Get more information on IT Asset Disposition (ITAD) Market - Request Sample Report

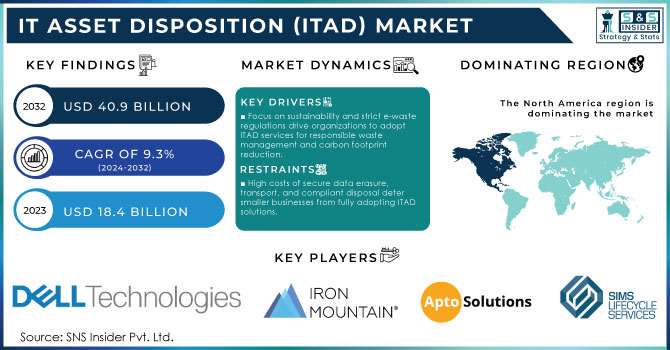

IT Asset Disposition (ITAD) Market size was valued at USD 18.4 billion in 2023 and is expected to grow to USD 40.9 billion by 2032 and grow at a CAGR of 9.3% over the forecast period of 2024-2032.

The IT Asset Disposition (ITAD) market has grown exponentially due to the presence of ever-increasing regulatory mandates by governments around the world and rising e-waste requiring safe disposal. The United Nations Global E-Waste Monitor 2023 reported a staggering 53.6 million metric tons of electronic waste generated globally in 2022, up by 7.2% from 2021, underscoring the urgency of proper asset disposal strategies. Governments responded by taking steps to minimize this with strict compliance measures such as the U.S. Environmental Protection Agency (EPA) Resource Conservation and Recovery Act (RCRA) that guarantees hazardous waste management. In contrast, the Waste Electrical and Electronic Equipment (WEEE) directive in Europe requires businesses to dispose of IT assets in a certain way, which is boosting ITAD market growth. The E-Waste Management Rules (2023) by the Ministry of Environment, Forest and Climate Change further mandates IT companies to ensure that at least 50% of their e-waste is processed responsible manner by certified ITAD services in India. The regulatory push is projected to increase demand for IT asset disposition services from companies that want to comply with strict e-waste legislation, while simultaneously ensuring the secure disposal of sensitive data.

The growing need for IT Asset Disposition (ITAD) services is fuelled by the transition of businesses towards cloud-based solutions and data center consolidation. Cloud migration and data center consolidation lead to decommissioned IT assets like servers, storage devices, and networking equipment that require proper disposal. ITAD services supervise this process alongside data erasure, logistics, and eco-sustainable disposal techniques which include recycling and refurbishment. By utilizing ITAD services, companies ensure compliance with data protection and environmental standards, making ITAD providers essential in managing the IT lifecycle from deployment to decommissioning in cloud-centric infrastructures.

ITAD Market Insights: Device Lifecycle, Data Security, and Sustainability

|

Category |

Details |

|---|---|

|

Device Refurbishment Rate |

55% of disposed assets are refurbished and resold |

|

Data Security Compliance |

85% of organizations prioritize data sanitization compliance (GDPR, HIPAA) |

|

E-waste Recycling Efficiency |

72% of IT assets are recycled after disposal |

|

Average Asset Lifespan |

Laptops: 3-5 years, Desktops: 5-7 years, Servers: 4-6 years |

|

Data Sanitization Methods |

Data Wiping: 60%, Degaussing: 25%, Physical Destruction: 15% |

|

End-of-Life Management |

40% of assets sent for certified recycling, 20% sent to secondary markets |

|

Environmental Impact (CO2e) |

ITAD reduces an average of 1.2 metric tons of CO2e per 100 disposed devices |

|

Resale Value Recovery Rate |

Average recovery rate: 45-50% of original device value |

|

ITAD Service Provider Trends |

35% of companies outsource ITAD services, 65% manage in-house |

|

Compliance Audits Frequency |

70% of organizations conduct annual compliance audits on ITAD practices |

Driver

Growing focus on environmental sustainability and strict government regulations around e-waste disposal encourage organizations to adopt ITAD services. Compliance with these regulations helps reduce carbon footprints and manage electronic waste responsibly.

Increasing cases of data breaches and stringent data privacy regulations (such as GDPR and CCPA) are pushing organizations to properly dispose of IT assets to avoid data leaks, ensuring sensitive information is destroyed securely.

Many companies are incorporating CSR into their business models, opting for eco-friendly ITAD solutions. These initiatives help them enhance their brand image by responsibly recycling and reselling old IT equipment.

The data security and privacy concern as a result of the growing number of data breaches, along with the emergence of strict regulatory frameworks is one of the primary factors driving the growth IT Asset Disposition (ITAD) market. With data privacy regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., companies are mandated to safeguard personal and sensitive data at all stages of their lifecycle, including disposal. According to the Identity Theft Resource Center, the number of data breaches in the U.S. alone reached 1,802 incidents in 2022, compromising over 422 million individuals' data. This shows how critical it is that companies protect the disposal of obsolete IT assets to prevent data leaks. Any data left on decommissioned devices could lead to severe financial penalties and reputational damage for businesses, especially if found in violation of compliance laws.

For example, in 2021, Morgan Stanley was fined $60 million by the U.S. Office of the Comptroller of the Currency (OCC) for failing to adequately dispose of outdated data center equipment, which led to potential data exposure. This incident is a reminder that certified ITAD providers offering secure data wiping, destruction, and certification disposal services should be used. As organizations seek ITAD solutions promising guaranteed data erasure and compliance with privacy laws, this aspect is expected to drive the growth of the global IT asset disposition market over the forecast period.

Restraints:

The cost of secure data erasure, transportation, and environmentally compliant disposal of IT assets can be high, deterring smaller businesses from fully embracing ITAD solutions.

Many organizations, especially small and medium enterprises (SMEs), are still unaware of the benefits of ITAD services or the risks associated with improper disposal of IT assets, limiting market adoption.

The high cost of services related to secure data erasure and environmentally compliant disposal process acts as a key restrain for the growth of the ITAD market. Businesses are subject to strict data protection and environmental laws that necessitate proper management of e-waste and secure methods of data destruction. That requires a lot of investment in technology, logistics, and certified processes which make the cost high. These costs can become oppressive and help justify not using ITAD services in smaller organizations, particularly where the budget is limited. Consequently, companies might use low and unsafe or improper techniques of disposal that lead to data breaches within the organization and environmental hazards. This cost barrier is a significant hurdle in the widespread adoption of comprehensive ITAD solutions, especially among smaller enterprises.

The computer segment accounted for a significant portion of the ITAD market share due to the sheer volume of computer hardware in operation globally. In 2023, approximately 2.2 billion personal computers were in use worldwide, with a large number of these assets approaching the end of their life cycle. One of the critical factors for ITAD growth is that technology has been moving at such an accelerated pace that computers tend to become outdated every 3-5 years. Governments worldwide have recognized the importance of recycling and safe disposal of these assets, mandating responsible end-of-life management through regulations. For example, the U.S. EPA promotes recycling of computer equipment through its Electronics Recycling Initiative where close to 25% of all electronics were disposed of responsibly in 2022. Corporate and governmental customers, which frequently cycle their hardware in large quantities, also contribute to the demand for sustainable disposal solutions for computers by driving the need for effective ITAD services. As a result of growing concerns about e-waste and the need to safely destroy sensitive information left on the devices, computers currently make up a significant portion of ITAD revenue.

By Service

Data sanitization and destruction services dominated the ITAD market in 2023 due to stringent regulations surrounding data privacy and protection. Governments are tightening up on regulations such as the EU General Data Protection Regulation – GDPR, U.S. Federal Information Security Management Act (FISMA) so organizations must now prove that sensitive information is completely destroyed when IT assets are decommissioned. According to the 2023 U.S. Federal Trade Commission (FTC) report, 56% of data breaches were associated with poor disposal practices which need proper sanitization services. For organizations that manage sensitive customer and corporate data, methods of data destruction degaussing, overwriting, and physical destruction are essential. There are ITAD service providers that, due to the increased need coming from companies in highly regulated industries including healthcare, banking, and government, have been offering organizations more help with adhering to laws such as the U.S. Health Insurance Portability and Accountability Act (HIPAA), requires organizations dealing with patient data to dispose of that information securely. Additionally, companies have adopted these services to mitigate the risks of data breaches and avoid hefty fines, thus driving the market for data sanitization and destruction services.

By End-use

Due to the increasing growth of digital infrastructure and regular hardware upgrades due to changing communication technologies, the IT & telecom industry dominated the ITAD market in 2023. The U.S. Federal Communications Commission (FCC) said that by 2023, more than 85% of U.S. households had access to at least one form of broadband service, leading telecommunications companies to constantly upgrade their network infrastructure. This growth has resulted in rising IT asset churn, particularly around things like servers, routers, and switches that typically need to be properly decommissioned and salvaged. Telecom providers are especially in demand of ITAD services that guarantee data destruction during the decommissioning process of outdated equipment, particularly adhering to the standards set forth by the U.S. National Security Agency (NSA) when it comes to destroying their data. Furthermore, the worldwide increase in 5G deployments is driving tons of old 4G infrastructure to digest, making the ITAD market a vital base for the IT and telecom sector.

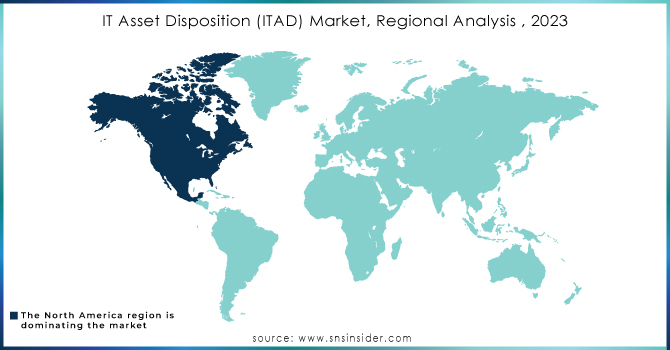

Regional Analysis

North America accounted for the largest share of the ITAD market in 2023 due to large e-waste volumes and stringent data protection regulations. In 2022, the U.S. EPA said that there are nearly 7.6 million metric tons of e-waste between both the U.S. and Canada combined. In addition, the focus of the U.S. government on sustainability and responsible disposal as evidenced by the Electronics Product Stewardship Initiative has served to drive growth in the ITAD market. North American companies, particularly in sectors like finance and healthcare, are significant users of ITAD services, due to their need to comply with stringent data privacy laws, such as HIPAA and the Sarbanes-Oxley Act.

On the other hand, the Asia-Pacific IT asset disposition market is projected to grow with the fastest CAGR during the forecast period 2024-2032 owing to increasing awareness regarding ITAD solutions among businesses in countries like China and India. India is the third largest producer of e-waste globally with 3.23 million metric tons produced in 2023, according to India’s Ministry of Electronics and Information Technology, making ITAD services an immediate necessity. The rapid digitization and industrialization of the region, along with governmental initiatives such as China Circular Economy Promotion Law, which focuses on recycling and sustainable disposal of e-waste are some of the significant factors responsible for the increasing market growth. Asia-Pacific accounted significant share of the global ITAD market in 2023 and is anticipated to grow at the highest CAGR owing to the rising turnover of IT assets coupled with growing demand for data destruction services.

Do you need any custom research on IT Asset Disposition (ITAD) Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers:

Sims Lifecycle Services (Sims Portal, SecureTrack)

Iron Mountain Incorporated (Secure IT Asset Disposition, Data Center Decommissioning)

Dell Technologies (Asset Recovery Services, Data Wipe)

Apto Solutions (Data Erasure Services, Asset Reclamation)

Hewlett Packard Enterprise (HPE) (HPE Asset Upcycling, HPE Certified Erasure)

Arrow Electronics, Inc. (Data Sanitization Services, Electronic Recycling)

IBM Global Asset Recovery Services (Secure Asset Disposal, IBM Data Sanitization)

TES-AMM (Circular Computing, Secure ITAD)

Ingram Micro ITAD (Chain of Custody, IT Asset Recycling)

CloudBlue (End-of-Life Asset Disposition, Device Lifecycle Management)

Users of ITAD Services:

Microsoft

Apple Inc.

Amazon

Intel Corporation

Facebook (Meta)

Cisco Systems

IBM Corporation

Sony Corporation

Samsung Electronics

| Report Attributes | Details |

|---|---|

| Market Size in 2023 |

USD 18.4 billion |

| Market Size by 2032 |

USD 40.9 billion |

| CAGR | CAGR of 9.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Asset Type (Computers/Laptops, Smartphones and Tablets, Peripherals, Storages, Servers, Others) •By Organization Size (Small and Medium-sized Enterprises, Large Enterprises) •By Service (De-Manufacturing and Recycling, Remarketing and Value Recovery, Data Destruction/Data Sanitation, Logistics Management and Reverse Logistics, Others) •By End-use (BFSI, IT & Telecom, Government, Energy and Utilities, Healthcare, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Sims Lifecycle Services, Iron Mountain Incorporated, Dell Technologies, Apto Solutions, Hewlett Packard Enterprise (HPE), Arrow Electronics, Inc., IBM Global Asset Recovery Services, TES-AMM, Ingram Micro ITAD, CloudBlue |

| Key Drivers |

•Growing focus on environmental sustainability and strict government regulations around e-waste disposal encourage organizations to adopt ITAD services. |

| RESTRAINTS | •The cost of secure data erasure, transportation, and environmentally compliant disposal of IT assets can be high, deterring smaller businesses from fully embracing ITAD solutions. •Many organizations, especially small and medium enterprises (SMEs), are still unaware of the benefits of ITAD services or the risks associated with improper disposal of IT assets, limiting market adoption. |

Ans:

Ans: The North American region dominated the IT Asset Disposition (ITAD) Market in 2023.

Ans: - The IT Asset Disposition (ITAD) market size was valued at USD 18.4 bn in 2023.

Ans: - 4 segments of the IT Asset Disposition (ITAD) Market.

Ans: - Manufacturers, Research Institutes, university libraries, suppliers, and distributors of the product.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. IT Asset Disposition (ITAD) Market Segmentation, By Asset Type

7.1 Chapter Overview

7.2 Computers/Laptops

7.2.1 Computers/Laptops Market Trends Analysis (2020-2032)

7.2.2 Computers/Laptops Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Smartphones and Tablets

7.3.1 Smartphones and Tablets Market Trends Analysis (2020-2032)

7.3.2 Smartphones and Tablets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Peripherals

7.4.1 Peripherals Market Trends Analysis (2020-2032)

7.4.2 Peripherals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Storages

7.5.1 Storages Market Trends Analysis (2020-2032)

7.5.2 Storages Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Servers

7.6.1 Servers Market Trends Analysis (2020-2032)

7.6.2 Servers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. IT Asset Disposition (ITAD) Market Segmentation, By Service

8.1 Chapter Overview

8.2 De-Manufacturing and Recycling

8.2.1 De-Manufacturing and Recycling Market Trends Analysis (2020-2032)

8.2.2 De-Manufacturing and Recycling Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Remarketing and Value Recovery

8.3.1 Remarketing and Value Recovery Market Trends Analysis (2020-2032)

8.3.2 Remarketing and Value Recovery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Data Destruction/Data Sanitation

8.4.1 Data Destruction/Data Sanitation Market Trends Analysis (2020-2032)

8.4.2 Data Destruction/Data Sanitation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Logistics Management and Reverse Logistics

8.5.1 Logistics Management and Reverse Logistics Market Trends Analysis (2020-2032)

8.5.2 Logistics Management and Reverse Logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. IT Asset Disposition (ITAD) Market Segmentation, By Organization size

9.1 Chapter Overview

9.2 Small and Medium-sized Enterprises

9.2.1 Small and Medium-sized Enterprises Market Trends Analysis (2020-2032)

9.2.2 Small and Medium-sized Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Large Enterprises

9.3.1 Large Enterprises Market Trends Analysis (2020-2032)

9.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. IT Asset Disposition (ITAD) Market Segmentation, By End-use

10.1 Chapter Overview

10.2 Government

10.2.1 Government Market Trends Analysis (2020-2032)

10.2.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Energy and Utilities

10.3.1 Energy and Utilities Market Trends Analysis (2020-2032)

10.3.2 Energy and Utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Healthcare

10.4.1 Healthcare Market Trends Analysis (2020-2032)

10.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Media and Entertainment

10.5.1 Media and Entertainment Market Trends Analysis (2020-2032)

10.5.2 Media and Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 BFSI

10.6.1 BFSI Market Trends Analysis (2020-2032)

10.6.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 IT & Telecom

10.7.1 IT & Telecom Market Trends Analysis (2020-2032)

10.7.2 IT & Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Others

10.8.1 Others Market Trends Analysis (2020-2032)

10.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America IT Asset Disposition (ITAD) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.2.4 North America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.5 North America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.2.6 North America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.2.7.2 USA IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.7.3 USA IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.2.7.4 USA IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.2.8.2 Canada IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.8.3 Canada IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.2.8.4 Canada IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.2.9.2 Mexico IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.9.3 Mexico IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.2.9.4 Mexico IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.7.3 Poland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.1.7.4 Poland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.8.3 Romania IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.1.8.4 Romania IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.9.3 Hungary IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.1.9.4 Hungary IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.10.3 Turkey IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.1.10.4 Turkey IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.5 Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.6 Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.7.3 Germany IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.7.4 Germany IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.8.2 France IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.8.3 France IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.8.4 France IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.9.2 UK IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.9.3 UK IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.9.4 UK IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.10.3 Italy IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.10.4 Italy IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.11.3 Spain IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.11.4 Spain IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.14.3 Austria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.14.4 Austria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.5 Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.6 Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.7.2 China IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.7.3 China IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.7.4 China IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.8.2 India IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.8.3 India IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.8.4 India IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.9.2 Japan IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.9.3 Japan IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.9.4 Japan IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.10.2 South Korea IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.10.3 South Korea IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.10.4 South Korea IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.11.3 Vietnam IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.11.4 Vietnam IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.12.2 Singapore IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.12.3 Singapore IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.12.4 Singapore IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.13.2 Australia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.13.3 Australia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.13.4 Australia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.1.4 Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.5 Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.1.6 Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.7.3 UAE IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.1.7.4 UAE IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.8.3 Egypt IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.1.8.4 Egypt IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.10.3 Qatar IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.1.10.4 Qatar IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.2.4 Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.5 Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.2.6 Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.7.3 South Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.2.7.4 South Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.6.4 Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.5 Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.6.6 Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.6.7.2 Brazil IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.7.3 Brazil IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.6.7.4 Brazil IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.6.8.2 Argentina IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.8.3 Argentina IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.6.8.4 Argentina IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.6.9.2 Colombia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.9.3 Colombia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.6.9.4 Colombia IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Asset Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By Organization size (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America IT Asset Disposition (ITAD) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Sims Lifecycle Services

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Iron Mountain Incorporated

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 Dell Technologies

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Apto Solutions

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 Hewlett Packard Enterprise (HPE).

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 Arrow Electronics, Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 IBM Global Asset Recovery Services

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 TES-AMM

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Ingram Micro ITAD

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 CloudBlue

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Asset Type

Computers/Laptops

Smartphones and Tablets

Peripherals

Storages

Servers

Others

By Organization size

Small and Medium-sized Enterprises

Large Enterprises

By Service

De-Manufacturing and Recycling

Remarketing and Value Recovery

Data Destruction/Data Sanitation

Logistics Management and Reverse Logistics

Others

By End-use

BFSI

IT & Telecom

Government

Energy and Utilities

Healthcare

Media and Entertainment

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The industry 5.0 Market Size was estimated at USD 58.15 billion in 2023 and will reach USD 673.18 billion by 2032, with a growing at CAGR of 15.63% by 2032.

The Machine Learning as a Service (MLaaS) Market Size was valued at USD 25.3 Billion in 2023 and is expected to reach USD 313.9 Billion by 2032 and grow at a CAGR of 32.3% Over the Forecast Period of 2024-2032.

Satellite Internet Market was valued at USD 8.16 billion in 2023 and is expected to reach USD 29.44 billion by 2032, growing at a CAGR of 15.39% by 2032

The Password Management Market was valued at USD 3.7 Billion in 2023 and is expected to reach USD 23.2 Billion by 2032, growing at a CAGR of 22.49% by 2032.

The IoT Kitchen System Market Size was valued at USD 23.86 Billion in 2023 and is expected to reach USD 80.03 billion by 2032 and grow at a CAGR of 14.4% over the forecast period 2024-2032.

Agriculture IoT Market was valued at USD 23.41 billion in 2023 and is expected to reach USD 60.12 billion by 2032, growing at a CAGR of 11.12% by 2032.

Hi! Click one of our member below to chat on Phone