Get more information on Insurance Telematics Market - Request Sample Report

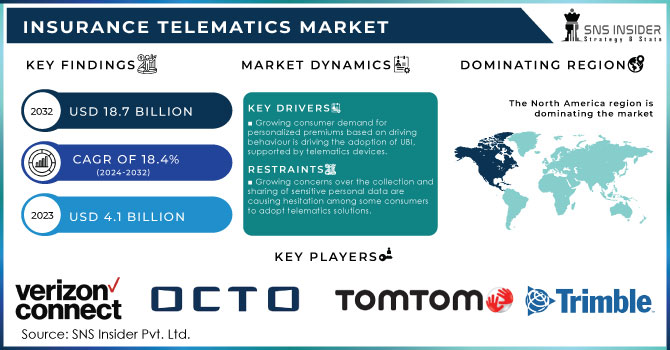

Insurance Telematics Market size was valued at USD 4.1 billion in 2023 and is expected to grow to USD 18.7 billion by 2032 and grow at a CAGR of 18.4 % over the forecast period of 2024-2032.

The insurance telematics market has gained substantial growth due to government initiatives and rising consumer demand for usage-based insurance (UBI) models. The government bodies’ initiatives to increase the use of telematics technology and reduce road-related accidents and insurance claims contribute to the market’s growth. For instance, in 2023, the U.S. Department of Transportation announced a 15% decline in road accidents, providing telematics-based monitoring systems to be effective in reducing claims and insurance costs related to accidents. Additionally, the European Union Vision Zero initiative, which intends to reduce road fatalities and reduce them to near zero by 2050, promoted the use of telematics, which is an essential part of the strategy. Telematics data help not only analyze the driver's behaviour but also interpret road conditions and adjust the traffic flow, leading to a decline in fuel consumption and emissions. According to the UK Department for Transport, telematics-based insurance policies accounted for nearly 30% of all motor insurance policies issued in 2023, highlighting their growing acceptance. Moreover, the Indian government, under its National Road Safety Policy, has made it mandatory for insurance companies to offer UBI products by 2025. These developments underscore the importance of telematics in shaping the future of insurance, making it a key driver of market expansion.

The increase in global demand can also be attributed to the ever-growing discontent with environmental pollution and the growing awareness of road accidents and reduce harmful emissions like carbon dioxide and nitrogen oxide. Insurance telematics ensures such effect by encouraging safe and “green” driving that eventually reduces the possibility of road accidents and injury as well as complies with the government’s regulatory measures such as the compulsory use of ELDs in commercial vehicles. Insurers are encouraged by these regulations to enhance and improve their risk assessment and enter the market more actively. For example, in September 2023, OCTO Telematics unveiled the effective Digital Driver Solution App, which encouraged safe driving without diverting the user’s attention from distractions.

Driver

Growing consumer demand for personalized premiums based on driving behaviour is driving the adoption of UBI, supported by telematics devices.

Improved IoT connectivity and big data analytics are enabling insurers to collect and analyze real-time driving data, enhancing risk assessment accuracy.

Mandates and regulations in various countries are pushing for telematics systems to improve road safety and reduce accidents, increasing telematics usage.

Increased adoption of usage-based insurance in the United States is one of the main drivers of the Insurance Telematics Market. It is a new concept that is changing the traditional B2B insurance model. UBI allows customers to pay for insurance based on their actual driving behaviour. According to a recent study, almost 50% of drivers in the United States would be interested in UBI programs. These technologies appear to be most popular with millennials and Gen Z who are highly technological. Telematics devices take an active part in the introduction of UBI technologies. They record the driver’s speed, pattern of braking, mileage as well as time of day when the driver operates the vehicle. The data received permits insurance companies to assess the actual image of the driver. Currently, these technologies allow policyholders to save up to 30% of their premiums. Thus, the State Farm’s Drive Safe & Save program demonstrates possible savings on premiums based on telematics data. In this way, other companies are developing their own UBI programs with telematics involvement.

The rise of electric and connected vehicles also facilitates the growth of UBI. Moreover, the data demonstrates a significant increase in UBI insurance. Thus, according to recent statistics, UBI policies based on telematics have increased by almost 30% in North America in 2023. Finally, the proliferation of technologies that are suitable for the implementation of UBI technologies reflects the overall telematics market trends. This trend highlights the growing alignment between consumer preferences for flexible premiums and insurers' need for more precise risk management tools, fuelling the telematics market’s expansion.

Restraints

Growing concerns over the collection and sharing of sensitive personal data are causing hesitation among some consumers to adopt telematics solutions.

The cost of telematics devices and their installation can be prohibitive for smaller insurance firms, limiting market growth potential.

Insurers face challenges in effectively managing and integrating vast amounts of telematics data into existing systems, creating operational inefficiencies.

Privacy concerns related to data collection are one of the primary constraints within the market. The increased adoption of telematics technology implies the recording of real-time driving data including speed, location, and driving habits of the insured. However, consumers become increasingly concerned with who and how their personal data might be used. The devices that provide the data often record the driving routine of the individual and receipt of such information by an unregistered party may lead to the breach of privacy. Additionally, the fact that the data is thorough implies that it can be used against the end user in ways not associated with driving or insurance. These concerns are heightened in regions with stringent data protection laws like GDPR in Europe, making it critical for insurance companies to adopt transparent and robust data privacy policies. Without adequate safeguards, privacy concerns may limit consumer willingness to adopt telematics-based insurance policies.

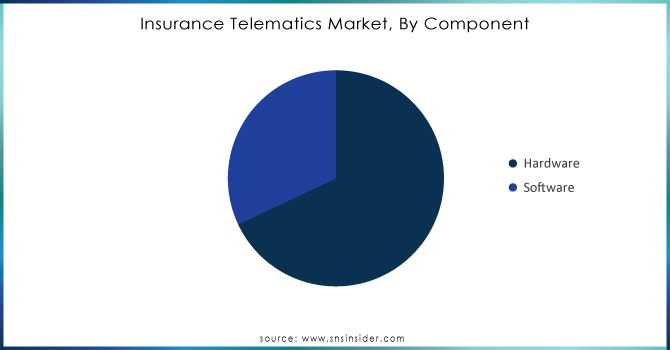

By Component

The hardware segment held the largest share 68% of the insurance telematics market in 2023, with hardware components such as telematics control units, global positioning system systems, and sensors. Several factors contributed to the dominance of hardware in the devices segment. Among these is the increasing demand for complex telematics devices that collect real-time data about driving, vehicle location, and the surrounding roads in personal and business vehicles. Moreover, the expansion of these devices in the market is driven by the emergence of advanced driver-assistance systems. Another important factor is the role of the government. For example, the European Union has imposed a mandate for hardware by passing a law for an in-vehicle telematics hardware called eCall to be deployed. The eCall telematics devices are required to alert the authorities about the crash incident automatically. Additionally, emerging markets like China and India have seen rapid growth in hardware deployment due to government-mandated safety and monitoring systems, further bolstering the market share of hardware in the insurance telematics ecosystem.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Usage Type

Pay-How-You-Drive usage type segment led the market with a 38% market share in 2023. It is because consumers demand personalized insurance that will reward them with lower premiums for safe driving. Governments include the PHYDub models in their strategies concentrating on road safety and responsible driving. For example, in the UK, the government states that in 2023 the usage of PHYD policies by drivers caused a 25% reduction in aggressive driving and 20% less speeding. With lower amounts of aggressive driving and speeding, the number of car accidents is reduced as well as the number of concluded insurances. So, the model is beneficial for both consumers and insurers. In the U.S. Federal Insurance Office (FIO) promotes the usage of PHYD policies by suggesting that insurance companies implement the model and offering them to employ it for a more competing and customer-oriented insurance market. This has led to a 10% increase in the adoption of PHYD policies in the U.S. market in 2023, further cementing its dominant position in the insurance telematics market.

By Vehicle Type

In 2023, passenger cars led the Insurance Telematics Market by mode of transport, taking the highest market share. The adoption of telematics solutions among passenger cars is high because of government regulations and the rising number of individual car owners opting for UBI models. Reportedly, 85% of the new passenger cars sold in Europe had a telematics system in 2023, which was major because of the EU’s eCall regulations. In 2023, the National Highway Traffic Safety Administration estimated that 70% of the new passenger cars sold in the U.S. were equipped with integrated telematics systems because the car owners in the country desire personalized insurance products. This growing penetration of telematics in passenger vehicles has contributed to a significant increase in market share for this segment, as consumers continue to seek more cost-effective and tailored insurance solutions.

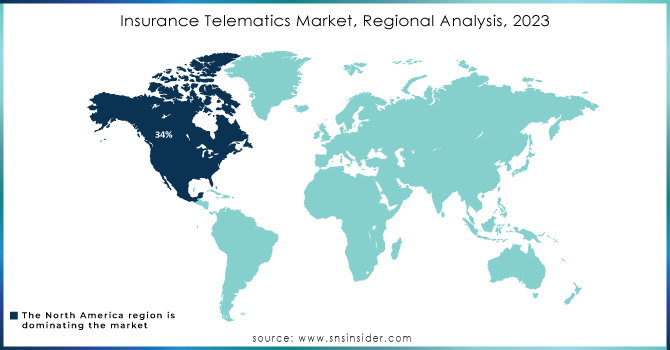

In 2023, North America led the insurance telematics market, contributing to 34% of the global market share. The presence of the most advanced telematics technology, favorable government policies, and a large base of telematics and insurance companies contribute to the dominance of the region. The U.S. government has been at the forefront of promoting telematics adoption. It has demanded the incorporation of telematics in new trucks and school buses as part of efforts to make the road safer for users. The implementation of the mandate further catalyzed the expansion of the Insurance Telematics Market. In Canada, the National Road Safety Strategy 2025 has made the adoption of technology a priority in the endeavor to reduce the number of accidents on the road. The formulation of the insurance telematics projects within the region played the role of promoting the expansion of the market.

Meanwhile, the Asia-Pacific region is expected to have the highest CAGR during the forecast period. In 2023, China led with a significant share. The Chinese government’s push for smart transportation and its mandate for telematics systems in commercial vehicles has accelerated market growth. As for India, the revival in the country’s insurance sector witnessed an increase in UBI products due to the regulation that favors the installation of telematics in vehicles. These developments position the Asia-Pacific region as a key growth market for the insurance telematics industry.

In February 2024, Kia formed a strategic alliance with LexisNexis for the extension of the Kia Connected Vehicle CIV data to U.S. auto insurers via the Telematics Exchange.

In March 2023, Trimble Inc. released its telematics portfolio of Mobility, offering dwell time metrics to optimize fleet management.

Key Service Providers/Manufacturers:

Verizon Connect (Reveal, Fleetmatics)

Octo Telematics (OCTO SmartDiag, OCTO Vantage)

TomTom Telematics (Webfleet, LINK)

Trimble Inc. (FieldMaster, GeoManager)

Teletrac Navman (Director, GPS Fleet Tracking)

Mix Telematics (MiX Fleet Manager, MiX DriveMate)

CalAmp (LenderOutlook, iOn Tag)

Vodafone Automotive (U-Tag, Fleet Performance)

Cambridge Mobile Telematics (CMT) (DriveWell, Safestop)

Geotab (Geotab GO9, MyGeotab)

Key Users of Insurance Telematics Services:

Progressive Corporation

Allianz SE

AXA Group

State Farm Insurance

Liberty Mutual Insurance

Zurich Insurance Group

Generali Group

Nationwide Mutual Insurance Company

Aviva plc

The Hartford

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.1 Bn |

| Market Size by 2032 | US$ 18.7 Bn |

| CAGR | CAGR of 18.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Deployment (On-premises, Cloud) • By Usage Type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) • By Vehicle Type (Passenger Cars, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Verizon Connect, Octo Telematics, TomTom Telematics, Trimble Inc., Teletrac Navman, Mix Telematics, CalAmp, Vodafone Automotive, Cambridge Mobile Telematics (CMT), Geotab |

| Key Drivers | • Growing consumer demand for personalized premiums based on driving behaviour is driving the adoption of UBI, supported by telematics devices. • Improved IoT connectivity and big data analytics are enabling insurers to collect and analyze real-time driving data, enhancing risk assessment accuracy. • Mandates and regulations in various countries are pushing for telematics systems to improve road safety and reduce accidents, increasing telematics usage. |

| Market Restraints | • Growing concerns over the collection and sharing of sensitive personal data are causing hesitation among some consumers to adopt telematics solutions. • The cost of telematics devices and their installation can be prohibitive for smaller insurance firms, limiting market growth potential. • Insurers face challenges in effectively managing and integrating vast amounts of telematics data into existing systems, creating operational inefficiencies. |

Ans: The Insurance Telematics Market is estimated to be worth USD 18.7 billion by 2032.

Ans: The Insurance Telematics Market was valued at USD 4.1 billion in 2023.

Ans: Some of the major key players in the Insurance Telematics Market are Verizon Connect, Octo Telematics, TomTom Telematics, Trimble Inc., Teletrac Navman, Mix Telematics, and others.

