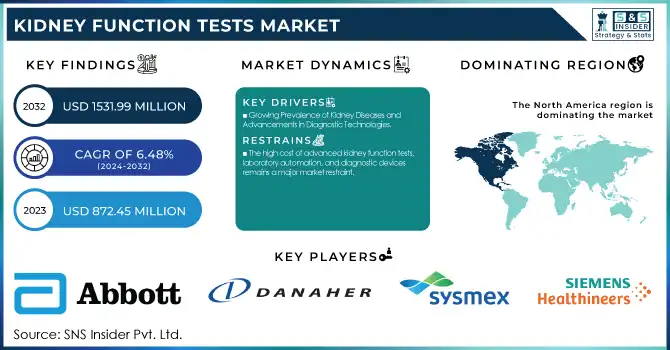

The Kidney Function Tests Market was valued at USD 872.45 Million in 2023 and is projected to reach USD 1531.99 Million by 2032, growing at a CAGR of 6.48% during 2024-2032.

To get more information on Kidney Function Tests Market - Request Free Sample Report

This report identifies technological innovations and advancements, including automated testing solutions and biomarker-based diagnostics, that are enhancing accuracy and efficiency. The study analyzes hospital and diagnostic lab utilization trends, highlighting the growing use of point-of-care testing and home-based monitoring. Also, it examines the effect of chronic conditions such as diabetes and hypertension on the increasing requirement for kidney function testing, as well as the use of early detection in avoiding serious complications. The report also examines the regulatory environment and compliance patterns, evaluating how changing guidelines and quality levels shape market forces and product development.

Drivers

Growing Prevalence of Kidney Diseases and Advancements in Diagnostic Technologies

The kidney function tests market is mainly fuelled by the growing burden of chronic kidney disease (CKD), which accounts for about 850 million people globally, and millions are still undiagnosed. Growing cases of diabetes and hypertension, which are causative factors in almost 75% of CKD cases, are further boosting the demand for early-diagnosis products. Since kidney ailments tend to progress quietly, it is necessary for early diagnosis with regular tests to avert catastrophic conditions like end-stage renal disease (ESRD). Advances in technology, such as automated urinometers, biomarker diagnostics, and artificial intelligence-driven predictive analytics, are improving the efficacy, efficiency, and convenience of kidney function tests. Rising sales of point-of-care and home-testing kits are also revolutionizing the market with easy, painless screening. Furthermore, government preventive healthcare initiatives and kidney disease educational campaigns like World Kidney Day and National Kidney Foundation campaigns are supporting periodic testing. Even the pharmaceutical and biotech sectors are investing in future diagnostic products, thereby promoting market growth further. Increased adoption of digital health technologies, including remote patient monitoring and artificial intelligence-based diagnostic equipment, is anticipated to improve disease management, and kidney function testing will become more efficient and accessible in various healthcare settings.

Restraints

The high cost of advanced kidney function tests, laboratory automation, and diagnostic devices remains a major market restraint

Advanced renal function tests, e.g., cystatin C and Iohexol clearance tests, are very costly and are not widely accessible due to their need for expensive equipment and expertise. In much of the world, especially Africa, South Asia, and Latin America, reliable kidney function tests are difficult to access because these areas have not developed adequate health infrastructure. High out-of-pocket costs and varied reimbursement policies further deter routine assessment of kidney function. Most insurance companies do not comprehensively cover biomarker-based kidney tests, resulting in imbalances in access to diagnosis. The scarcity of qualified lab technicians restricts the uptake of high-accuracy diagnostic solutions, impacting overall market growth. Delays in regulatory approval of new diagnostic technologies further hinder the launch of new testing solutions, limiting market growth. Additionally, in many developing nations, there is low awareness of routine kidney function testing, and thus kidney diseases are diagnosed late, placing a heavy burden on healthcare systems. Solving these cost and access problems will be critical to increasing the availability of kidney function testing globally.

Opportunities

The rising demand for at-home kidney function testing kits presents a major opportunity in the market

Companies are increasingly creating portable, AI-based urine and blood testing machines that enable patients to track their kidney function without regular hospital trips. The combination of telehealth and remote patient monitoring is also revolutionizing the market by making real-time data exchange possible between patients and healthcare professionals. The fast pace of digitalization in healthcare and growing internet penetration has enabled telemedicine-based consultations to become more accessible, enabling early diagnosis and improved disease management. Moreover, government and industry efforts are also encouraging the creation of cost-effective diagnostic solutions to fill the gap in underserved areas. For instance, the National Kidney Foundation and other healthcare organizations are investing in patient education programs and discounted testing programs. Furthermore, partnerships between diagnostic firms and pharmaceutical companies are facilitating the creation of individualized kidney health management plans, combining diagnostics with focused therapeutic interventions. Improvements in biomarker-based diagnostics and lab-on-a-chip technologies will continue to improve at-home testing accuracy, increasing the availability of kidney disease screening. These trends will likely fuel market growth, enhancing early diagnosis and disease outcomes.

Challenges

Stringent regulatory requirements, slow down the approval and commercialization of new diagnostic solutions.

Regulatory agencies like the FDA, EMA, and WHO enforce strict requirements for test precision, quality assurance, and conformance, and this creates hurdles for the release of novel products into the market within a timely manner. The diversity in approval procedures from country to country further presents complications in expanding overseas, and businesses must work across numerous regulatory systems. Another significant challenge is data privacy and cybersecurity issues, particularly with the increasing use of cloud-based and AI-driven diagnostic tools. The widespread use of electronic health records (EHRs) and telemedicine platforms creates concerns about patient data security since breaches would reveal sensitive medical data. In addition, physician reluctance to trust at-home kidney function tests due to skepticism about their accuracy prevents widespread use, as most healthcare providers still favor conventional lab-based diagnostic techniques. The absence of well-established protocols for novel diagnostic biomarkers also prevents their incorporation into standard clinical practice. Furthermore, healthcare disparities and restricted reimbursement schemes for sophisticated testing technologies complicate the provision of broad access. Overcoming these challenges necessitates more robust regulatory backing, stronger data protection safeguards, and better physician education in novel diagnostic techniques.

By Product

In 2023, the clearance tests segment led the kidney function tests market with the highest revenue share of 28.3%. The reason behind this leadership is the high precision and reliability of clearance tests in determining glomerular filtration rate (GFR), a key parameter for the assessment of kidney health. Clearance tests like creatinine and inulin clearance are universally accepted and utilized in hospitals as well as diagnostic labs because they can accurately measure renal function. With the accelerating incidence of CKD, along with the increasing focus on early diagnosis, the market for these tests has further been driven. Also, improved laboratory automation and biomarker-based clearance testing have increased diagnostic effectiveness, rendering the tests a sought-after option for healthcare professionals. The urine tests segment, however, is projected to grow the fastest over the coming years. This can be attributed mainly to the increased use of urine-based diagnostics, which provide an inexpensive and non-invasive solution for the diagnosis of kidney disease. The rising availability of home test kits, coupled with emerging consumer education regarding the maintenance of routine kidney health checks, is also fueling market growth. Moreover, technical advancements like dipstick and microalbuminuria tests are enhancing diagnostic precision and access.

By End-Use

Hospitals captured the highest share of revenue at 40.8% in 2023, mostly attributed to being first-line healthcare centers for the diagnosis and management of kidney disease. Hospitals are fitted with high-quality diagnostic equipment, which facilitates in-depth assessment of kidney functions such as clearance tests, blood tests, and urine tests. The growing incidence of chronic kidney disease and acute kidney injuries has led to more patient hospital visits, boosting demand for kidney function tests even further. Also, hospitals offer specialized treatment with the presence of nephrologists and lab facilities under a single roof, facilitating early diagnosis and treatment. Government programs facilitating kidney disease screening programs and enhanced healthcare infrastructure have also aided in hospital segment dominance. On the other hand, the diagnostic laboratories segment is expected to grow at the highest rate. This growth is driven by the rising need for specialized renal diagnostics and the rising trend of laboratory services outsourcing. Diagnostic laboratories are adopting advanced technologies like automated analyzers and artificial intelligence-based diagnostic tools, enhancing test accuracy and efficiency. Also, increasing demand for autonomous laboratories with rapid turnaround times and value-for-money test services is increasingly driving the growth of the market. As kidney disease load continues to swell, diagnostic laboratories will have an important role in disease identification and control.

North America dominated the largest market share in the kidney function tests market in 2023, supported mainly by the high prevalence of chronic kidney disease (CKD), robust healthcare infrastructure, and strong presence of key players in the market. The region is favored by rising awareness of early disease detection and a growing population of geriatric individuals who are prone to renal disorders. Moreover, positive reimbursement policies and ongoing investments in diagnostic research drive market growth. Sophisticated laboratory technologies, a high rate of adoption of automated diagnostic solutions, and the presence of major pharmaceutical and biotechnology firms further consolidate North America's leadership in the market.

The Asia-Pacific region is also expected to record the most rapid growth, driven by the increasing prevalence of kidney conditions, expanding healthcare spending, and enhanced diagnostic ability. China, India, and Japan are already seeing high demand for accessible and affordable kidney function tests due to growing healthcare facilities and enhanced awareness of kidney conditions among people. Government support in enhancing the accessibility of healthcare services and increased investments in diagnostic technologies are further boosting market growth within the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Abbott – i-STAT, ARCHITECT Clinical Chemistry Analyzer

Danaher Corporation – DxC Integrated Systems (Beckman Coulter)

F. Hoffmann-La Roche Ltd. – COBAS Systems

Sysmex Corporation – Sysmex UF-Series

Siemens Healthineers – CLINITEK Status Analyzer

Randox Laboratories Ltd. – Evidence Investigator

Quest Diagnostics – Renal Function Panel

ACON Laboratories, Inc. – On Call Express

Nova Biomedical Corporation – Stat Profile Prime Plus

Laboratory Corporation of America Holdings – LabCorp Renal Panel

Bio-Rad Laboratories, Inc. – BioPlex 2200 System

77 Elektronika Kft – LabUMat and Urised Urinalysis Systems

Recent Developments

In Feb 2024, Simple HealthKit introduced a new kidney care program aimed at improving health outcomes for patients with diabetes. The initiative features a kidney health test designed to help insurers enhance performance metrics such as HEDIS and Medicare Advantage star ratings. This launch aligns with the company's focus on diagnostics and follow-up care for chronic conditions.

In Aug 2023, Signify Health, a CVS Health company expanded its Diagnostic and Preventive Services by launching comprehensive in-home kidney health evaluations. This new offering aims to enhance early detection, diagnosis, and management of chronic kidney disease (CKD) among Medicare Advantage beneficiaries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 872.45 Million |

| Market Size by 2032 | USD 1531.99 Million |

| CAGR | CAGR of 6.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Clearance Tests, Urine Tests, Blood Tests, Dilution and Concentration Tests, Other Tests] • By End-Use [Hospitals, Diagnostic Laboratories, Research Laboratories and Institutes, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, Danaher Corporation, F. Hoffmann-La Roche Ltd., Sysmex Corporation, Siemens Healthineers, Randox Laboratories Ltd., Quest Diagnostics, ACON Laboratories, Inc., Nova Biomedical Corporation, Laboratory Corporation of America Holdings, Bio-Rad Laboratories, Inc., 77 Elektronika Kft. |

Ans: The Kidney Function Tests market is projected to grow at a CAGR of 6.48% during the forecast period.

Ans: By 2032, the Kidney Function Tests market is expected to reach USD 1531.99 Million, up from USD 872.45 Million in 2023.

Ans: The kidney function tests market is mainly fuelled by the growing burden of chronic kidney disease (CKD), which accounts for about 850 million people globally, and millions are still undiagnosed.

Ans: The high cost of advanced kidney function tests, laboratory automation, and diagnostic devices remains a major market restraint.

Ans: North America is the dominant region in the Kidney Function Tests market.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technological Advancements and Innovations in Kidney Function Testing

5.2 Hospital & Diagnostic Lab Utilization Trends

5.3 Impact of Chronic Diseases on Kidney Function Testing Demand

5.4 Regulatory Landscape and Compliance Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Kidney Function Tests Market Segmentation, by Product

7.1 Chapter Overview

7.2 Clearance Tests

7.2.1 Clearance Tests Market Trends Analysis (2020-2032)

7.2.2 Clearance Tests Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Urine Tests

7.3.1 Urine Tests Market Trends Analysis (2020-2032)

7.3.2 Urine Tests Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Blood Tests

7.4.1 Blood Tests Market Trends Analysis (2020-2032)

7.4.2 Blood Tests Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Dilution and Concentration Tests

7.5.1 Dilution and Concentration Tests Market Trends Analysis (2020-2032)

7.5.2 Dilution and Concentration Tests Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Other Tests

7.6.1 Other Tests Market Trends Analysis (2020-2032)

7.6.2 Other Tests Market Size Estimates and Forecasts to 2032 (USD Million)

8. Kidney Function Tests Market Segmentation, by End-Use

8.1 Chapter Overview

8.2 Hospitals

8.2.1 Hospitals Market Trends Analysis (2020-2032)

8.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Diagnostic Laboratories

8.3.1 Diagnostic Laboratories Market Trends Analysis (2020-2032)

8.3.2 Diagnostic Laboratories Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Research Laboratories and Institutes

8.4.1 Research Laboratories and Institutes Market Trends Analysis (2020-2032)

8.4.2 Research Laboratories and Institutes Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Kidney Function Tests Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.4 North America Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.5.2 USA Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.6.2 Canada Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Mexico Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Kidney Function Tests Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.5.2 Poland Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.6.2 Romania Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.7.2 Hungary Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.8.2 Turkey Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Kidney Function Tests Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.4 Western Europe Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.5.2 Germany Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.6.2 France Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.7.2 UK Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.8.2 Italy Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.9.2 Spain Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.12.2 Austria Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Kidney Function Tests Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.4 Asia Pacific Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 China Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 India Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 Japan Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.6.2 South Korea Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Vietnam Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.8.2 Singapore Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.9.2 Australia Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Kidney Function Tests Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.4 Middle East Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.5.2 UAE Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.6.2 Egypt Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.8.2 Qatar Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Kidney Function Tests Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.4 Africa Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.5.2 South Africa Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Kidney Function Tests Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.4 Latin America Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.5.2 Brazil Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.6.2 Argentina Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.7.2 Colombia Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Kidney Function Tests Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Kidney Function Tests Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10. Company Profiles

10.1 Abbott

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Danaher Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 F. Hoffmann-La Roche Ltd.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Sysmex Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Siemens Healthineers

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Randox Laboratories Ltd.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Quest Diagnostics

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 ACON Laboratories, Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Nova Biomedical Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Bio-Rad Laboratories, Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Clearance Tests

Urine Tests

Blood Tests

Dilution and Concentration Tests

Other Tests

By End-Use

Hospitals

Diagnostic Laboratories

Research Laboratories and Institutes

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Blood Group Typing market size was USD 2.26 billion in 2023 and is expected to reach USD 4.82 billion by 2032 and grow at a CAGR of 8.80% over the forecast period of 2024-2032.

Ethylene Oxide (EtO) Sterilization Services Market was valued at USD 4.7 billion in 2023 and is expected to reach USD 10.55 billion by 2032, growing at a CAGR of 10.52% over the forecast period 2024-2032.

Fecal Calprotectin Testing Market was valued at USD 4.51 billion in 2023 and is expected to reach USD 12.23 billion by 2032, growing at a CAGR of 11.61% from 2024-2032.

The Biopharmaceutical Excipients Market Size was valued at USD 2.57 billion in 2023 and is expected to reach USD 4.04 billion by 2032 and grow at a CAGR of 5.18% over the forecast period 2024-2032.

The Wound Care Market size is expected to reach 33.99 billion by 2032 from USD 21.8 billion in 2023 and grow at a CAGR of 5.08% from 2024 to 2032.

The Laboratory Developed Tests Market was valued at USD 12.43 billion in 2023 and is expected to reach USD 23.03 billion by 2032, growing at a CAGR of 7.11% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone