Get More Information on Isoamyl Acetate Market - Request Sample Report

The Isoamyl Acetate Market size was valued at USD 366.8 Million in 2023. It is expected to grow to USD 605.05 Million by 2032 and grow at a CAGR of 5.7% over the forecast period of 2024-2032.

An increase in demand for eco-friendly paint & coating solvents such as isoamyl acetate across industrial applications such as paints, coatings & varnish is projected for market growth. With the increasing environmental regulations for industries and the demand to minimize hazardous chemicals, isoamyl acetate is a strong candidate to replace commonly used solvents such as acetone, toluene, and xylene. This change is in sync with the global trend towards environmentally sustainable and green chemicals as a result of regulatory demands and increasing consumer awareness and preferences.

Furthermore, it is increasingly being used in adhesives, inks, and cleaning agents, which is expected to open new avenues of demand for industrial applications. They overdrive spending on green solutions to comply with regulatory requirements and sustainability targets, which reveals an important market opportunity for isoamyl acetate.

The European Chemicals Agency also reported that global demand for bio-based and green solvents is growing between 6-7% a year, with more attention being paid to sustainable solvents and green chemicals. Programs such as the U.S. Safer Choice Program administered by the EPA support manufacturers who use safer solvents and other chemicals, while governments across Europe and the U.S. are encouraging such decisions.

The printing industry has been witnessing a significant surge in demand for high-quality prints in sectors such as packaging and labeling, driving the market growth for isoamyl acetate. It is widely used in printing inks as a solvent due to its good solubility and quick-drying nature. Consequently, making it one of the most vital components in manufacturing intense, clear, and lasting prints as per rising needs from different industries like food & beverage; consumer goods, and pharmaceuticals. Higher demand for quality printing solutions owing to the increasing focus on packaging designs and product differentiation. In addition to this, growing ecological regulations are driving the printing industry toward less toxic and environmentally friendly solvents isoamyl acetate additionally bolstering its acceptance.

Packaging shipments from the U.S. packaging industry reached an estimated USD 180 billion in 2022 according to the U.S. Census Bureau, signaling mounting demand for premium packaging solutions. These trends are directly impacting the printing ink industry, which is also an important sector for packaging materials that require solvent-type isoamyl acetate to achieve high-resolution printing.

Drivers

Increasing demand in the flavor and fragrance industry drives the market growth.

The increasing demand in the flavor and fragrance industry is a major driver of the isoamyl acetate market, fueled by rising consumer preferences for natural and pleasant-smelling products. Isoamyl acetate is an important component in producing synthetic flavors and fragrances for food and beverages because of its typical banana-like fruity note. Strong growth in the global flavor and fragrance market as applications proliferate in food and drink, cosmetics, and personal care. The International Fragrance Association notes that the global fragrance market generated more than USD25.2 billion in 2022 and continues to grow, spurred over the years by rising demand globally for middle and high-end fragrance products in particular across regions such as Asia-Pacific and Latin America. Isoamyl acetate is also approved as safe by the U.S. Food and Drug Administration (FDA), contributing to its use in flavored foods and drinks such as candy, confectionery, and flavored beverages.

The growth of the market for these synthetic flavoring agents has been driven by consumers leaning towards consuming more natural flavors as well as exotic flavors. Regulations by the European Food Safety Authority (EFSA) in Europe also supported isoamyl acetate, which is anticipated to drive demand for food flavoring applications. Such rising demand is consequently sparking growth opportunities for the isoamyl acetate market.

Restraint

Fluctuating in the raw material prices may hamper the market growth.

Common fluctuation in the prices of raw materials is a major hamper for the isoamyl acetate market thus affects production and profitability. The production of Isoamyl acetate involves the utilization of raw materials namely isoamyl alcohol and acetic acid, having a price-sensitive nature subjected to global supply-demand dynamics, geopolitical factors as well as crude oil price fluctuations. A major feedstock is isoamyl alcohol, which originates from petroleum-based sources and its price responds strongly to global oil markets. Changes in crude oil prices such as those observed in the past couple of years due to global trade tensions, blockages, and OPEC policies directly affect petroleum derivatives prices with isoamyl alcohol making no exception. The same methanol chain is the basis for acetic acid as well, and fluctuations in price due to supply constraints only add to these uncertainties in producer costs.

Opportunity

Growing Demand for Natural and Organic Products

Innovations in the Food and Beverage Sector

By Application

Food and Beverage held the largest market share around 40% in 2023. Isoamyl acetate has the highest market share in Food and Beverage owing to its wide application as a flavoring agent. This compound is preferred due to its unique fruit flavor, particularly banana-like aroma which makes this ingredient suitable for many food products such as confections, biscuits, and beverages. The manufacturers are gradually using isoamyl acetate in the formulation of end products due to increasing consumer need for good aesthetic pleasantness such as natural flavors. Based on statistics from the U.S. Department of Agriculture (USDA), the market size is predicted to expand to a total of around USD 1.5 trillion by 2025, boosted by trends including premiumization and health awareness for Americans, even if they are delivered outside of United States borders. In a competitive landscape where companies are always looking to differentiate their products, the versatility and sensory attributes of isoamyl acetate continue to drive significant use in this sector.

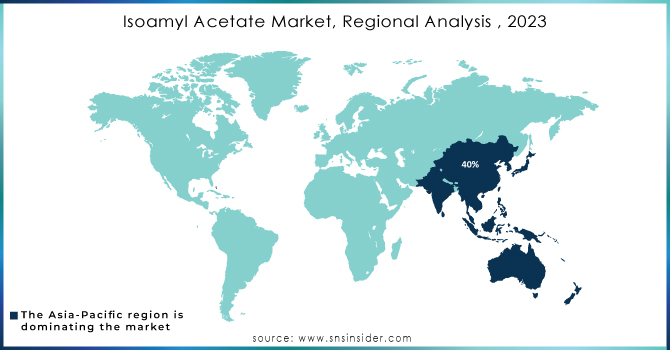

Asia-Pacific region held the largest market share around 40% in 2023. This is owing to rapid industrialization, the growth of the food and beverage industry, and rising consumer preference for flavored products. This is spurred by the economic boom in the likes of China, India, and Japan with the rise of disposable income and a new appetite to taste premium and innovative food. Moreover, the rapidly growing cosmetics and personal care industry in the region owing to the youthful population and rising urbanization is likely to propel demand for isoamyl acetate as a fragrance and flavoring agent during the forecast period. International flavor trends have been adopted and the focus on quality products is considerable as well. Regulatory support from governments in the form of legislation permitting the usage of food-grade additives & flavoring agents to use in food products serves as a positive gap filler towards market trends for the biomass isoamyl acetate development which will lead to upscaled consumption demand for execution. Thus, robust economic growth along with changing consumer behavior and economy-friendly regulations would consolidate the Asia-Pacific isoamyl acetate market over the forecast timeframe. Furthermore, the companies focused on the expansion in the isoamyl acetate market for instance, in 2023, BASF announced the expansion of its production capacity for isoamyl acetate at its manufacturing facility in Nanjing, China. This expansion aims to meet the increasing demand for flavoring agents and solvents in the food and beverage, cosmetics, and personal care industries. The company emphasized its commitment to sustainable practices and high-quality production standards.

Need any customization research on Isoamyl Acetate Market - Enquiry Now

Key Players

Key Manufacturers

LGC Limited

Thermo Fisher Scientific

BASF SE

Dow

Finetech Industry Limited

Ernesto Ventós, S.A.

Kraton Corporation

SABIC

Eastman Chemical Company

Cargill, Inc.

Mitsubishi Chemical Corporation

Nippon Shokubai Co., Ltd.

Aroma Chemicals

Jungbunzlauer

Axyntis

Takasago International Corporation

Givaudan

Fujifilm Diosynth Biotechnologies

Key Users

Coca-Cola Company

PepsiCo, Inc.

Nestlé S.A.

Procter & Gamble Co.

Unilever

L'Oréal S.A.

Estée Lauder Companies Inc.

Mondelez International, Inc.

Kraft Heinz Company

Reckitt Benckiser Group plc

Colgate-Palmolive Company

In 2023, BASF announced an increase in production capacity for isoamyl acetate at its Nanjing facility in China, responding to the growing demand from the food and beverage industry.