Ans:

Growing consumer demand for personalized premiums based on driving behaviour is driving the adoption of UBI, supported by telematics devices.

Improved IoT connectivity and big data analytics are enabling insurers to collect and analyze real-time driving data, enhancing risk assessment accuracy.

Ans: The North American region dominated the Insurance Telematics Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Insurance Telematics Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Insurance Telematics Market Segmentation, By Usage Type

8.1 Chapter Overview

8.2 Pay-As-You-Drive (PAYD)

8.2.1 Pay-As-You-Drive (PAYD) Market Trends Analysis (2020-2032)

8.2.2 Pay-As-You-Drive (PAYD) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pay-How-You-Drive (PHYD)

8.3.1 Pay-How-You-Drive (PHYD) Market Trends Analysis (2020-2032)

8.3.2 Pay-How-You-Drive (PHYD) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Manage-How-You-Drive (MHYD)

8.4.1 Manage-How-You-Drive (MHYD) Market Trends Analysis (2020-2032)

8.4.2 Manage-How-You-Drive (MHYD) Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Insurance Telematics Market Segmentation, By Deployment

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 On-Premise

9.3.1 Desktops Market Trends Analysis (2020-2032)

9.3.2 Desktops Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Insurance Telematics Market Segmentation, By Vehicle Type

10.1 Chapter Overview

10.2 Passenger Cars

10.2.1 Passenger Cars Market Trends Analysis (2020-2032)

10.2.2 Passenger Cars Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Commercial Vehicles

10.3.1 Commercial Vehicles Market Trends Analysis (2020-2032)

10.3.2 Commercial Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Insurance Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.2.5 North America Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.6 North America Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.2.7.3 USA Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7.4 USA Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Canada Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.2.8.3 Canada Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8.4 Canada Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9.4 Mexico Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Insurance Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7.4 Poland Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8.4 Romania Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Insurance Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.6 Western Europe Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7.4 Germany Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 France Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.8.3 France Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8.4 France Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9.4 UK Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10.4 Italy Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11.4 Spain Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14.4 Austria Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Insurance Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.6 Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 China Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.7.3 China Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7.4 China Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 India Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.8.3 India Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8.4 India Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 Japan Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.9.3 Japan Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9.4 Japan Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10.4 South Korea Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11.4 Vietnam Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12.4 Singapore Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Australia Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.13.3 Australia Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13.4 Australia Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Insurance Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.6 Middle East Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7.4 UAE Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Insurance Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.2.5 Africa Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.6 Africa Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Insurance Telematics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.6.5 Latin America Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.6 Latin America Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7.4 Brazil Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8.4 Argentina Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9.4 Colombia Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Insurance Telematics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Insurance Telematics Market Estimates and Forecasts, By Usage Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Insurance Telematics Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Insurance Telematics Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12. Company Profiles

12.1 Verizon Connect

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Octo Telematics

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 TomTom Telematics

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Trimble Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 Teletrac Navman

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 Mix Telematics

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 CalAmp

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Vodafone Automotive

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Cambridge Mobile Telematics (CMT)

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Geotab.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

By Deployment

On-premises

Cloud

By Usage Type

Pay-As-You-Drive (PAYD)

Pay-How-You-Drive (PHYD)

Manage-How-You-Drive (MHYD)

By Vehicle Type

Passenger Cars

Commercial Vehicles

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Data Visualization Tools Market was valued at USD 8.90 billion in 2023 and is expected to reach USD 22.85 billion by 2032, growing at a CAGR of 11.08% from 2024-2032.

The Content Services Platforms Market, valued at USD 61.9 Bn in 2023, is projected to reach USD 228.2 Bn by 2032, growing at a 15.61% CAGR from 2024 to 2032.

The Virtual Meeting Software Market Size was valued at USD 23.87 billion in 2023 and is projected to reach USD 205.69 billion by 2032 with a growing CAGR of 27.12% Over the Forecast Period of 2024-2032.

Customer Information System Market was valued at USD 1.26 billion in 2023 and is expected to reach USD 3.54 billion by 2032, growing at a CAGR of 12.23% from 2024-2032

The Data Science Platform market size was valued at USD 100.09 Billion in 2023 and is expected to reach USD 760.03 Billion by 2032 and grow at a CAGR of 25.28% over the forecast period 2024-2032.

The Decision Intelligence Market is anticipated to reach from USD 12.7 billion in 2023 to USD 62.2 billion by 2032, growing at a CAGR of 19.31% over 2024-2032.

Hi! Click one of our member below to chat on Phone