Isostearic Acid Market Key Insights:

To Get More Information on Isostearic Acid Market - Request Sample Report

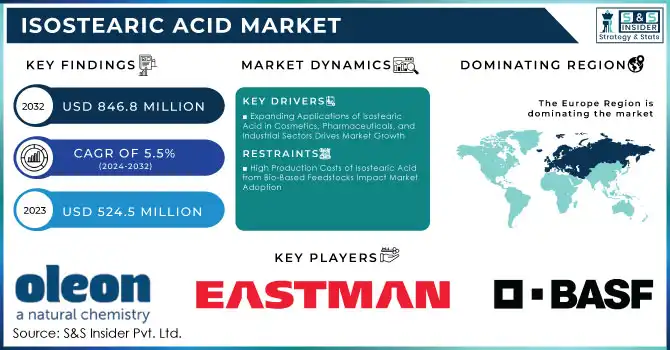

The Isostearic Acid Market Size was valued at USD 524.5 million in 2023 and is expected to reach USD 846.8 million by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The Isostearic Acid market has seen considerable advancements due to its growing use across various industries such as cosmetics, personal care, food, and pharmaceuticals. This is largely driven by the increasing demand for bio-based and sustainable alternatives to petrochemical-derived products. The shift toward green chemistry has intensified the focus on eco-friendly and renewable ingredients, with isostearic acid becoming a popular choice for its multifunctionality in emulsifiers, surfactants, and lubricants. As consumer preferences evolve towards more sustainable and non-toxic products, the market for isostearic acid is expanding rapidly. This trend is further supported by innovations that aim to improve the quality and performance of isostearic acid in industrial applications.

In December 2023, Avril Group made a significant move by doubling the production capacity of its isostearic acid and dimer production unit. This expansion aligns with the company’s strategic goals to enhance its growth in the oleochemistry sector and respond to the increasing demand for sustainable chemical solutions. Avril Group's investment is part of a broader initiative to strengthen its position in the market, driven by the rising need for high-performance, renewable products across industries like cosmetics and lubricants. This expansion also highlights Avril’s commitment to meeting the growing demand for green chemistry solutions. The company's move to scale up production further underscores the rising global interest in plant-based chemicals, particularly isostearic acid, which is recognized for its environmentally friendly properties.

In addition to Avril, other companies are also capitalizing on the growing demand for isostearic acid. Their focus on enhancing production capabilities and improving the environmental profile of their products plays a crucial role in the market’s growth. With continued innovation and expansion, the isostearic acid market is poised for further success, propelled by sustainable manufacturing practices and increasing industrial needs for eco-conscious chemicals.

Market Dynamics

Drivers:

-

Rising Consumer Preference for Sustainable and Bio-Based Products Fuels the Demand for Isostearic Acid

-

Expanding Applications of Isostearic Acid in Cosmetics, Pharmaceuticals, and Industrial Sectors Drives Market Growth

-

Technological Advancements in Isostearic Acid Production Enhance Its Performance and Sustainability

-

Growing Environmental Regulations and Sustainability Goals Boosts Demand for Green Chemicals Like Isostearic Acid

-

Increased Investment in Renewable Energy and Bio-Based Feedstocks Supports Isostearic Acid Market Expansion

The increasing investment in renewable energy and bio-based feedstocks is helping expand the isostearic acid market. Many producers are shifting their focus to renewable raw materials derived from plants and other bio-based sources, which can be used to produce isostearic acid. This transition is driven by both environmental concerns and the need for energy-efficient production processes. Additionally, the growing availability of bio-based feedstocks provides a stable and sustainable supply of raw materials, further bolstering market growth. As the availability of renewable resources increases, it enables the large-scale production of isostearic acid, making it a more accessible and affordable option for a variety of applications.

Restraint:

-

High Production Costs of Isostearic Acid from Bio-Based Feedstocks Impact Market Adoption

Despite the growing demand for bio-based isostearic acid, the high production costs associated with its synthesis from renewable feedstocks remain a significant restraint. Bio-based isostearic acid is generally more expensive to produce than its petroleum-derived counterparts due to the cost of raw materials and the complex production processes involved. While there are advancements in production technologies to reduce these costs, they are still relatively high compared to traditional chemical alternatives. This price differential may hinder the widespread adoption of isostearic acid, particularly in price-sensitive industries or regions where cost efficiency is a primary concern. Manufacturers must find ways to balance sustainability with cost-effectiveness to overcome this barrier.

Opportunity:

-

Rising Demand for Clean Label Products Offers Growth Opportunities for Isostearic Acid in Food and Cosmetics

-

Expansion of Isostearic Acid Applications in Emerging Markets Provides New Growth Avenues

Challenge:

-

Growing Focus on Green Chemistry in Industrial Manufacturing Drives Demand for Sustainable Chemicals

| Regulation/Certification | Description | Impact on the Isostearic Acid Market |

|---|---|---|

| REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) | European Union regulation aimed at improving the protection of human health and the environment from chemical risks. | Requires Isostearic Acid producers to register chemicals, assess safety, and comply with regulations. |

| FDA (Food and Drug Administration) | U.S. regulatory body overseeing the safety of food additives, cosmetics, and pharmaceuticals. | Governs the approval of Isostearic Acid for use in food, cosmetics, and personal care products in the U.S. |

| ISO 9001 (Quality Management Systems) | The international standard for quality management in manufacturing processes. | Manufacturers of Isostearic Acid must meet ISO standards to ensure product consistency and quality. |

| COSMOS (COSMetic Organic Standard) | Certification for organic and natural cosmetic products in Europe. | Certification ensures that Isostearic Acid used in cosmetics meets organic and natural product standards. |

| California Proposition 65 | California law requires businesses to warn consumers about chemicals that may cause cancer or reproductive harm. | Isostearic Acid producers may need to disclose if the product contains any chemicals listed under this law. |

Key Market Segments

By Grade

In 2023, the Cosmetic Grade segment dominated the Isostearic Acid market with a market share of around 45%. The demand for cosmetic-grade isostearic acid is driven by its widespread use in the formulation of personal care products such as skin creams, lotions, and makeup. Its role as an emulsifier, stabilizer, and conditioning agent makes it a preferred ingredient in the cosmetics industry. This segment’s dominance is further supported by the growing consumer preference for eco-friendly, natural, and sustainable beauty products, positioning cosmetic-grade isostearic acid as a key component in these formulations.

By Application

In 2023, the Cosmetics segment dominated and held the largest market share in the application category, with a share of 38%. This is due to the increasing demand for natural and sustainable ingredients in personal care products, where isostearic acid serves as a key component in formulations for moisturizers, sunscreens, and lip balms. The rise in clean beauty trends, along with growing consumer preference for eco-conscious products, has significantly boosted the adoption of isostearic acid in cosmetics. Additionally, isostearic acid’s ability to improve the texture and stability of formulations makes it highly sought after in this sector.

By End Use Industry

In 2023, the Cosmetics and Personal Care industry dominated the Isostearic Acid market with a share of 40%. The growth in this segment is driven by the increasing consumer demand for clean and sustainable beauty products. Isostearic acid is valued for its natural origin and versatility, being used in a variety of skincare and beauty products such as creams, lotions, and hair care items. Major cosmetic brands are incorporating isostearic acid into their formulations due to its non-toxic, biodegradable, and eco-friendly properties, which cater to the rising trend of sustainable and green chemistry in the beauty industry.

Regional Analysis

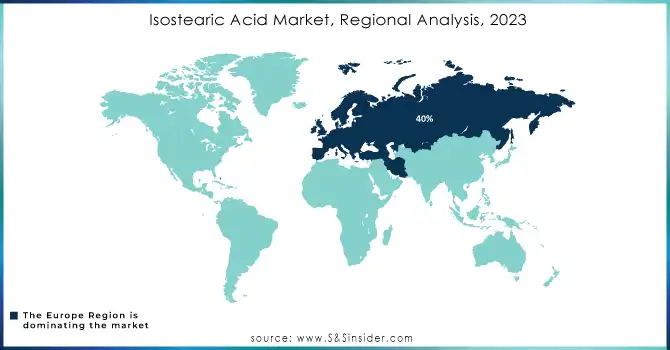

In 2023, Europe dominated the Isostearic Acid market, holding a substantial market share of approximately 40%. The dominance of this region can be attributed to the increasing demand for high-quality cosmetic and personal care products, which heavily rely on ingredients like isostearic acid for their emulsifying and stabilizing properties. The European Union has been at the forefront of adopting strict environmental regulations, encouraging the use of biodegradable and eco-friendly ingredients in formulations. Countries like Germany and France are major consumers of isostearic acid, as cosmetic companies in these regions focus on clean beauty trends and sustainable ingredients. For example, Germany, with its strong presence of cosmetics and personal care giants like Beiersdorf (owner of Nivea), is witnessing a growing adoption of natural ingredients like isostearic acid in skin and hair care products. Furthermore, Europe’s robust automotive industry also contributes to the demand for isostearic acid in lubricants and grease applications, further solidifying the region’s dominance.

Moreover, in 2023, the Asia-Pacific region emerged as the fastest-growing market for Isostearic Acid, with a CAGR of 8%. The rapid growth in this region can be attributed to the booming cosmetics and personal care industries in countries such as China, India, and South Korea, which are adopting more sustainable and bio-based ingredients in their product formulations. China, the largest market in the region, has seen a surge in demand for natural skincare products due to the rising awareness of environmental impact and consumer preference for clean beauty. In India, the growing middle-class population and increasing disposable income are driving demand for cosmetics and personal care products, pushing up the need for ingredients like isostearic acid. Moreover, South Korea’s innovation in beauty and skincare products has led to higher usage of eco-friendly ingredients, creating an increased demand for isostearic acid. The region's rapid industrialization, expanding consumer base, and rising preference for sustainable solutions position Asia-Pacific as the fastest-growing market for isostearic acid in 2023.

Do You Need any Customization Research on Isostearic Acid Market - Inquire Now

Recent Developments

December 2023: Oleon expanded its production capacity by doubling its Isostearic Acid and Dimer production unit. This expansion is part of the company’s strategy to meet the growing demand for sustainable bio-based ingredients across industries such as cosmetics, personal care, and lubricants.

Key Players

-

BASF SE - (Emery isostearic acid, Emersol 1220, Emersol 1210)

-

Eastman Chemical Company - (Eastman Isostearic Acid, Eastman LQ Series)

-

Emery Oleochemicals - (Emersol 1120, Emersol 1220)

-

Oleon (A subsidiary of the Avril Group) - (Oleon isostearic acid, Emersol 1100 series)

-

The Chemical Company - (Isostearic acid)

-

Kraton Polymers - (Kraton G1640, Kraton G1700)

-

Lanxess AG - (Lewatit, Noveon)

-

Murray Enterprises - (Murray's isostearic acid, Murray series chemicals)

-

Shandong Huijin Chemical Co., Ltd. - (Isostearic acid)

-

Vantage Specialty Chemicals - (Vantage isostearic acid, Ester of Isostearic acid)

-

Adani Wilmar - (Wilmar isostearic acid, Adani bioderived chemicals)

-

AkzoNobel - (AkzoNobel isostearic acid, Akzo fatty acid derivatives)

-

ArcelorMittal - (ArcelorMittal industrial oils, ArcelorMittal fatty acids)

-

Evonik Industries - (Evonik isostearic acid, Evonik chemical intermediates)

-

Fushun Tianfu Chemicals - (Isostearic acid)

-

Global Bio-Chem Technology Group - (Isostearic acid)

-

Huntsman Corporation - (Huntsman isostearic acid, Huntsman specialty chemicals)

-

KLK OLEO - (KLK OLEO isostearic acid, KLK oleochemical products)

-

Stepan Company - (Stepan isostearic acid)

-

Wilmar International - (Wilmar isostearic acid, Wilmar fatty acid products)

-

Research and Development (R&D) Organizations:

-

Fraunhofer UMSICHT

-

National Renewable Energy Laboratory (NREL)

-

Indian Institute of Chemical Technology (IICT)

-

-

Renewable Chemical Companies:

-

Corbion

-

Neste Corporation

-

Green Biologics

-

-

Contract Manufacturers:

-

Lonza Group

-

WuXi AppTec

-

BASF Contract Manufacturing

-

-

Distributors and Wholesalers:

-

Reed Manufacturing

-

TCI Chemicals

-

Sigma-Aldrich

-

-

Raw Material Providers:

-

Cargill

-

ADM (Archer Daniels Midland)

-

IOI Oleochemical

-

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 524.5 Million |

| Market Size by 2032 | US$ 846.8 Million |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Pharmaceutical Grade, Cosmetic Grade, Others) •By Application (Detergents, Lubricants and Grease, Chemical Esters, Cosmetics, Food Additive, Pigment Enhancer, Others) •By End Use Industry (Cosmetics and Personal Care, Automotive, Food & Beverages, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kraton Polymers, Eastman Chemical Company, BASF SE, Oleon (A subsidiary of the Avril Group), The Chemical Company, Emery Oleochemicals, Murray Enterprises, Lanxess AG, Shandong Huijin Chemical Co., Ltd., Vantage Specialty Chemicals and other key players |

| Key Drivers | • Rising Consumer Preference for Sustainable and Bio-Based Products Fuels the Demand for Isostearic Acid •Expanding Applications of Isostearic Acid in Cosmetics, Pharmaceuticals, and Industrial Sectors Drives Market Growth |

| Restraints | • High Production Costs of Isostearic Acid from Bio-Based Feedstocks Impact Market Adoption |