To Get More Information on Intrusion Detection System Market - Request Sample Report

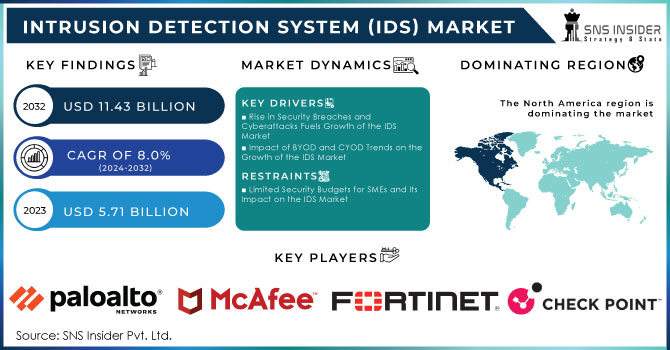

The Intrusion Detection System (IDS) Market Size was valued at USD 5.71 Billion in 2023 and is expected to reach USD 11.43 Billion by 2032 and grow at a CAGR of 8.0% over the forecast period 2024-2032.

An emerging IDS market exists as a result of the growing need for efficient solutions to robust cybersecurity in a world where digital threats are rising to high levels day after day. IDS plays an integral role in identifying malicious activities or policy violations within a network, hence making them an important part of a defence strategy within an organization. The monitoring systems track network traffic, which means they detect suspicious activities that may define potential cyber-attacks. With more and more markets embracing advanced security measures to protect sensitive information, and critical infrastructures, and to comply with government regulations, market IDS is on a steep growth curve. The following is an overview of the major growth drivers in the IDS market.

The increasing sophistication and virulence of cyberattacks is, however, one of the major driving factors behind the IDS market. Cybercriminals are continually evolving more sophisticated methods such as Distributed Denial of Service (DDoS), ransomware, and pushing attacks targeting organizations irrespective of sectors. For this reason, companies have begun using IDS solutions to strengthen their defences by real-time monitoring and threat detection. According to Cybersecurity Ventures, cybercrime costs are expected to grow to USD 10.5 trillion annually by 2025, and thus, investment in such strong security systems as IDS is crucial in preventing financial loss and reputational damage. This can also be seen in the initiatives of the U.S. Department of Homeland Security (DHS), where national cybersecurity has been reinforced with programs such as the EINSTEIN program an IDS-based system that detects and prevents cyber threats across federal networks. These government initiatives underscore the utmost importance of IDS in securing national infrastructure. Growing cyber threats and the emergence of increasingly sophisticated attack methodologies, like zero-day vulnerabilities and APTs, demonstrate the pressing need for IDS technologies that detect known and new threats. Therefore, a tremendous increase in the IDS market is expected, as it simply mirrors the increasing threat landscape.

KEY DRIVERS:

• Rise in Security Breaches and Cyberattacks Fuels Growth of the IDS Market

The rising phenomenon of intense cyberattacks on a global level is a very compelling factor in installing Intrusion Detection Systems. Such attacks most often relate to sophisticated politically motivated or financially driven attacks on endpoints, networks, and IT infrastructures with consequent attrition of tremendous data loss among individuals, corporations, and government entities. The Identity Theft Resource Centre reports data breaches in the U.S. alone affected over 422 million individuals during 2022, a 41.5 percent increase over 2021, further highlighting the rising threat landscape. Increased dependency on digital transactions across finance, healthcare, and e-commerce continues to amplify the risk of security breaches. With much sensitive data now being processed and stored online, the risk of data leaks or theft increases and calls for more advanced systems of detection and prevention.

• Impact of BYOD and CYOD Trends on the Growth of the IDS Market

The BYOD and CYOD models in organizations have grown rapidly to increase the implementation of intrusion detection and prevention systems as a form of protection from cyber-attacks. In addition to growing reliance on the BYOD and CYOD model, people in an organization use personal or company-selected devices such as smartphones, laptops, or tablets to access corporate networks remotely. This change has increased the attack surface for potential cyber threats because those devices can become vulnerable entry points for malicious actors. What is more, workers access corporate data from diverse locations and devices, so there is a great urge to make the devices and networks more secure.

In light of this trend of mobile and remote working, organizations have had to adopt the most updated security solutions such as IDPS, which monitor and detect anomalies in the connected devices and ensure secure access to the corporate networks. The global IDPS market will quite be promising because companies are still looking to invest in the solutions that secure their growing digital infrastructure. The U.S. The National Institute of Standards and Technology says "As BYOD becomes more pervasive, companies will have to balance the trend with the need for cybersecurity, since there is an associated security risk when personal devices are used for business functions."

RESTRAIN:

• Limited Security Budgets for SMEs and Its Impact on the IDS Market

SMEs face great challenges in cyber security because of small budgets which may prohibit them from installing advanced security solutions that entail more than just the point solutions, for example, Intrusion Detection Systems. Large corporations can allocate large sums of money towards establishing strong information security infrastructure whilst SME needs to split their budget across several IT investments which in most cases hold priorities to issues in immediate operational needs rather than in cyber security. There is also the high R&D expenditure when designing such next-generation cybersecurity solutions as IDS, which contributes to why these technologies come at a cost. Such high prices mean that smaller organizations cannot hope to achieve even a fraction of the security levels enjoyed by their more prominent counterparts, thus becoming easy targets for cyberattacks. According to the survey, by the Ponemon Institute, nearly 60% of small businesses have been victims of a cyberattack. As such, there's an urgent need for at least decent affordability in cybersecurity solutions. For most SMEs, however, such a well-rounded IDS solution needed to detect and neutralize such attacks would prove unaffordable. Furthermore, the US Small Business Administration has reported that 43% of all cybersecurity attacks target small businesses, thereby making it riskier for those small businesses that spend less on their security. Apart from these costs, SMEs have to incur the recruitment of cybersecurity experts to run these systems with additional financial burdens that exacerbate the situation. Despite these financial constraints, cloud-based IDS solutions are a better and more cost-effective solution for SMEs with scalable security systems at lower up-front costs. Government efforts, through such programs as the Cybersecurity and Infrastructure Security Agency (CISA) providing small businesses with cybersecurity guides, are also part of bridge-building activities that advance accessible and affordable mechanisms in cybersecurity.

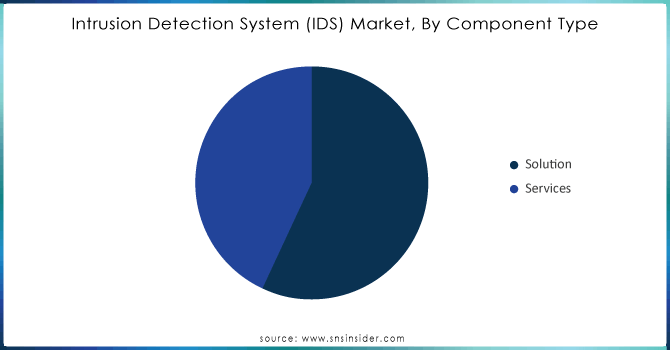

BY COMPONENT TYPE

In 2023, the Solution Segment led the global Intrusion Detection System (IDS) market with a significant revenue share of about 56.00%, majorly due to the increasing demand for sophisticated cybersecurity strategies in light of increasing cyber-attacks. Organizations are increasingly investing in deploying robust IDS solutions to improve their security posture. Major players, such as Cisco Systems have designed cutting-edge AI-based IDS capabilities to increase their threat detection and response capabilities. In the meantime, Palo Alto Networks also pushed its cloud-based IDS solutions to hybrid environments. This should help ensure that the organization can scale its security infrastructure effectively. Such a rising need for effective intrusion detection must be complemented by similar initiatives from the Cybersecurity and Infrastructure Security Agency (CISA), which regards real-time monitoring tools as critical to safeguarding the nation's critical infrastructure. The rise in cybercrime tactics will just increase the focus on IDS solutions, as they comprise a vital part of cybersecurity.

The Services Segment is expected to grow the most in the IDS market during the forecast period. It will have an estimated CAGR of 9.33%. It is driven by increased demand for managed security services and expert advice on tackling sophisticated cyber threats. For instance, IBM expanded its services to include advanced analytics in its managed security services to better detect threats and respond more effectively. Fortinet, not long ago, launched FortiGuard, which includes tailored detection of threat capabilities and incident response. McAfee recently launched a new set of managed security services targeting the real-time monitoring of emerging threats so organizations become responsive in a timely fashion. As companies are looking for integrated solutions that combine technology with expert services, the IDS service is going to rise in demand and will form a vital part of modern strategies on cybersecurity.

Do You Need any Customization Research on Intrusion Detection System Market - Inquire Now

BY DEPLOYMENT TYPE

Cloud-based was the largest segment in the intrude detection system (IDS) market in 2023. The segment accounted for 66.00% of revenue. It is because organizations these days are adopting cloud technology to achieve scalable and flexible security solutions without the burden of carrying on-premises infrastructure. These innovations have further empowered AWS to introduce the Amazon GuardDuty, a cloud-native threat detection service, that continuously scans for malicious activity and unauthorized behavior thereby emphasizing more cloud-based security. Cisco also extended its cloud security portfolio by integrating advanced IDS features that allow organizations to protect data stored within various environments of the cloud. With the growing demand for cloud-based infrastructure among enterprises, the requirement for solid IDS solutions in the cloud is expected to rise exponentially and hence will constitute a critically vital area in the overall IDS market.

The infrastructure-Based segment in the Intrusion Detection System (IDS) market is expected to grow at the highest compound annual growth rate over the coming years due to the need for customized security solutions for the on-premises environment. This growth is enormously impacted by the rise in cybersecurity threats on critical infrastructures in the financial, healthcare, and government sectors. which streamlines threat detection and response across network environments. In addition, IBM has designed its QRadar system, which offers rich visibility into network flows, enabling organizations to become aware of potential intrusions more easily. As organizations continue to pay greater attention to securing their infrastructure, investments in robust IDS solutions are expected to increase dramatically.

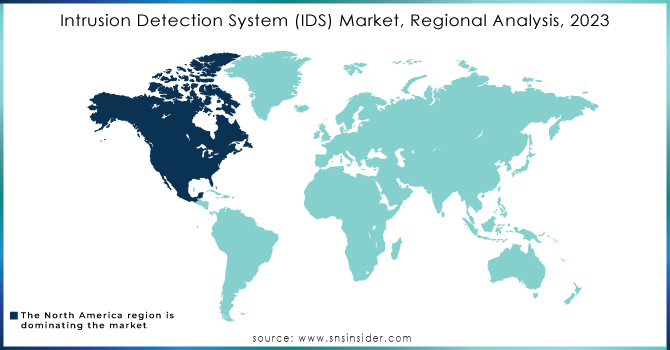

North America is one of the most prized markets for intrusion detection systems currently and is likely to continue in the future as well, due to soaring government spending on data safety & security, the mature IT industry, and growing awareness about security solutions. Countries like the USA are witnessing a high demand for intrusion detection systems as cases of cyberattacks are on the rise. At times, these countries have accused their adversaries, including Russia and China, of launching cyber-attacks. The threat of such cyber-attacks in these countries is fueling the growth of the intrusion detection system market.

The Asia Pacific IDS market is expected to grow at a healthy CAGR of 10.23% over the review period, led by several factors. Notably, the emerging IT infrastructure in countries such as India and China is driving the adoption of advanced security solutions. For example, the Indian government has allocated around USD 14 billion towards strengthening the cybersecurity infrastructure of the country under its National Cyber Security Strategy. Another factor is the growth of cloud computing in the region, where Frost & Sullivan has indicated that growth is expected to be 30% per year. Scalable IDSs that can monitor and protect the cloud environment will become more important. Government support also increases this growth trend. For instance, Singapore's Cybersecurity Strategy 2021 commits to public-private partnerships toward strengthening cybersecurity efforts, which has triggered enterprises to move forward toward the advanced protection offered by modern IDS technologies. The potential escalation in demand for IDSs will be justified by the relevance of sound security frameworks in organizations, which will give an impetus to market growth in the Asia-Pacific region.

Some of the major players in the Intrusion Detection System Market are:

Palo Alto Networks (Palo Alto Networks WildFire, Cortex XDR)

Cisco (Cisco Firepower Next-Generation Firewall, Cisco Advanced Malware Protection)

McAfee (McAfee Enterprise Security Manager, McAfee Advanced Threat Protection)

Fortinet (FortiGate Next-Generation Firewall, FortiSandbox)

IBM (IBM QRadar Security Intelligence Platform, IBM Security Guardium Data Security Platform)

Check Point Software Technologies (Check Point Infinity Architecture, Check Point Threat Prevention)

Trend Micro (Trend Micro Deep Security, Trend Micro Network Security Platform)

Sophos (Sophos XG Firewall, Sophos Intercept X Advanced Endpoint Protection)

Kaspersky (Kaspersky Security Center, Kaspersky Endpoint Security)

Symantec (Symantec Endpoint Protection, Symantec Advanced Threat Protection)

Rapid7 (InsightVM Vulnerability Management, InsightIDR Security Detection and Response)

Darktrace (Darktrace Enterprise Immune System, Darktrace Antigena)

CrowdStrike, (CrowdStrike Falcon Platform, CrowdStrike Falcon Endpoint Protection)

Carbon Black (Carbon Black Cloud Platform, Carbon Black Endpoint Protection)

Qualys (Qualys Vulnerability Management and Compliance, Qualys Cloud Agent)

Tripwire (Tripwire Enterprise, Tripwire Log Center)

ArcSight (ArcSight Enterprise Security Management (ESM), ArcSight Logger)

LogRhythm (LogRhythm NextGen SIEM, LogRhythm Threat Detection and Response)

AlienVault (AlienVault OSSIM, AlienVault Threat Intelligence Platform)

Suricata (Suricata Open-source IDS, Suricata Cloud IDS)

Cisco Systems, Inc.

McAfee, LLC

Palo Alto Networks, Inc.

Fortinet, Inc.

IBM Corporation

Juniper Networks, Inc.

Check Point Software Technologies

FireEye, Inc.

AT&T Cybersecurity

Rapid7, Inc.

In June 2024: the rail system will install an optical fiber-based intrusion detection system along its 33-km Kottekkad-Madukkarai section. This would be the first time the Southern Railway would be using the system, which has been successfully installed in four divisions of the NFR.

In August 2024: Fortinet the global cybersecurity leader that builds trust in and protects the digital world, delivering comprehensive, end-to-end security and strong risk/reward. today announced enhancements to its OT security platform, a benchmark for the industry as the most comprehensive. The new features enhance the company's customers' ability to improve secure networking and security operations capabilities while further expanding Fortinet's strategic alliances with some of the top OT vendors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.71 Billion |

| Market Size by 2032 | US$ 11.43 Billion |

| CAGR | CAGR of 8.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-User Type (BFSI, IT & Communication, Aerospace and Defense, Software Industry, Manufacturing) • By Deployment Type (Cloud-Based, Infrastructure-Based) • By Component Type (Solution, SERVICES) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Palo Alto Networks, Cisco, McAfee, Fortinet, IBM, Check Point Software Technologies, Trend Micro, Sophos, Kaspersky, Symantec, Rapid7, Darktrace, CrowdStrike, Carbon Black, Qualys, Tripwire, ArcSight, LogRhythm, AlienVault, Suricata |

| Key Drivers | • Rise in Security Breaches and Cyberattacks Fuels Growth of the IDS Market • Impact of BYOD and CYOD Trends on the Growth of the IDS Market |

| Restraints | • Limited Security Budgets for SMEs and Its Impact on the IDS Market |

Ans: The Intrusion Detection System Market is expected to grow at a CAGR of 8.0% during 2024-2032.

Ans: The Intrusion Detection System Market size was USD 5.71 billion in 2023 and is expected to Reach USD 11.43 billion by 2032.

Ans: The major growth factor of the Intrusion Detection System Market is the increasing demand for advanced security solutions to protect networks and systems from cyber threats.

Ans: The Solution dominated the Intrusion Detection System Market.

Ans: North America dominated the Intrusion Detection System Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Intrusion Detection System Market Segmentation, By Component Type

7.1 Chapter Overview

7.2 Solution

7.2.1 Solution Market Trends Analysis (2020-2032)

7.2.2 Solution Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Intrusion Detection System Market Segmentation, By End-Use Type

8.1 Chapter Overview

8.2 BFSI

8.2.1 BFSI Market Trends Analysis (2020-2032)

8.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 IT & Communication

8.3.1 IT & Communication Market Trends Analysis (2020-2032)

8.3.2 IT & Communication Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Aerospace and Defense

8.4.1 Aerospace and Defense Market Trends Analysis (2020-2032)

8.4.2 Aerospace and Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Software Industry

8.5.1 Software Industry Market Trends Analysis (2020-2032)

8.5.2 Software Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Manufacturing

8.6.1 Manufacturing Market Trends Analysis (2020-2032)

8.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Intrusion Detection System Market Segmentation, By Deployment Type

9.1 Chapter Overview

9.2 Cloud-Based

9.2.1 Cloud-Based Market Trends Analysis (2020-2032)

9.2.2 Cloud-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Infrastructure-Based

9.3.1 Infrastructure-Based Market Trends Analysis (2020-2032)

9.3.2 Infrastructure-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Intrusion Detection System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.2.4 North America Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.2.5 North America Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.2.6.2 USA Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.2.6.3 USA Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.2.7.2 Canada Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.2.7.3 Canada Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Intrusion Detection System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Intrusion Detection System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.7.2 France Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.7.3 France Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Intrusion Detection System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.6.2 China Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.6.3 China Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.7.2 India Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.7.3 India Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.8.2 Japan Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.8.3 Japan Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.12.2 Australia Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.12.3 Australia Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Intrusion Detection System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Intrusion Detection System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.2.4 Africa Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.2.5 Africa Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Intrusion Detection System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.6.4 Latin America Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.6.5 Latin America Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Intrusion Detection System Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Intrusion Detection System Market Estimates and Forecasts, By Component Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Intrusion Detection System Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Palo Alto Networks

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Cisco

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 McAfee

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Fortinet

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Trend Micro

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Sophos

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Kaspersky

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Darktrace

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 CrowdStrike

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 LogRhythm

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

MARKET SEGMENTATION

BY COMPONENT TYPE

Solution

SERVICES

By Deployment Type

Cloud-Based

Infrastructure-Based

By End-User Type

BFSI

IT & Communication

Aerospace and Defense

Software Industry

Manufacturing

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Customer Success Platform Market size was recorded at USD 1.48 billion in 2023 and is expected to Reach USD 8.10 billion by 2032, growing at a CAGR of 22.2 % over the forecast period of 2024-2032.

The Serverless Computing Market was valued at USD 19.30 billion in 2023 and will reach USD 70.52 billion by 2032, growing at a CAGR of 15.54% by 2032.

The Wireless Microphone Market was valued at USD 2.21 Billion in 2023 and is expected to reach USD 4.50 Billion by 2032, growing at a CAGR of 8.21% by 2032.

Hybrid Cloud Market was valued at USD 96.78 billion in 2023 and is expected to reach USD 405.62 billion by 2032, growing at a CAGR of 17.31% by 2032.

The Telecom Billing and Revenue Management Market was valued at USD 17.24 billion in 2023 and is expected to reach USD 43.03 billion by 2032, growing at a CAGR of 10.73% over the forecast period 2025-2032.

The Modular Data Center Market was valued at USD 25.3 Billion in 2023 and is expected to reach USD 111.3 Billion by 2032, growing at a CAGR of 17.93% by 2032.

Hi! Click one of our member below to chat on Phone