Get More Information on Insurtech Market - Request Sample Report

Insurtech Market was worth USD 8.24 billion in 2023 and is predicted to be worth USD 378.08 billion by 2032, growing at a CAGR of 53.03 % between 2024 and 2032.

The insurtech market, which merges insurance with technology, has recently seen notable growth and change. Advances in digital technology, data analytics, and artificial intelligence are transforming traditional insurance models. Major factors driving this growth include the rising demand for tailored insurance products, the widespread use of smartphones and connected devices, and increasing expectations for smooth digital interactions. Innovations like telematics, which uses vehicle data for customized premiums, and blockchain, which improves transparency and efficiency in claims processing, are reshaping the industry. Additionally, the focus on customer-oriented solutions and the drive for operational efficiency are leading insurance companies to invest in digital tools and platforms. As insurtech evolves, incorporating machine learning, big data, and IoT will likely spur further innovation, enhance risk assessment, and improve customer engagement.

The rise in number of insurance claims worldwide is one of the major factors accentuating the market growth. Auto, life, and home insurance are the most frequently claimed types of insurance globally. According to an Insurance Barometer, 37% of American respondents planned to purchase life insurance in 2023. Insurance companies are progressively investing in digital technologies to Cut down on operational expenditures and boost operational productivity and the entire customer experience.

Numerous insurtech firms are forming alliances with insurance companies to provide blockchain technology-driven solutions. For example, in December 2020, Amodo, an insurtech firm, revealed its collaboration with Galileo Platforms Limited, a tech company. This partnership aims to leverage blockchain technology to assist insurers in delivering innovative insurance solutions and enhancing customer experiences. Additionally, insurance companies are progressively embracing cryptocurrency payments. In December 2021, Metromile, an auto insurer, announced its intention to allow policyholders to pay premiums and receive claims in cryptocurrency. This move is anticipated to straighten the company's competitive standing in the market.

Market Dynamics

Drivers

Insurtech solutions help to reduce operational costs and streamline processes, increasing insurance companies' profitability.

Growing venture capital and investment in insurtech startups are driving innovation and market growth.

Innovations in artificial intelligence, machine learning, and blockchain are enabling more efficient and effective insurance solutions.

Recent advancements in artificial intelligence (AI), machine learning (ML), and blockchain are significantly enhancing the efficiency and effectiveness of insurance solutions. AI and ML technologies are transforming how insurers process data, assess risk, and handle claims. According to research, AI-driven tools can reduce the time required for claims processing by up to 30%, and ML algorithms improve underwriting accuracy by analyzing vast amounts of data more effectively than traditional methods. For instance, companies like Lemonade are leveraging AI to automate claims approval, resulting in claims being paid in as little as three seconds.

Blockchain technology is also making a substantial impact by providing a decentralized and transparent ledger for transactions. A 2022 report from Deloitte highlights that blockchain can enhance transparency and reduce fraud in the insurance industry. Blockchain’s ability to securely store and verify transactions helps in streamlining processes like policy issuance and claims management. For example, Insurwave, a platform developed by EY and Guardtime, uses blockchain to manage marine insurance contracts, improving efficiency and reducing administrative costs.

These technological innovations are not just theoretical; they are actively reshaping the insurance landscape. A 2024 survey by Accenture found that 45% of insurers are already investing in AI and blockchain technologies, with 35% expecting to see a return on investment within the next three years. These advancements are paving the way for more accurate risk assessment, quicker claims resolution, and a more streamlined customer experience, ultimately driving the growth and modernization of the insurtech market.

Restraints

Dependency on advanced technologies that may fail or underperform.

Challenges in handling sensitive customer information securely.

High competition and market fullness in developed regions.

In the insurtech market, high competition and market saturation, especially in developed regions like North America and Europe, pose significant challenges. Numerous startups and established players are competing for market share, leading to strong competition. This saturation makes it difficult for new entrants to differentiate themselves, attract customers, and achieve growth. Insurtech companies must continuously innovate and provide unique value propositions to stand out, often leading to high marketing and operational costs. Furthermore, established insurers are rapidly adopting digital strategies, further intensifying the competitive landscape. As a result, insurtech firms struggle to maintain profitability and secure long-term sustainability. This competitive pressure also forces companies to offer lower prices and enhanced services, which can squeeze profit margins. Ultimately, market saturation limits growth opportunities, making it crucial for insurtech companies to find niche markets or expand to emerging regions to sustain their business.

By Type

With more than 23.5% share of the global revenue, the health segment dominated the market in 2023. The rising demand for digital platforms, which connect exchanges, brokers, providers, and carriers in health insurance, is anticipated to boost the demand for the health segment. Insurers are increasingly integrating mobility features into their health insurance services to enhance convenience.

The home insurance segment is expected to experience the most significant growth during the forecast period. Many home insurance providers are developing innovative products tailored for both commercial and residential real estate professionals, as well as their tenants and residents. These companies are embracing insurtech solutions to reduce the time from listing to leasing. By leveraging AI technology, these solutions offer personalized insurance policies and manage claims efficiently, eliminating the need for insurance brokers.

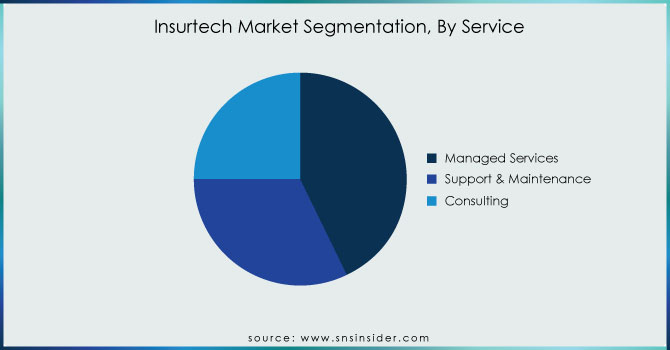

By Service

In 2023, the managed services segment captured the largest revenue share, exceeding 43.2%. Managed services providers offer insurers a strategic path to transformation by combining their expertise and talent with cutting-edge technologies. They also supply insurers with optimal processes, best practices, and regulatory guidance. Additionally, managed services help insurers tackle IT and operational challenges while seizing new opportunities in the insurance sector.

The support and maintenance segment is expected to register the highest growth over the forecast period. The expansion of the support and maintenance segment is driven by the rising adoption of advanced technologies and distribution channels among insurance companies. Many insurers worldwide are concentrating on implementing cutting-edge technology and tailoring legacy software to meet their specific requirements.

Need any customization research on Insurtech Market - Enquiry Now

By Technology

The cloud computing segment dominated the market with a revenue share more than of 24.3% in 2023. Cloud computing has revolutionized the insurance industry through its versatility, ease of implementation, and flexibility. The increasing adoption of Bring Your Device (BYOD) policies, along with the rising volume of data collected by insurance companies, is projected to fuel growth. Simultaneously, collaborations between cloud computing solution providers and insurance companies are boosting the development of insurtech products, which is anticipated to spur market growth. For instance, in November 2021, Amazon Web Services Inc. announced that American International Group, Inc. had selected it as their preferred public cloud provider. This partnership is intended to help American International Group improve its services for customers.

The blockchain segment is expected to account for the highest growth during the forecast period. Blockchain technology allows insurance companies to reduce operational costs and enhance operational efficiencies. this technology can fuel growth, unify diverse insurtech platforms, and facilitate the introduction of new services, especially for individuals who previously lacked access to insurance.

By End-User

In 2023, the BFSI segment led the market, capturing over 20.5% of the global revenue share. BFSI companies are increasingly adopting insurtech solutions to enhance business efficiency. The rise in connected devices within the BFSI sector is generating substantial amounts of data. Insurance companies have recognized the potential of this data to improve services, reduce costs, gain valuable insights, and increase revenue.

The healthcare segment is anticipated to register the fastest growth during the forecast period. The increasing digitization within the insurance sector is likely to accelerate the adoption of insurtech solutions in the healthcare industry. The expansion of devices has led to a greater need for efficient monitoring, management, and maintenance of data across healthcare organizations.

Regional analysis

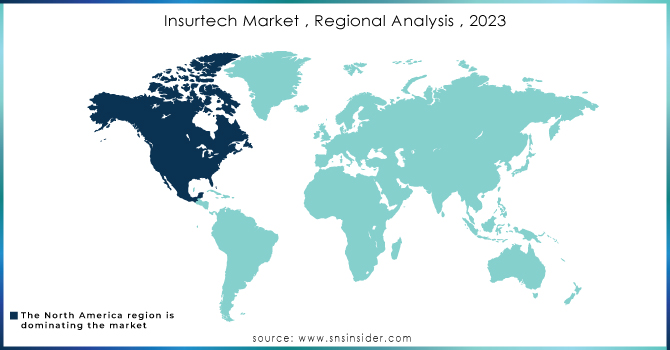

With more than 35.8% share of the global revenue, North America dominated the market for insurtech in 2022. The region is experiencing a rise in the adoption of insurtech solutions due to growing customer spending on insurance products. Additionally, these solutions provide customizable and flexible plans for property and health insurance.

Asia Pacific is projected to become the fastest-growing regional market during the forecast period. This growth is attributed to the presence of many emerging economies and financial centers such as Singapore, India, and Hong Kong. Insurance providers in the region are focused on delivering affordable premium plans, and the increasing use of smartphones across the Asia Pacific is also expected to boost market growth.

The Indian government has actively supported the growth of insurtech through initiatives like the Digital India campaign and regulatory sandboxes, which provide a favorable environment for startups to experiment and innovate. Additionally, the Insurance Regulatory and Development Authority of India (IRDAI) has implemented forward-thinking regulations to promote insurtech innovation while ensuring consumer protection.

The Major Players are Damco Group, DXC Technology Company, Insurance Technology Services, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Policy Bazaar, Wipro Limited, Clover Health Insurance, ZhongAn Insurance, Acko General Insurance Limited, and Other Players

In March 2024, CNB Bank & Trust (CIBC) partnered with Insuritas to launch an embedded, full-service digital insurance agency. The collaboration integrates Insuritas' award-winning BUNDLE platform into CIBC's ecosystem, offering comprehensive insurance solutions for retail and commercial clients.

In June 2023, Clover Health Investments Corp. announced a settlement agreement in principle for seven derivative lawsuits across Delaware, New York, and Tennessee courts, aiming to resolve legal disputes and focus on improving Medicare access and physician enablement services.

In November 2021, Amazon Web Services Inc. announced that it had been chosen as a preferred public cloud provider by American International Group, Inc., an insurance company.

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.24 Bn |

| Market Size by 2032 | US$ 378.08 Bn |

| CAGR | CAGR of 53.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Auto, Business, Health, Home, Specialty, Travel, and Others) • By Service (Consulting, Support & Maintenance, and Managed Services) • By Technology (Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, and Others) • By End-use (Automotive, BFSI, Government, Healthcare, Manufacturing, Retail, Transportation, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Damco Group, DXC Technology Company, Insurance Technology Services, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Policy Bazaar, Wipro Limited, Clover Health Insurance, ZhongAn Insurance, Acko General Insurance Limited |

| Key Drivers | • Insurtech solutions help to reduce operational costs and streamline processes, increasing insurance companies' profitability. • Growing venture capital and investment in insurtech startups are driving innovation and market growth. |

| Market Opportunities | • Dependency on advanced technologies that may fail or underperform. • Challenges in handling sensitive customer information securely |

The market is expected to grow to USD 378.08 billion by the forecast period of 2032.

Growth rate of the Insurtech Market is CAGR 53.03%.

The major worldwide key players in the Insurtech Market are Damco Group, DXC Technology Company, Insurance Technology Services, Majesco, Oscar Insurance, Quan template, Shift Technology, Trov Insurance Solutions, LLC., Wipro Limited.

USD 8.24 billion in 2023 is the market share of the Insurtech Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Insurtech Market Segmentation, by Type

7.1 Chapter Overview

7.2 Auto

7.2.1 Auto Market Trends Analysis (2020-2032)

7.2.2 Auto Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3Business

7.3.1Business Market Trends Analysis (2020-2032)

7.3.2Business Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Health

7.4.1 Health Market Trends Analysis (2020-2032)

7.4.2 Health Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5Specialty

7.5.1Specialty Market Trends Analysis (2020-2032)

7.5.2Specialty Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Travel

7.6.1 Travel Market Trends Analysis (2020-2032)

7.6.2 Travel Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Other

7.7.1 Other Market Trends Analysis (2020-2032)

7.7.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Insurtech Market Segmentation, by Service

8.1 Chapter Overview

8.2 Consulting

8.2.1 Consulting Market Trends Analysis (2020-2032)

8.2.2 Consulting Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3Support & Maintenance

8.3.1Support & Maintenance Market Trends Analysis (2020-2032)

8.3.2Support & Maintenance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Managed Services

8.4.1 Managed Services Market Trends Analysis (2020-2032)

8.4.2 Managed Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Insurtech Market Segmentation, by Technology

9.1 Chapter Overview

9.2 Blockchain

9.2.1 Blockchain Market Trends Analysis (2020-2032)

9.2.2 Blockchain Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Cloud Computing

9.3.1 Cloud Computing Market Trends Analysis (2020-2032)

9.3.2 Cloud Computing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 IoT

9.4.1 IoT Market Trends Analysis (2020-2032)

9.4.2 IoT Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Machine Learning

9.5.1 Machine Learning Market Trends Analysis (2020-2032)

9.5.2 Machine Learning Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Robo Advisory

9.6.1 Robo Advisory Market Trends Analysis (2020-2032)

9.6.2 Robo Advisory Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Technology 6 Market Trends Analysis (2020-2032)

9.7.2 Technology 6 Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Insurtech Market Segmentation, by End-User

10.1 Chapter Overview

10.2 Automotive

10.2.1 Automotive Market Trends Analysis (2020-2032)

10.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 BFSI

10.3.1 BFSI Market Trends Analysis (2020-2032)

10.3.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Government

10.4.1 Government Market Trends Analysis (2020-2032)

10.4.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Healthcare

10.5.1 Healthcare Market Trends Analysis (2020-2032)

10.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Manufacturing

10.6.1 Manufacturing Market Trends Analysis (2020-2032)

10.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Retail

10.6.1 Retail Market Trends Analysis (2020-2032)

10.6.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Transportation

10.6.1 Transportation Market Trends Analysis (2020-2032)

10.6.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

10.9 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Insurtech Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.4 North America Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.2.5 North America Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.6 North America Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.7.2 USA Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.2.7.3 USA Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.7.4 USA Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.8.2 Canada Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.2.8.3 Canada Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.8.4 Canada Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.2.9.3 Mexico Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.9.4 Mexico Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Insurtech Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.1.7.3 Poland Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.7.4 Poland Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.1.8.3 Romania Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.8.4 Romania Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Insurtech Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.5 Western Europe Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.6 Western Europe Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.7.3 Germany Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.7.4 Germany Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.8.2 France Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.8.3 France Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.8.4 France Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.9.3 UK Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.9.4 UK Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.10.3 Italy Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.10.4 Italy Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.11.3 Spain Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.11.4 Spain Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.14.3 Austria Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.14.4 Austria Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Insurtech Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.5 Asia Pacific Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.6 Asia Pacific Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.7.2 China Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.7.3 China Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.7.4 China Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.8.2 India Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.8.3 India Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.8.4 India Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.9.2 Japan Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.9.3 Japan Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.9.4 Japan Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.10.3 South Korea Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.10.4 South Korea Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.11.3 Vietnam Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.11.4 Vietnam Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.12.3 Singapore Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.12.4 Singapore Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.13.2 Australia Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.13.3 Australia Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.13.4 Australia Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Insurtech Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.1.5 Middle East Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.6 Middle East Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.1.7.3 UAE Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.7.4 UAE Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Insurtech Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.4 Africa Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.2.5 Africa Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.6 Africa Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Insurtech Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.4 Latin America Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.6.5 Latin America Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.6 Latin America Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.6.7.3 Brazil Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.7.4 Brazil Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.6.8.3 Argentina Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.8.4 Argentina Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.6.9.3 Colombia Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.9.4 Colombia Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Insurtech Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Insurtech Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Insurtech Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Insurtech Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

12. Company Profiles

12.1 Damco Group

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 DXC Technology Company

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Insurance Technology Services

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Majesco

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Oscar Insurance

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Quantemplate

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Shift Technology

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 TrÅv

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Wipro Limited

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 ZhongAn Insurance

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Auto

Business

Health

Home

Specialty

Travel

Others

By Service

Consulting

Support & Maintenance

Managed Services

By Technology

Blockchain

Cloud Computing

IoT

Machine Learning

Robo Advisory

Others

By End-use

Automotive

BFSI

Government

Healthcare

Manufacturing

Retail

Transportation

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The In-Memory Computing Market size was USD 17.8 billion in 2023 and is expected to Reach USD 72 billion by 2032 and grow at a CAGR of 16.8% over the forecast period of 2024-2032.

The Contactless Payment Market was valued at USD 45.33 billion in 2023 and will reach USD 194.51 Billion by 2032, growing at a CAGR of 17.59 % by 2032.

Network Attached Storage Market was worth USD 31.71 billion in 2023 and is predicted to be worth USD 109.72 billion by 2032, growing at a CAGR of 14.82% between 2024 and 2032.

Big Data Analytics Market was valued at USD 284.3 billion in 2023 and is expected to reach USD 842.6 billion by 2032, growing at a CAGR of 12.9% from 2024-2032.

The Robotic Process Automation in BFSI Market Size was valued at USD 1.12 Billion in 2023 and will reach USD 20.48 Billion by 2032 and CAGR of 38.2% by 2032.

The Smart Contracts Market Size was valued at USD 1.6 Billion in 2023 and will reach USD 11.7 Billion by 2032, growing at a CAGR of 24.7% by 2032.

Hi! Click one of our member below to chat on Phone