Inventory Management Software Market Report Scope & Overview:

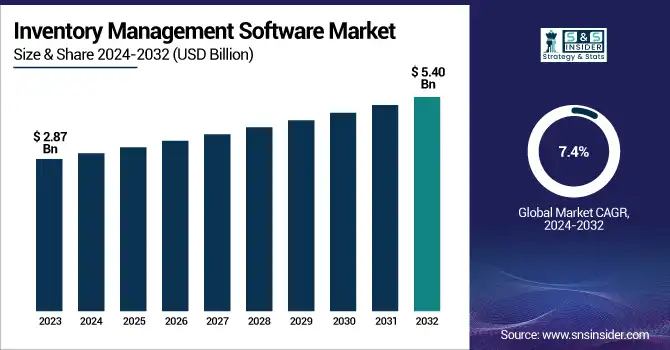

The Inventory Management Software Market Size was valued at USD 2.87 Billion in 2023 and is expected to reach USD 5.40 Billion by 2032 and grow at a CAGR of 7.4% over the forecast period 2024-2032.

To Get more information on Inventory Management Software Market - Request Free Sample Report

The market is growing rapidly due to increasing demand for automation, real-time tracking, and supply chain optimization. Businesses are shifting to cloud-based solutions for scalability and cost efficiency. Key players like Oracle, SAP, and Microsoft are integrating AI, predictive analytics, and blockchain to enhance inventory visibility. IoT and RFID technology are improving real-time tracking and demand forecasting. The rise of omnichannel retailing and automated replenishment is further driving market expansion. Despite challenges like data security and integration issues, trends such as autonomous warehouses, blockchain, and RPA are transforming inventory management, enhancing supply chain efficiency globally.

The U.S. Inventory Management Software Market size was USD 0.69 billion in 2023 and is expected to reach USD 1.13 billion by 2032, growing at a CAGR of 5.76% over the forecast period of 2024-2032.

The U.S. Inventory Management Software Market is experiencing steady growth due to the increasing adoption of automation and cloud-based solutions across industries. Businesses in retail, e-commerce, and manufacturing are leveraging advanced inventory tracking systems to optimize stock levels, reduce operational costs, and improve supply chain efficiency. Key players like Oracle, SAP, and Microsoft are integrating AI, IoT, and predictive analytics to enhance inventory visibility and accuracy. The rise of omnichannel retailing and just-in-time inventory strategies is further driving demand. Despite challenges like data security concerns, the market is expected to grow as digital transformation and automation trends continue to expand.

Inventory Management Software Market Dynamics

Key Drivers:

-

Growing Adoption of Cloud-Based Solutions Enhances Growth of the Inventory Management Software Market

The increasing adoption of cloud-based inventory management software is a key driver propelling market growth. Cloud-based solutions offer scalability, cost-effectiveness, and remote accessibility, making them highly attractive for businesses of all sizes. Companies are shifting away from traditional on-premises systems to cloud-based platforms that provide real-time inventory tracking, automated stock replenishment, and seamless integration with other enterprise resource planning (ERP) and supply chain management systems.

Additionally, cloud platforms allow businesses to streamline warehouse operations, optimize logistics, and enhance demand forecasting through data-driven insights. As companies focus on digital transformation and automation, cloud-based inventory management solutions are becoming a critical component in improving operational efficiency and reducing stock discrepancies. Despite initial concerns over data security, continuous advancements in cybersecurity measures are ensuring a safer cloud environment.

Restrain:

-

High Implementation Costs and Integration Complexities Restrain the Inventory Management Software Market Growth

One of the major restraints limiting the widespread adoption of inventory management software is the high implementation cost and integration complexities. Many businesses, particularly small and medium-sized enterprises (SMEs), struggle with the upfront costs associated with deploying inventory management systems, including software licensing fees, infrastructure setup, and employee training. Additionally, integrating inventory software with existing enterprise resource planning (ERP) systems, customer relationship management (CRM) tools, and supply chain management solutions can be challenging, requiring significant time and resources. Legacy systems often lack compatibility with modern inventory management platforms, leading to operational disruptions during the transition process.

Furthermore, inadequate technical expertise within companies can create additional hurdles in effectively utilizing advanced features such as AI-driven demand forecasting and IoT-enabled real-time tracking. Addressing these cost and integration challenges requires strategic partnerships with software providers offering flexible pricing models, seamless API integrations, and robust customer support to ensure a smooth transition and optimal software utilization.

Opportunities:

-

Rising Adoption of AI and Predictive Analytics Creates Lucrative Opportunities in the Inventory Management Software Market

The integration of artificial intelligence (AI) and predictive analytics into inventory management software is creating significant growth opportunities for businesses. AI-powered inventory solutions enable companies to automate demand forecasting, optimize stock replenishment, and enhance decision-making through real-time data analysis. Predictive analytics uses historical sales patterns, seasonal trends, and customer behavior insights to improve inventory planning, reducing stockouts and overstock situations. Companies such as IBM, Microsoft, and Oracle are heavily investing in AI-driven inventory solutions, helping businesses improve efficiency and reduce operational costs. Retailers and e-commerce platforms are particularly leveraging AI-powered inventory management to optimize fulfillment strategies and enhance customer satisfaction.

Additionally, machine learning algorithms are enabling businesses to detect fraudulent transactions, identify supply chain inefficiencies, and automate warehouse management. With the rapid expansion of digital commerce and omnichannel retailing, AI-based inventory solutions are expected to revolutionize inventory management by enabling dynamic pricing strategies and real-time order adjustments.

Challenges:

-

Data Security and Cybersecurity Threats Pose Significant Challenges in the Inventory Management Software Market

With the increasing reliance on cloud-based inventory management software, businesses face growing concerns about data security and cybersecurity threats. Inventory management systems store vast amounts of sensitive business data, including supplier information, stock levels, financial records, and customer details, making them prime targets for cyberattacks. The rising number of cyber threats, including ransomware attacks, data breaches, and phishing scams, poses a major challenge for companies adopting digital inventory solutions. Security vulnerabilities in cloud-based platforms can lead to unauthorized access, data manipulation, and financial losses.

Additionally, the risk of data corruption and system failures due to cyberattacks can disrupt supply chain operations and negatively impact business continuity. Companies such as Microsoft, SAP, and IBM are enhancing their inventory management software with advanced encryption protocols, multi-factor authentication, and AI-driven threat detection to mitigate cybersecurity risks. However, ensuring robust cybersecurity measures requires continuous investment in security infrastructure, employee training, and regulatory compliance.

Inventory Management Software Market Segment Analysis

By Application

The Order Management segment held the largest revenue share in the Inventory Management Software Market in 2023, driven by increasing adoption across industries such as retail, e-commerce, and manufacturing. Order management software automates the entire order fulfillment process, reducing errors, optimizing inventory levels, and ensuring seamless order processing across multiple channels.

For instance, Oracle NetSuite’s Order Management System enhances inventory visibility and automates order-to-cash workflows, while SAP’s Commerce Cloud provides AI-driven analytics for accurate demand forecasting.

The rapid expansion of omnichannel retailing has further fueled demand for these solutions, as businesses require seamless synchronization between online and offline sales channels. Additionally, automation in warehouses and the adoption of AI-driven order processing tools have significantly improved inventory efficiency, reducing stockouts and overstock situations.

The Inventory Control & Tracking segment is experiencing rapid growth, with a projected CAGR of 8.5% over the forecast period, driven by technological advancements in RFID, IoT, and AI-based tracking systems. Businesses across industries such as manufacturing, healthcare, and logistics are increasingly adopting real-time inventory tracking solutions to reduce errors, minimize theft, and enhance stock visibility. Leading companies such as IBM, Microsoft, and Fishbowl have developed AI-powered tracking solutions that use predictive analytics to optimize stock levels.

IBM’s Watson AI for inventory management integrates IoT-enabled RFID tracking, offering real-time stock insights and predictive demand forecasting. Similarly, Microsoft’s Dynamics 365 Supply Chain Management leverages AI and machine learning to automate replenishment decisions.

The rising adoption of automated warehouse management systems (WMS), barcode scanning, and cloud-based inventory control software further fuels segment growth. With businesses focusing on just-in-time (JIT) inventory strategies and demand-driven supply chains, the adoption of advanced inventory control solutions is expected to accelerate, making it the fastest-growing segment in the Inventory Management Software Market.

By Organization Size

Large enterprises accounted for the largest revenue share in the Inventory Management Software Market in 2023, primarily due to their complex supply chain networks and high-volume inventory management needs. Companies such as SAP, Oracle, and IBM offer enterprise-grade inventory management solutions designed to handle multi-location stock tracking, advanced analytics, and AI-driven automation. SAP’s Integrated Business Planning (IBP) and Oracle Fusion Cloud SCM provide end-to-end supply chain visibility and automated inventory optimization.

The integration of blockchain technology for inventory transparency and robotic process automation (RPA) in warehouses further enhances inventory accuracy and security. Additionally, large enterprises benefit from AI-powered demand forecasting tools that help minimize stockouts and overstock issues, ensuring efficient resource allocation.

The Small and Medium-Sized Enterprises (SMEs) segment is expected to grow at the highest CAGR in the Inventory Management Software Market, driven by the increasing adoption of cloud-based and AI-driven inventory solutions. SMEs are shifting from manual inventory tracking methods to affordable, scalable, and automated software solutions to enhance operational efficiency. Leading companies such as Zoho, Fishbowl, and Intuit QuickBooks are launching SME-friendly solutions with subscription-based pricing models, making inventory management technology accessible to small businesses.

Furthermore, SMEs benefit from mobile-based inventory management apps, enabling remote access and real-time tracking. With increasing government support for digital transformation initiatives and the rising number of SMEs adopting cloud technology, the segment is poised for significant expansion in the coming years.

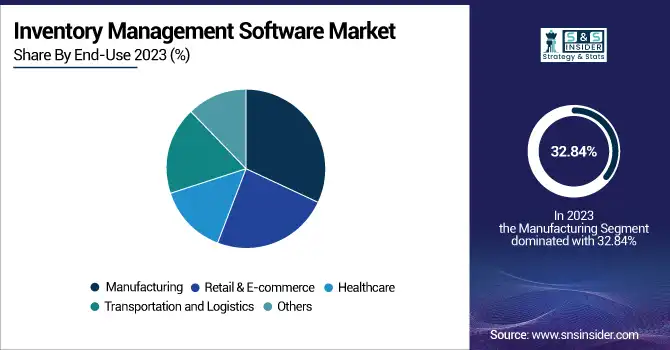

By End-Use

The Manufacturing sector dominated the Inventory Management Software Market in 2023, accounting for the largest revenue share due to its high dependency on real-time inventory tracking, supply chain automation, and just-in-time (JIT) inventory strategies. Manufacturing companies rely on advanced inventory management solutions to optimize raw material procurement, reduce waste, and improve production efficiency.

Additionally, manufacturers are leveraging blockchain technology for enhanced inventory traceability and counterfeit prevention. As the manufacturing industry shifts towards Industry 4.0 and smart factories, investments in intelligent inventory management software continue to grow, solidifying the segment’s dominance in the market.

The Retail & E-commerce segment is experiencing the fastest growth in the Inventory Management Software Market, with a projected CAGR of 8.05% over the forecast period. The rapid growth of online shopping, omnichannel retailing, and AI-driven inventory optimization is driving demand for automated inventory tracking and order fulfillment solutions.

Additionally, the integration of cloud-based POS (point-of-sale) systems and automated warehouse robotics enhances inventory accuracy and reduces human errors. As retailers focus on real-time stock updates, AI-driven recommendations, and seamless order management, the adoption of inventory management solutions in retail and e-commerce is expected to soar.

Regional Analysis

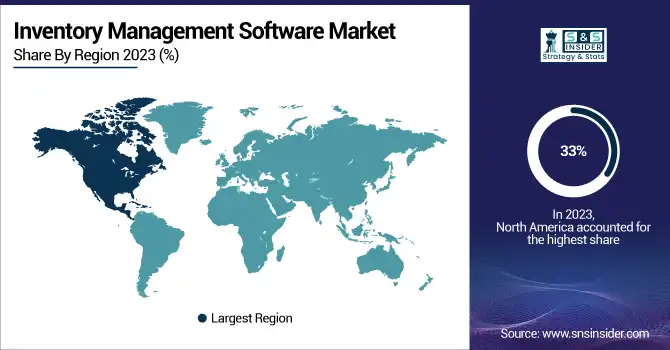

North America held the largest share in the Inventory Management Software Market in 2023, accounting for approximately 33% of the total market revenue. The dominance of this region is driven by strong digital infrastructure, high adoption of cloud-based inventory solutions, and the presence of leading software providers such as Oracle, SAP, Microsoft, and IBM. The U.S. leads the market due to the rapid implementation of AI-driven inventory systems, RFID tracking, and IoT-enabled warehouse management solutions in industries such as retail, e-commerce, healthcare, and manufacturing.

Additionally, the rise of omnichannel retailing and e-commerce platforms like Shopify has further increased the demand for efficient inventory management solutions. Government initiatives supporting digital transformation and supply chain automation also contribute to market growth in North America. With businesses increasingly adopting predictive analytics, robotics, and blockchain for inventory tracking, the region is expected to maintain its leadership in the global market.

The Asia Pacific region is the fastest-growing market for Inventory Management Software, with an estimated CAGR of 8.9% over the forecast period. This growth is fueled by the rapid expansion of the e-commerce sector, the rising digitalization of supply chains, and increasing investments in smart warehouse solutions. Countries like China, India, Japan, and South Korea are leading the adoption of AI-powered inventory tracking, cloud-based warehouse management, and IoT-enabled logistics solutions.

Additionally, government initiatives such as China’s "Made in China 2025" and India’s "Digital India" are promoting digital transformation in the supply chain and manufacturing sectors. Advancements in barcode scanning, RFID tracking, and AI-powered demand forecasting are further accelerating adoption. As more businesses in retail, logistics, and manufacturing invest in automated inventory solutions, the Asia Pacific region is expected to witness significant market expansion in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Oracle Corporation (Oracle NetSuite Inventory Management, Oracle Fusion Cloud SCM)

-

SAP SE (SAP Extended Warehouse Management, SAP Business One Inventory)

-

Microsoft Corporation (Microsoft Dynamics 365 Supply Chain Management, Microsoft Dynamics 365 Business Central)

-

IBM Corporation (IBM Sterling Inventory Control Tower, IBM Watson Supply Chain)

-

Manhattan Associates (Manhattan Active Inventory, Manhattan Active Supply Chain)

-

Epicor (Epicor Prophet 21, Epicor Kinetic Inventory Management)

-

Zoho Corporation (Zoho Inventory, Zoho Creator Supply Chain Management)

-

Fishbowl (Fishbowl Warehouse, Fishbowl Manufacturing)

-

NetSuite (NetSuite Inventory Management, NetSuite Warehouse Management System)

-

DataLogic (Datalogic Inventory Tracking Solutions, Datalogic RFID Inventory System)

-

NCR Corporation (NCR Counterpoint Inventory, NCR Power Inventory)

-

Intuit, Inc. (QuickBooks Commerce, QuickBooks Enterprise Inventory)

-

Acumatica, Inc. (Acumatica Cloud ERP Inventory Management, Acumatica Warehouse Management System)

Recent Trends

-

In March 2023, Manhattan Associates unveiled significant enhancements to its Manhattan Active Warehouse Management solution. These updates introduced advanced inventory management capabilities, including real-time tracking and predictive analytics, aimed at optimizing warehouse operations and improving inventory accuracy for retailers and distributors.

-

In May 2024, Epicor announced the acquisition of Smart Software, a provider of AI-powered inventory planning solutions. This strategic move is intended to integrate advanced forecasting and inventory optimization tools into Epicor's existing inventory management software, enabling businesses to enhance demand planning and reduce holding costs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.87 Billion |

| Market Size by 2032 | US$ 5.40 Billion |

| CAGR | CAGR of 7.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Inventory Control & Tracking, Order Management, Scanning and Barcoding, Asset Management, Others) • By Deployment (Cloud, On-premises) • By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises) • By End-Use (Retail & E-Commerce, Healthcare, Transportation and Logistics, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle Corporation, SAP SE, Microsoft Corporation, IBM Corporation, Manhattan Associates, Epicor, Zoho Corporation, Fishbowl, NetSuite, DataLogic, NCR Corporation, Intuit, Inc., Acumatica, Inc. |