Get E-PDF Sample Report on Isoparaffin Solvents Market - Request Sample Report

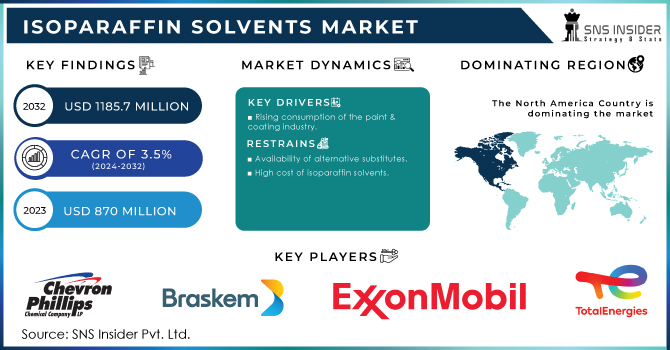

The Isoparaffin Solvents Market Size was USD 870 Million in 2023 and is expected to Reach USD 1185.7 Million by 2032 and grow at a CAGR of 3.5% over the forecast period of 2024-2032.

Demand for isoparaffin solvents has increased in the cleaning and industrial sectors as they provide excellent solvency along with low odor, and compatibility with different cleaning agents. Solvents are also powerful when it comes to dissolving and removing the most difficult residues, which is why they are used in a variety of industrial cleaning agents, degreasers, and even household cleaning products. Industrial specialists seeking solutions that will be effective against certain contaminants or on certain surfaces without leaving any residues or compromising the material integrity are on the rise. Isoparaffin solvents fulfill these needs by striking a good balance between effectiveness and safety (low toxicity and low volatility less air quality).

Furthermore, the shift to more specialized and function-specific cleaning solutions has increased the need for solvents to be both cleansers while also meeting high safety and regulatory requirements. With the growing number of sectors like manufacturing, automotive, and electronics requiring stringent cleanliness, it will further increase the need for isoparaffin-based cleaning applications. The versatility and adaptability of cleaning applications reflect that isoparaffin solvents are playing an increasing role in addressing the changing needs of commercial and consumer markets.

According to the U.S. Environmental Protection Agency (EPA), industrial cleaning and maintenance sectors account for approximately 40% of solvent usage in the United States, reflecting the high demand for effective and safe solvents in these industries. This significant share highlights the need for efficient solvents like isoparaffins, which are valued for their low toxicity and regulatory compliance, supporting their widespread use in industrial and household cleaning products.

Isoparaffin Solvents market demand is increasing in the personal care and cosmetics market owing to their safety profile, low odor, and low skin irritation potential. They are also solvents in many deodorants, skincare, and makeup products, as they fit into the product as carriers of active ingredients while being non-irritating and non-sensitizing. Over the past couple of years, consumer preferences have decisively changed in the direction of products made with non-toxic, hypoallergenic materials even more so in personal care, where skin sensitivity and product safety can be more prominent concerns. Isoparaffins also conform to this requirement because they are neutral on the skin, have no strong scent, and are safe for all delicate applications.

According to the U.S. Food and Drug Administration (FDA), the global cosmetics and personal care industry, which includes a significant proportion of skincare and makeup products, is estimated to be worth over USD 100 billion annually in the U.S. alone. This robust market size underlines the increased demand for safer and skin-friendly ingredients, such as isoparaffin solvents, as consumer expectations for non-toxic and hypoallergenic personal care formulations continue to grow in alignment with FDA safety standards.

Drivers

Rising consumption of the paint & coating industry

Consumption of paints and coatings products is on the rise owing to the growth in construction, automotive, and industrial applications. With global urbanization and infrastructure development on the rise, especially within emerging natural markets, that has resulted in huge demand for paints and coatings that provide protection, an aesthetically pleasing appearance, and other functional properties. For example, in the construction sector, coatings serve both decorative and protective purposes, preventing surfaces from being adversely affected by moisture, UV exposure, and corrosion. Likewise, high-performance coatings for vehicle durability and aesthetics are a significant segment in the automotive industry, and coatings for extreme operating conditions are an essential commodity in the industrial sector. In addition to this, an increasing demand for novel items like eco-friendly and VOC-compliant coatings can urge manufacturers to shift to more advanced forms. Moreover, industry has responded with innovation and a broader range of sustainable coatings due to government regulations encouraging environmental compliance fuelling consumption. Combined, these aspects highlight the increasing role of paints & coatings across several industries, which continue to support the growth of this market.

According to data from the U.S. Bureau of Economic Analysis, the construction sector in the United States contributed approximately USD 1.8 trillion to the GDP in 2022, reflecting the robust demand for building materials, including paints and coatings. Furthermore, the global automotive industry is projected by the International Organization of Motor Vehicle Manufacturers (OICA) to produce over 92 million vehicles annually by 2025, further driving demand for high-performance coatings.

Restraint

Availability of alternative substitutes.

High cost of isoparaffin solvents.

Isoparaffin solvents are made from petroleum-derived naphtha, which is costly. Furthermore, the production procedure for these solvents is expensive, which raises the overall price of the end product. Furthermore, harmful gases and pollutants emitted during the chemical reaction of raw materials pose serious health and environmental risks.

Substitutes such as paraffin are commonly available and simple to manufacture, and raw materials acquisition is similarly simple. As a result, they have a reduced-price range. In addition, some minor personal care businesses are ramping up output. Because these businesses cannot afford pricey raw materials, they use more isoparaffin solvents.

By Application

The paints & coatings segment held the largest market share of around 43% in 2023. Due to its functionality and aesthetics enhancement role to the surfaces, paints and coatings fire the largest market share all across the industries. The painting and coating industry is a major end-user industry in the construction industry as paints and coatings protect buildings and other infrastructures against environmental damage, including corrosion, ultraviolet (UV) exposure, and moisture, thus increasing the lifespan of materials and structures. The same is true in the automotive sector, where coatings are used for appearances, wear, chemicals, and extreme weather. Moreover, special coatings that provide heat resistant, anti-microbial, and anti-slip properties are extensively used in the industrial sector, especially in manufacturing and food processing & healthcare-related settings.

North America held the largest market share around 44% in 2023. North America owing to a synergistic mix of developed structure, high demand from end-use industries and positive regulatory support for quality and sustainability. Due to the commercial and residential construction activity within the region, specifically in Central and South Florida, a significant volume of heavy-duty, high-performance coatings are required to protect the structures from weather and environmental degradation. North America includes a sizable automotive sector, with U.S. and Canadian automotive manufacturers utilizing advanced coatings to enhance vehicle durability, appearance, and performance.

North America is also home to a variety of manufacturing sectors which require coatings capable of meeting known performance and safety specifications, such as aerospace and electronics. Innovation in this region is supported by regulatory frameworks such as those from the U.S. Environmental Protection Agency (EPA), as well as Canada’s Environmental Protection Act which call for low or zero-VOCs and environmentally safe formulations. This emphasis on sustainability resonates with consumers who are increasingly looking for greener options and also provides a competitive leg up to North America. All in all, the combination of factors, from industry demand to regulatory backing and consumer trends, strengthens the attractiveness of North America as a robust market for paints & coatings.

Get Customized Report as per your Business Requirement - Request For Customized Report

Chevron Phillips Chemical Company (Soltrol 130, Soltrol 145)

Braskem S.A. (IsoSolve, IsoPura)

Exxon Mobil Corporation (Isopar M, Isopar G)

TotalEnergies SE (Total Isane IP 140, Total Isane IP 160)

Idemitsu Kosan Co. Ltd (Isoparaffin H, Isoparaffin L)

Royal Dutch Shell plc (ShellSol D60, ShellSol T)

INEOS (Isopar E, Isopar K)

Luan Group (LuanSol IP, LuanSol MS)

RB Products (Isopar RC, Isopar HC)

Mehta Petro Refineries Ltd (Mehtol IP, Mehtol MC)

Neste Oyj (Neste Renewable Isoparaffins, Neste MY)

SK Global Chemical Co., Ltd. (SK Solvent S, SK Solvent L)

Dow Chemical Company (Dowanol DPnB, Dowanol PnP)

HCS Group (Haltermann Carless) (HCS Isopar N, HCS Isopar M)

DHC Solvent Chemie GmbH (DHC Isopar H, DHC Isopar L)

Petrochem Carless Ltd (Petrosol H, Petrosol M)

LyondellBasell Industries (Lyondell Isopar L, Lyondell Isopar V)

Sasol Limited (Sasol Solvents P, Sasol Solvents M)

Calumet Specialty Products Partners, L.P. (Calumet Penreco, Calumet Hydrocal)

Cepsa Química (Cepsa EcoSolv IP, Cepsa SolvFlex)

Key User

Procter & Gamble

BASF

Henkel

Sherwin-Williams

Kao Corporation

AkzoNobel

ExxonMobil

In 2023, ExxonMobil launched a new line of Isopar M products with improved environmental compliance and performance for use in coatings and cleaning products. The new formulations meet stricter low-VOC (volatile organic compound) standards, catering to increasing consumer and regulatory demand for eco-friendly products.

In 2022, Chevron Phillips announced the expansion of its Soltrol isoparaffin solvents production capacity to meet rising demand from the automotive and industrial cleaning sectors. The expansion was driven by the increasing adoption of isoparaffins in high-performance coatings and degreasers due to their superior solvency properties.

In 2022, TotalEnergies introduced its Isane series of isoparaffin solvents, specifically targeting industries like paints and coatings. These solvents are designed for high solvency and low odor, ensuring better environmental compliance and improved safety profiles for users in industrial applications.

| Report Attributes | Details |

| Market Size in 2023 | US$ 870 Million |

| Market Size by 2032 | US$ 1185.7 Million |

| CAGR | CAGR of 3.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Metalworking, Paints & Coatings, Agrochemicals, Cleaning, Pharmaceuticals and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Chevron Phillips Chemical Company, Braskem S.A., Exxon Mobil Corporation, TotalEnergies SE, Idemitsu Kosan Co. Ltd, Royal Dutch Shell plc., INEOS, Luan Group, RB Products, Mehta Petro Refineries Ltd |

| Key Drivers | • Rising consumption of the paint & coating industry |

| Market Opportunity | • Rising applications of solvent in end-user |

Ans. USD 1185.7 million is the projected Isoparaffin Solvents Market size of the market by 2032.

Ans. The CAGR of the Isoparaffin Solvents Market over the forecast period is 3.5%.

Ans. USD 870 million is the projected value in 2023 for the Isoparaffin Solvents Market.

Ans. North America is the fastest-growing region of the Isoparaffin Solvents Market.

Ans. The availability of alternative substitutes and the high cost of isoparaffin solvents are the challenges to market growth.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Isoparaffin Solvents Market Segmentation, By Application

7.2 Metalworking

7.2.1 Metalworking Market Trends Analysis (2020-2032)

7.2.2 Metalworking Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Paints & Coatings

7.3.1 Paints & Coatings Market Trends Analysis (2020-2032)

7.3.2 Paints & Coatings Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Agrochemicals

7.4.1 Agrochemicals Market Trends Analysis (2020-2032)

7.4.2 Agrochemicals Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Cleaning

7.5.1 Cleaning Market Trends Analysis (2020-2032)

7.5.2 Cleaning Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Pharmaceuticals

7.6.1 Pharmaceuticals Market Trends Analysis (2020-2032)

7.6.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

7.7 Other

7.7.1 Other Market Trends Analysis (2020-2032)

7.7.2 Other Market Size Estimates and Forecasts to 2032 (USD Million)

8. Regional Analysis

8.1 Chapter Overview

8.2 North America

8.2.1 Trends Analysis

8.2.2 North America Isoparaffin Solvents Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.2.3 North America Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.2 USA

8.2.2.1 USA Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.3 Canada

8.2.3.1 Canada Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.4 Mexico

8.2.4.1 Mexico Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3 Europe

8.3.1 Eastern Europe

8.3.1.1 Trends Analysis

8.3.1.2 Eastern Europe Isoparaffin Solvents Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.3.1.3 Eastern Europe Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.4 Poland

8.3.1.4.1 Poland Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.5 Romania

8.3.1.5.1 Romania Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.6 Hungary

10.3.1.8.1 Hungary Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.7 Turkey

8.3.1.7.1 Turkey Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.8 Rest of Eastern Europe

8.3.1.8.1 Rest of Eastern Europe Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2 Western Europe

8.3.2.1 Trends Analysis

8.3.2.2 Western Europe Isoparaffin Solvents Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.3.2.3 Western Europe Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.4 Germany

8.3.2.4.1 Germany Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.5 France

8.3.2.5.1 France Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.6 UK

8.3.2.6.1 UK Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.7 Italy

8.3.2.7.1 Italy Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.8 Spain

8.3.2.8.1 Spain Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.9 Netherlands

8.3.2.9.1 Netherlands Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.10 Switzerland

8.3.2.10.1 Switzerland Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.11 Austria

8.3.2.11.1 Austria Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.12 Rest of Western Europe

8.3.2.12.1 Rest of Western Europe Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4 Asia-Pacific

8.4.1 Trends Analysis

8.4.2 Asia-Pacific Isoparaffin Solvents Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.4.3 Asia-Pacific Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.4 China

8.4.4.1 China Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.5 India

8.4.5.1 India Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.6 Japan

8.4.6.1 Japan Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.7 South Korea

8.4.7.1 South Korea Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.8 Vietnam

8.4.8.1 Vietnam Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.9 Singapore

8.4.9.1 Singapore Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.10 Australia

8.4.10.1 Australia Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.11 Rest of Asia-Pacific

8.4.11.1 Rest of Asia-Pacific Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5 Middle East and Africa

8.5.1 Middle East

8.5.1.1 Trends Analysis

8.5.1.2 Middle East Isoparaffin Solvents Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.4 UAE

8.5.1.4.1 UAE Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.5 Egypt

8.5.1.5.1 Egypt Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.6 Saudi Arabia

8.5.1.6.1 Saudi Arabia Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.7 Qatar

8.5.1.7.1 Qatar Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.8 Rest of Middle East

8.5.1.8.1 Rest of Middle East Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2 Africa

8.5.2.1 Trends Analysis

8.5.2.2 Africa Isoparaffin Solvents Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.5.2.3 Africa Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.4 South Africa

8.5.2.4.1 South Africa Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.5 Nigeria

8.5.2.5.1 Nigeria Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.6 Rest of Africa

8.5.2.6.1 Rest of Africa Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6 Latin America

8.6.1 Trends Analysis

8.6.2 Latin America Isoparaffin Solvents Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.6.3 Latin America Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.4 Brazil

8.6.4.1 Brazil Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.5 Argentina

8.6.5.1 Argentina Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.6 Colombia

8.6.6.1 Colombia Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.7 Rest of Latin America

8.6.7.1 Rest of Latin America Isoparaffin Solvents Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9. Company Profiles

9.1 Chevron Phillips Chemical Company

9.1.1 Company Overview

9.1.2 Financial

9.1.3 Products/ Services Offered

9.1.4 SWOT Analysis

9.2 Braskem S.A.

9.2.1 Company Overview

9.2.2 Financial

9.2.3 Products/ Services Offered

9.2.4 SWOT Analysis

9.3 Exxon Mobil Corporation

9.3.1 Company Overview

9.3.2 Financial

9.3.3 Products/ Services Offered

9.3.4 SWOT Analysis

9.4 TotalEnergies SE

9.4.1 Company Overview

9.4.2 Financial

9.4.3 Products/ Services Offered

9.4.4 SWOT Analysis

9.5 Idemitsu Kosan Co. Ltd

9.5.1 Company Overview

9.5.2 Financial

9.5.3 Products/ Services Offered

9.5.4 SWOT Analysis

9.6 Royal Dutch Shell plc.

9.6.1 Company Overview

9.6.2 Financial

9.6.3 Products/ Services Offered

9.6.4 SWOT Analysis

9.7 Luan Group

9.7.1 Company Overview

9.7.2 Financial

9.7.3 Products/ Services Offered

9.7.4 SWOT Analysis

9.8 RB Products

9.8.1 Company Overview

9.8.2 Financial

9.8.3 Products/ Services Offered

9.8.4 SWOT Analysis

9.9 INEOS

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Products/ Services Offered

9.9.4 SWOT Analysis

9.10 Mehta Petro Refineries Ltd

9.10.1 Company Overview

9.10.2 Financial

9.10.3 Products/ Services Offered

9.10.4 SWOT Analysis

10. Use Cases and Best Practices

11. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Application

Metalworking

Paints & Coatings

Agrochemicals

Cleaning

Pharmaceuticals

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Aroma Chemicals Market Size was valued at USD 5.59 Billion in 2023 and is expected to reach USD 8.66 Billion by 2032, growing at a CAGR of 4.99% over the forecast period of 2024-2032.

The Bio-Polyamide Market Size was valued at USD 224.3 million in 2023 and will reach USD 925.2 million by 2032 and grow at a CAGR of 17.1% by 2024-2032.

Copper Mining Market size was valued at USD 8.9 billion in 2023 and is expected to reach USD 12.1 billion by 2032, growing at a CAGR of 3.5% from 2024-2032.

The Marine Lubricants Market Size was valued at USD 6.5 Billion in 2023 and is expected to reach USD 7.8 Billion by 2032 and grow at a CAGR of 2.07% over the forecast period 2024-2032.

The high-performance plastics market size was valued at USD 27.75 billion in 2023 and is expected to reach USD 61.72 billion by 2032, growing at a CAGR of 9.29% over the forecast period of 2024-2032

Artificial Turf Market was valued at USD 4.02 billion in 2023 and is expected to reach USD 7.09 billion by 2032, growing at a CAGR of 6.72% from 2024-2032.

Hi! Click one of our member below to chat on Phone