Get More Information on Intruder Alarm Systems Market - Request Sample Report

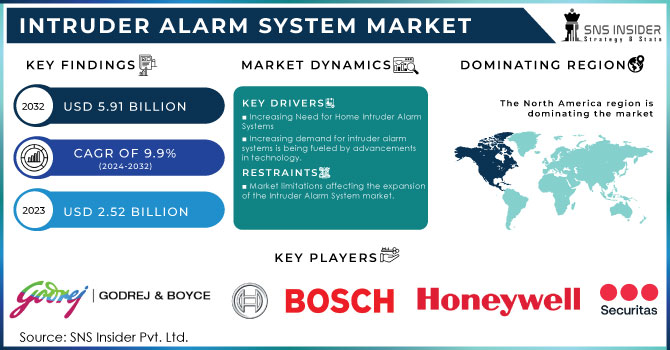

The Intruder Alarm System Market Size was valued at USD 2.52 Billion in 2023 and is expected to grow to USD 5.91 Billion by 2032 and grow at a CAGR of 9.9% over the forecast period of 2024-2032.

The market for intruder alarm systems is growing steadily due to increasing worries about security for homes and businesses, along with advancements in technology. These systems, which identify unauthorized entry and notify homeowners or security staff, are gaining popularity because of the rising focus on safety and the incorporation of smart home capabilities. In 2023, a large number of alarm systems were used by approximately 39 million households in the United States, spanning both residential and commercial markets. Estimates for 2024 indicate that 13 million more households will adopt new systems, indicating an increasing interest in improved security measures. Nevertheless, obstacles like expensive installation and upkeep fees, worries regarding privacy and cybersecurity threats, and the absence of industry uniformity are still hindering wider acceptance.

The market for home security systems is growing rapidly due to rising worries about residential safety and progress in smart home technologies. As more homeowners look for increased security against burglary and other dangers, the intruder alarm system market, an important sector of this industry, is growing. Projections suggest that the market will keep expanding as more households in the U.S. choose to install alarm systems, with an estimated 13 million new systems being installed in 2024. Technological advancements in security devices, like video surveillance and access control systems, are driving this trend and are now more easily available to customers. Nevertheless, obstacles such as expensive installation and upkeep, privacy issues, cybersecurity risks, and a lack of uniformity in the industry are impeding widespread market adoption. In 2023, around 39 million households in the United States were protected by alarm systems, with 72% of homeowners implementing a security measure of some kind. 43% chose professional installation, the remaining individuals set up their own systems, showcasing the variety of options in the market. 42% of homeowners utilize video surveillance, while 37% use video doorbells, and 32% have alarm systems installed, making them some of the most popular devices. The market for intruder alarm systems in the U.S. in 2023 remains highly fragmented, with a total of 57,238 businesses, showing a 4.6% decrease compared to the previous year. California, Florida, and Texas are top in the security alarm service provider market, with California having 9,504 businesses on its own. In spite of these obstacles, the ongoing expansion of the home security industry demonstrates a rising need for complete safety solutions, with the intruder alarm system market taking a key role in influencing future developments.

Drivers

Increasing Need for Home Intruder Alarm Systems

The residential sector is seeing strong growth in the uptake of intruder alarm systems, due to rising security worries and heightened consumer knowledge. Despite intruder alarms being commonly used in residential, commercial, military, and industrial settings, the residential sector is experiencing a significant increase in demand. The decreasing costs of technology are encouraging homeowners to upgrade or install new systems, driven by technological improvements. The increase in gated communities, particularly in developing countries, is increasing demand even more, as security becomes a major concern for residents. Governments are also actively involved in promoting these technologies to address the increasing levels of crime. The National Crime Victimization Survey from the U.S. Department of Justice shows that homes with security systems, like intruder alarms, have a much lower chance of being burglarized, leading to increased use of these systems. Moreover, according to FBI Crime Data, there was a substantial decrease in burglaries in the United States, with approximately 1.04 million incidents reported in 2020, a trend that is partly linked to the increasing adoption of home security systems. The continuous emphasis on home security, supported by government efforts and increased consumer interest in advanced safety features, is projected to fuel consistent growth in the intruder alarm system market, creating new chances for advancement and growth.

Increasing demand for intruder alarm systems is being fueled by advancements in technology.

The need for intruder alarm systems is set to grow significantly because of the ongoing introduction of advanced technologies like biometrics and smart card systems, which are becoming more popular with consumers. Although traditional access control technologies such as keypad systems and magnetic stripe cards will continue to be used because of their ease of use, there is a noticeable trend towards adopting more sophisticated technologies. Moreover, an upturn in both business and consumer spending, especially in residential construction, is driving growth in the intruder alarm system market. This fast-growing industry driven by technology is quickly changing, improving product features for consumers. The integration of wireless technology has greatly enhanced intruder alarm systems, making them more effective and easier to use. With the decreasing cost of wireless technology, manufacturers are introducing more cost-effective choices that cater to a wider range of customers. Furthermore, a lot of systems currently include touchscreen interfaces, improving user experience and making control easier. The rise in burglary cases, as noted by the BJS National Crime Victimization Survey (NCVS), has heightened the demand for efficient intruder alarm systems. The NCVS shows that homes with security systems have lower property crime rates, emphasizing the significance of security measures for houses. As people deal with the demands of hectic schedules, the importance of being able to monitor and control home security systems remotely through smartphone integration has become crucial. Major manufacturers are prioritizing the creation of automated home security systems that utilize GSM technology and embedded microcontroller units. These developments are expected to draw in more customers to choose advanced burglar alarm systems, leading to increased market expansion as safety and ease become top priorities in home security options.

Restraints

Market limitations affecting the expansion of the Intruder Alarm System market.

Although the intruder alarm system market shows promise in terms of growth, there are various factors that could limit its expansion. A major obstacle is the expensive upfront cost of buying and setting up these systems, which may discourage potential buyers, particularly in markets where price is a key concern. Furthermore, continuing to pay for maintenance and subscription fees for monitoring services can add to the total expenses, causing consumers to delay their purchase of home security systems. Many people are hesitant to embrace these technologies due to concerns about constant monitoring and invasion of privacy. Moreover, there is a significant risk posed by cybersecurity threats as more intruder alarm systems are being connected to the internet, thus becoming susceptible to hacking and data breaches. Consumers may face difficulties in finding compatible systems or trusting the security measures of different vendors due to the industry's lack of standardization, adding complexity. Inadequate knowledge about the advantages of intruder alarm systems could restrict market entry in specific areas. In conclusion, the market's diversity, which includes many different companies offering various products, can cause confusion for consumers, making it difficult to find the best solutions. These combined factors may hamper the growth of the intruder alarm system market.

by Type

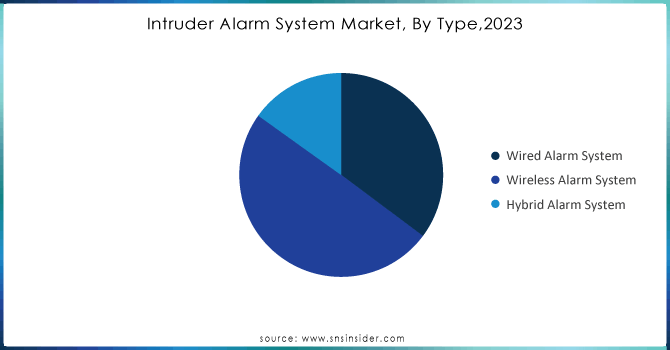

The wireless alarm system sector asserted its dominance in the intruder alarm system market in 2023, capturing 49.67% of the revenue. Several factors, such as the ease of installation and scalability provided by wireless systems, are responsible for this increase in growth, as opposed to traditional wired systems. With the increasing demand for smart home technology from consumers, manufacturers are making investments in wireless solutions that can easily connect with other smart devices.As an example, Ring, a company owned by Amazon, has introduced high-tech wireless security cameras and alarm systems with remote monitoring and control feature through mobile applications. Likewise, ADT Inc. has broadened its range of products with fresh wireless home security options, highlighting easy-to-use interfaces and advanced functionalities such as instant notifications and choices for cloud storage. The increasing popularity of smart home technology is fueling the need for wireless alarm systems, which are becoming more and more compatible with Internet of Things devices.

Additionally, the improvement of battery technology and the addition of features like two-way sound and upgraded motion detection abilities are increasing the attractiveness of wireless systems to customers. Therefore, the wireless alarm system sector is expected to maintain its strong upward trend, greatly impacting the overall workings of the intruder alarm system market.

Need any customization research on Intruder Alarm System Market- Enquiry Now

by Application

In the intruder alarm system market, the residential application segment saw a significant revenue share of 64.56% in 2023, indicating an increasing focus on home security by consumers. The increase in need is mostly caused by increased worries about safety and higher crime levels, leading homeowners to buy reliable security systems to protect their homes and loved ones. Major players in the market are reacting by introducing creative products specifically designed for home use. One example is Vivint Smart Home’s introduction of a cutting-edge home security system that utilizes artificial intelligence to provide live monitoring and notifications, allowing homeowners to easily control their security through mobile devices. In the same way, SimpliSafe increased its range of products with the introduction of a new DIY security system created for simple installation, targeting homeowners in search of affordable yet trustworthy options. The rise of smart home technology is boosting the growth of this market, as companies like Nest are incorporating burglar alarms into other smart products to provide remote access and automation options. These advancements not only improve user experience but also increase the attractiveness of residential intruder alarm systems to tech-savvy consumers. With a focus on security, the intruder alarm system market is expected to experience continuous growth due to advancements in technology and higher interest from consumers in the residential sector.

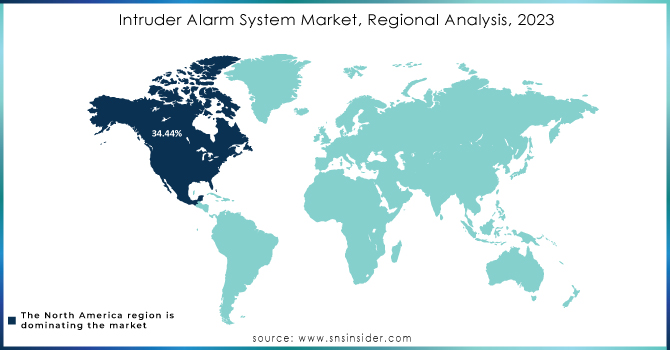

In the intruder alarm system market, North America dominated in 2023, claiming around 34.44% of the total revenue. Several factors contribute to this dominance, such as a surge in crime rates and growing consumer concern for safety leading to a high demand for advanced security solutions. The area has experienced notable technological progress, especially in the field of smart home security systems. ADT Inc. and other companies have introduced new products like the ADT Command, which combines home security and automation functions, enabling users to manage alarms and security cameras through smartphone applications. In the same manner, Vivint launched its Vivint Smart Home Security system with a focus on easy-to-use interfaces and wireless technology. The United States and Canada lead in market growth due to government efforts to improve public safety and security. For example, many state and local governments have put in place initiatives that promote the use of security technologies by homeowners, offering financial rewards for installing them. Moreover, the rising urbanization rates in cities, especially in metropolitan regions, have led to an increase in the development of gated communities, which has also boosted the need for advanced intruder alarm systems. Consequently, North America continues to be an important market for progress and development in the intruder alarm industry, paving the way for continuous improvements in security technology.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for intruder alarm systems, driven by rapid urbanization, increasing disposable incomes, and heightened awareness of security concerns among consumers. Countries such as China and India are leading this growth due to their burgeoning middle class and urban expansion. The growing adoption of smart technologies is further propelling demand for advanced security systems. For instance, Hikvision, a prominent player in the security industry, launched its DeepinView series of cameras that incorporate AI-driven features for enhanced intrusion detection capabilities. Additionally, Bosch Security Systems introduced its B Series Intrusion Panels, which offer flexible, scalable solutions for residential and commercial applications. Government initiatives aimed at improving public safety and urban planning, such as smart city projects, are also contributing to the market's expansion. For example, the Indian government's push for smart city development includes the integration of advanced security systems in urban infrastructure. The increasing frequency of burglaries and property crimes in urban areas has heightened consumer demand for reliable intruder alarm solutions, making the Asia-Pacific market a focal point for manufacturers looking to innovate and expand their product offerings. This combination of factors positions the Asia-Pacific region as a pivotal area for growth in the global intruder alarm system market.

Key Players

Some of the Major key players in the Intruder Alarm System Market, along with relevant products they offer:

Godrej & Boyce Mfg. Co. Ltd (Electronic Security Systems)

Johnson Controls (Tyco Security Products)

Robert Bosch GmbH (Bosch Intrusion Alarm Systems)

Honeywell International Inc (Honeywell Security Solutions)

ADT (ADT Pulse Smart Home Security)

Assa Abloy Group (Assa Abloy Alarm Systems)

Hangzhou Hikvision Digital Technology Co., Ltd (Hikvision Intruder Alarms)

Banham Group (Banham Intruder Alarm Systems)

Securitas AB (Securitas Alarm Services)

Risco Group (Risco Intruder Alarm Systems)

Napco Security Technologies (Napco Intruder Alarm Systems)

Axis Communications (Axis Network Cameras and Alarm Systems)

Dahua Technology Co., Ltd (Dahua Intruder Alarm Solutions)

Infinova (Infinova Security Alarm Systems)

Vivint (Vivint Smart Home Security)

Netgear (Arlo Smart Security Cameras)

Kidde (Kidde Security Alarms)

iControl Networks (iControl Home Security Solutions)

Frontpoint Security (Frontpoint Home Security Systems)

SecureNet (SecureNet Monitoring and Alarm Solutions)

Ring (Ring Alarm Security Kit)

Others

Recent Development

On February 11, 2024, Ring launched the Ring Battery Video Doorbell Pro, its most advanced battery-powered doorbell. Unlike previous models that required a wired connection, this new version features 3D motion detection and Bird's Eye View for improved accuracy and flexibility in motion alerts while minimizing false positives.

On December 20, 2022, ADT UK and Ireland launched the ADT Smart Home Hub, a new touchscreen alarm panel for their ADT Smart Home system .

August of 2021, Honeywell has introduced the Morley MAx fire detection and alarm system, which aids in the protection of buildings and occupants.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.52 Billion |

| Market Size by 2032 | USD 5.91 Billion |

| CAGR | CAGR of 9.9 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wired Alarm System, Wireless Alarm System, Hybrid Alarm System) • By Component (Hardware, Alarm Sensors, RTU, Central Monitoring Receiver, Motion Detection Sensor, Others, Software, Services) • By Application (Residential, Commercial & Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Godrej & Boyce Mfg. Co. Ltd, Johnson Controls, Robert Bosch GmbH, Honeywell International Inc, ADT, Assa Abloy Group, Hangzhou Hikvision Digital Technology Co., Ltd, Banham Group, Securitas AB, Risco Group, Napco Security Technologies, Axis Communications, Dahua Technology Co., Ltd, Infinova, Vivint, Netgear, Kidde, iControl Networks, Frontpoint Security, SecureNet, Ring & Others |

| Key Drivers | • Increasing Need for Home Intruder Alarm Systems • Increasing demand for intruder alarm systems is being fueled by advancements in technology. |

| Restraints | • Market limitations affecting the expansion of the Intruder Alarm System market. |

Ans: Intruder Alarm System Market size was valued at USD 2.52 billion in 2023 and is expected to grow to USD 5.91billion by 2032.

Ans: North America dominated the Intruder Alarm System Market in 2023.

Ans: The major growth factor of the Intruder Alarm System Market is the increasing demand for advanced security solutions driven by rising concerns over safety and security in residential and commercial spaces.

Ans: The Intruder Alarm System Market grow at a CAGR of 9.9 %over the forecast period of 2024-2032.

Ans: The Wireless Alarm System segment dominated the Intruder Alarm System Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Intruder Alarm System Market Segmentation, by Type

7.1 Chapter Overview

7.2 Wired Alarm System

7.2.1 Wired Alarm System Market Trends Analysis (2020-2032)

7.2.2 Wired Alarm System Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Wireless Alarm System

7.3.1 Wireless Alarm System Market Trends Analysis (2020-2032)

7.3.2 Wireless Alarm System Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Hybrid Alarm System

7.4.1 Hybrid Alarm System Market Trends Analysis (2020-2032)

7.4.2 Hybrid Alarm System Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Intruder Alarm System Market Segmentation, by Component

8.1 Chapter Overview

8.2 Hardware

8.2.1 Hardware Market Trends Analysis (2020-2032)

8.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Alarm Sensors

8.2.3.1 Alarm Sensors Market Trends Analysis (2020-2032)

8.2.3.2 Alarm Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 RTU

8.2.4.1 RTU Market Trends Analysis (2020-2032)

8.2.4.2 RTU Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.5 Central Monitoring Receiver

8.2.5.1 Central Monitoring Receiver Market Trends Analysis (2020-2032)

8.2.5.2 Central Monitoring Receiver Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.6 Motion Detection Sensor

8.2.6.1 Motion Detection Sensor Market Trends Analysis (2020-2032)

8.2.6.2 Motion Detection Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.7 Others

8.2.7.1 Others Market Trends Analysis (2020-2032)

8.2.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Software

8.3.1 Software Market Trends Analysis (2020-2032)

8.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Services

8.4.1 Services Market Trends Analysis (2020-2032)

8.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Intruder Alarm System Market Segmentation, by Application

9.1 Chapter Overview

9.2 Residential

9.2.1 Residential Market Trends Analysis (2020-2032)

9.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Commercial & Industrial

9.3.1 Commercial & Industrial Market Trends Analysis (2020-2032)

9.3.2 Commercial & Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Intruder Alarm System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.5 North America Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.6.3 USA Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.7.3 Canada Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.8.3 Mexico Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Capability Centers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.6.3 Poland Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Capability Centers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.7.3 Romania Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Capability Centers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.5 Western Europe Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.6.3 Germany Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.7.3 France Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.8.3 UK Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.9.3 Italy Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.10.3 Spain Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.13.3 Austria Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Intruder Alarm System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.6.3 China Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.7.3 India Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.8.3 Japan Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.9.3 South Korea Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.10.3 Vietnam Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.11.3 Singapore Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.12.3 Australia Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Capability Centers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.5 Middle East Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.6.3 UAE Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Capability Centers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.5 Africa Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Capability Centers Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Capability Centers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Intruder Alarm System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.5 Latin America Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.6.3 Brazil Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.7.3 Argentina Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.8.3 Colombia Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Intruder Alarm System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Intruder Alarm System Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Intruder Alarm System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Godrej & Boyce Mfg. Co. Ltd

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Johnson Controls

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Robert Bosch GmbH

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Honeywell International Inc

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 ADT

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Assa Abloy Group

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Hangzhou Hikvision Digital Technology Co., Ltd

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Banham Group

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Securitas AB

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Risco Group

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Wired Alarm System

Wireless Alarm System

Hybrid Alarm System

By Component

Hardware

Alarm Sensors

RTU

Central Monitoring Receiver

Motion Detection Sensor

Others

Software

Services

By Application

Residential

Commercial & Industrial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Supercapacitors Market Size was valued at USD 2.36 Billion in 2023 and expected to grow at a CAGR of 16.05% to reach USD 9.01 Billion by 2032.

The Factory Automation Sensor Market Size was valued at USD 15.98 billion in 2023 and is expected to reach USD 26.26 billion by 2032 and grow at a CAGR of 5.68% by 2032.

The Precision Aquaculture Market Size was valued at USD 529.47 million in 2023 and is expected to grow at 14.38% CAGR to reach USD 1767.15 million by 2032

The Power Management IC Market Size was valued at USD 36.63 Billion in 2023 and is expected to grow at a CAGR of 5.5% to reach USD 58.91 Billion by 2032.

The Volumetric 3D Displays Market Size was valued at USD 322.95 Million in 2023 and is expected to grow at 23.98% CAGR to reach USD 2232.20 Million by 2032

The Automated Passenger Counting and Information System Market Size was valued at USD 7.98 Billion in 2023 and is expected to reach USD 18.21 Billion by 2032 and grow at a CAGR of 9.7% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone