To get more information on ISO Container Market - Request Sample Report

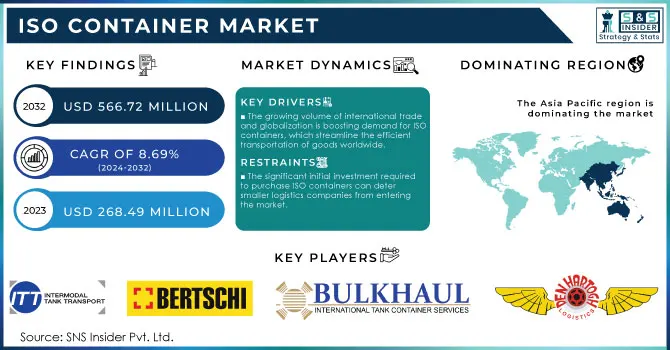

The ISO container Market size is expected to value at USD 268.49 Million in 2023 and is estimated to reach USD 566.72 Million by 2032 with a growing CAGR of 8.69% over the forecast period 2024-2032.

ISO containers are vital to the global supply chain, providing efficient transport and storage solutions across various industries. Standardized by the International Organization for Standardization (ISO), these containers typically come in two common sizes: 20 feet, with a volume of approximately 33.2 cubic meters, and 40 feet, which can hold about 67.7 cubic meters. With over 35 million ISO containers in circulation worldwide, their role in international trade logistics cannot be overstated. Constructed from robust materials like steel, ISO containers are designed to endure harsh environmental conditions and rough handling during transit. Their versatility allows them to accommodate a wide range of cargo, from perishables to hazardous materials, enabling businesses to optimize logistics operations without the need for repacking during intermodal transport. This adaptability is essential as the globalization of trade increases the demand for efficient and secure shipping solutions.

| Services | Description | Commercial Products |

|---|---|---|

| Standard ISO Containers | Intermodal containers adhering to ISO standards for international shipping and transport. | Maersk ISO Containers, Hapag-Lloyd Containers |

| Refrigerated ISO Containers | Temperature-controlled containers for transporting perishable goods. | Carrier Transicold, Daikin Reefer Containers |

| Tank ISO Containers | Containers designed for the transportation of liquids, gases, and chemicals. | Taree Global Tank Containers, TSI Tanks |

| Open Top ISO Containers | Containers with removable roofs for transporting heavy or oversized cargo. | Seaco Open Top Containers, Triton Open Top |

| Flat Rack ISO Containers | Flatbed containers used for heavy equipment and cargo that doesn’t fit in standard containers. | Textainer Flat Racks, Seaco Flat Racks |

| High Cube ISO Containers | Containers taller than standard height, offering more volume for cargo. | Maersk High Cube Containers, COSCO High Cube |

| ISO Logistics Services | Comprehensive services that include container leasing, transportation, and logistics management. | C.H. Robinson Logistics, Kuehne + Nagel Logistics |

| Container Tracking Solutions | Technologies that provide real-time tracking and monitoring of containers during transit. | ZIM Container Tracking, Maersk Remote Container |

| Custom ISO Container Solutions | Tailored containers designed to meet specific customer requirements or industry standards. | CIMC Custom Containers, Singamas Custom Solutions |

Moreover, advancements in technology are enhancing the functionality of ISO containers. A growing number are being equipped with IoT technology, with projections indicating that around 30% of all shipping containers will be smart containers by 2025. These innovations enable real-time tracking and monitoring, improving supply chain visibility and reducing the risk of cargo loss or damage. Sustainability is becoming increasingly significant in the ISO container market, as companies aim to minimize their environmental impact. This shift has sparked interest in eco-friendly materials and practices, with many exploring recyclable container options that reduce carbon emissions during production and transport. Currently, over 60% of companies involved in international shipping utilize ISO containers due to their reliability and versatility, especially in sectors like agriculture, electronics, and automotive.

DRIVERS

The surge in global trade growth and the interconnectedness of economies are significantly influencing the demand for ISO containers. As international trade expands, businesses seek efficient methods to transport goods across borders, making ISO containers essential for global logistics. These containers are standardized, durable, and versatile, allowing for seamless movement of various types of cargo, including perishables, textiles, machinery, and hazardous materials. The use of ISO containers not only enhances efficiency but also reduces shipping costs and transit times, which are critical in today’s fast-paced market.

In 2022, approximately 1.8 billion twenty-foot equivalent units (TEUs) were transported worldwide, reflecting the increasing reliance on container shipping. Over 90% of global trade by volume is carried by shipping containers, underscoring their pivotal role in the logistics industry. The rise of e-commerce further fuels the demand for ISO containers, as retailers and suppliers need reliable shipping solutions to meet consumer expectations for quick and efficient delivery. Additionally, advancements in logistics technology, such as digital tracking and automated handling systems, are improving the overall efficiency of container shipping, making it an attractive option for businesses. As trade agreements continue to evolve and new markets emerge, the demand for ISO containers is expected to grow, further solidifying their importance in global trade dynamics.

The expansion of e-commerce has fundamentally transformed the logistics and supply chain landscape, driving an unprecedented demand for efficient transportation solutions. As consumers increasingly favor online shopping, the volume of goods requiring swift and reliable delivery has surged. This shift necessitates a robust infrastructure capable of supporting the rapid movement of products from manufacturers to consumers, prominently featuring ISO containers. These standardized containers facilitate the efficient handling, storage, and transportation of goods across various modes of transport, including ships, trucks, and trains.

The adoption of e-commerce platforms has encouraged businesses to streamline their supply chains, leading to an increase in inventory turnover rates. As a result, companies are optimizing their logistics operations to ensure quicker fulfillment of customer orders. In this context, ISO containers serve as a vital tool, enabling retailers and wholesalers to efficiently manage their inventory while minimizing shipping costs and transit times. The versatility and reliability of ISO containers not only support e-commerce businesses in meeting consumer expectations for fast delivery but also enhance overall supply chain resilience. Thus, the interplay between the growth of e-commerce and the demand for ISO containers is a key driver in the logistics industry, shaping the future of global trade and transportation.

RESTRAIN

The logistics industry increasingly relies on ISO containers for efficient and standardized transportation of goods. However, one of the major barriers to entry for smaller logistics companies is the high initial costs associated with purchasing these containers. For smaller firms, this substantial investment can strain budgets, especially when coupled with other startup expenses like transportation vehicles, warehousing, and operational costs. Furthermore, the expenses extend beyond the initial purchase; companies must also consider maintenance, storage, and insurance costs, which can accumulate over time.

According to the research indicates that approximately 50% of small logistics companies struggle to manage the upfront capital required to enter the ISO container market. As a result, many opt for leasing options, which can also be financially burdensome, leading to long-term commitments without ownership benefits. The reluctance to invest in ISO containers can limit smaller firms' ability to compete with larger, established companies that have the financial flexibility to absorb such costs. This situation creates a barrier to market entry, restricting innovation and service diversification in the logistics sector. To foster a more inclusive market environment, potential solutions could include financing programs or partnerships with container suppliers, enabling smaller companies to access the necessary resources without incurring overwhelming financial pressure.

By Transport Mode

The marine transport segment dominated the market share over 38.42% in 2023. Approximately 90% of global trade by volume is carried out via shipping, making marine transport indispensable for the movement of ISO containers. The efficiency and cost-effectiveness of transporting large volumes of goods over long distances by sea bolster its prominence in international logistics. In fact, around 60% of ISO containers are utilized in maritime shipping operations.

By Capacity

The 20,000 to 35,000 liters segment dominated the market share over 44.08% in 2023. These containers are particularly beneficial for the logistics industry, facilitating the movement of perishable items like food and pharmaceuticals, as well as non-perishable goods such as industrial chemicals and agricultural products. Their design allows for easy loading and unloading, optimizing operational efficiency. Furthermore, the growing trend toward globalization and increased demand for reliable supply chains are driving the adoption of these containers. Additionally, the food and beverage sector is projected to account for around 30% of containerized trade, underscoring the critical role of ISO containers in modern logistics and supply chain management.

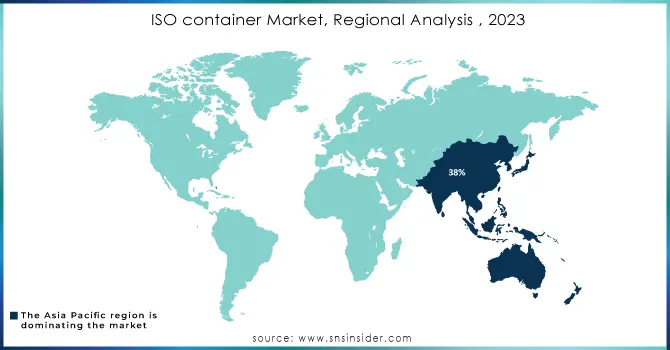

The Asia Pacific region dominated the market share over 38 % in 2023, primarily due to its strategic position as a global manufacturing hub and a key player in international trade. Countries like China, Singapore, and South Korea serve as significant container terminals, facilitating a high volume of shipping activities. The Port of Shanghai is consistently ranked as one of the busiest ports in the world, handling over 40 million TEUs (Twenty-foot Equivalent Units) annually. China's robust industrial base, characterized by rapid urbanization and economic development, drives the demand for ISO containers, which are essential for transporting goods across borders. Notably, China dominates global container production, accounting for over 80% of the total output. This impressive production capability translates to approximately 2 million containers produced each year, ensuring a steady supply to meet both domestic and international needs.

The European market for ISO containers is poised for significant growth, fueled by a resurgence in maritime trade activities across the continent. Europe boasts approximately 1,000 commercial ports, with major hubs like Rotterdam, Antwerp, and Hamburg leading the way in container throughput. Furthermore, around 70% of Europe's freight transport is conducted via maritime routes, highlighting the importance of shipping in the region’s supply chain. The container shipping sector employs nearly 600,000 individuals across various functions, from logistics to manufacturing, showcasing the industry’s contribution to job creation. In terms of sustainability, more than 50% of European shipping companies are adopting eco-friendly practices, including the use of energy-efficient ISO containers, in response to strict environmental regulations.

Do You Need any Customization Research on ISO Container Market - Inquire Now

Some of the major key players of ISO Container Market

Intermodal Tank Transport (Specialized tank containers)

Bertschi AG (Chemical tank containers)

Bulkhaul Limited (Chemical and gas tank containers)

Royal Den Hartogh Logistics (Chemical ISO tank containers)

HOYER GmbH (Liquid bulk containers)

Interflow TCS Ltd. (Gas and chemical ISO tanks)

New Port Tank (ISO tank containers)

Sinochain Logistics Co., Ltd. (ISO liquid tank containers)

Stolt-Nielsen Limited (Tank containers for bulk liquids)

CIMC (China International Marine Containers) (Standard dry cargo and tank containers)

Singamas Container Holdings Ltd. (Dry freight containers, refrigerated containers)

W&K Containers, Inc. (Dry and specialty containers)

TLS Offshore Containers International (Offshore DNV containers)

Danteco Industries BV (Tank containers for liquid chemicals)

Container Corporation of India Ltd. (CONCOR) (Freight containers)

Seaco Global Ltd. (Dry freight containers, tank containers)

UBE Industries, Ltd. (Chemical tank containers)

Trifleet Leasing (Leased tank containers)

VTG Tanktainer GmbH (Liquid chemical tank containers)

Eurotainer SA (Bulk liquid ISO tank containers)

Suppliers for Specializes in refrigerated containers, ideal for cold chain logistics and temperature-sensitive goods of ISO Container Market:

CIMC (China International Marine Containers)

Singamas Container Holdings Ltd.

Maersk Container Industry (MCI)

TLS Offshore Containers

BSL Containers

Florens Container Services

Sea Box, Inc.

Container Technology, Inc.

W&K Containers, Inc.

Hoover Ferguson

In 2024: Dana is set to open a new ISO tank container depot in Kansas City, Kansas, adjacent to a Union Pacific location, with operations expected to begin in mid-July. The facility aims to centralize tank fleets and enhance transloading capabilities, expanding Dana's existing network.

In March 2024: H&S Group, one of Europe's leading food and liquid transport companies, Royal Den Hartogh Logistics is broadening its services to offer global transportation of chemicals, gases, and foodstuffs.

In 2024: Airbus Defence and Space unveiled the first serial model of the protected casualty transport container for the Bundeswehr, enhancing capabilities for overland patient transport.

In December 2023: Stolt Tankers became the first shipping company globally to apply an advanced, durable coating to the hull of one of its chemical tankers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 268.49 Million |

| Market Size by 2032 | USD 566.72 Million |

| CAGR | CAGR of 8.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Transport Mode (Road, Rail, Marine) •By Capacity (Below 20,000 Liters, 20,000 - 35,000 Liters, Above 35,000 Liters) •By Container Type (Multi-Compartment Tank, Lined Tank, Reefer Tank, Cryogenic & Gas Tanks, Swap Body Tank) •By End-use Industry, (Chemicals, Petrochemicals, Food & Beverage, Pharmaceuticals, Industrial Gas, Others (Paints) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intermodal tank transport, Bertschi AG, Bulkhaul Limited, Royal Den Hartogh Logistics, HOYER GmbH, Interflow TCS Ltd., New Port Tank, Sinochain Logistics Co., Ltd., Stolt-Nielsen Limited, CIMC, Singamas Container Holdings Ltd., W&K Containers, Inc., TLS Offshore Containers International, Danteco Industries BV, Container Corporation of India Ltd. (CONCOR), Seaco Global Ltd., UBE Industries, Ltd., Trifleet Leasing, VTG Tanktainer GmbH, and Eurotainer SA. |

| Key Drivers | • The growing volume of international trade and globalization is boosting demand for ISO containers, which streamline the efficient transportation of goods worldwide. • The expansion of e-commerce has significantly increased the demand for shipping containers, particularly ISO containers, to efficiently transport goods in logistics and supply chain management. |

| RESTRAINTS | • The significant initial investment required to purchase ISO containers can deter smaller logistics companies from entering the market. |

Ans: The ISO Container Market is expected to grow at a CAGR of 8.69% during 2024-2032.

Ans: The ISO Container Market was USD 268.49 Million in 2023 and is expected to Reach USD 566.72 Million by 2032.

Ans: The growing volume of international trade and globalization is boosting demand for ISO containers, which streamline the efficient transportation of goods worldwide.

Ans: The “marine” segment dominated the ISO Container Market.

Ans: Asia-Pacific dominated the ISO Container Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by region, (2020-2023)

5.2 Utilization Rates, by region, (2020-2023)

5.3 Maintenance and Downtime Metrix

5.4 Technological Adoption Rates, by region

5.5 Export/Import Data, by region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. ISO Container Market Segmentation, By Transport Mode

7.1 Chapter Overview

7.2 Road

7.2.1 Road Market Trends Analysis (2020-2032)

7.2.2 Road Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Rail

7.3.1 Rail Market Trends Analysis (2020-2032)

7.3.2 Rail Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Marine

7.4.1 Marine Market Trends Analysis (2020-2032)

7.4.2 Marine Market Size Estimates and Forecasts to 2032 (USD Million)

8. ISO Container Market Segmentation, By Capacity

8.1 Chapter Overview

8.2 Below 20,000 Liters

8.2.1 Below 20,000 Liters Market Trends Analysis (2020-2032)

8.2.2 Below 20,000 Liters Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 20,000 - 35,000 Liters

8.3.1 20,000 - 35,000 Liters Market Trends Analysis (2020-2032)

8.3.2 20,000 - 35,000 Liters Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Above 35,000 Liters

8.4.1 Above 35,000 Liters Market Trends Analysis (2020-2032)

8.4.2 Above 35,000 Liters Market Size Estimates and Forecasts to 2032 (USD Million)

9. ISO Container Market Segmentation, By Container Type

9.1 Chapter Overview

9.2 Multi-Compartment Tank

9.2.1 Multi-Compartment Tank l Market Trends Analysis (2020-2032)

9.2.2 Multi-Compartment Tank Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Lined Tank

9.3.1 Lined Tank Market Trends Analysis (2020-2032)

9.3.2 Lined Tank Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

9.4 Reefer Tank

9.4.1 Reefer Tank Market Trends Analysis (2020-2032)

9.4.2 Reefer Tank Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

9.5 Cryogenic & Gas Tanks

9.5.1 Cryogenic & Gas Tanks Market Trends Analysis (2020-2032)

9.5.2 Cryogenic & Gas Tanks Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

9.6 Swap Body Tank

9.6.1 Swap Body Tank Market Trends Analysis (2020-2032)

9.6.2 Swap Body Tank Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

10. ISO Container Market Segmentation, By End-use Industry

10.1 Chapter Overview

10.2 Chemicals

10.2.1 Chemicals Market Trends Analysis (2020-2032)

10.2.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

10.3 Petrochemicals

10.3.1 Petrochemicals Market Trends Analysis (2020-2032)

10.3.2 Petrochemicals Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

10.4 Food & Beverage

10.4.1 Food & Beverage Market Trends Analysis (2020-2032)

10.4.2 Food & Beverage Size Estimates and Forecasts to 2032 (USD Million/Volume)

10.5 Pharmaceuticals

10.4.1 Pharmaceuticals Market Trends Analysis (2020-2032)

10.4.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

10.6 Industrial Gas

10.4.1 Industrial Gas Market Trends Analysis (2020-2032)

10.4.2 Industrial Gas Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

10.7 Others (Paints)

10.4.1 Others (Paints) Market Trends Analysis (2020-2032)

10.4.2 Others (Paints) Market Size Estimates and Forecasts to 2032 (USD Million/Volume)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America ISO Container Market Estimates and Forecasts, by Country (2020-2032) (USD Million/Volume)

11.2.3 North America ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.2.4 North America ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.2.5 North America ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.2.6 North America ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.2.7 USA

11.2.7.1 USA ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.2.7.2 USA ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.2.7.3 USA ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.2.7.4 USA ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.2.8 Canada

11.2.8.1 Canada ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.2.8.2 Canada ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.2.8.3 Canada ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.2.8.4 Canada ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.2.9 Mexico

11.2.9.1 Mexico ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.2.9.2 Mexico ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.2.9.3 Mexico ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.2.9.4 Mexico ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe ISO Container Market Estimates and Forecasts, by Country (2020-2032) (USD Million/Volume)

11.3.1.3 Eastern Europe ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.1.4 Eastern Europe ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.1.5 Eastern Europe ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.1.6 Eastern Europe ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.1.7 Poland

11.3.1.7.1 Poland ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.1.7.2 Poland ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.1.7.3 Poland ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.1.7.4 Poland ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.1.8 Romania

11.3.1.8.1 Romania ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.1.8.2 Romania ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.1.8.3 Romania ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.1.8.4 Romania ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.1.9 Hungary

11.3.1.9.1 Hungary ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.1.9.2 Hungary ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.1.9.3 Hungary ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.1.9.4 Hungary ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.1.10 Turkey

11.3.1.10.1 Turkey ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.1.10.2 Turkey ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.1.10.3 Turkey ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.1.10.4 Turkey ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.1.11.2 Rest of Eastern Europe ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.1.11.3 Rest of Eastern Europe ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.1.11.4 Rest of Eastern Europe ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe ISO Container Market Estimates and Forecasts, by Country (2020-2032) (USD Million/Volume)

11.3.2.3 Western Europe ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.4 Western Europe ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.5 Western Europe ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.6 Western Europe ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.7 Germany

11.3.2.7.1 Germany ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.7.2 Germany ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.7.3 Germany ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.7.4 Germany ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.8 France

11.3.2.8.1 France ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.8.2 France ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.8.3 France ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.8.4 France ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.9 UK

11.3.2.9.1 UK ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.9.2 UK ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.9.3 UK ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.9.4 UK ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.10 Italy

11.3.2.10.1 Italy ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.10.2 Italy ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.10.3 Italy ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.10.4 Italy ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.11 Spain

11.3.2.11.1 Spain ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.11.2 Spain ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.11.3 Spain ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.11.4 Spain ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.12.2 Netherlands ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.12.3 Netherlands ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.12.4 Netherlands ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.13.2 Switzerland ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.13.3 Switzerland ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.13.4 Switzerland ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.14 Austria

11.3.2.14.1 Austria ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.14.2 Austria ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.14.3 Austria ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.14.4 Austria ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.3.2.15.2 Rest of Western Europe ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.3.2.15.3 Rest of Western Europe ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.3.2.15.4 Rest of Western Europe ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific ISO Container Market Estimates and Forecasts, by Country (2020-2032) (USD Million/Volume)

11.4.3 Asia Pacific ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.4 Asia Pacific ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.5 Asia Pacific ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.6 Asia Pacific ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.7 China

11.4.7.1 China ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.7.2 China ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.7.3 China ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.7.4 China ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.8 India

11.4.8.1 India ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.8.2 India ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.8.3 India ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.8.4 India ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.9 Japan

11.4.9.1 Japan ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.9.2 Japan ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.9.3 Japan ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.9.4 Japan ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.10 South Korea

11.4.10.1 South Korea ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.10.2 South Korea ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.10.3 South Korea ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.10.4 South Korea ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.11 Vietnam

11.4.11.1 Vietnam ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.11.2 Vietnam ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.11.3 Vietnam ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.11.4 Vietnam ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.12 Singapore

11.4.12.1 Singapore ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.12.2 Singapore ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.12.3 Singapore ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.12.4 Singapore ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.13 Australia

11.4.13.1 Australia ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.13.2 Australia ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.13.3 Australia ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.13.4 Australia ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.4.14.2 Rest of Asia Pacific ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.4.14.3 Rest of Asia Pacific ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.4.14.4 Rest of Asia Pacific ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East ISO Container Market Estimates and Forecasts, by Country (2020-2032) (USD Million/Volume)

11.5.1.3 Middle East ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.1.4 Middle East ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.1.5 Middle East ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.1.6 Middle East ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.1.7 UAE

11.5.1.7.1 UAE ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.1.7.2 UAE ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.1.7.3 UAE ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.1.7.4 UAE ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.1.8 Egypt

11.5.1.8.1 Egypt ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.1.8.2 Egypt ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.1.8.3 Egypt ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.1.8.4 Egypt ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.1.9.2 Saudi Arabia ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.1.9.3 Saudi Arabia ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.1.9.4 Saudi Arabia ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.1.10 Qatar

11.5.1.10.1 Qatar ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.1.10.2 Qatar ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.1.10.3 Qatar ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.1.10.4 Qatar ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.1.11.2 Rest of Middle East ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.1.11.3 Rest of Middle East ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.1.11.4 Rest of Middle East ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa ISO Container Market Estimates and Forecasts, by Country (2020-2032) (USD Million/Volume)

11.5.2.3 Africa ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.2.4 Africa ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.2.5 Africa ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.2.6 Africa ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.2.7 South Africa

11.5.2.7.1 South Africa ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.2.7.2 South Africa ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.2.7.3 South Africa ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.2.7.4 South Africa ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.2.8.2 Nigeria ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.2.8.3 Nigeria ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.2.8.4 Nigeria ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.5.2.9.2 Rest of Africa ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.5.2.9.3 Rest of Africa ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.5.2.9.4 Rest of Africa ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America ISO Container Market Estimates and Forecasts, by Country (2020-2032) (USD Million/Volume)

11.6.3 Latin America ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.6.4 Latin America ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.6.5 Latin America ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.6.6 Latin America ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.6.7 Brazil

11.6.7.1 Brazil ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.6.7.2 Brazil ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.6.7.3 Brazil ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.6.7.4 Brazil ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.6.8 Argentina

11.6.8.1 Argentina ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.6.8.2 Argentina ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.6.8.3 Argentina ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.6.8.4 Argentina ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.6.9 Colombia

11.6.9.1 Colombia ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.6.9.2 Colombia ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.6.9.3 Colombia ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.6.9.4 Colombia ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America ISO Container Market Estimates and Forecasts, By Transport Mode (2020-2032) (USD Million/Volume)

11.6.10.2 Rest of Latin America ISO Container Market Estimates and Forecasts, By Capacity (2020-2032) (USD Million/Volume)

11.6.10.3 Rest of Latin America ISO Container Market Estimates and Forecasts, By Container Type (2020-2032) (USD Million/Volume)

11.6.10.4 Rest of Latin America ISO Container Market Estimates and Forecasts, By End-use Industry (2020-2032) (USD Million/Volume)

12. Company Profiles

12.1 Intermodal Tank Transport

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Bertschi AG

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Bulkhaul Limited

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Royal Den Hartogh Logistics

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 HOYER GmbH

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Interflow TCS Ltd.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 New Port Tank

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Sinochain Logistics Co., Ltd.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Stolt-Nielsen Limited

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 CIMC (China International Marine Containers)

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Market Segments

By Transport Mode

Road

Rail

Marine

By Capacity

Below 20,000 Liters

20,000 - 35,000 Liters

Above 35,000 Liters

By Container Type

Multi-Compartment Tank

Lined Tank

Reefer Tank

Cryogenic & Gas Tanks

Swap Body Tank

By End-use Industry

Chemicals

Petrochemicals

Food & Beverage

Pharmaceuticals

Industrial Gas

Others (Paints)

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automatic Lubrication System Market size was estimated at USD 1001.71 million in 2023 and is expected to reach USD 1424.55 million by 2031 at a CAGR of 4.5% during the forecast period of 2024-2031.

The Microplastic Detection Market Size was valued at USD 4.55 Billion in 2023 and is expected to reach USD 7.91 Billion by 2032 and grow at a CAGR of 6.41% over the forecast period 2024-2032.

The Air Duct Market Size was estimated at USD 7.14 billion in 2023 and is expected to arrive at USD 10.20 billion by 2032 with a growing CAGR of 4.04% over the forecast period 2024-2032.

Flow Meter Market was estimated at USD 9.21 billion in 2023 and is expected to reach USD 15.68 billion by 2032, with a growing CAGR of 6.09% from 2024 to 2032.

Oil & Gas Processing Seals Market was valued at USD 6.29 Billion in 2023 and is expected to reach USD 8.75 Billion by 2032, at a CAGR of 3.80% from 2024-2032.

The Fluid Handling Systems Market Size was estimated at USD 74.55 billion in 2023 and is expected to arrive at USD 111.28 billion by 2032 with a growing CAGR of 4.55% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone