Lab Automation Market Report Scope & Overview:

Get More Information on Lab Automation Market - Request Sample Report

The Lab Automation Market size was estimated at USD 7.31 billion in 2023 and is expected to reach USD 13.05 billion by 2032, with a growing CAGR of 6.65% during the forecast period of 2024-2032.

The surge in demand for lab automation is primarily driven by the need for enhanced efficiency, accuracy, and safety within laboratory operations. The ability of robots and AI to execute tasks with precision, reducing human error, is a key factor. Moreover, the escalating volume of samples and the growing complexity of experiments necessitate automation to maintain productivity. The pivotal role of data in modern research has also fueled demand, as automated systems excel at data collection, analysis, and integration.

Demand for lab automation is particularly strong within academic and research institutions. These organizations seek to enhance productivity by automating time-consuming tasks, thereby freeing up researchers to focus on higher-level cognitive work. The expanding application of automated instruments in drug discovery and development is also expected to drive substantial market growth in the coming years. Miniaturization, expanding applications, and the need for high throughput are key drivers of the lab automation market. The demand for smaller, more efficient laboratory processes, coupled with the increasing complexity of scientific research, is accelerating the adoption of automated solutions. From drug discovery to clinical diagnostics, lab automation is being integrated into a wide range of applications, driving market growth. Additionally, the ability to process large volumes of samples efficiently through automation is a significant market opportunity.

Safety concerns, particularly when handling hazardous materials, have positioned lab automation as a crucial tool for risk mitigation. Industries such as drug discovery, diagnostics, and life sciences research are at the forefront of adopting automation to accelerate research, improve diagnostic accuracy, and tackle complex scientific challenges. However, high implementation costs and the need for specialized skills can hinder widespread adoption. Overcoming these obstacles and capitalizing on the burgeoning demand will be essential for the growth of the lab automation industry.

The supply of lab automation solutions is expanding rapidly as robotics capabilities advance. Robotics are evolving from tools for simple, repetitive tasks to versatile platforms capable of handling complex and dynamic laboratory workflows. This increased sophistication is driving the development of more sophisticated and adaptable automation systems, thereby expanding the supply of solutions for laboratories of all sizes.

For example, AI-powered systems can be used to analyze images and identify patterns that might be missed by human pathologists. Robotic arms can be used to automate tasks such as sample preparation and testing.

Lab automation is rapidly evolving with innovations like the Spinnaker 3 microplate mover. These user-friendly systems streamline workflows, boost accuracy, and accelerate research without demanding specialized training. This shift towards accessible automation is reshaping the future of laboratory efficiency.

Overall, the demand for lab automation is expected to grow in the coming years as diagnostic labs seek to improve efficiency, accuracy, and turnaround times. However, the supply of automated systems may be limited by factors such as cost and the availability of skilled workers to operate and maintain them.

Market Dynamics

Drivers

-

A Strategic Catalyst Driving Growth in the Lab Automation Market

Automation streamlines workflows accelerates processes, and enables laboratories to handle larger sample volumes. Simultaneously, the imperative for precision and accuracy, particularly in critical applications such as diagnostics and drug discovery, has fueled the demand for automation.

Moreover, the exponential growth of data in scientific research has necessitated efficient data management and analysis capabilities, which automation excels at providing. Beyond these operational benefits, automation contributes to cost reduction by optimizing resource utilization and minimizing labor expenses. It also plays a crucial role in enhancing laboratory safety by shielding personnel from hazardous materials. In an increasingly regulated environment, automation aids in ensuring compliance with stringent quality and regulatory standards. Ultimately, by accelerating research and development timelines, automation is a strategic tool for organizations seeking a competitive edge in today's fast-paced scientific landscape.

Restraints

-

High Initial Investment

The purchase and implementation of automated systems require significant upfront capital expenditure, which can be a barrier for smaller laboratories or institutions with limited budgets.

-

Lack of Skilled Personnel

Operating and maintaining complex automation systems require specialized expertise. A shortage of skilled labor can impede the effective utilization of these technologies.

Key Segmentation

By Process

In 2023, the continuous flow segment held the highest market share of 56.8% due to the rising usage of continuous flow in laboratories for the provision of high-quality services and the increased need for continuous flow systems in industries. In addition, continuous flow is one of the most popular procedures and is appropriate when a lot of samples need to be analyzed.

By Automation Type

In 2023, the modular automation systems segment dominated the market share of 51.7% due to the mix-and-match and flexibility features provided by modular automation systems. The increasing use of modular systems by end users is also another aspect promoting market expansion. These types of systems are appropriate for laboratories that require automation for particular procedures.

By End User

In 2023, the clinical chemistry analysis segment dominated the market growth with 27.3% due to factors such as technological advancements, increasing demand for automation in clinical chemistry labs for sample handling, storage, and labeling, as well as the growing preference for automated laboratory instruments.

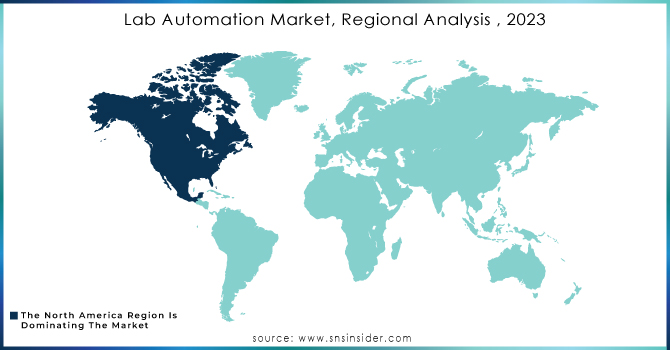

Regional Analysis

North America held a significant market share, growing with a CAGR of 35.9% in 2023, due to the presence of a well-established healthcare framework and the significant need for automation systems in laboratories because of their speed, consistency, and precision. Rising demand for integrated laboratory systems and government policies that promote research are further factors driving the market.

Asia-Pacific is witnessing the fastest CAGR rate of 8.6% during the forecast period due to the rising number of small and middle-sized laboratories in the area and the rising investments made by regional market leaders to introduce novel systems. Another aspect promoting the growth of the regional industry is the supportive government regulations for lab automation.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major players are QIAGEN, PerkinElmer Inc., Thermo Fisher Scientific, Inc., Siemens Healthcare GmbH, Danaher, Agilent Technologies, Inc., Eppendorf SE, Hudson Robotics, Aurora Biomed Inc., BMG LABTECH GmbH, Tecan Trading AG, Hamilton Company, F. Hoffmann-La Roche Ltd, and Others.

Recent Developments

-

Abbott Laboratories (2023): Launched the GLP Systems Track lab automation system in India to streamline diagnostic laboratory workflows.

-

Kokilaben Dhirubhai Ambani Hospital (2023): Partnered with Roche Diagnostics to implement a total lab automation solution.

Recent Activities

-

Thermo Fisher Scientific: Continued to expand its product portfolio through acquisitions and new product launches, focusing on integrated solutions for various laboratory workflows.

-

Danaher Corporation: Leveraged its diverse business units to offer comprehensive automation solutions across different industries, such as diagnostics and life sciences.

-

Tecan Group: Introduced new automation platforms and software solutions to address the growing demand for high-throughput screening and sample management.

-

PerkinElmer: Expanded its presence in the genomics and drug discovery markets through product launches and strategic partnerships.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.31 Billion |

| Market Size by 2032 | US$ 13.05 Billion |

| CAGR | CAGR of 6.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process (Continuous Flow, Discrete Processing) • By Automation Type (Total Automation Systems, Modular Automation Systems) • By End User (Photometry & Fluorometry, Immunoassay Analysis, Electrolyte Analysis, Clinical Chemistry Analysis, Other end-user) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | QIAGEN, PerkinElmer Inc., Thermo Fisher Scientific, Inc., Siemens Healthcare GmbH, Danaher, Agilent Technologies, Inc., Eppendorf SE, Hudson Robotics, Aurora Biomed Inc., BMG LABTECH GmbH, Tecan Trading AG, Hamilton Company, F. Hoffmann-La Roche Ltd |

| Key Drivers | • A Strategic Catalyst Driving Growth in the Lab Automation Market |

| Market Restraints | • High Initial Investment • Lack of Skilled Personnel |