To Get More Information on Investment Casting Market - Request Sample Report

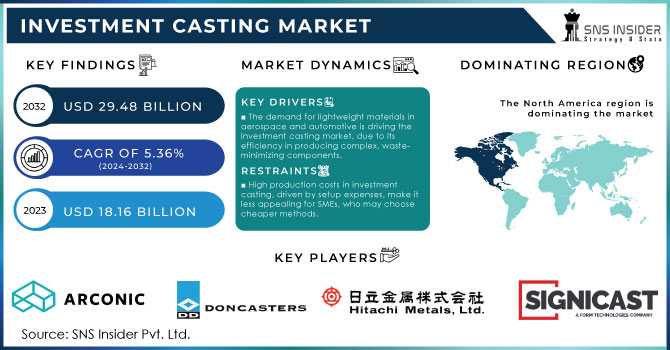

The Investment Casting Market Size was valued at USD 18.16 Billion in 2023 and is expected to reach USD 29.48 Billion by 2032 and grow at a CAGR of 5.36% over the forecast period 2024-2032.

Investment casting provides numerous benefits, including excellent surface finish and dimensional accuracy, often eliminating the need for additional machining processes. This efficiency can significantly reduce production costs and time, making it a preferred solution for high-volume production. However, the process does have limitations; the initial tooling and mold investment can be substantial, especially for low-volume production runs. Additionally, certain geometries that require undercuts or extreme complexity may not be suitable for this method. Nonetheless, advancements in technologies like 3D printing are addressing these challenges by enabling more complex designs and shortening lead times for pattern creation.

The process can achieve dimensional tolerances of up to ±0.005 inches, depending on the material and size of the component. Moreover, it can deliver a surface finish as smooth as Ra 125 microinches, enhancing the aesthetic and functional characteristics of the produced parts. Additionally, investment casting is environmentally friendly, boasting material utilization rates as high as 98%, which underscores its efficiency compared to traditional casting methods. Overall, investment casting stands out as a reliable and efficient method for manufacturing precision metal components in a range of industries.

DRIVERS

The growing demand for lightweight materials across various industries, particularly aerospace and automotive, significantly drives the investment casting market. In these sectors, the push for fuel efficiency, performance enhancement, and reduced emissions has led manufacturers to seek materials that are not only strong but also lightweight. Investment casting, known for its precision and ability to create complex geometries, is particularly well-suited for producing such components. This process enables the creation of intricate shapes that traditional manufacturing methods often struggle to achieve, allowing for the design of lightweight structures without compromising strength or durability.

Furthermore, investment casting minimizes material waste, which is a critical consideration in an era where sustainability is becoming increasingly important. By utilizing this technique, manufacturers can optimize material usage, thereby reducing costs and environmental impact. Industries are also focusing on integrating advanced materials, such as titanium and aluminum alloys, which can be effectively processed through investment casting to produce lightweight parts. This approach not only meets the specific requirements of industries demanding high-performance components but also aligns with the broader trend of reducing the overall weight of vehicles and aircraft to enhance fuel efficiency. As a result, investment casting is becoming a preferred choice for manufacturers looking to innovate and stay competitive in a rapidly evolving market, highlighting its crucial role in addressing the demand for lightweight materials.

Technological advancements in casting technologies have significantly transformed the investment casting process, enhancing both efficiency and precision. One of the key innovations is the development of improved mold materials. Modern molds are now made from high-performance materials that can withstand extreme temperatures and pressures, leading to better dimensional accuracy and surface finish. These advanced materials reduce the likelihood of defects, such as warping or cracking, which can compromise the integrity of the final product.

Additionally, the introduction of advanced coating techniques has revolutionized the way molds are prepared. Coatings can be applied to molds to improve the release properties, reducing the chances of part sticking and facilitating smoother ejection. This not only speeds up the production process but also minimizes the need for extensive post-processing, thereby reducing overall costs.

These technological improvements have made investment casting an attractive option for industries seeking high-quality, complex parts that meet stringent performance standards. Industries such as aerospace, automotive, and medical devices are increasingly relying on these advanced casting technologies to produce intricate components that require precise tolerances and surface finishes. As a result, the demand for investment casting continues to rise, driven by the need for lightweight, durable, and complex geometries that traditional manufacturing methods struggle to achieve. Ultimately, the innovations in casting technologies position investment casting as a leading choice for manufacturers aiming to enhance product performance while maintaining cost-effectiveness and efficiency.

RESTRAIN

High production costs are a significant barrier to the widespread adoption of investment casting, particularly for small and medium enterprises (SMEs). The investment casting process involves several stages, including pattern creation, mold production, and finishing, each requiring specialized materials and equipment. The initial setup costs for investment casting are notably high, as they often involve the use of high-quality patterns, precise molds, and advanced technologies to achieve the desired dimensional accuracy and surface finish. These costs can deter SMEs, which typically operate on tighter budgets and may not have the financial flexibility to invest in such capital-intensive processes.

Additionally, the need for skilled labor to operate sophisticated casting equipment and to maintain quality control further escalates expenses. SMEs may find it challenging to compete with larger firms that can absorb these costs more effectively and benefit from economies of scale. As a result, many smaller manufacturers might opt for alternative production methods, such as sand casting or injection molding, which can offer lower upfront investments and faster turnaround times, despite potentially sacrificing some quality or precision. Consequently, the high production costs associated with investment casting limit its appeal for SMEs, restricting market growth and innovation within this sector. For the investment casting industry to thrive, addressing these cost barriers through advancements in technology and process efficiency will be crucial in making it more accessible to a broader range of manufacturers.

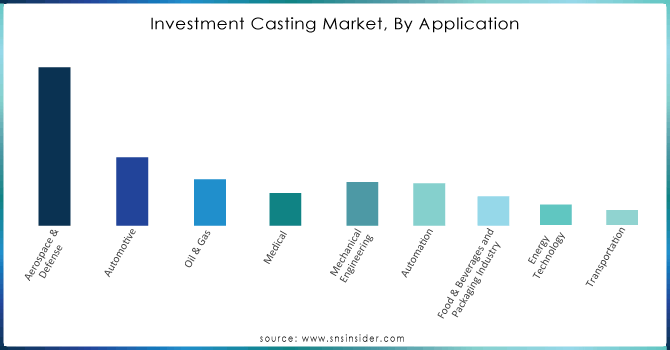

By Application

The aerospace & defense segment dominated the market share over 46.02% in 2023. Investment cast products play a significant role in the aerospace industry, providing a variety of crucial applications. The investment casting process is utilized to manufacture precision castings such as cable clamps, ball bearings, fuel valves, fuel manifolds, landing gear, brake systems, pitot probes, and various sensors.

Do You Need any Customization Research on Investment Casting Market - Inquire Now

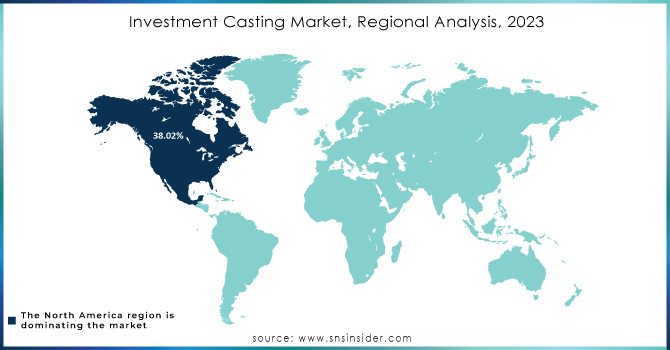

The North America region held a dominant position in the investment casting market in 2023, accounting for over 38.02% of the market share. This strong performance can be attributed to the widespread application of investment casting in manufacturing high-value components across several critical industries, including aerospace and defense, oil and gas, and medical sectors. Investment casting is particularly favored in these industries due to its ability to produce complex geometries with high precision, making it ideal for the production of components that require stringent quality standards.

The Asia Pacific region is anticipated to experience rapid growth during the forecast period. This growth is primarily driven by the sustainable expansion of the automotive, aerospace, and industrial machinery manufacturing sectors within the region. The demand for investment casting is expected to rise significantly as these industries continue to thrive. Notably, the presence of a high number of small and medium-sized manufacturers in Asia Pacific positions the region as a major source of investment cast products.

Some of the major key players of Investment Casting Market

Arconic, Inc. (Aluminum and titanium investment castings)

Doncasters Group Ltd. (Superalloy investment castings)

Hitachi Metals, Ltd. (Steel and non-ferrous investment castings)

MetalTek International (Custom investment castings in various metals)

Signicast (Precision investment castings in steel and stainless steel)

Precision Castparts Corp (Berkshire Hathaway) (Aerospace and industrial investment castings)

Zollern GmbH and Co. KG (Investment castings for various industries)

Impro Precision Industries Limited (Investment casting, machining, and assembly services)

Rogers Corp. (High-performance investment castings for electronics)

Alcoa Corporation (Aluminum investment castings)

Apex Foundry (Investment castings for aerospace and automotive sectors)

Eisenmann Corporation (Industrial and custom investment castings)

Castrol (Investment castings for automotive applications)

Lisi Aerospace (Investment castings for aerospace components)

Kern-Liebers Group (Precision investment castings for various applications)

Töddler Foundry (Investment castings in carbon steel and stainless steel)

Luminant Capital (Investment castings for energy applications)

Ferrostaal GmbH (Investment castings for engineering and manufacturing)

Harrison Castings Ltd. (Aluminum and zinc investment castings)

Shaanxi Tisky International (Investment casting services in various alloys)

In 2023: Texmo Precision Castings purchased 75.1% of Feinguss Blank, a company located in Germany with facilities in Romania, for an undisclosed sum. Texmo Precision Castings, a division of the Texmo Group based in India, operates production plants in both the U.S. and India.

In September 2024: 3D Systems introduced QuickCast Air, an advanced tool for investment casting that reduces material consumption, improves burnout, and enhances pattern draining efficiency. This tool is particularly beneficial for aerospace and defense sectors, allowing for high-precision, large-volume casting patterns.

| Report Attributes | Details |

| Market Size in 2023 | USD 18.16 Billion |

| Market Size by 2032 | USD 29.48 Billion |

| CAGR | CAGR of 5.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Aerospace & Defense, Automotive, Oil & Gas, Medical, Mechanical Engineering, Automation, Food & Beverages and Packaging Industry, Energy Technology, Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arconic, Inc., Doncasters Group Ltd., Hitachi Metals, Ltd., MetalTek International, Signicast, Precision Castparts Corp (Berkshire Hathaway), Zollern GmbH and Co. KG, Impro Precision Industries Limited, Rogers Corp., Alcoa Corporation, Apex Foundry, Eisenmann Corporation, Castrol, Lisi Aerospace, Kern-Liebers Group, Töddler Foundry, Luminant Capital, Ferrostaal GmbH, Harrison Castings Ltd., Shaanxi Tisky International. |

| Key Drivers | • The increasing need for lightweight materials in industries like aerospace and automotive is boosting the investment casting market, as it efficiently produces complex shapes with minimal waste, perfect for lightweight components. • Technological advancements in casting, including better mold materials and coating techniques, boost investment casting's efficiency and precision, drawing industries seeking high-quality, intricate components. |

| RESTRAINTS | • High production costs in investment casting arise from significant initial setup expenses, making it less appealing for small and medium enterprises compared to other manufacturing methods. |

Ans: The Investment Casting Market is expected to grow at a CAGR of 5.36% during 2024-2032.

Ans: The Investment Casting Market was USD 18.16 Billion in 2023 and is expected to Reach USD 29.48 Billion by 2032.

Ans: The increasing need for lightweight materials in industries like aerospace and automotive is boosting the investment casting market, as it efficiently produces complex shapes with minimal waste, perfect for lightweight components.

Ans: The “aerospace & defense” segment dominated the Investment Casting Market.

Ans: North America dominated the Investment Casting Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by region, (2020-2023)

5.2 Utilization Rates, by region, (2020-2023)

5.3 Maintenance and Downtime Metrix

5.4 Technological Adoption Rates, by region

5.6 Export/Import Data, by region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Investment Casting Market Segmentation, By Application

7.2 Aerospace & Defense

7.2.1 Aerospace & Defense Market Trends Analysis (2020-2032)

7.2.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Automotive

7.3.1 Automotive Market Trends Analysis (2020-2032)

7.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Oil & Gas

7.4.1 Oil & Gas Market Trends Analysis (2020-2032)

7.4.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Medical

7.5.1 Medical Market Trends Analysis (2020-2032)

7.5.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Mechanical Engineering

7.6.1 Mechanical Engineering Market Trends Analysis (2020-2032)

7.6.2 Mechanical Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Automation

7.7.1 Automation Market Trends Analysis (2020-2032)

7.7.2 Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Food & Beverages and Packaging Industry

7.8.1 Food & Beverages and Packaging Industry Market Trends Analysis (2020-2032)

7.8.2 Food & Beverages and Packaging Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Energy Technology

7.9.1 Energy Technology Market Trends Analysis (2020-2032)

7.9.2 Energy Technology Market Size Estimates and Forecasts to 2032 (USD Billion)

7.10 Transportation

7.10.1 Transportation Market Trends Analysis (2020-2032)

7.10.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Regional Analysis

8.1 Chapter Overview

8.2 North America

8.2.1 Trends Analysis

8.2.2 North America Investment Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.2.3 North America Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.2 USA

8.2.2.1 USA Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.3 Canada

8.2.3.1 Canada Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.4 Mexico

8.2.4.1 Mexico Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3 Europe

8.3.1 Eastern Europe

8.3.1.1 Trends Analysis

8.3.1.2 Eastern Europe Investment Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.3.1.3 Eastern Europe Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.4 Poland

8.3.1.4.1 Poland Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.5 Romania

8.3.1.5.1 Romania Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.6 Hungary

10.3.1.8.1 Hungary Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.7 Turkey

8.3.1.7.1 Turkey Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.8 Rest of Eastern Europe

8.3.1.8.1 Rest of Eastern Europe Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2 Western Europe

8.3.2.1 Trends Analysis

8.3.2.2 Western Europe Investment Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.3.2.3 Western Europe Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.4 Germany

8.3.2.4.1 Germany Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.5 France

8.3.2.5.1 France Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.6 UK

8.3.2.6.1 UK Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.7 Italy

8.3.2.7.1 Italy Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.8 Spain

8.3.2.8.1 Spain Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.9 Netherlands

8.3.2.9.1 Netherlands Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.10 Switzerland

8.3.2.10.1 Switzerland Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.11 Austria

8.3.2.11.1 Austria Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.12 Rest of Western Europe

8.3.2.12.1 Rest of Western Europe Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4 Asia-Pacific

8.4.1 Trends Analysis

8.4.2 Asia-Pacific Investment Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.4.3 Asia-Pacific Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.4 China

8.4.4.1 China Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.5 India

8.4.5.1 India Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.6 Japan

8.4.6.1 Japan Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.7 South Korea

8.4.7.1 South Korea Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.8 Vietnam

8.4.8.1 Vietnam Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.9 Singapore

8.4.9.1 Singapore Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.10 Australia

8.4.10.1 Australia Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.11 Rest of Asia-Pacific

8.4.11.1 Rest of Asia-Pacific Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5 Middle East and Africa

8.5.1 Middle East

8.5.1.1 Trends Analysis

8.5.1.2 Middle East Investment Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.4 UAE

8.5.1.4.1 UAE Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.5 Egypt

8.5.1.5.1 Egypt Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.6 Saudi Arabia

8.5.1.6.1 Saudi Arabia Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.7 Qatar

8.5.1.7.1 Qatar Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.8 Rest of Middle East

8.5.1.8.1 Rest of Middle East Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2 Africa

8.5.2.1 Trends Analysis

8.5.2.2 Africa Investment Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.5.2.3 Africa Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.4 South Africa

8.5.2.4.1 South Africa Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.5 Nigeria

8.5.2.5.1 Nigeria Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.6 Rest of Africa

8.5.2.6.1 Rest of Africa Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6 Latin America

8.6.1 Trends Analysis

8.6.2 Latin America Investment Casting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.6.3 Latin America Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.4 Brazil

8.6.4.1 Brazil Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.5 Argentina

8.6.5.1 Argentina Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.6 Colombia

8.6.6.1 Colombia Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.7 Rest of Latin America

8.6.7.1 Rest of Latin America Investment Casting Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9. Company Profiles

9.1 Arconic, Inc.

9.1.1 Company Overview

9.1.2 Financial

9.1.3 Products/ Services Offered

9.1.4 SWOT Analysis

9.2 Doncasters Group Ltd.

9.2.1 Company Overview

9.2.2 Financial

9.2.3 Products/ Services Offered

9.2.4 SWOT Analysis

9.3 Hitachi Metals, Ltd.

9.3.1 Company Overview

9.3.2 Financial

9.3.3 Products/ Services Offered

9.3.4 SWOT Analysis

9.4 MetalTek International

9.4.1 Company Overview

9.4.2 Financial

9.4.3 Products/ Services Offered

9.4.4 SWOT Analysis

9.5 Signicast

9.5.1 Company Overview

9.5.2 Financial

9.5.3 Products/ Services Offered

9.5.4 SWOT Analysis

9.6 Precision Castparts Corp (Berkshire Hathaway)

9.6.1 Company Overview

9.6.2 Financial

9.6.3 Products/ Services Offered

9.6.4 SWOT Analysis

9.7 Zollern GmbH and Co. KG

9.7.1 Company Overview

9.7.2 Financial

9.7.3 Products/ Services Offered

9.7.4 SWOT Analysis

9.8 Impro Precision Industries Limited

9.8.1 Company Overview

9.8.2 Financial

9.8.3 Products/ Services Offered

9.8.4 SWOT Analysis

9.9 Rogers Corp.

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Products/ Services Offered

9.9.4 SWOT Analysis

9.10 Alcoa Corporation

9.10.1 Company Overview

9.10.2 Financial

9.10.3 Products/ Services Offered

9.10.4 SWOT Analysis

10. Use Cases and Best Practices

11. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Application

Aerospace & Defense

Automotive

Oil & Gas

Medical

Mechanical Engineering

Automation

Food & Beverages and Packaging Industry

Energy Technology

Transportation

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Residential Filters Market size was valued at USD 8.26 Billion in 2023 and is now anticipated to grow to USD 16.78 Billion by 2032, displaying a CAGR of 8.2% during the forecast period of 2024-2032.

The Thermoelectric Generators Market Size was esteemed at USD 854.56 million in 2023 and is supposed to arrive at USD 1792.25 million by 2031 and develop at a CAGR of 9.7% over the forecast period 2024-2031.

The Vacuum Valve Market Size was esteemed at USD 1.37 billion in 2023 and is supposed to arrive at USD 2.80 billion by 2031 and develop at a CAGR of 9.3% over the forecast period 2024-2031.

The Total Organic Carbon (TOC) Analyzer Market size was valued at USD 1.3 Bn in 2023 and is expected to reach USD 2.33 Bn by 2031 and grow at a CAGR of 6.74% over the forecast period 2024-2032.

The Vacuum Evaporators Market was estimated at USD 2.51 billion in 2023 and is expected to reach USD 4.24 billion by 2032, with a growing CAGR of 6.01% over the forecast period 2024-2032.

The Variable Displacement Pumps Market Size was estimated at USD 5.47 billion in 2023 and is expected to arrive at USD 7.79 billion by 2032 with a growing CAGR of 4.0% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone