Get More Information on Intraoperative Imaging Market - Request Sample Report

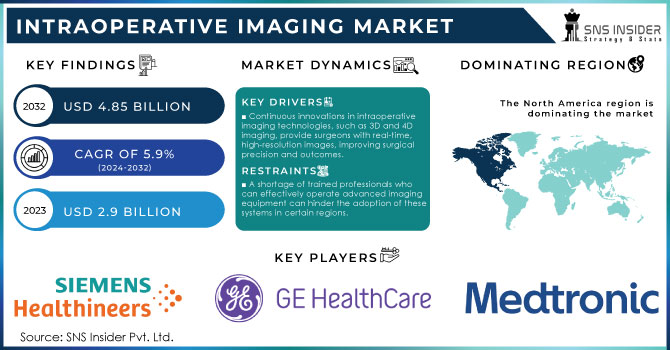

The Intraoperative Imaging Market Size was valued at USD 2.9 Billion in 2023 and is expected to reach USD 4.85 Billion by 2032, growing at a CAGR of 5.9% over the forecast period 2024-2032.

The growth of the intraoperative imaging market is primarily attributed to increasing adoption rates for minimally invasive surgeries, technological advancements, and a growing prevalence of chronic diseases. As the global geriatric population rises sharply at least 1 in 6 people will be aged 60 or older by 2030, according to WHO so demand for better surgical care is increase. Intraoperative imaging tools such as Ultrasound, C-arm and iMRI are becoming essential in surgeries for neurology, orthopedics, and cardiology. The technologies improve precision, which provides better results and operating room efficiency. For instance, in March 2021, GE Healthcare received FDA approval for the OEC 3D surgical imaging system, which provides both 3D and 2D imaging, setting a new standard for spine and orthopedic procedures. Technological advances, including AI, 3D technology, and real-time imaging, are further fueling the market. In April 2023, GE Healthcare expanded the bkActiv system to aid in urology, colorectal, and pelvic surgeries. However, the high cost of these systems and increasing demand for refurbished devices may hinder market growth.

Companies, however, are venturing into mergers and acquisitions to reinforce their competencies in technology offerings while expanding regional interest. Although regulatory policies are necessary to protect the patient and stimulate innovation, they can sometimes be too costly which has an impact on costs device availability. Adoption is better in high-income countries such as U.S. and Japan but slower in developing regions due to lack of healthcare access, weak regulations and undeveloped infrastructure.

Market Dynamics

Drivers

Continuous innovations in intraoperative imaging technologies, such as 3D and 4D imaging, provide surgeons with real-time, high-resolution images, improving surgical precision and outcomes.

The growing incidence of cancer, cardiovascular diseases, and neurological disorders is boosting the adoption of intraoperative imaging to assist in complex surgeries for these conditions.

Intraoperative imaging systems are increasingly being integrated with surgical navigation platforms, providing real-time feedback during surgery, leading to enhanced procedural success rates.

Rising global healthcare spending and investments in advanced medical infrastructure, particularly in developed countries, are fueling the adoption of cutting-edge intraoperative imaging systems.

Intraoperative imaging allows for more precise surgical interventions, reducing the likelihood of re-operations and leading to faster patient recovery and better outcomes.

One of the most important reasons for improving the efficacy and precision in surgical procedures is being a significant driver due to advancements made in intraoperative imaging technology. 3D and 4D imaging, real-time MRI, intraoperative computer tomography these are technologies that provide surgeons with the ability to see exactly where they are working which means more accurate surgery and better patient outcomes. These advances make possible for example better navigation support in neurosurgery, spinal surgery and tumor resection in oncological surgery. For instance, 3D imaging systems allow surgeons colour corrected images of tissues and organs which help the surgeons in performing minimally invasive surgeries with high precision. A 2023 report from the American College of Surgeons states that intraoperative imaging during minimally invasive surgeries has increased by 15% in the last five years, marking an uptick towards technology-enabled procedures.

Another important technology is Intraoperative MRI (iMRI) In 2022, studies were published demonstrating that the rate of complete tumour removal was increased by up to an absolute value of 30% in surgeries with this imaging over those performed without it. It has the unique ability to provide surgeons with a real-time assessment of margins and extent of resection while the patient is still in surgery, allowing for greater certainty that all tumor areas have been identified resulting in avoiding follow-up surgeries. In addition, systems are being combined with AI to deliver a more sophisticated imaging solution for real-time decision making.

Restraints

The substantial capital investment required for the procurement and installation of intraoperative imaging devices is a significant barrier, particularly for small and mid-sized healthcare facilities.

A shortage of trained professionals who can effectively operate advanced imaging equipment can hinder the adoption of these systems in certain regions.

Complex and stringent regulatory approval processes for intraoperative imaging devices can delay product launches and restrict market entry, especially in emerging markets.

Inadequate healthcare infrastructure and limited financial resources in developing regions restrict access to advanced imaging systems, slowing market growth in these areas.

High cost of intraoperative imaging systems is a major restraint for the global market. These technologies, which include intraoperative MRI (iMRI) and CT scanners are high end systems, that require heavy capital investments for both acquisition as well as installation. Hospitals and surgical centers have a particularly difficult time justifying these costs, especially when resources are limited to begin with or the expected ROI (return on investment) is not immediately obvious. On top of this, costs for maintenance as well the necessity to have specially trained staff on-hand further ramp up expenses. The cost is especially prohibitive for smaller care facilities and clinics in an emerging market, which have less access to high-end medical equipment. This increasingly limits asset accessibility to high-budget hospitals and dedicated centers, thereby slowing the overall acceptance of these systems in global healthcare markets.

By Product

In 2023 the C-arm segment led the market and accounted more than 32% of the revenue share. The flexible nature of the system allows it to be positioned around a patient while providing optimal image angles that conform to patient comfort. Technological advancements are expected to drive further growth in this segment. for instance, in September 2023, Philips introduced the Zenition 30 and mobile C-arm series. The Zenition 30 offers customization and high image quality in a versatile system that streamlines clinical procedures Based on the established Zenition platform, which is synonymous with simplicity and seamless workflow enhancements, this system represents a cost-effective way to transform decision-time in many medical procedures.

The iMRI market is estimated to register a significant CAGR over the forecast period because of its ability to provide high-quality, real-time images. Thus, this technology makes surgeries more precise, especially in minimalist surgical tasks. It is particularly useful in neurosurgery as real-time intraoperative scans help surgeons visualise the anatomy and pathology, correct for brain shift and update neuronavigation data. Also used in surgical oncology, radiation oncology and ophthalmological areas among others, iMRI is an important tool for improving precise surgery and patient prognosis. The increased need for these advanced imaging systems fits well with global healthcare targets to enhance surgical precision and patient safety.

By Application

The neurosurgery segment also accounted for the largest share of revenue in 2023, with a share of around 29%, due to an increasing prevalence neurological disorder such as epilepsy, stroke, Parkinson's disease, migraines and more headache types, brain tumors multiple sclerosis; Alzheimer's Disease cadre. Epilepsy also appears to be on the rise, with almost 50 million people affected globally in 2023 as estimated by a WHO report from February 2023, suggesting significant increases in the global burden of neurological diseases. Intraoperative imaging has powerful implications on neurosurgery, and it allows surgeons to perform operations with more precision. This minimizes additional procedures and patient transfers in and out of the operating room, reducing risk.

The orthopedic surgery is expected to progress at CAGR of 7.6% throughout the forecast period principally owing rise in number of road traffic accidents. The WHO estimates that the economic costs of road-traffic injuries cost countries 3% of their GDP. The application of intraoperative imaging systems is also likely to surge with mounting demand for orthopedic surgeries. These smart imaging technologies are of extreme value in guided surgeries to increase surgical precision and patient benefit by assisting real-time. Global health continues to push towards improved delivery of care and surgical outcomes in all orthopedic procedures.

By End-use

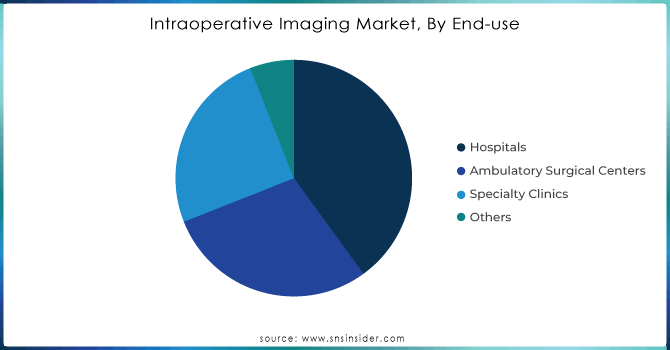

The hospital segment accounted for more than 40% of revenue and is expected to maintain its dominance throughout the forecast period. The growth of this market is largely due to the increasing adoption of advanced intraoperative imaging systems for improved patient outcomes. The advance technology is expected to offer major advancements in surgical care, especially for the treatment of patients with brain tumors by being able to provide imaging data during an operation.

The ambulatory surgical centers (ASCs) segment is expected to grow at the highest CAGR during 2024-2032 due to increasing penetration of advanced technologies in these centres. ASCs have numerous advantages, including greater affordability for patients and insurance providers since they do not require overnight stays, which helps reduce healthcare costs. Furthermore, ASCs are generally less likely to present an infection risk in comparison with hospitals due to their smaller size and substantially lesser patient volumes. By having relatively short wait time and a more efficient overall patient experience, patients too can take advantage of ASCs being the increasingly popular choice for certain outpatient procedures. These advantages contribute to the growing demand for intraoperative imaging technologies in ASCs as part of efforts to enhance care quality and efficiency.

Need any customization research on Intraoperative Imaging Market - Enquiry Now

Region Analysis

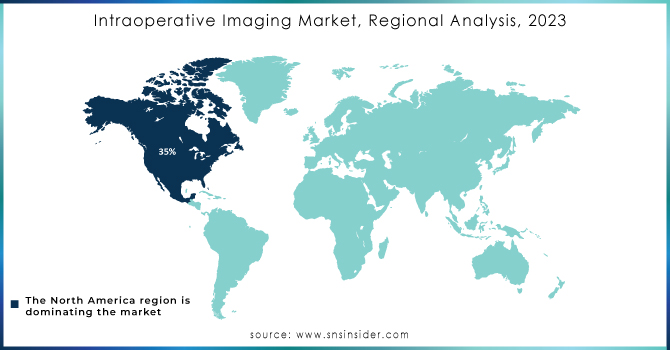

North America held the largest share of 35% in terms of revenue generation in 2023, due to presence major market players and their continuous efforts towards product development activities such as acquisitions & expansions for R&D purposes. These initiatives ensure the availability of authentic medical-grade imaging systems, promoting market growth. In April 2021, the U.S.-based company Activ Surgical received FDA clearance on its ActivSight Intraoperative Imaging Module used to increase surgical visualization of real-time intra-operative visual data helping improve patient outcomes and operating room safety. The U.S. market is expected to grow at the fastest CAGR during the forecast period, due to a higher rate of chronic diseases and presence of major players with advanced imaging technologies that allow minimal invasive surgeries, which mean greater improvements in surgical efficiency. The region’s growth has been powered in part by increased collaborations between market leaders and technology companies. Through partnerships in the last two years, Ziehm Imaging GmbH has integrated with Carestream Health to distribute their c-arm -Ziehm Vision RFD C-Arms refreshing the access of high-end imaging system across different regions even after incorporation.

The Asia-Pacific region will grow at highest CAGR over (2024-2032) during forecast period due to developing healthcare infrastructure in emerging markets such as China and India along with increasing acceptance of advanced imaging equipment. High occurrence of chronic diseases coupled with massive geriatric population to drive the market revenue. The future, for example in Africa, is the need to provide more advanced medical imaging solutions.

The major players are Canon Medical Systems Corporation, Siemens Healthcare GmbH, Ziehm Imaging GmbH, Medtronic plc, GE HealthCare, IMRIS, Brainlab AG, Koninklijke Philips N.V., NeuroLogica Corp, Shimadzu Corporation (Medical Systems). and other players

Recent Developments

September 2023, Strategic Collaboration for Research and Product Development with Mayo Clinic and GE HealthCare Together, the companies aim to reinvent radiology for patients and providers while also advancing new therapies.

In October 2023, IMRIS and Black Forest Medical Group introduced a new cranial stabilization system to the market. This cutting-edge system is specifically designed to support intraoperative MRI imaging during neurosurgical procedures.

New Flat-Panel Detector, November 2022 In May Search Ziehm Imaging GmbH demonstrated a new Indium Gallium Zinc Oxide (IGZO) flat panel detector at the Radiological Society of North America conference. It offers greater image quality with lower radiation exposure to patients for medical professionals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.9 Billion |

| Market Size by 2032 | USD 4.8 Billion |

| CAGR | CAGR of 5.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (C-arms, iCT, Intraoperative Ultrasound, X-ray, iMRI, Intraoperative Optical Imaging) • By Application (Neurosurgery, Trauma /Emergency Room Surgery, Oncology Surgery, Cardiovascular Surgery, Orthopedic Surgery, ENT Surgery, Others) • By End-use (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Canon Medical Systems Corporation, Siemens Healthcare GmbH, Ziehm Imaging GmbH, Medtronic plc, GE HealthCare, IMRIS, Brainlab AG, Koninklijke Philips N.V., NeuroLogica Corp, Shimadzu Corporation (Medical Systems). |

| Key Drivers | • Continuous innovations in intraoperative imaging technologies, such as 3D and 4D imaging, provide surgeons with real-time, high-resolution images, improving surgical precision and outcomes. • The growing incidence of cancer, cardiovascular diseases, and neurological disorders is boosting the adoption of intraoperative imaging to assist in complex surgeries for these conditions. |

| RESTRAINTS | • The substantial capital investment required for the procurement and installation of intraoperative imaging devices is a significant barrier, particularly for small and mid-sized healthcare facilities. • A shortage of trained professionals who can effectively operate advanced imaging equipment can hinder the adoption of these systems in certain regions. |

Ans. The projected market size for the Intraoperative Imaging Market is USD 4.8 billion by 2032.

Ans. The CAGR of the Intraoperative Imaging Market is 5.9% During the forecast period of 2024-2032.

Ans: The North American region dominated the Intraoperative Imaging Market in 2023.

Ans: The hospitals end use segment dominated the Intraoperative Imaging Market.

Ans: Yes, you can customize the report as per your requirements.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Intraoperative Imaging Market Segmentation, By Product

7.1 Chapter Overview

7.2 C-arms

7.2.1 C-arms Market Trends Analysis (2020-2032)

7.2.2 C-arms Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 iCT

7.3.1 iCT Market Trends Analysis (2020-2032)

7.3.2 iCT Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Intraoperative Ultrasound

7.4.1 Intraoperative Ultrasound Market Trends Analysis (2020-2032)

7.4.2 Intraoperative Ultrasound Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 X-ray

7.5.1 X-ray Market Trends Analysis (2020-2032)

7.5.2 X-ray Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 iMRI

7.6.1 iMRI Market Trends Analysis (2020-2032)

7.6.2 iMRI Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Intraoperative Optical Imaging

7.7.1 Intraoperative Optical Imaging Market Trends Analysis (2020-2032)

7.7.2 Intraoperative Optical Imaging Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Intraoperative Imaging Market Segmentation, By Application

8.1 Chapter Overview

8.2 Neurosurgery

8.2.1 Neurosurgery Market Trends Analysis (2020-2032)

8.2.2 Neurosurgery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Trauma /Emergency Room Surgery

8.3.1 Trauma /Emergency Room Surgery Market Trends Analysis (2020-2032)

8.3.2 Trauma /Emergency Room Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Oncology Surgery

8.4.1 Oncology Surgery Market Trends Analysis (2020-2032)

8.4.2 Oncology Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Cardiovascular Surgery

8.5.1 Cardiovascular Surgery Market Trends Analysis (2020-2032)

8.5.2 Cardiovascular Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Orthopedic Surgery

8.6.1 Orthopedic Surgery Market Trends Analysis (2020-2032)

8.6.2 Orthopedic Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 ENT Surgery

8.7.1 ENT Surgery Market Trends Analysis (2020-2032)

8.7.2 ENT Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Intraoperative Imaging Market Segmentation, By End-use

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Ambulatory Surgical Centers

9.3.1 Ambulatory Surgical Centers Market Trends Analysis (2020-2032)

9.3.2 Ambulatory Surgical Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Specialty Clinics

9.4.1 Specialty Clinics Market Trends Analysis (2020-2032)

9.4.2 Specialty Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Intraoperative Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.4 North America Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.6.2 USA Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.7.2 Canada Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Intraoperative Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Intraoperative Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.7.2 France Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Intraoperative Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.6.2 China Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.7.2 India Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.8.2 Japan Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.12.2 Australia Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Intraoperative Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Intraoperative Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.4 Africa Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Intraoperative Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.4 Latin America Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Intraoperative Imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Intraoperative Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Intraoperative Imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Canon Medical Systems Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Siemens Healthcare GmbH

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Ziehm Imaging GmbH

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Medtronic plc

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 GE HealthCare

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 IMRIS

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Brainlab AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Koninklijke Philips N.V.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 NeuroLogica Corp

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Shimadzu Corporation (Medical Systems).

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

C-arms

iCT

Intraoperative Ultrasound

X-ray

iMRI

Intraoperative Optical Imaging

By Application

Neurosurgery

Trauma /Emergency Room Surgery

Oncology Surgery

Cardiovascular Surgery

Orthopedic Surgery

ENT Surgery

Others

By End-use

Hospitals

Ambulatory Surgical Centers

Specialty Clinics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Flash Chromatography Market was valued at USD 0.33 million in 2023, is projected to reach USD 0.50 million by 2032, growing at a CAGR of 4.6% from 2024 to 2032.

The Multiple Sclerosis Market size was valued at USD 23.64 billion in 2023 and is projected to reach USD 43.40 billion by 2032, growing at a CAGR of 7.00%.

The Anesthesia Drugs Market Size was valued at USD 5.9 billion in 2023 & is expected to reach USD 8.6 billion by 2032 with a growing CAGR of 4.2% over the forecast period of 2024-2032.

The Population Screening Market was valued at USD 26.65 billion in 2023 and is expected to reach USD 42.48 billion by 2032, growing at a CAGR of 5.34% over the forecast period 2024-2032.

The Laboratory Developed Tests Market was valued at USD 12.43 billion in 2023 and is expected to reach USD 23.03 billion by 2032, growing at a CAGR of 7.11% over the forecast period of 2024-2032.

The Autoimmune Disease Testing Market size was valued at USD 5.43 billion in 2023 and it is expected to be worth around USD 12.41 billion by 2032 growing at a remarkable CAGR of 9.64% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone