Get More Information on Interactive Display Market - Request Sample Report

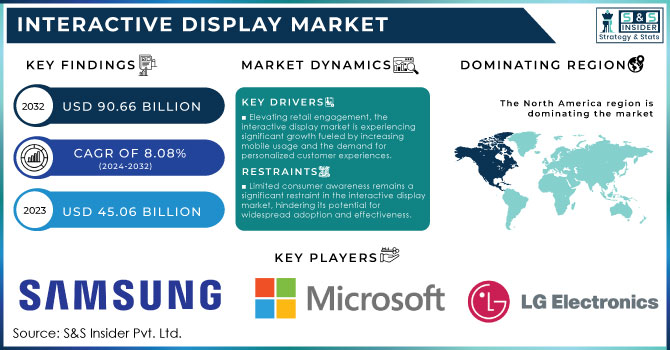

The Interactive Display Market Size was valued at USD 45.06 billion in 2023 and is expected to reach USD 90.66 billion by 2032, and grow at a CAGR of 8.08% over the forecast period 2024-2032.

The interactive display market is poised for significant growth as retailers adopt technology to enhance customer engagement and create immersive shopping experiences. Recent insights indicate that 72% of consumers prefer interacting with displays in retail environments, highlighting a shift toward digital solutions that promote engagement. Furthermore, the rise of retail media networks is compelling 67% of brands to increase investments in digital advertising, leveraging interactive displays for targeted promotions. Marketers recognize the value of these displays, with 83% believing that interactive elements enhance consumer retention and brand loyalty. This demand is further fueled by advancements in artificial intelligence and data analytics, enabling personalized experiences that drive foot traffic and sales. As the holiday shopping season approaches, the competitive landscape intensifies, especially with consumers facing financial pressures. Retailers, particularly smaller direct-to-consumer (D2C) brands, must leverage interactive displays to stand out against established competitors with strong brand recognition. Traditionally, D2C brands allocated nearly 70% of their marketing budgets to search and social media, but rising customer acquisition costs-up 50% in two years-are prompting a reevaluation of these strategies. Many brands are shifting away from Google Ads, indicating a significant change in the digital advertising landscape. While search engine marketing remains vital, social media platforms are becoming oversaturated with ads, leading to consumer fatigue. Display advertising continues to be an essential part of media strategy, with projections suggesting U.S. spending will reach USD 163.29 billion in 2023. To succeed in the holiday season, brands must adapt to changing consumer behaviors, leveraging the increase in mobile usage-users check their phones over 50 times daily-to engage customers and capture attention through interactive displays, ultimately transforming the in-store experience and reshaping customer connections.

Drivers

Elevating retail engagement, the interactive display market is experiencing significant growth fueled by increasing mobile usage and the demand for personalized customer experiences.

The interactive display market is experiencing substantial growth driven by the significant rise in mobile device usage. Studies show that consumers check their smartphones over 50 times daily and spend an average of four hours each day on apps. This increase in mobile engagement creates a prime opportunity for brands to connect with customers through interactive displays, particularly in retail environments. With mobile transactions projected to represent a significant share of all e-commerce revenue, incorporating interactive displays into marketing strategies is crucial for capturing consumer attention. Mobile devices not only facilitate tailored content delivery but also enhance engagement, leading to higher sales. Additionally, advancements in mobile advertising technologies encourage brands to adopt innovative solutions that leverage mobile interactions to improve customer experiences. With more than 90% of consumers favoring personalized content, the ability of interactive displays to adjust to individual preferences is vital for retaining interest and fostering brand loyalty. The integration of technologies like 5G further enhances mobile media consumption, allowing for seamless interactions with digital displays. As retailers embrace these trends, interactive displays are poised to transform shopping experiences and meet evolving consumer expectations during peak seasons, such as the holidays.

Restraints

Limited consumer awareness remains a significant restraint in the interactive display market, hindering its potential for widespread adoption and effectiveness.

