Get more information on Ion Chromatography Market - Request Sample Report

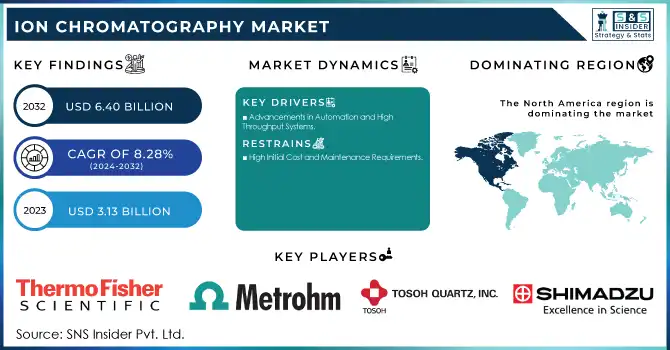

The Ion Chromatography Market Size was valued at USD 3.13 billion in 2023 and is expected to reach USD 6.40 billion by 2032 and grow at a CAGR of 8.28% over the forecast period 2024-2032.

The ion chromatography (IC) market is experiencing growth, driven by technological advancements and increasing demand across various sectors. A major factor contributing to the growth of the market is the growing need for efficient, high-precision analytical methods, especially in the face of stricter regulations in industries such as environmental monitoring, pharmaceuticals, and food safety.

Technological innovations, particularly the development of high-pressure ion chromatography (HPIC) systems, are central to the market’s expansion. HPIC systems enable faster sample analysis, higher resolution, and increased throughput. Systems like the Thermo Fisher Dionex ICS-5000+ Universal HPIC have proven essential in streamlining workflows, enabling laboratories to manage high sample volumes and achieve greater productivity. These advancements not only reduce operational costs but also enhance the ability to monitor multiple ions simultaneously, responding to the rising complexity of the samples being analyzed.

In the environmental sector, the demand for ion chromatography is increasing as regulatory bodies tighten standards on water quality testing and pollutant detection. IC is the preferred technology for monitoring trace-level contaminants such as nitrates, sulfates, and heavy metals in water and soil. With regulations becoming stricter in both developed and developing countries, governments, and industries are investing in more advanced ion chromatography systems to meet compliance. For instance, IC’s application in the detection of harmful substances like perchlorate and hexavalent chromium in water is becoming more crucial, spurring market growth.

In the food and beverage industry, ion chromatography is gaining significant traction due to rising consumer concerns over food safety and quality. IC systems are used to test for additives, preservatives, and contaminants in food products. As food manufacturers face increasing scrutiny over the safety and purity of their products, ion chromatography systems are integral to meeting regulatory standards and ensuring compliance with safety guidelines. The technology’s ability to analyze complex matrices like beverages and processed foods, where various ions are present, has expanded its role in ensuring product integrity.

Furthermore, the pharmaceutical industry is a significant growth driver for ion chromatography. As pharmaceutical companies focus on quality control, IC’s role in analyzing drug compositions, detecting impurities, and ensuring the purity of ingredients is indispensable. Recent innovations have improved the sensitivity of IC systems, enabling more precise analysis of complex biological samples and pharmaceutical formulations. This development is especially important as the pharmaceutical sector pushes forward with the production of biologics and personalized medicines, where high-quality analytical methods are paramount.

Overall, the market for ion chromatography is poised for significant expansion, driven by continued advancements in system capabilities, increased regulatory pressure, and the growing demand from high-precision industries like pharmaceuticals, environmental monitoring, and food safety. With the ongoing development of more efficient and automated systems, the ion chromatography market is expected to see continued growth over the next decade.

Drivers

Rising Demand for Water Quality Testing

A major driver of the ion chromatography (IC) market is the increased demand for effective water quality testing. As environmental pollution awareness rises and the need for strict water safety regulations grows, both industries and government agencies are increasingly relying on ion chromatography to detect trace contaminants, including heavy metals, nitrates, and pesticides, in water sources. This growing concern for ensuring safe drinking water and preventing environmental contamination is fueling the adoption of IC systems.

Pharmaceutical Industry’s Role in Market Growth

The pharmaceutical industry also plays a key role in driving the market. As drug development becomes more complex, especially with biologics and personalized medicine, the need for accurate and reliable analytical methods for drug formulation and impurity detection is pushing pharmaceutical companies to adopt ion chromatography. This technology offers the sensitivity required to meet the industry’s high standards for quality control.

Increasing Regulatory Pressures in Food and Beverage

In the food and beverage sector, market growth is driven by increasing regulatory pressures related to food safety and a rising consumer demand for cleaner, safer products. Ion chromatography serves as a vital tool for testing additives, preservatives, and contaminants, helping manufacturers comply with regulatory standards while meeting consumer expectations.

Advancements in Automation and High-Throughput Systems

The shift towards automation and high-throughput systems in laboratories is accelerating the adoption of ion chromatography. Recent innovations in IC systems that integrate automation and enhance sample throughput allow for faster, more efficient analyses, meeting the growing demands of industries that require high accuracy and manage large sample volumes. These advancements make ion chromatography an essential tool for industries needing high-efficiency applications.

Restraints

High Initial Cost and Maintenance Requirements

The high cost of ion chromatography equipment, along with ongoing maintenance and operational expenses, can be a significant barrier for smaller laboratories or organizations with limited budgets.

Complexity in Operation and Training

Ion chromatography systems require skilled operators and specialized training to ensure accurate results, which can limit their adoption in environments lacking sufficient technical expertise.

By Technique

In 2023, ion exchange chromatography (IEC) emerged as the dominant technique with a 43.0% share in the ion chromatography market. This technique has long been favored for its versatility and ability to effectively separate ionic species in complex mixtures. IEC is widely used across various industries, including environmental testing, pharmaceuticals, and chemicals, due to its high resolution and reliable results. In particular, its efficiency in separating ions in water and other liquids makes it a go-to solution for detecting trace contaminants such as nitrates, sulfates, and heavy metals in environmental samples. The dominance of IEC can also be attributed to its cost-effectiveness and adaptability to various sample types, which makes it an ideal choice for routine testing. In 2023, IEC held a significant portion of the market share, accounting for approximately 45.0% of the total ion chromatography market. This continued dominance reflects its established position as a standard technique across several key industries and its broad range of applications.

Ion-exclusion chromatography is the fastest-growing technique in the ion chromatography market, with significant advancements in recent years. Unlike other techniques, ion-exclusion chromatography is highly effective for separating neutral and charged species, making it especially useful in analyzing complex food and beverage samples. This technique is gaining traction in the food industry, where it is increasingly used to analyze sugars and organic acids.

By Application

The environmental testing application segment was the dominant segment of the ion chromatography market in 2023, largely due to the increasing global focus on environmental pollution and stringent regulatory standards. Ion chromatography is an essential tool for detecting trace contaminants such as heavy metals, nitrates, and pesticides in environmental samples like water, soil, and air. With growing concerns over water safety and air quality, both industrial players and governmental bodies are increasingly turning to ion chromatography for accurate and efficient environmental testing. In 2023, environmental testing accounted for 40.0% of the total ion chromatography market share. The rising demand for water quality testing and the need to comply with global environmental regulations are key factors contributing to this dominance.

The pharmaceutical industry is the fastest-growing application segment for ion chromatography, driven by the increasing complexity of drug development and the demand for high-precision analytical techniques. With the rise of biologics, personalized medicine, and more stringent regulatory frameworks, pharmaceutical companies are placing greater emphasis on drug quality and purity.

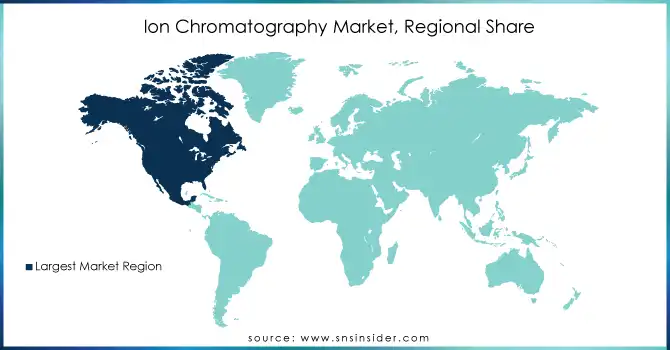

In 2023, North America dominated the ion chromatography market, primarily driven by its well-established pharmaceutical, environmental, and chemical industries. The demand for advanced analytical solutions is high, particularly in environmental monitoring and pharmaceutical applications. In the U.S. and Canada, regulatory requirements such as the Clean Water Act have significantly increased the adoption of ion chromatography for water quality testing. Additionally, the pharmaceutical industry's focus on drug quality and purity has further accelerated the use of ion chromatography in drug formulation and impurity detection.

Europe also held a strong position in the market, with countries like Germany and the UK being major contributors. The region’s stringent regulatory environment, particularly regarding food safety and environmental protection, is a key driver of market growth. The European Union's emphasis on high standards for water, food, and pharmaceutical quality has spurred increased adoption of ion chromatography across these industries. The food and beverage sector in Europe uses ion chromatography extensively to test for additives, preservatives, and contaminants, further fueling market demand.

In the Asia Pacific region, ion chromatography is witnessing the fastest growth, driven by rapid industrialization and increasing awareness of environmental pollution. Countries such as China and India are investing heavily in both environmental monitoring and healthcare infrastructure. The demand for high-quality pharmaceuticals, along with growing regulatory measures in environmental and food safety, has contributed to the rising adoption of ion chromatography. This growing focus on industrial and environmental standards is making the Asia Pacific a key region for the future of ion chromatography.

Key Players

Dionex Ion Chromatography systems, Dionex ICS-5000+ Series, Dionex IonPac Columns

2. Metrohm

850 Professional IC, 881 Compact IC Pro, 930 Compact IC Flex, Metrosep Ion Chromatography Columns

TSKgel IC Ion Chromatography Columns, Tosoh Bio-Systems IC systems

4. Shimadzu

Nexera XR, Prominence UFLC, Shimadzu IC-2010 Plus Ion Chromatography System

5. Qingdao Shenghan Chromatograph Technology Co., Ltd

Shenghan Ion Chromatography Systems, Ion Chromatography Columns

6. MembraPure GmbH

High-Purity Water Systems for Ion Chromatography

7. Nittoseiko Analytech Co., Ltd

Ion Chromatography Columns, IC Systems for Environmental and Industrial Analysis

8. Qingdao Puren Instrument

Ion Chromatography Systems for Water and Environmental Testing

9. East & West Analytical Instruments

Ion Chromatography Systems, Ion Chromatography Columns for Various Industries

10. Qingdao Luhai

Ion Chromatography Systems for Water and Environmental Analysis

11. Sykam

Ion Chromatography Systems and Accessories for Pharmaceutical and Environmental Testing

12. Cecil Instruments

Ion Chromatography Systems for Environmental and Pharmaceutical Testing

13. Bio-Rad Laboratories Inc

Bio-Rad Ion Chromatography Systems and Columns

14. Metrohm AG

930 Compact IC Flex, 850 Professional IC, Ion Chromatography Columns and Consumables

15. Agilent Technologies Inc

1260 Infinity II Ion Chromatography System, IonPac Columns

16. Danaher Corporation (Cytiva)

Ion Chromatography Systems and Consumables for Water and Pharmaceutical Applications

17. Mitsubishi Chemical Corporation

Ion Chromatography Systems for Environmental and Industrial Testing

In Dec 2024, IonOpticks entered a long-term supply agreement with Biognosys to provide custom chromatography columns, enhancing Biognosys’ TrueDiscovery, TrueSignature, and TrueTarget contract research services. The custom columns are designed to meet Biognosys' rigorous standards, improving sensitivity, reproducibility, and depth of coverage in proteomics research workflows.

In Feb 2024, Thermo Fisher Scientific launched the Thermo Scientific Dionex Inuvion Ion Chromatography System, designed to enhance reliability, efficiency, and functional adaptability for laboratories. This new system streamlines ion analysis and broadens testing capabilities for ionic and small polar compounds, offering improved performance for diverse applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.13 billion |

| Market Size by 2032 | USD 6.40 Billion |

| CAGR | CAGR of 8.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technique (Ion-exchange chromatography, Ion-exclusion chromatography, Ion-pair chromatography) • By Application (Environmental testing, pharmaceutical industry, Food industry, Chemical industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Metrohm, Tosoh Bioscience, Shimadzu, Qingdao Shenghan Chromatograph Technology Co., Ltd, MembraPure GmbH, Nittoseiko Analytech Co., Ltd, Qingdao Puren Instrument, East & West Analytical Instruments, Qingdao Luhai, Sykam, Cecil Instruments, Bio-Rad Laboratories Inc, Agilent Technologies Inc, Danaher Corporation (Cytiva), and Mitsubishi Chemical Corporation |

| Key Drivers | • Rising Demand for Water Quality Testing • Pharmaceutical Industry’s Role in Market Growth • Increasing Regulatory Pressures in Food and Beverage • Advancements in Automation and High-Throughput Systems |

| Restraints | • High Initial Cost and Maintenance Requirements • Complexity in Operation and Training |

Ans: The Ion Chromatography Market Size was valued at USD 3.13 billion in 2023.

Ans Rising demand for water quality testing, pharmaceutical industry’s role in market growth, increasing regulatory pressures in food and beverage and advancements in automation and high-throughput systems are the key drivers of the Ion Chromatography market

Ans. North America will dominate the worldwide ion chromatography market.

Ans. Thermo Fisher Scientific, Metrohm, Tosoh Bioscience, Shimadzu, Qingdao Shenghan Chromatograph Technology Co., Ltd, MembraPure GmbH, Nittoseiko Analytech Co., Ltd, Qingdao Puren Instrument, East & West Analytical Instruments, Qingdao Luhai, Sykam, Cecil Instruments, Bio-Rad Laboratories Inc, Agilent Technologies Inc, Danaher Corporation (Cytiva), and Mitsubishi Chemical Corporationare the key players of Ion Chromatography market

Ans: The Ion Chromatography Market is growing at a CAGR of 8.28% over the forecast period 2024-2032.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Trends in Ion Chromatography Utilization (2023), by Region

5.3 Healthcare Spending on Ion Chromatography Devices, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Ion Chromatography Market Segmentation, by Technique

7.2 Ion-exchange chromatography

7.2.1 Ion-exchange Chromatography Market Trends Analysis (2020-2032)

7.2.2 Ion-exchange Chromatography Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Ion-exclusion chromatography

7.3.1 Ion-exclusion Chromatography Market Trends Analysis (2020-2032)

7.3.2 Ion-exclusion Chromatography Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Ion-pair chromatography

7.4.1 Ion-pair Chromatography Market Trends Analysis (2020-2032)

7.4.2 Ion-pair Chromatography Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Ion Chromatography Market Segmentation, by Application

8.2 Environmental testing

8.2.1 Environmental Testing Market Trends Analysis (2020-2032)

8.2.2 Environmental Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pharmaceutical industry

8.3.1 Long-Term Care Facilities Market Trends Analysis (2020-2032)

8.3.2 Long-Term Care Facilities Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Food industry

8.4.1 Food Industry Market Trends Analysis (2020-2032)

8.4.2 Food Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Chemical industry

8.5.1 Chemical Industry Market Trends Analysis (2020-2032)

8.5.2 Chemical Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Ion Chromatography Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.2.4 North America Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.2.5.2 USA Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.2.6.2 Canada Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.2.7.2 Mexico Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Ion Chromatography Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.1.5.2 Poland Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.1.6.2 Romania Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Ion Chromatography Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.4 Western Europe Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.5.2 Germany Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.6.2 France Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.7.2 UK Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.8.2 Italy Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.9.2 Spain Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.12.2 Austria Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Ion Chromatography Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.4 Asia Pacific Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.5.2 China Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.5.2 India Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.5.2 Japan Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.6.2 South Korea Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.2.7.2 Vietnam Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.8.2 Singapore Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.9.2 Australia Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Ion Chromatography Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.1.4 Middle East Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.1.5.2 UAE Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Ion Chromatography Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.2.4 Africa Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Ion Chromatography Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.6.4 Latin America Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.6.5.2 Brazil Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.6.6.2 Argentina Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.6.7.2 Colombia Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Ion Chromatography Market Estimates and Forecasts, by Technique (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Ion Chromatography Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Thermo Fisher Scientific

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Tosoh Bioscience

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Shimadzu

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Qingdao Shenghan Chromatograph Technology Co., Ltd

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 MembraPure GmbH

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Nittoseiko Analytech Co., Ltd

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Bio-Rad Laboratories Inc

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Agilent Technologies Inc

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Danaher Corporation (Cytiva)

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Mitsubishi Chemical Corporation

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technique

Ion-exchange chromatography

Ion-exclusion chromatography

Ion-pair chromatography

By Application

Environmental testing

Pharmaceutical industry

Food industry

Chemical industry

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Catheter Stabilization Devices Market Size was valued at USD 1.48 Billion in 2023 and is expected to reach USD 2.77 billion by 2032, growing at a CAGR of 7.22% over the forecast period 2024-2032.

The Thyroid Cancer Diagnostics Market size was estimated at USD 2.94 billion in 2023, expected to reach USD 4.81 billion by 2032 with a 5.65% CAGR.

The Pupillometer Market Size was USD 405.15 million in 2023 and is expected to reach USD 741.38 million by 2032 and grow at a CAGR of 6.96% by 2024-2032.

The Biodefense Market was valued at USD 16.03 billion in 2023 and is expected to reach USD 25.06 billion by 2032, growing at a CAGR of 5.11% over the forecast period of 2024-2032.

The Proteomics Market Size was valued at USD 30.61 billion in 2023 and is expected to reach USD 96.35 Billion by 2032, growing at a CAGR of 13.61% from 2024-2032.

The Healthcare IT Consulting Market Size was valued at USD 50.1 billion in 2023 and is expected to reach USD 168.14 billion by 2032 and grow at a CAGR of 14.4% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone