Jerry Cans Market Report Scope & Overview:

Get More Information on Jerry Cans Market - Request Sample Report

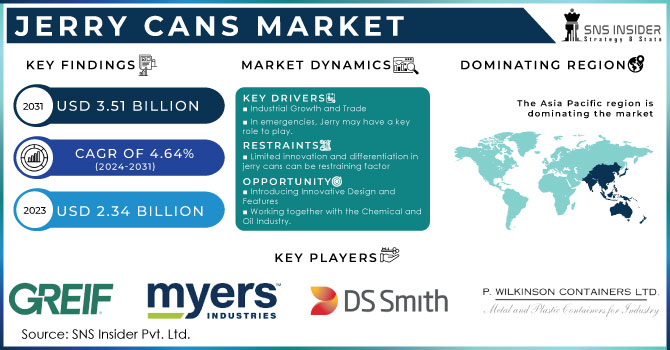

The Jerry Cans Market size was USD 2.34 billion in 2023 and is expected to Reach USD 3.51 billion by 2031 and grow at a CAGR of 4.64 % over the forecast period of 2024-2031

Demand for jerry cans reached to around more than 2.8 billion in the year 2022. Due to the expansion of chemical industry the market is expected to see rise of 1.2 billion over the forecast period. The expansion of jerry cans market is expected to be around 1.5 times over the forecast period. Due to the end use of jerry cans the sales is expected to rise 1.5 times over the projection period.

MARKET DYNAMICS

KEY DRIVERS:

-

Industrial Growth and Trade

The demand for jerry cans is highly correlated with industrial growth, manufacturing and world trade. The need to store and transport liquids of all types, e.g. Chemical, Oil or Other Industrial Fluids, increases as the economy expands and trade activities become more intense, which drives demand for jerry cans.

-

In emergencies, Jerry may have a key role to play.

RESTRAIN:

-

Limited innovation and differentiation in jerry cans can be restraining factor

It may lead to lower consumer interest and slower growth, if the jerry can market becomes too saturated and there are limited innovation in terms of design and functionality.

OPPORTUNITY:

-

Introducing Innovative Design and Features

In order to increase the user friendliness and consumer appeal of jerry cans, it is appropriate to introduce innovation in design such as better pour mechanisms, integrated handles or stackable designs.

-

Working together with the Chemical and Oil Industry.

CHALLENGES:

-

The price fluctuations of the raw materials used by jerry can, for example plastics or metals, are liable to have an impact on production costs and lead to a decline in profitability.

IMPACT OF RUSSIAN UKRAINE WAR:

The market for jerry cans has been significantly affected by the conflict between Russia and Ukraine. Jerry cans have been used for storing and transporting fuel; war has caused the world's supply to be interrupted. This, coupled with the fact that jerry cans are becoming more scarce, prompted people to rush for fuel in case of shortages.

In the United States, in the weeks following the start of the war, the average price of a 5 gallon jerry can increased from $10 to $20. The prices for jerry cans have risen considerably in Europe, where some of them are sold at as much as $50. The United Kingdom has set a limit of two jerrycans per day for each person. A study conducted by the Association of Convenience Stores in the United Kingdom shows that since the outbreak of war, there has been a 500 % rise in sales of jerry cans.

IMPACT OF ONGOING RECESSION:

The current economic downturn is expected to have a negative impact on the jerry can market. A 11.1% drop has occurred on the market. The growing popularity of electric vehicles. The electric vehicle doesn't require fuel, so you need fewer jerry cans to store it and transport it. Development of new technology for the storage and transportation of petroleum. jerry cans may become obsolete because of these new technologies. The jerry can is being regulated more and more. Jerry tanks are becoming increasingly regulated by governments, which can increase their costs and make it more difficult for them to operate. There was an uneven effect on the jerry cans market from the economic downturn. In some segments of the market, recession is more likely than others. For instance, there is more vulnerability in the market for jerry drums used by businesses compared with the market for bottles sold to consumers. In fact, companies are more likely to reduce production during recessions and consumers tend to still use jerry cans when they need them.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Metal

Based on Material, Plastic is the dominant subsegment globally. The plastic segment is estimated to hold around 80 % market share. The plastic is easily available raw material due to which it is most common used packaging material.

By Capacity

-

20-40 liters

-

40-60 liters

-

60-80 liters

-

Others

The 20 Litres segment is dominating the market by capacity. This is due to the increased demand from end use industries such as agrochemicals, petrochemicals.

By Shape

-

Round

-

Stackable

-

Square

-

Others

In 2022, By Shape the square segment dominated the global market. The square shape is easy to handle and store the liquid items. Hence, they are more preferable. They are more rigid and have high strength. 1140 x 1140 mm pallet is ideal dimensions for the usage.

By Manufacturing Process

-

Blow Molding

-

Compression Molding

-

Injection Molding

Based on the manufacturing process, blow molding is holding a significant market share.

By End Use

-

Food & Beverages

-

Pharmaceuticals

-

Oil & Lubricants

-

Chemicals

-

Others

Food & Beverages end use segment accounted for the largest market share of around more than 60%. In this industry the jerry cans are widely used in transportation of liquid items such as sauces, liquid food. Along with this the increased alcoholic beverages consumptions is giving boost to the segment growth.

REGIONAL ANALYSIS

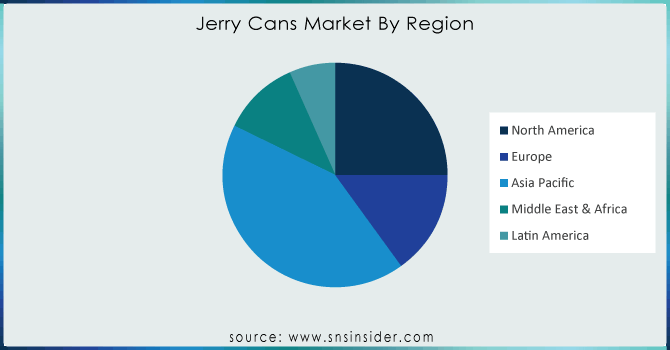

Over the projection period, Asia Pacific will remain the dominant market for the jerry cans. Due to the rapid industrialization, and growth of the construction and manufacturing sectors in the countries such as India and China. This is increasing demand for the various chemicals and petrochemical needs, which is also giving growth to the jerry cans market.

Europe is the second largest market for the jerry cans due to the growth of millennial population in the regions.

North America is the fastest growing market over the forecast period.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Jerry Cans market are Greif Inc, Myers Industries Inc, Barrier Plastics Inc, Wilkinson Containers Ltd, DS Smith Plastics Ltd, Can-One Berhad, Time Technoplast Ltd, California Plastics Products, Nexus Packaging Ltd, Carrick Packaging and other players.

RECENT DEVELOPMENT

-

In 2022, Greif Inc., announced the launch in Brazil of a lightweight, high- performance jerry can for agrochemicals, chemicals, beverages and preservatives.

-

In 2022, Myers Industries Inc, acquired a rotational molding facility in Georgia to increase its production capacity.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.34 Bn |

| Market Size by 2031 | US$ 3.51 Bn |

| CAGR | CAGR of 4.64 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Metal) • by Capacity (20-40 litres, 40-60 litres, 60-80 litres, Others) • by Shape (Round, Stackable, Square, Others) • by Manufacturing Process (Blow Molding, Compression Molding, Injection Molding) • by End Use (Food & Beverages, Pharmaceuticals, Oil & Lubricants, Chemicals, Agrochemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Greif Inc, Myers Industries Inc, Barrier Plastics Inc, Wilkinson Containers Ltd, DS Smith Plastics Ltd, Can-One Berhad, Time Technoplast Ltd, California Plastics Products, Nexus Packaging Ltd, Carrick Packaging |

| Key Drivers | • Industrial Growth and Trade • In emergencies, Jerry may have a key role to play. |

| Key Restraints | • Limited innovation and differentiation in jerry cans can be restraining factor |