Despite the increasing interaction with technology, many consumers still lack a thorough understanding of the benefits and functionalities offered by interactive displays in retail and other environments. Research indicates that over 60% of consumers are unaware of how these displays can enhance their shopping experiences, leading to missed opportunities for businesses seeking to utilize these technologies for improved customer engagement. This knowledge gap can significantly reduce the effectiveness of interactive displays, as consumers may not recognize the personalized experiences or valuable information they provide. Additionally, nearly 70% of brands acknowledge the importance of raising awareness about their interactive solutions to drive foot traffic and enhance customer interactions. Without focused marketing and educational initiatives, companies may find it challenging to attract consumers to their interactive displays, resulting in underutilization of these tools. As competition in the retail sector intensifies, businesses must prioritize not only the implementation of interactive solutions but also consumer education about their advantages. This is especially critical in saturated markets where consumers face numerous choices. Addressing the issue of limited consumer awareness is vital for brands to fully leverage interactive displays, fostering a more informed customer base and optimizing marketing strategies to boost engagement and sales.

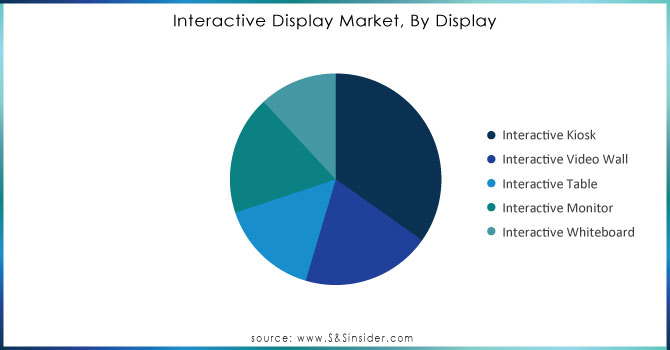

By Display

The interactive display market analysis indicates that interactive kiosks captured around 35% of the revenue share in 2023, reflecting their significant appeal across various sectors. Their versatility is a key factor, as these kiosks are widely utilized in retail, hospitality, healthcare, and transportation for applications like wayfinding, self-service checkouts, and information dissemination. This broad utility enhances their adoption. Moreover, interactive kiosks elevate customer experiences by providing immediate access to information and services, thus reducing wait times and increasing satisfaction. They also offer cost efficiency by minimizing staffing needs and providing 24/7 customer service availability, which is particularly beneficial in competitive environments. Technological advancements, such as touchscreens, artificial intelligence, and data analytics, have further transformed kiosks, enabling businesses to gather valuable insights and personalize user interactions. The COVID-19 pandemic heightened the demand for touchless solutions, solidifying kiosks' role in maintaining hygiene standards while engaging customers. Companies like Zivelo have launched innovative kiosk solutions that incorporate advanced features for enhanced user interaction. Similarly, companies such as Olea Kiosks have developed robust kiosks that cater to various industries, ensuring continued growth and solid market presence. As the focus on customer engagement and operational efficiency persists, the demand for interactive kiosks is poised to remain robust.

Need Any Customization Research On Interactive Display Market- Inquiry Now

By Application

In the interactive display market, the Banking, Financial Services, and Insurance (BFSI) sector stands out as the largest revenue contributor, accounting for approximately 29% of the market share in 2023. This prominence is fueled by several factors that enhance the effectiveness and relevance of interactive displays in this competitive field. Firstly, these displays significantly boost customer engagement by offering instant access to financial information, services, and personalized experiences. Banks utilize them for product promotions, account management, and self-service options, simplifying customer navigation through their offerings. Furthermore, companies like Diebold Nixdorf have introduced advanced interactive banking kiosks featuring touchscreen technology and biometric authentication, enabling secure and convenient transactions for users. Interactive displays also improve operational efficiency by reducing wait times and facilitating self-service functions such as account inquiries and transaction processing, which is crucial in busy banking environments. Additionally, integrating data analytics capabilities allows financial institutions to collect valuable customer insights, enabling them to tailor services and enhance overall customer experiences. With a strong focus on security, interactive displays often feature advanced protective measures, including encryption and secure access protocols, to safeguard sensitive customer data. Consequently, the BFSI segment's substantial market share highlights its pivotal role in improving customer engagement and operational efficiency.