In 2023, Merck KGaA made a strategic move to expand its product portfolio by introducing food-grade isoamyl acetate, specifically designed to cater to the increasing demands of the flavor and fragrance market. This development is a response to the rising consumer preference for natural and high-quality flavoring agents in food and beverage applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 366.8 Million |

| Market Size by 2032 | US$ 605.05 Million |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Food and Beverage, Cosmetics, Textile, Pharmaceuticals, Other End-user Industries) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Merck KGaA, LGC Limited, Thermo Fisher Scientific, Chemoxy International Ltd., BASF SE, Dow, Finetech Industry Limited, Ernesto Ventós, S.A., Others players. |

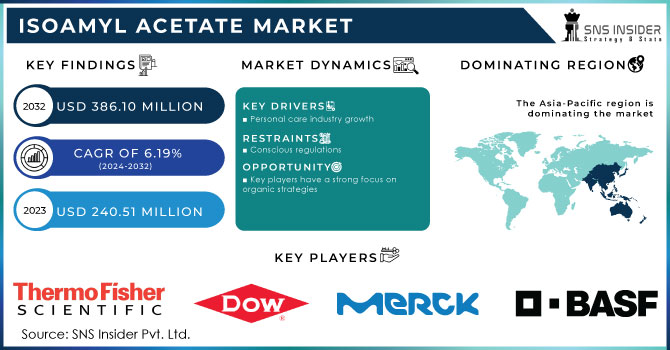

| DRIVERS | • Personal care industry growth |

| Restraints | • Conscious regulations |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Conscious regulations are the restrain faced by the Isoamyl Acetate Market.

Ans: Key players have a strong focus on organic strategies are the opportunity for Isoamyl Acetate Market.

Ans: Food and Beverage, Cosmetics, Textile, Pharmaceuticals and Other End-user Industries are the sub-segments of by application segment

Ans: Isoamyl Acetate Market Size was valued at USD 240.51 million in 2023, and expected to reach USD 386.10 million by 2032, and grow at a CAGR of 6.19 % over the forecast period 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Isoamyl Acetate Market Segmentation, By Application

Chapter Overview

7.2 Food and Beverage

7.2.1 Food and Beverage Market Trends Analysis (2020-2032)

7.2.2 Food and Beverage Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Cosmetics

7.3.1 Cosmetics Market Trends Analysis (2020-2032)

7.3.2 Cosmetics Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Textile

7.4.1 Textile Market Trends Analysis (2020-2032)

7.4.2 Textile Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Pharmaceuticals

7.5.1 Pharmaceuticals Market Trends Analysis (2020-2032)

7.5.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Regional Analysis

8.1 Chapter Overview

8.2 North America

8.2.1 Trends Analysis

8.2.2 North America Isoamyl Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.2.3 North America Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.2 USA

8.2.2.1 USA Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.3 Canada

8.2.3.1 Canada Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.4 Mexico

8.2.4.1 Mexico Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3 Europe

8.3.1 Eastern Europe

8.3.1.1 Trends Analysis

8.3.1.2 Eastern Europe Isoamyl Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.3.1.3 Eastern Europe Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.4 Poland

8.3.1.4.1 Poland Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.5 Romania

8.3.1.5.1 Romania Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.6 Hungary

10.3.1.8.1 Hungary Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.7 Turkey

8.3.1.7.1 Turkey Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.8 Rest of Eastern Europe

8.3.1.8.1 Rest of Eastern Europe Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2 Western Europe

8.3.2.1 Trends Analysis

8.3.2.2 Western Europe Isoamyl Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.3.2.3 Western Europe Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.4 Germany

8.3.2.4.1 Germany Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.5 France

8.3.2.5.1 France Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.6 UK

8.3.2.6.1 UK Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.7 Italy

8.3.2.7.1 Italy Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.8 Spain

8.3.2.8.1 Spain Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.9 Netherlands

8.3.2.9.1 Netherlands Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.10 Switzerland

8.3.2.10.1 Switzerland Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.11 Austria

8.3.2.11.1 Austria Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.12 Rest of Western Europe

8.3.2.12.1 Rest of Western Europe Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4 Asia-Pacific

8.4.1 Trends Analysis

8.4.2 Asia-Pacific Isoamyl Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.4.3 Asia-Pacific Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.4 China

8.4.4.1 China Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.5 India

8.4.5.1 India Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.6 Japan

8.4.6.1 Japan Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.7 South Korea

8.4.7.1 South Korea Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.8 Vietnam

8.4.8.1 Vietnam Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.9 Singapore

8.4.9.1 Singapore Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.10 Australia

8.4.10.1 Australia Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.11 Rest of Asia-Pacific

8.4.11.1 Rest of Asia-Pacific Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5 Middle East and Africa

8.5.1 Middle East

8.5.1.1 Trends Analysis

8.5.1.2 Middle East Isoamyl Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.4 UAE

8.5.1.4.1 UAE Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.5 Egypt

8.5.1.5.1 Egypt Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.6 Saudi Arabia

8.5.1.6.1 Saudi Arabia Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.7 Qatar

8.5.1.7.1 Qatar Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.8 Rest of Middle East

8.5.1.8.1 Rest of Middle East Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2 Africa

8.5.2.1 Trends Analysis

8.5.2.2 Africa Isoamyl Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.5.2.3 Africa Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.4 South Africa

8.5.2.4.1 South Africa Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.5 Nigeria

8.5.2.5.1 Nigeria Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.6 Rest of Africa

8.5.2.6.1 Rest of Africa Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6 Latin America

8.6.1 Trends Analysis

8.6.2 Latin America Isoamyl Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.6.3 Latin America Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.4 Brazil

8.6.4.1 Brazil Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.5 Argentina

8.6.5.1 Argentina Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.6 Colombia

8.6.6.1 Colombia Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.7 Rest of Latin America

8.6.7.1 Rest of Latin America Isoamyl Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9. Company Profiles

9.1 Merck KGaA,

9.1.1 Company Overview

9.1.2 Financial

9.1.3 Products/ Services Offered

9.1.4 SWOT Analysis

9.2 LGC Limited

9.2.1 Company Overview

9.2.2 Financial

9.2.3 Products/ Services Offered

9.2.4 SWOT Analysis

9.3 Thermo Fisher Scientific

9.3.1 Company Overview

9.3.2 Financial

9.3.3 Products/ Services Offered

9.3.4 SWOT Analysis

9.4 Chemoxy International Ltd.

9.4.1 Company Overview

9.4.2 Financial

9.4.3 Products/ Services Offered

9.4.4 SWOT Analysis

9.5 BASF SE

9.5.1 Company Overview

9.5.2 Financial

9.5.3 Products/ Services Offered

9.5.4 SWOT Analysis

9.6 Dow

9.6.1 Company Overview

9.6.2 Financial

9.6.3 Products/ Services Offered

9.6.4 SWOT Analysis

9.7 Finetech Industry Limited

9.7.1 Company Overview

9.7.2 Financial

9.7.3 Products/ Services Offered

9.7.4 SWOT Analysis

9.8 Ernesto Ventós, S.A.

9.8.1 Company Overview

9.8.2 Financial

9.8.3 Products/ Services Offered

9.8.4 SWOT Analysis

9.9 Kraton Corporation

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Products/ Services Offered

9.9.4 SWOT Analysis

9.10 Eastman Chemical Company

9.10.1 Company Overview

9.10.2 Financial

9.10.3 Products/ Services Offered

9.10.4 SWOT Analysis

10. Use Cases and Best Practices

11. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Application

Cosmetics

Textile

Pharmaceuticals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Cold Chain Monitoring Market Size was USD 5.7 Billion in 2023 and is expected to reach $22.1 Billion by 2032 and grow at a CAGR of 16.2% by 2024-2032.

The Decarbonization Market was valued at USD 1906.1 Billion in 2023 and is expected to reach USD 5644.2 Billion by 2032, growing at a CAGR of 12.84% from 2024-2032.

Rare Earth Metals Market size was valued at USD 7.66 billion in 2023 and is expected to reach USD 16.26 billion by 2032, at a CAGR of 8.75% from 2024-2032.

The 3D Printing Plastics Market Size was valued at USD 1.6 billion in 2023 and is expected to reach USD 10.0 billion by 2032 and grow at a CAGR of 22.6% over the forecast period 2024-2032.

The Biofuel Additives Market Size was valued at USD 15.05 billion in 2023 and is expected to reach USD 32.39 billion by 2032 and grow at a CAGR of 8.89% over the forecast period 2024-2032.

The Adipic Acid Market size was valued at USD 5.20 billion in 2023. It is estimated to hit USD 7.46 billion by 2032 and grow at a CAGR of 4.09% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone