IR Camera Market Size & Overview:

The IR Camera Market Size was valued at USD 8.02 billion in 2023 and is projected to reach USD 14.98 billion by 2032, growing at a robust CAGR of 7.19 % over the forecast period of 2024-2032.

Get more information on IR Camera Market - Request Free Sample Report

The infrared (IR) camera market is experiencing rapid growth, driven by increasing adoption in the automotive industry for advanced driver-assistance systems (ADAS) and autonomous vehicles. IR cameras, particularly long-wave infrared (LWIR) types, are crucial for night vision, pedestrian detection, and autonomous emergency braking (AEB). AEB systems have shown to reduce pedestrian crash risk by 25-27% and injury risk by 29-30%. China, with 30.1 million passenger vehicle sales in 2023, leads in market volume, with AEB penetration at 40% in 2024 and projected to exceed 60% by 2030. The U.S. National Highway Traffic Safety Administration (NHTSA) mandates AEB testing for new vehicles by 2029, requiring 5% of vehicles to undergo hardware upgrades while most will need software updates.

China’s new C-NCAP regulations, introduced in 2024, prioritize ADAS features like AEB and vulnerable road user (VRU) detection, with stringent testing conditions for pedestrians and two-wheelers at speeds of 10-80 km/h. Euro NCAP and NHTSA tests further enhance global adoption of LWIR cameras, especially for low-light conditions where over 75% of pedestrian injuries occur. Advancements in AI-powered and multi-functional IR cameras are accelerating growth across automotive, security, and manufacturing sectors.

With Europe selling 10.5 million passenger vehicles in 2023 and stringent safety regulations globally, IR cameras and enhanced safety requirements in the U.S. and Europe highlight significant opportunities for IR camera manufacturers. These trends position the IR camera market for substantial growth, driven by advancements in ADAS technology and stringent safety protocols.

Market Dynamics

Drivers

-

Innovations and Strategic Defense Applications Fueling the IR Camera Market

Innovations in infrared (IR) imaging technology and its critical role in modern defense applications are key drivers of the IR camera market. Advancements in long- and mid-wave IR wavelengths (8–15 µm and 3–8 µm) and short-wave IR (1.4–3 µm) are improving imaging performance in challenging conditions, such as fog, haze, and rain. Hyperspectral imaging (HSI), which combines visible light imaging with spectroscopy, is also emerging as a game-changer, offering unparalleled detection and analysis capabilities. These innovations, coupled with fusion technology that integrates data from multiple sensors, enhance threat detection during both day and night; even in adverse weather conditions. Electro-optic/infrared (EO/IR) systems are gaining prominence for their ability to provide detailed 360-degree environmental monitoring. For example, shipboard panoramic EO/IR systems, such as SPEIR, offer wide-field passive detection of threats, including cruise missiles, UAVs, and mines, through advanced mid-wave IR and full-color cameras on stabilized platforms. These systems are increasingly being deployed by global militaries, including NATO countries and Asia-Pacific defense programs. Geopolitical tensions and cross-border conflicts are escalating demand for advanced IR imaging solutions. The U.S. Department of Defense, the world’s largest spender on military technology, continues to drive adoption of EO/IR systems in UAVs, soldier-worn devices, and autonomous surveillance platforms. Short wave IR cameras, known for detecting objects in harsh environments, are becoming indispensable for naval and aerial missions.Military modernization programs in Europe, the U.S., and Asia are bolstering IR camera integration for long-range reconnaissance and critical infrastructure security. Rising defense budgets, along with AI-powered real-time threat analysis, are further accelerating market growth. These factors underscore the pivotal role of IR cameras in the global defense and security landscape.

Restraints

-

The IR camera market is significantly constrained by stringent regulatory and export restrictions, particularly for military-grade and high-performance systems.

Infrared cameras, often classified as dual-use technologies, are subject to control regimes like the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR). For instance, in February 2024, the Bureau of Industry and Security (BIS) revised licensing requirements cameras and systems, expanding export controls to mitigate risks associated with unauthorized use. These regulations now include specific restrictions on thermal imaging technologies, including mid-wave and long-wave IR cameras, which are integral to military and surveillance applications. Non-compliance with these export controls can lead to fines ranging from USD 300,000 to USD 1 million per violation, as reported by compliance audits.The complexity of these restrictions has led to substantial compliance costs for manufacturers. Companies are required to navigate licensing exceptions, which vary across countries, further complicating cross-border sales. The U.S., as the largest exporter of IR cameras, has enforced stricter controls on advanced detectors and cooled systems, hindering their availability in Asia-Pacific and Middle Eastern markets. In Vietnam, for example, U.S. export controls have limited the adoption of advanced IR technologies, creating a gap in defense and surveillance capabilities. The revisions to the Export Administration Regulations in 2024 have also included broader classifications of controlled items, such as ISR (Intelligence, Surveillance, and Reconnaissance) pods and EO/IR systems.

Segment Analysis

By Type

The Near and Short-wavelength infrared (SWIR) segment dominated the IR camera market in 2023, holding approximately 37% of the market share. This segment benefits from its capability to produce high-contrast images even in challenging weather conditions like fog, rain, and dust. The shorter wavelengths, typically ranging from 0.9 to 2.5 µm, are particularly valuable for military, defense, and industrial applications where clear imaging is essential for surveillance, reconnaissance, and security purposes. The demand for SWIR cameras is expected to grow further due to advancements in technology, miniaturization, and the increasing use of IR cameras in autonomous systems and UAVs.

The Long-Wavelength Infrared (LWIR) segment is expected to be the fastest growing in the IR camera market from 2024 to 2032. LWIR cameras, typically operating in the 8-15 µm range, are essential for applications such as night vision, security, and military surveillance due to their ability to detect heat signatures in low-light conditions. The increasing adoption of LWIR technology in defense, automotive, and industrial sectors is driving this growth. Notably, the demand for LWIR cameras in autonomous vehicles, border security, and military reconnaissance is set to rise, contributing to its rapid market expansion during the forecast period.

By Technology

The uncooled infrared (IR) camera segment dominated the market in 2023, accounting for approximately 61% of the market share. Uncooled IR cameras operate at ambient temperatures without the need for bulky and expensive cooling systems, making them more cost-effective and compact. These cameras are widely used in applications such as building inspections, automotive night vision, and security surveillance. Their popularity is driven by advancements in sensor technologies, including micro bolometer detectors, which enable higher performance at lower costs. Uncooled IR cameras offer reliable thermal imaging for various industries, contributing significantly to their dominant position in the IR camera market.

The cooled infrared (IR) camera segment is expected to experience the fastest growth in the IR camera market during the forecast period from 2024 to 2032. Cooled IR cameras, which utilize cryogenic cooling to enhance the sensor's sensitivity and performance, are ideal for high-precision applications such as military surveillance, aerospace, and scientific research. These cameras offer superior image quality, especially in low-light and high-temperature environments, making them essential for advanced defense and security operations. The growing demand for high-performance imaging in critical applications, coupled with technological advancements, is driving the rapid expansion of the cooled IR camera segment.

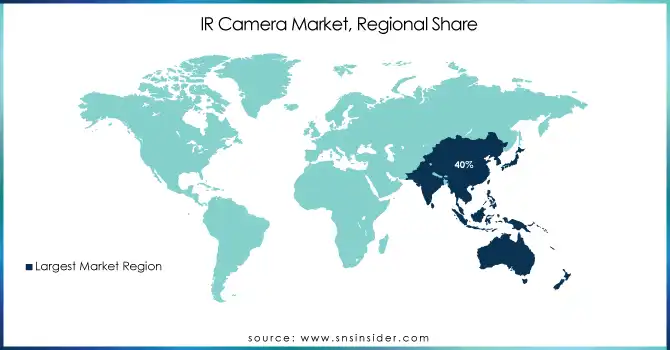

Regional Analysis

The Asia-Pacific (APAC) region dominated the IR camera market with a share of approximately 40% in 2023. This growth is fueled by technological advancements, rising defense budgets, and increasing industrial applications in countries such as China, India, Japan, and South Korea. China leads the region, driven by significant investments in military modernization and the demand for advanced surveillance systems. India and Japan are also witnessing growing adoption of IR cameras, particularly in sectors like automotive, security, and infrastructure monitoring. A large manufacturing base, strong research and development efforts, and a focus on defense and public safety support APAC’s dominance. Additionally, urbanization and economic growth in the region are accelerating the use of IR technology in various applications.

North America is the fastest-growing region in the IR camera market in 2023, driven by the increasing demand for advanced surveillance, defense, and industrial applications. The United States, with its robust defense sector and emphasis on technological innovation, is a key contributor, investing heavily in military-grade IR camera systems for surveillance, reconnaissance, and target detection. Canada is also expanding its use of IR cameras in sectors like aerospace, defense, and security. The region's growth is further fueled by the rise in smart infrastructure, demand for enhanced security systems, and the integration of AI and machine learning for improved operational efficiency.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in IR Camera along with their product:

-

Teledyne FLIR LLC (Thermal Cameras, Handheld IR Imaging Systems)

-

SPI Corp. (Tactical IR Cameras, Custom Thermal Imaging Systems)

-

OPGAL Optronic Industries Ltd. (Thermal Imaging Cameras, Fire Detection Systems)

-

Raytheon Company (Military-Grade IR Sensors, Infrared Surveillance Systems)

-

Seek Thermal Inc. (Consumer Thermal Cameras, Smartphone Thermal Imaging Devices)

-

Fluke Corporation (Industrial IR Cameras, Portable Thermal Imagers)

-

Leonardo DRS (Defense IR Sensors, Tactical Imaging Solutions)

-

Axis Communication AB (Network IR Cameras, Thermal Security Cameras)

-

Xenics nv (Infrared Detectors, Line-Scan IR Cameras)

-

L3Harris Technologies Inc. (Tactical Thermal Imaging, Long-Range IR Surveillance)

-

Testo SE & Co. KGaA (Compact Thermal Cameras, Building Diagnostics Systems)

-

Bosch Security Systems (Thermal Surveillance Cameras, Fire Detection Cameras)

-

Hanwha Techwin Co., Ltd. (Thermal Imaging Security Cameras)

-

Jenoptik AG (Industrial Infrared Cameras, Military Imaging Systems)

List of potential suppliers that provide raw materials and components for the IR camera market:

-

Corning Inc.

-

SCHOTT AG

-

II-VI Incorporated

-

Umicore

-

Edmund Optics Inc.

-

Newport Corporation

-

Zygo Corporation

-

Materion Corporation

-

IRnova AB

-

TAMRON Co., Ltd.

-

Excelitas Technologies Corp.

-

Sunny Optical Technology Co., Ltd.

-

LightPath Technologies, Inc.

-

Rhom Semiconductor

-

Omega Optical, LLC

Recent Development

-

July 2024: Teledyne FLIR unveiled the next-generation embedded software for its Boson+ thermal camera module, enhancing thermal sensitivity to ≤20 mK and integrating advanced AI-ready features for defense, automotive, and industrial applications.

-

August 22, 2024: The U.S. Air Force tasked Raytheon to increase production of the StormBreaker radar- and infrared-guided smart munitions under a USD325 million order to enhance precision targeting in adverse conditions.

-

October2024: The entire 3100i family pairs the image quality of Bosch with Intelligent Video Analytics Pro (IVA Pro) Buildings as a built-in standard. Bosch Building Technologies has expanded its IP camera portfolio with the 3100i series, offering edge-based, AI-driven video analysis ideal for small to midsize surveillance projects.

| Report Attributes | Details |

| Market Size in 2023 | USD 8.02 Billion |

| Market Size by 2032 | USD 14.98 Billion |

| CAGR | CAGR of 7.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Near and Short-wavelength IR, Medium-wavelength IR, Long-Wavelength IR) • By Technology (Cooled, Uncooled) • By Material (Germanium, Silicon, Sapphire, Others) • By Application (Military & Defense, Automotive, Industrial, Commercial, Residential, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Teledyne FLIR LLC, SPI Corp., OPGAL Optronic Industries Ltd., Raytheon Company, Seek Thermal Inc., Fluke Corporation, Leonardo DRS, Axis Communication AB, Xenics nv, L3Harris Technologies Inc., Testo SE & Co. KGaA, Bosch Security Systems, Hanwha Techwin Co., Ltd., Jenoptik AG. |

| Key Drivers | • Innovations and Strategic Defense Applications Fueling the IR Camera Market. |

| Restraints | • The IR camera market is significantly constrained by stringent regulatory and export restrictions, particularly for military-grade and high-performance systems. |