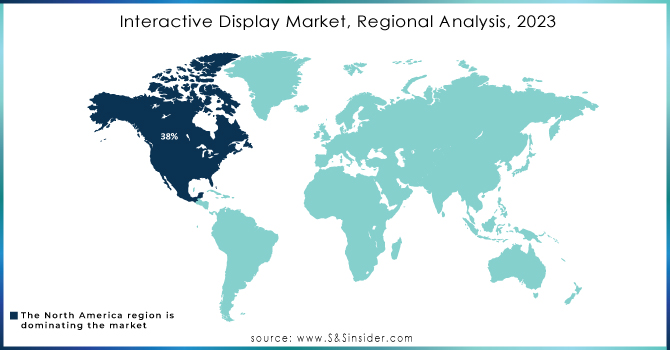

In 2023, North America emerged as the leading region in the interactive display market, accounting for approximately 38% of total revenue. This dominance is fueled by rapid digital technology adoption across various sectors, including retail, education, and healthcare, where interactive displays enhance customer engagement and streamline operations. Retailers increasingly leverage kiosks and digital signage for personalized promotions and self-service options, catering to tech-savvy consumers. Major companies like LG Electronics and Samsung drive innovation; LG launched a new line of interactive displays for educational settings, while Samsung introduced its "Flip" series for interactive business meetings. Additionally, advancements in touch technology and software integration further propel market growth, especially as organizations adapt to remote work and hybrid learning. With a strong technological infrastructure and a growing preference for personalized experiences, North America's interactive display market is set for continued expansion, reflecting substantial investments in enhancing user experience and operational efficiency.

The Asia Pacific region is the fastest-growing market for interactive displays in 2023, driven by several key factors. Rapid urbanization is creating a demand for innovative technologies across retail, education, and entertainment sectors, prompting businesses to adopt interactive displays for enhanced customer engagement. The rising middle class in countries like China, India, and Southeast Asia is increasing consumer spending on technology, making interactive displays more accessible and appealing. Additionally, substantial investments in educational technology are leading institutions to implement interactive solutions that facilitate engaging learning environments. Government initiatives promoting digital transformation and smart city projects further encourage businesses to invest in interactive displays. The presence of local tech companies also fosters innovation, with tailored products launched to meet regional needs.

Some of the major players in Interactive Display market with product:

Samsung Electronics: (Interactive Digital Signage, SMART Signage Solutions)

LG Electronics: (Interactive Whiteboards, Touch Displays)

Microsoft: (Surface Hub 2S, Microsoft Teams Rooms)

Google: (Jamboard, Interactive Displays for Google Workspace)

Sharp: (AQUOS BOARD Interactive Display Panels)

BenQ: (Interactive Flat Panel Displays, Smart Signage)

Elo Touch Solutions: (Touchscreen Displays, Interactive Kiosks)

NEC Display Solutions: (MultiSync Interactive Displays)

ViewSonic: (Interactive Flat Panel Displays, Touch Monitors)

SMART Technologies: (SMART Board Interactive Displays)

Promethean: (ActivPanel Interactive Displays)

InFocus: (Mondopad Interactive Displays)

Panasonic: (Interactive Whiteboards, 4K Touch Displays)

Crestron: (DigitalMedia Solutions with Interactive Touchscreens)

Cisco: (Cisco Webex Board)

Zebra Technologies: (Interactive Kiosks for Retail and Healthcare)

DynaScan Technology: (High Brightness Interactive Digital Signage)

TouchSystems: (Touch Screen Monitors and Interactive Displays)

Acer: (Interactive Flat Panels for Education and Business)

Raspberry Pi Foundation: (Raspberry Pi-based Interactive Displays and Kiosks)

List of potential customer companies that may be interested in interactive display solutions, categorized into two-party categories:

Potential Corporate Customers

Walmart

Amazon

Coca-Cola

Starbucks

McDonald's

Bank of America

Siemens

Microsoft

Apple

Nike

Potential Educational Institutions

Harvard University

Stanford University

Khan Academy

University of California, Berkeley

Massachusetts Institute of Technology (MIT)

Texas A&M University

Los Angeles Unified School District

New York City Department of Education

Duke University

University of Southern California (USC)

August 6, 2024 A recent development in the workplace, is the increased investment in meeting room interactive displays, such as the Samsung WAD Interactive Displays, which facilitate dynamic presentations and enhance hybrid collaboration. With 63% of U.S. companies adopting these technologies, they provide features like an infinite whiteboard and videoconferencing capabilities, significantly boosting productivity and teamwork in modern office environments.

On November 1, 2024, an interactive map was launched to help users locate the scariest Halloween displays in their area, created by Natasha Marriott in response to increasing crowds at her Chipping Sodbury home. This online tool allows fellow Halloween enthusiasts to add their own displays, ensuring plenty of thrills for trick-or-treaters seeking spooky attractions.

On October 21, 2024, an interactive display called "Barter Boat" was featured at the BLINK festival in Covington, Kentucky, allowing participants to test their bartering skills with artists while exploring the emotional and artistic value of objects. This unique display, which operates like a carnival game without monetary costs, encourages attendees to bring meaningful items to trade for prizes sourced from previous stops on the Barter Boat's journey across ten states.

On July 1, 2024, Samsung Electronics America announced the upcoming launch of its Samsung AI Class Assistant for the WAD series of interactive displays, set to introduce generative AI tools later this year. This innovative feature will provide automatic transcriptions and summaries of lessons, generate quizzes based on classroom materials, and incorporate voice recognition technology for seamless control of display functions by teachers.

On October 5, 2024, the Lubbock Economic Development Alliance (LEDA) celebrated its 20-year anniversary by launching an interactive exhibit in collaboration with Visit Lubbock, showcasing significant milestones and landmarks in the city. Located in the Arts District near downtown Lubbock, the exhibit features interactive art, including QR codes that link to a map called "Chilton Trail" and a comprehensive city guide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 45.06 billion |

| Market Size by 2032 | USD 90.66 billion |

| CAGR | CAGR of 8.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Display Type (Interactive Kiosk, Interactive Video Wall, Interactive Table, Interactive Monitor, Interactive Whiteboard) • By Application (Retail, Hospitality, Healthcare, Transportation, BFSI, Corporate, Entertainment, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Electronics, Microsoft, Google, Sharp, BenQ, Elo Touch Solutions, NEC Display Solutions, ViewSonic, SMART Technologies, Promethean, InFocus, Panasonic, Crestron, Cisco, Zebra Technologies, DynaScan Technology, TouchSystems, Acer, and Raspberry Pi Foundation are key players in the interactive display market. |

| Key Drivers | • Elevating retail engagement, the interactive display market is experiencing significant growth fueled by increasing mobile usage and the demand for personalized customer experiences. |

| RESTRAINTS | • Limited consumer awareness remains a significant restraint in the interactive display market, hindering its potential for widespread adoption and effectiveness. |

Ans: The Interactive Display Market Size was valued at USD 45.06 billion in 2023 and is expected to reach USD 90.66 billion by 2032, and grow at a CAGR of 8.08% over the forecast period 2024-2032.

Ans: The growing demand for enhanced engagement and interactive experiences in educational and corporate settings is a key driver for the Interactive Display market.

Ans: North America is dominating in in Interactive Display market in 2023

Ans: Interactive Kiosk segment is dominating in Interactive Display market in 2023Ans: Interactive Kiosk segment is dominating in Interactive Display market in 2023

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Interactive Display Market Segmentation, by Display

7.1 Chapter Overview

7.2 Interactive Kiosk

7.2.1 Interactive Kiosk Market Trends Analysis (2020-2032)

7.2.2 Interactive Kiosk Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Interactive Video Wall

7.3.1 Interactive Video Wall Market Trends Analysis (2020-2032)

7.3.2 Interactive Video Wall Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Interactive Table

7.4.1 Interactive Table Market Trends Analysis (2020-2032)

7.4.2 Interactive Table Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Interactive Monitor

7.5.1 Interactive Monitor Market Trends Analysis (2020-2032)

7.5.2 Interactive Monitor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Interactive Whiteboard

7.6.1 Interactive Whiteboard Market Trends Analysis (2020-2032)

7.6.2 Interactive Whiteboard Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Interactive Display Market Segmentation, by Application

8.1 Chapter Overview

8.2Retail

8.2.1 Retail Market Trends Analysis (2020-2032)

8.2.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Hospitality

8.3.1 Hospitality Market Trends Analysis (2020-2032)

8.3.2 Hospitality Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Healthcare

8.4.1 Healthcare Market Trends Analysis (2020-2032)

8.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Transportation

8.5.1Transportation Market Trends Analysis (2020-2032)

8.5.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 BFSI

8.6.1 BFSI Market Trends Analysis (2020-2032)

8.6.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Corporate

8.7.1 Corporate Market Trends Analysis (2020-2032)

8.7.2 Corporate Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Entertainment

8.8.1 Entertainment Market Trends Analysis (2020-2032)

8.8.2 Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Education

8.9.1 Education Market Trends Analysis (2020-2032)

8.9.2 Education Market Size Estimates and Forecasts to 2032 (USD Billion)

8.10 Others

8.10.1OthersMarket Trends Analysis (2020-2032)

8.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Interactive Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.2.4 North America Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.2.5.2 USA Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.2.6.2 Canada Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.2.7.2 Mexico Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Interactive Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.1.5.2 Poland Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.1.6.2 Romania Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Interactive Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.4 Western Europe Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.5.2 Germany Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.6.2 France Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.7.2 UK Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.8.2 Italy Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.9.2 Spain Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.12.2 Austria Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Interactive Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.5.2 China Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.5.2 India Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.5.2 Japan Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.6.2 South Korea Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.2.7.2 Vietnam Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.8.2 Singapore Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.9.2 Australia Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Interactive Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.1.4 Middle East Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.1.5.2 UAE Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Interactive Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.2.4 Africa Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Interactive Display Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.6.4 Latin America Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.6.5.2 Brazil Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.6.6.2 Argentina Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.6.7.2 Colombia Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Interactive Display Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Interactive Display Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Samsung Electronics

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 LG Electronics

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Microsoft

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Valmont Industries

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Google

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Sharp

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 BenQ

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Elo Touch Solutions

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 NEC Display Solutions

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 ViewSonic

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Display

Interactive Kiosk

Interactive Video Wall

Interactive Table

Interactive Monitor

Interactive Whiteboard

By Application

Retail

Hospitality

Healthcare

Transportation

BFSI

Corporate

Entertainment

Education

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Battery Materials Market size was valued at USD 43.63 billion in 2023 and is expected to reach USD 89.27 billion by 2032, with growing at a CAGR of 8.31% over the forecast period 2024-2032.

The E-Paper Display Market Size was valued at USD 2.88 Billion in 2023 and is expected to reach USD 9.88 Billion by 2032 and grow at a CAGR of 14.72% over the forecast period 2024-2032.

The Semiconductor Tubing Market Size was valued at USD 0.33 Billion in 2023 and is expected to reach USD 0.57 Billion by 2032 at 6.3% CAGR, During 2024-2032

The Washing Machine Market Size was valued at USD 62.22 Billion in 2023 and is expected to reach USD 117.54 Billion by 2032 and grow at a CAGR of 7.4% over the forecast period 2024-2032.

The Microphone Market Size was valued at USD 6.10 Billion in 2023 and is expected to grow at a CAGR of 5.63% to reach USD 9.98 Billion by 2032.

The Industrial 3D Printing Market Size was valued at USD 3.04 Billion in 2023 and is expected to grow at 19.12% CAGR to reach USD 14.66 Billion by 2032.

Hi! Click one of our member below to chat on Phone