapid and high throughput diagnostics, Lab-on-a-Chip Market trends toward personalized medicine, and high expenditure on up-to-date biotechnology and research. Also, increasing regulatory support including FDA approvals for in-vitro diagnostics is fueling innovation and commercial expansion.

Lab-on-a-Chip Market Dynamics

Key Drivers:

-

Revolutionizing Healthcare with Point-of-Care Diagnostics and Miniaturized Lab on Lab on Chip Devices Boost Market Expansion

Point-of-care (PoC) diagnostics, particularly in resource-limited environments, will be the major force acting on the Lab-on-a-Chip Market. Due to their potential for rapid, sensitive, and low-cost diagnostic testing with small sample volumes, these devices have been translated into the clinic. Microfluidics, integration of biosensors, and miniaturization of laboratory processes are also becoming increasingly practical, allowing for the design of very high throughput and portable devices in the lab-on-a-chip device market. The increasing number of chronic and infectious diseases, combined with the worldwide effort to enhance healthcare infrastructure, is also expediting the market expansion. In addition, the rising adoption of personalized medicine and real-time monitoring propels the deployment of lab-on-a-chip systems in developed and developing nations.

Restraints:

-

Challenges are Scaling Up Lab-on-a-Chip Market Due to Design Complexity and Lack of Standardization

The lack of scale-up for device design and fabrication is one of the top restraints for the Lab on Chips market. Combining several laboratory functions on a single microchip requires precision engineering and experience in microfluidics, material science, and bioengineering. This added level of technical complexity can slow down rapid prototyping, bringing research and commercialization closer together. There is no standard interface to access certain components, including sensors, and there are no common design/testing/validation protocols between applications, which makes standardization also challenging. Such inconsistency often constrains the interoperability of devices and may prolong regulatory approvals, especially in clinical and diagnostic applications where strict compliance with healthcare standards is required.

Opportunities:

-

Expanding Opportunities in the Lab-on-a-Chip Market Driven by AI Integration and Diverse Application Growth

Major opportunities come from expanded applications including environmental monitoring, food safety testing, and forensic science. In addition, the increasing focus of pharma/biotech companies on organ-on-chip and lab-on-chip platforms for drug discovery and development is expected to provide significant opportunities to such players. For instance, greater government and private sector investments in R&D (particularly in academic and research institutes) will lead to more development and commercialization. Integration with AI and IoT is likely to lead to smart lab-on-chip platforms with automated, remote diagnostics as the technology matures creating wider avenues for market expansion.

Challenges:

-

Overcoming Cross-Disciplinary Challenges and Scalability Issues to Widen Adoption of Lab on a Chip Technologies

One of the most critical challenges then comes from the lack of cross-disciplinary experts in microfluidics, electronics, and biotech. Designing and refining lab on a chip systems’ demands interdisciplinary teamwork, an endeavor that is notoriously difficult to orchestrate. Moreover, although lab on a chip device market analysis also provide simple and rapid testing with high specificity and sensitivity, adoption for general use can be limited owing to user reluctance to embrace these technologies due to uncertainty regarding reliability and volume scalability. Transitioning from industry proof-of-concept or lab-scale prototypes to mass production raises important questions regarding the robustness and accuracy of devices under real-world conditions. Tackling those scientific and practical challenges will be critical for lab-on-a-chip technologies to be adopted more widely and widely used in different industries.

Lab on Chip Market Segmentation Analysis:

By Product & Service

In 2023, the Lab-on-a-Chip Market by Material type was led by Reagents & Consumables, which accounted for a 40.3% share of the total market. The continued usage of these products in diagnostic and research applications results in a sustained demand from healthcare, pharmaceutical, and academic markets is driving this dominance. Consumables include cartridges, a microfluidic chip, and assay kits, which are required and replaced regularly for the device to function, providing a stable flow of income for manufacturers.

The fastest CAGR is expected to witnessed by the Software & Services segment over the forecast period. The segment’s growth is driven by an increasing requirement for improved data analytics, remote monitoring, and real-time interfacing of lab on a chip system with digital platforms. The cross-lab quip, as lab on a chip tech continues to grow and is even more elaborative and data-driven, further increasing the need for high-end software and support services. Role of these solutions in improving device efficiency and workflow streamlining along with automation in diagnostics and drug discovery processes.

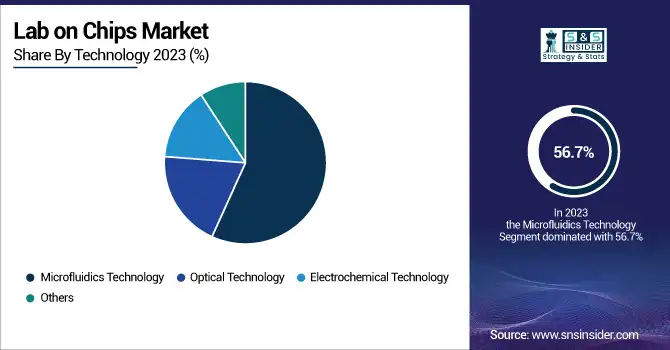

By Technology

In 2023, Microfluidics Technology registered the largest Lab-on-a-Chip Market share of 56.7% in the Lab-on-a-Chip Market. The basis for lab-on-a-chip systems, this technology allows for the micro-manipulation of small volumes of fluid for applications including diagnostics, drug development, and biochemical assays. The good universal acceptability can be attributed to factors such as low input for reagents, short processing duration, and high throughput properties, which have made it a requirement of a clinical and research setting.

It is expected that optical technology to experience the highest CAGR over 2024-2032. Optical-based lab on a chip platforms are riding the wave of a growing need for real-time, non-invasive, and highly sensitive detection methods, boost the segment’s expansion. The new systems rely on fluorescence, absorbance, or surface plasmon resonance to enhance analytical performance. Optical lab on a chip solutions are garnering increasing interest for applications in point-of-care diagnostics, environmental monitoring, and life science by being integrated with conductive-based lab on a chip devices with optical sensors and imaging technologies.

By Application

Clinical Diagnostics held the majority of the Lab-on-a-Chip Market share of 53.3% in 2023 as it is majorly driven by increasing demand for quick, precise, and point-of-care diagnostic solutions for infectious and chronic diseases. Lab-on-chip devices can yield results within minutes while requiring very small sample volumes which means they can be used for clinical purposes in hospitals, diagnostic labs, and emergency care units. They provide prompt and accurate diagnostics that result in improved patient outcomes and more effective healthcare delivery.

During 2024-2032, the Drug Discovery & Development segment is anticipated to record the fastest revenue growth. In the pharmaceutical and biotech industries, the increasing demand for rapid preclinical screening, toxicity testing, and target validation, is expected to boost the use of lab on a chip platforms, further augmenting segment’s expansion. By enabling high-throughput screening, shorter development times, and cost-effective experimentation, these systems are valuable assets for efficient drug pipelines and more productive R&D.

By End-Use

In 2023, Hospitals &Diagnostic Centers were the largest segment in the Lab-on-a-Chip Market with a 49.1% market share. The highest revenue share can be accounted for by the high demand for lab-on-chip devices used for point-of-care diagnostics, rapid detection of diseases, and patient monitoring, are boosting the segment’s growth. The hospitals enjoy the advantages of rapid, sensitive, and non-invasive results offered by the technology, leading to better clinical decision-making and patient care. This segment continues to see robust usage driven by the need for optimal diagnostic workflows and rapid turnaround times.

The academic & research institutes segment is expected to grow at the fastest CAGR during the forecast period of 2024–2032. Academic use of the lab-on-chip platforms is being fueled by ramping-up investments in biomedical research and the ever-increasing interest in microfluidics, organ-on-chip, and next-generation diagnostics. These latter are leading-edge innovation institutes that utilize lab-on-chip systems as exploratory research, prototype development, and early-test systems, setting the stage for quite radical advances in healthcare and the greater life sciences.

Lab-on-a-Chip Market Regional Outlook:

North America accounted for the largest share of the Lab on the market in 2023, at 47.7%, owing to the high investments in healthcare, the wide range of R&D activities, and the early adoption of advanced technologies. Within the region, the U.S. is a leader in research activity and industry-academia partnerships in this area. The lab-on-chip development is pioneered by institutions including the Massachusetts Institute of Technology (MIT), and companies including Fluidigm Corporation and Thermo Fisher Scientific are leading the way for clinical diagnostics, genomics, and personalized medicine. Moreover, regulatory frameworks that promote innovation and government funding for biomedical innovation in the region have further added to the development of the market in the Lab on a Chip Industry.

The Asia Pacific region is anticipated to observe the fastest CAGR during the forecast period of 2024-2032 as a result of the rapid development of healthcare infrastructure, and surging investment in research, coupled with the growing need for affordable diagnostic solutions. Countries including China, India, and Japan are investing a lot in microfluidics and biosensors that provide many advantages. Some of the research going on in lab-on-chip applications is in places including China Tsinghua University and IIT Bombay India. Besides, companies, such as MicruX Technologies and Dolomite Microfluidics Asia are also making the region their playground thus paving the way for innovation and affordability. The increasing emphasis on early disease identification and targeted medicine is expected to further drive penetration in the Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Lab-on-a-Chip Companies are:

-

Abbott Laboratories (Freestyle Libre)

-

Thermo Fisher Scientific (Ion GeneStudio S5)

-

Danaher Corporation (LabChip GX)

-

Agilent Technologies (InfinityLab LC Series)

-

Siemens Healthineers (Atellica VTLi)

-

PerkinElmer (LabChip GX II)

-

Bio-Rad Laboratories (QX200 Droplet Digital PCR System)

-

Fluidigm Corporation (C1 Single-Cell Auto Prep System)

-

Microsys (Lab-on-a-Chip Platform)

-

Becton Dickinson (BD FACSCelesta)

-

Stanford Biotech (Lab-on-a-Chip Immunoassay)

-

Life Technologies (Ion Proton)

-

InSphero (3D In Vitro Cell-based Assay Platforms)

-

Dolomite Microfluidics (Mitos P-Pump)

-

Blacktrace Holdings (Chemix)

Recent Development

-

In March 2025, Thermo Fisher Scientific launched the Vulca Automated Lab, a cutting-edge solution that transforms semiconductor analysis with AI-enhanced automation for faster, more precise data acquisition.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.79 Billion |

| Market Size by 2032 | USD 15.58 Billion |

| CAGR | CAGR of 9.71% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Reagents & Consumables, Instruments, Software & Services) • By Technology (Microfluidics Technology, Optical Technology, Electrochemical Technology, Others) • By Application (Clinical Diagnostics, Drug Discovery & Development, Others) • By End Use (Academic & Research Institutes, Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, Siemens Healthineers, PerkinElmer, Bio-Rad Laboratories, Fluidigm Corporation, Microsys, Becton Dickinson, Stanford Biotech, Life Technologies, InSphero, Dolomite Microfluidics, Blacktrace Holdings. |