To Get More Information on IoT in Construction Market - Request Sample Report

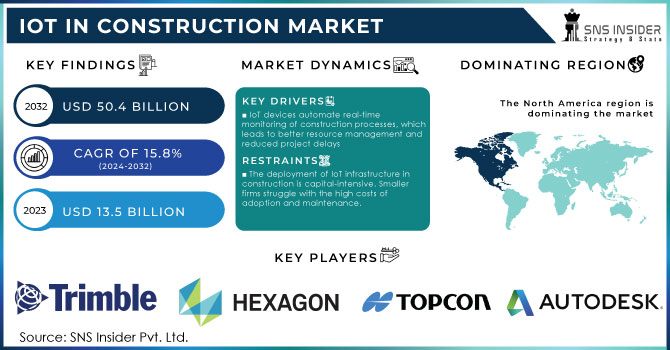

IoT In Construction Market Size was valued at USD 13.5 Billion in 2023 and is expected to reach USD 50.4 Billion by 2032, growing at a CAGR of 15.8% over the forecast period 2024-2032.

The IoT in Construction Market has been increasing rapidly as a result of technical innovation, the tendency towards automation, and enhanced investments in intelligent infrastructure. Governments display a substantial amount of effort throughout the world to promote the deployment of IoT in the construction sector. For instance, the 2023 report by the U.S. Department of Commerce reveals that the federal government of the U.S. has invested $1.2 trillion in infrastructure development. A proportion of this investment will be directed to the state’s infrastructure by the incorporation of IoT technologies. The European Union has invested approximately €750 billion too in smart city projects under the European Green Deal, with a substantial investment directed towards implementing advanced construction systems based on IoT technology. As per the report by the Ministry of Housing and Urban-Rural Development of the mentioned country, China is also involved in speeding up the smart construction pilots in over 100 cities. In the next five years, 70% of the new infrastructure projects in China will be based on IoT technology. The escalating global demands oriented towards sustainable development will result in strong growth in the industry as the deployment of IoT in projects will help minimize time wastage, enhance resource management, and ensure safety. As a result, the IoT in construction market is expected to see continuous growth throughout the forecast period.

To address these safety concerns, the integration of Internet of Things (IoT) technology into construction has become increasingly important. By utilizing smart wearables like smart glasses, wearable sensors, safety vests, wearable exoskeletons, and smart helmets, real-time safety management on construction sites is made possible. These devices enable active monitoring of workers' vital signs, such as breathing rate and heart rate, as well as their body's response to the work environment. By implementing IoT technology and wearable devices, construction companies can enhance safety measures and reduce the risk of accidents. The ability to monitor and analyze data collected from these wearable technologies provides valuable insights into improving safety protocols and preventing future incidents.

Drivers

One of the key drivers of the IoT in Construction markets is Improved Safety and Risk Management. The construction industry is by its nature dangerous, as accidents and other safety risks are not uncommon on construction sites. However, IoT technology is playing a critical role in creating innovative safety protocols that preserve the well-being of employees. For example, sensors, wearable devices, and drones can provide real-time data on the status of construction workers. IoT-enabled wearable devices collect information about the workers’ health indicators, such as their heart rate, body temperature, and level of fatigue, and raise an alarm when the condition of the employee reaches a critical level. In this way, the risk of traumatic accidents is minimized, as the employers cannot push the employees beyond their capacity with irreversible results such as a heart attack.

Furthermore, IoT sensors can be mounted on the safety gear of the construction worker or simply stationed at the construction site. They notify the workers when they are at risk of slipping or are in proximity to noxious substances on the site. Moreover, IoT-enabled sensors can monitor the structure of the construction site and any major deviations from its initial condition and behavior that warrant an evacuation of the individuals present on the site. According to the Occupational Safety and Health Administration, a study conducted in 2022 shows that IoT sensors create a proactive environment that allows the IoT operator to manage the risks even before they damage someone. In addition, the IoT has decreased the rate of workplace incidents by approximately 20 percent, the same was noted by Skanka, one of the major construction companies in the United States. Thus, IoT technologies prevent problems from escalating to injuries and fatalities. It also reduces the legal risk of hiring unsafe employees and project delays.

Restraints

The deployment of IoT infrastructure in construction is capital-intensive. Smaller firms struggle with the high costs of adoption and maintenance.

IoT devices generate vast amounts of sensitive construction data, Inadequate cybersecurity measures can lead to data breaches or loss.

Data security and privacy concerns are one major restraint in the IoT in the construction market. There is a high amount of data involved when it comes to IoT devices in a construction site. These IoT devices may be related to the status and progress of a certain project, the information about the machinery used in such a project, or the data regarding employees of a construction company. Since all devices in an IoT system are highly reliant on each other, it may not always be secure from cyberattacks. Unfortunately, many construction companies do not have any cybersecurity investments, meaning they could easily be breached, have data stolen, have the data accessed, or the whole system could even be hacked. If IoT systems are not properly secured, lots of sensitive data may e compromised. For example, the blueprints of a project, the financial information of a company, or the personal information of employees may be leaked. Moreover, IoT devices do not always have standardized security protocols, adding to data privacy complexity. Companies will need to invest in these areas more as IoT systems become more prominent in the construction secured.

While the Internet of Things (IoT) presents numerous benefits and potential cost savings in the construction sector, the initial investment required to implement this technology is substantial. For example, the Building Information Modeling (BIM) software utilized for 3D modeling can range from USD 3,100 to USD 5,200. Moreover, the software necessitates a significant amount of training to effectively utilize its capabilities. In addition to the software expenses, the costs associated with training and services are also considerable. It is worth noting that in certain countries, the wages provided to workers in the construction industry are significantly low. Consequently, construction companies may be hesitant to adopt IoT technology as it further increases the overall project costs. This reluctance stems from the belief that the benefits of IoT may not outweigh the financial burden it imposes.

By component: Hardware dominated in 2023, Services to Experience Fastest Growth

In 2023, the hardware segment was the largest component in the IOT in construction market globally with accounted 55% share in 2023. The hardware segment is considered the largest one due to the massive use of IOT devices such as sensors, RFID tags, and connected construction rather construction equipment. The device is used to enable real-tie monitoring and data collection of construction sites. In addition, this hardware is encouraged by the government at a global level, since many countries are incorporating them in their initial smart infrastructure plans at a country level. For example, in 2023, the U. K’s Industrial Strategy Challenge Fund had awarded £170 million towards smart construction and IOT; for this to be implemented, there is an absolute need for the hardware for the exact innovation to take place.

Nevertheless, from 2024 to 2032, the services component is projected to grow by the highest CAGR. This is as a result of IOT-driven services such as remote monitoring, predictive maintenance, and real-time data analytics for the fast-growing and demanded services component. In addition, the hardware component is being encouraged by the government at a global level. For example, the U.S. government had funded the IOT-driven construction services in their country at a mass level through the U.S. Infrastructure Investment and Jobs Act. For this reason, the conventional model will change from not only hardware but also service-based models such as cloud-based IOT platforms.

By End-Use: Commercial Segment Led the Market in 2023

The commercial segment dominated and accounted for a high market share 68% of the IoT in the construction market in 2023. This is primarily owing to the rising number of such projects across the world amid governments’ focus on enhancing and modernizing urban infrastructure. In the U.S., commercial construction, such as smart offices, retail spaces, and multi-use commercial buildings, is experiencing a vast change with the implementation of IoT. According to the U.S. Census Bureau, the commercial construction spending in the U.S. reached $ 158 billion in 2023, and more than one-third of this incorporated IoT to enable energy management, various security systems, and operations automation, among other aspects. Moreover, in the European Union, government-led IoT smart city initiatives are expected to drive IoT adoption in the commercial real estate sector. The European Commission in 2023 stated that commercial property projects constituted over 40% of the smart infrastructure investments and were being increasingly designed to encompass sustainability and energy efficiency goals along with complete automation. In addition to the aforementioned aspects, the commercial sectors are also adopting IoT to cut down operational costs and comply with the smart and sustainable buildings government norms.

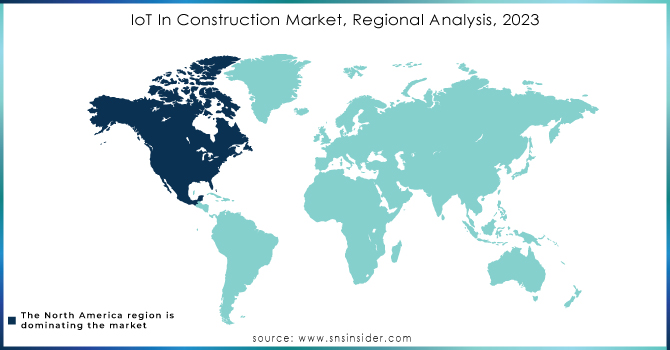

Regional Dominance

In 2023, North America became the leading region in the IoT in construction market. One of the major reasons for such a strong presence of the IoT technologies in the region is the U. S. which enjoys significant government investment in smart infrastructure and smart. In 2023, the total investment in the smart cities and smart infrastructure projects in the country reached over $500 billion according to the U. S. Department of Transportation’s 2023 report. Construction of smart highways, bridges, and buildings is currently underway in North America, which results in a higher demand for IoT technologies assets. In Canada, another market-leading country, the 2023 Smart Cities Challenge announced the investment of over CAD 300 million in the development of the IoT-enabled urban infrastructure. Furthermore, North America has a vast number of public-private partnerships focused on the innovation of the construction field, with the integration of the IoT technologies being one of the priorities. In addition, the region is advantaged by the significant government focus on infrastructure and construction resilience and sustainability, accompanied by a mature technology ecosystem. The overall dynamics in the region will allow it to remain the leading regional market through 2032.

Europe region is also expected to exhibit substantial growth with the largest incremental potential of all regional markets in the forecast period. One of the reasons is the significant technological advancement in the European market, and the stabilizing residential construction recovery in the region. However, the highest Compound Annual Growth Rate is projected for the Asia Pacific with a high increase in the adoption of IoT technologies in the construction sector, due to its overall adoption of advanced technologies and rapid urbanization, with strong construction industry expansions in China, India, Japan, and Singapore.

Do You Need any Customization Research on IoT in Construction Market - Enquire Now

Key Players

Trimble Inc. (Trimble Connect, SiteVision)

Hexagon AB (HxGN SmartNet, Leica ConX)

Topcon Corporation (MAGNET Enterprise, Sitelink3D)

Autodesk, Inc. (BIM 360, AutoCAD)

Oracle Corporation (Oracle Aconex, Oracle Primavera)

Siemens AG (MindSphere, Building X)

Caterpillar Inc. (Cat Connect, Cat VisionLink)

Procore Technologies, Inc. (Procore Construction Platform, Procore Analytics)

Komatsu Ltd. (KomConnect, Smart Construction Dashboard)

Hitachi Construction Machinery Co., Ltd. (ConSite, Solution Linkage)

Hilti Corporation (ON!Track, Hilti PROFIS Engineering)

ABB Group (ABB Ability, Smart Buildings)

Schneider Electric (EcoStruxure, Building Advisor)

Dassault Systèmes (3DEXPERIENCE, SIMULIA)

Bentley Systems, Inc. (SYNCHRO, ProjectWise)

Rockwell Automation, Inc. (FactoryTalk, Arena Simulation Software)

Microsoft Corporation (Azure IoT, Azure Digital Twins)

Johnson Controls International plc (Metasys, OpenBlue)

FARO Technologies, Inc. (FARO As-Built, FARO Focus Laser Scanner)

PlanGrid (Autodesk) (PlanGrid, Autodesk Build) and others

Latest Developments in the IoT in Construction Market

April 2024 – Microsoft Corporation unveiled its two key accelerators—an adaptive cloud approach and Azure IoT Operations and preview—at Hannover Messe to improve industrial transformation by the integration of IT and operational technology with open standards and unified data.

March 2024 – The U.S. Federal Highway Administration has released its IoT-enabled sensors into several national highway projects, annually monitoring the real-time integrity of transport assets and reducing accidents and maintenance costs. It was made possible by $300 billion allocated from the U.S. Federal Government’s Infrastructure Investment and Jobs Act.

July 2023 – The European Commission has developed the Smart Building Initiative as a part of its EU Green Deal, offering €200 million to provide existing 5000 commercial buildings with IoT for energy efficiency, security, and operations automation. Its aim is to bring 20% of the EU’s business premises into line with its ambitious sustainability goals by 2030.

| Report Attributes | Details |

| Market Size in 2023 | USD 13.5 Billion |

| Market Size by 2032 | USD 50.4 Billion |

| CAGR | CAGR of 15.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Application (Asset Monitoring, Fleet Management, Predictive Maintenance, Remote Operations, Safety, Wearables, Others) • By End-use (Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Trimble Inc., Hexagon AB, Topcon Corporation, Autodesk, Inc., Oracle Corporation, Siemens AG, Caterpillar Inc., Procore Technologies, Inc., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Hilti Corporation, ABB Group, Schneider Electric, Dassault Systèmes, Bentley Systems, Inc., Rockwell Automation, Inc., Microsoft Corporation |

| Key Drivers | •IoT devices automate real-time monitoring of construction processes, which leads to better resource management and reduced project delays •IoT-based wearable devices and sensors ensure worker safety, these technologies reduce onsite accidents by identifying hazards early. |

| Market Restraints | •The deployment of IoT infrastructure in construction is capital-intensive. Smaller firms struggle with the high costs of adoption and maintenance. •IoT devices generate vast amounts of sensitive construction data, Inadequate cybersecurity measures can lead to data breaches or loss. |

Ans: The market is expected to grow to USD 40.92 billion by the forecast period of 2030.

Ans. The CAGR of the IoT in Construction Market for the forecast period 2022-2030 is 15.98%.

Ans: Yes, you can buy reports in bulk quantity as per your requirements. Check Here for more details.

The major players in the market are Oracle Corporation, Hexagon AB, Trimble, Inc., Hilti Corporation, CalAmp Corporation, Advanced Opto-Mechanical Systems and Technologies Inc., WorldSensing, Autodesk, Inc., Triax Technologies, Inc. and others in the final report.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. IoT In Construction Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. IoT In Construction Market Segmentation, By Application

8.1 Chapter Overview

8.2 Asset Monitoring

8.2.1 Asset Monitoring Market Trends Analysis (2020-2032)

8.2.2 Asset Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Fleet Management

8.3.1 Fleet Management Market Trends Analysis (2020-2032)

8.3.2 Fleet Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Predictive Maintenance

8.4.1 Predictive Maintenance Market Trends Analysis (2020-2032)

8.4.2 Predictive Maintenance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Remote Operations

8.5.1 Remote Operations Market Trends Analysis (2020-2032)

8.5.2 Remote Operations Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Safety

8.6.1 Safety Market Trends Analysis (2020-2032)

8.6.2 Safety Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Wearables

8.7.1 Wearables Market Trends Analysis (2020-2032)

8.7.2 Wearables Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. IoT In Construction Market Segmentation, By End-use

9.1 Chapter Overview

9.2 Commercial

9.2.1 Commercial Market Trends Analysis (2020-2032)

9.2.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Residential

9.3.1 Residential Market Trends Analysis (2020-2032)

9.3.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America IoT In Construction Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.4 North America IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.6.2 USA IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.7.2 Canada IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.8.2 Mexico IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe IoT In Construction Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe IoT In Construction Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.7.2 France IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.8.2 UK IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific IoT In Construction Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.4 Asia Pacific IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.6.2 China IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.7.2 India IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.8.2 Japan IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.9.2 South Korea IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.11.2 Singapore IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.12.2 Australia IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East IoT In Construction Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.4 Middle East IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa IoT In Construction Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.4 Africa IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America IoT In Construction Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.4 Latin America IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.6.2 Brazil IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.7.2 Argentina IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.8.2 Colombia IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America IoT In Construction Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America IoT In Construction Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America IoT In Construction Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Trimble Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Hexagon AB

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Topcon Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Autodesk, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Oracle Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Siemens AG

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Caterpillar Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Procore Technologies, Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Komatsu Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Hitachi Construction Machinery Co., Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

Services

By Application

Asset Monitoring

Fleet Management

Predictive Maintenance

Remote Operations

Safety

Wearables

Others

By End-use

Commercial

Residential

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Plant Asset Management Market was valued at USD 6.59 billion in 2023 and is expected to reach USD 21.21 billion by 2032, growing at a CAGR of 13.91% from 2024-2032.

The Digital Farming Market size was valued at USD 23.9 Billion in 2023 and is expected to grow to USD 74.70 Billion by 2032 and grow at a CAGR of 13.5% by 2032.

The Network Function Virtualization (NFV) Market Size was valued at USD 30.78 Billion in 2023 and will reach USD 229.20 Billion by 2032 and grow at a CAGR of 25.03% by 2032.

The Virtualization Security Market was valued at USD 2.0 billion in 2023 and will reach USD 7.2 billion by 2032, growing at a CAGR of 15.24% by 2032.

The Bare Metal Cloud Market was valued at USD 8.47 billion in 2023 and is expected to reach USD 46.14 billion by 2032, growing at a CAGR of 20.77% over the forecast period 2024-2032.

The Augmented Shopping Market size was USD 5.92 Billion in 2023 and is expected to Reach USD 199.24 Billion by 2032 and grow at a CAGR of 47.8% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone