Get More Information on Insurance Fraud Detection Market - Request Sample Report

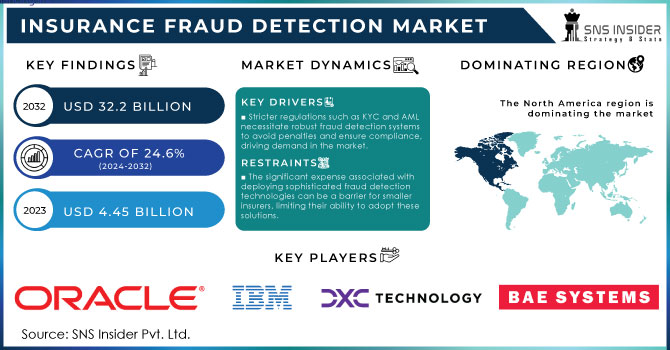

The Insurance Fraud Detection Market Size was valued at USD 4.45 Billion in 2023 and is expected to reach USD 32.2 Billion by 2032, growing at a CAGR of 24.6% over the forecast period 2024-2032.

One of the major drivers of the insurance fraud detection market is the growing prevalence of fraudulent activities in the insurance sector. It causes governmental and private entities to emphasize their efforts to prevent fraud. According to the Coalition Against Insurance Fraud, it costs the insurance sector approximately $308 billion each year in the U.S. alone. As a result, its Department of Justice is highly active in its attempts to combat the issue due to the devastating impact of this phenomenon, including a 15% rise in federal funding for fraud prevention and investigation programs throughout 2023. Moreover, as stated by the National Insurance Crime Bureau, the number of suspicious claims rose by 12% between 2021 and 2022 due to the extensive problems and damages caused by insurance fraud.

Another driver of the insurance fraud detection market is the increased use of technology. Digital technology provides major benefits to the insurance sector; however, it also creates more opportunities for fraud that must be detected. Currently, many insurers are utilizing advanced analytics and artificial intelligence, among other tools, to identify and predict patterns of fraudulent behaviour. The factors of governmental support and the implementation of regulations and requirements will facilitate the growth of the insurance fraud detection market. The rising consumer awareness about fraud risks and their potential financial repercussions further drives demand for effective insurance fraud detection tools, reinforcing the need for continuous advancements in this sector. The Insurance Fraud Department of the U.S., Department of Justice and FBI estimate the annual cost of insurance claims at over $40 billion. As the number of fraud cases grows, these modern solutions will become more popular and effective. Additionally, insurers are increasingly adopting digital platforms and innovative threat detection systems to combat tech-enabled fraud and strengthen customer relations.

Drivers

The growing prevalence of insurance fraud across sectors like healthcare and motor insurance is prompting insurers to invest in advanced fraud detection solutions to safeguard against significant financial losses.

Stricter regulations such as KYC and AML necessitate robust fraud detection systems to avoid penalties and ensure compliance, driving demand in the market.

Innovations in AI, machine learning, and big data analytics enable insurers to analyze vast data sets effectively, improving their capability to detect and prevent fraudulent activities.

The increase in digital transactions has heightened vulnerabilities, necessitating enhanced fraud detection mechanisms to combat payment and billing fraud.

The main driver of the insurance fraud detection market is the remarkable increase in fraudulent activities. In nations like the U.S., where fraud in sectors such as healthcare and motor insurance is a significant concern, insurance companies pay up to over $80 billion annually. For example, in healthcare, the National Health Care Anti-Fraud Association (NHCAA) reports that around 3% to 10% of total healthcare spending is lost to fraud, amounting to billions of dollars every year. This statistic underscores the critical need for insurance companies to invest in advanced technologies capable of identifying and preventing fraudulent activities. Insurers are increasingly adopting machine learning algorithms and predictive analytics to analyze claims data for patterns indicative of fraud, thereby mitigating losses and improving operational efficiency.

Restraints

The significant expense associated with deploying sophisticated fraud detection technologies can be a barrier for smaller insurers, limiting their ability to adopt these solutions.

The need to access sensitive personal data raises privacy and security issues, potentially hindering the growth of the fraud detection market due to compliance challenges

The rapid evolution of fraudulent tactics poses ongoing challenges for detection systems, requiring continuous updates and adaptations that can strain resources.

One main challenge in the insurance fraud detection market is the evolving fraudulent schemes. Fraudsters are always finding new ways to present more complexities while exploiting new vulnerabilities within the insurance system. For instance, advancements in digital tools and artificial intelligence can both aid fraud detection and enable criminals to bypass traditional security measures. This evolving landscape requires companies to constantly update and adapt their detection systems to remain effective, which can be resource-intensive. The need for constant monitoring and periodic upgrades increases operational complexity for insurers-especially those who may not have the technical know-how or even know how to respond quickly to these emergent threats quickly. Another fact is that dynamic fraud tactics-for example, synthetic identity fraud or staged accidents-will make old fraud detection models static, and hence, companies will have to adopt more agile, real-time analytics systems.

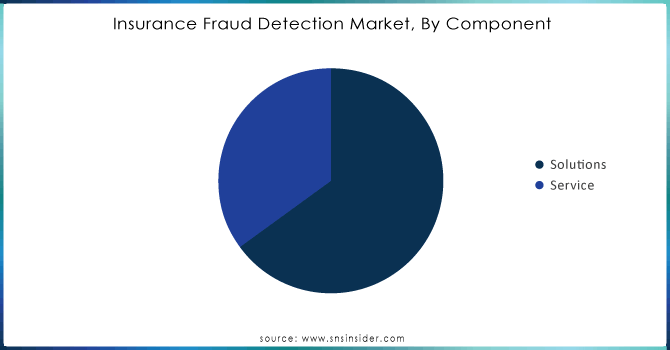

By component

In 2023, the market was dominated by the solutions segment, which accounted for a revenue share of 61%. This dominance is due to the growing adoption of technological solutions, data analytics, machine learning, and AI that empower insurers to manage large data volumes more effectively. According to the Insurance Information Institute (III), more than 70% of insurance companies reported integrating advanced analytics into their fraud detection processes in 2023, showcasing the shift towards data-centric approaches.

The services segment is projected to grow with the highest CAGR during the forecast period. It will be driven by the growing demand for consulting and support services that provide organizations with the necessary information to implement and manage fraud detection systems. Additionally, with the number of regulations pertaining to insurance fraud becoming more rigid and complex, firms need to receive professional and expert support to ensure both the compliance and effectiveness of the operations. The trend is supported by the data about the governmental experience showing that the demand for consulting services aimed at fraud prevention rose by 22% in 2023.

Need Any Customization Research On Insurance Fraud Detection Market - Inquiry Now

By Deployment

The on-premise deployment type held the highest revenue share of the global insurance fraud detection market in 2023. The main driving factor behind this preference for on-premise solutions is the need for better security and more control over sensitive data. Insurance firms are usually hesitant to adopt fully cloud-based solutions as they fear vulnerabilities in data privacy, compliance, and leaks. According to a CISA 2023 report, "85 percent of insurance organizations said they prefer on-premise systems for fraud detection to protect customer information and comply with stringent regulations, especially amid rising rates of cyberattacks targeting the insurance industry". In addition, data protection regulations, for example, the General Data Protection Regulation in Europe and some state-level legislation in the United States, place a necessity on insurers to maintain strict control over their data environments. Cloud-based solutions are flexible and scalable, but the demand for on-premise deployments is ongoing, especially for security and compliance reasons. This trend underscores the absolutely critical importance of data protection and regulatory compliance in shaping preference for deployment in the market for insurance fraud detection.

By organization size

In 2023, the large organization segment held about 65% of the global insurance fraud detection market. The dominance of the segment can be attributed to the high resources and advanced technologies present with large insurers, enabling them to invest in the right insurance fraud detection systems immune to different types of fraud. According to the government statistics of the National Association of Insurance Commissioners, more large organizations are using these advanced applications with 78% of them as of 2023. Large organizations are also prone to fraud due to the amounts of claims they deal with in their business, prompting them to have sufficient fraud detection measures in place. In addition, more small organizations are becoming aware of the benefits of fraud detection, but their low budgets and highly inadequate technologies to leverage on advanced applications make it a challenge for them to invest. Large insurers will supposedly dominate in this trend given the changing regulatory environment, which Favors their status and size in the eventuality of enhancing their fraud detection systems.

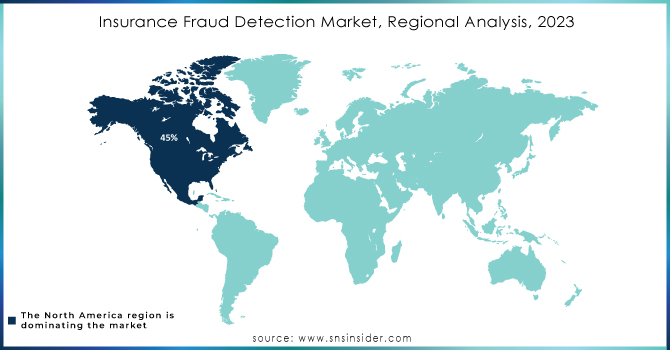

North America dominated the insurance fraud detection market in 2023, accounted 45% of the global market share. The dominance is attributed to a strict regulatory environment in the region, an advanced technological infrastructure, and a high awareness of fraud-related concerns among sophistically consumers and organizations. According to the Federal Bureau of Investigation bureau, insurance fraud is a big deal in U.S. America, and the insurers have to spend highly advanced technologies to detect fraud. Additionally, there is a high economic performance of the region, alongside the presence of major players in the insurance sector. The robust economy allows insurance enterprises to innovate on a regular. Furthermore, the region's robust economy and presence of major insurance players facilitate continuous innovation and adoption of fraud detection solutions. The insurance fraud detection market in NA was led by the U.S. in 2023 due to the increase in cases alongside technology upscale hence the introduction of new risks. Service providers are enhancing ease of use for solutions, while partnerships between companies and insurers aim to improve customer experiences. For example, in October 2023, Shippo and Cover Genius launched Shippo Total Protection, a solution offering comprehensive global coverage and streamlined claims processing for merchants.

The Asia-Pacific region is expected to grow with the fastest CAGR during the forecast, the reason being that the insurance sector is going digital as cases are fraud are also on the rise. According to the government data available, insurance fraud cases in India and China have been increasing by over 30% and this has prompted the companies to augment their fraud detection capabilities. The region accounts significant share of the market in 2023 and with growing investments in technology and increasing regulatory scrutiny, its market share is projected to expand significantly in the forecast period.

The new data-sharing initiative for combating insurance frauds through advanced analytics was recently launched by the Insurance Fraud Bureau in the UK in April 2024 in an effort to improve the collaboration of insurance firms with crime prevention teams.

In May 2024, Solutis joined forces with FICO to prevent fraud and also reduce losses of medium-sized banks and insurance companies in order to improve financial inclusion.

Verisk, in May 2023, teamed up with CCC Intelligent Solutions to merge the fraud detection analytics with CCC's claims platform. This will further intensify fraud prevention in the P&C insurance sector.

Service Providers

FICO (FICO Falcon Fraud Manager, FICO Insurance Fraud Solution)

IBM Corporation (IBM Safer Payments, IBM Counter Fraud Management)

SAS Institute Inc. (SAS Fraud Framework, SAS Detection and Investigation for Insurance)

Oracle Corporation (Oracle Insurance Fraud Analytics, Oracle Financial Services Analytical Applications)

SAP SE (SAP Fraud Management, SAP Business Integrity Screening)

DXC Technology (DXC Fraud Detection Solution, DXC Insurance Suite)

Experian plc (Experian Fraud Risk Management, Experian Fraud Shield)

BAE Systems (NetReveal Fraud Detection, BAE Systems Fraud Detection Platform)

Shift Technology (Force Fraud Detection, Shift Claims Fraud Detection)

ACI Worldwide (ACI Fraud Management for Insurance, ACI Enterprise Payments Fraud Management)

Users of Services/Products

Allianz SE

AXA Group

State Farm

Progressive Corporation

GEICO

Zurich Insurance Group

American International Group (AIG)

MetLife, Inc.

Chubb Limited

Liberty Mutual Insurance

and others in final Report.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.45 Billion |

| Market Size by 2032 | USD 32.2 Billion |

| CAGR | CAGR of 24.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions {Fraud Analytics, Authentication, Governance, Risk, and Compliance, Others}), Services {Professional Services, Managed Services}) • By Organization (SMB, Large Organization) • By Deployment (Cloud, On-Premise) • By End-user Industry (Automotive, BFSI, Healthcare, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, FICO (Fair Isaac Corporation), SAS Institute Inc.,Oracle Corporation, SAP SE, DXC Technology, Experian Information Solutions, Inc., LexisNexis Risk Solutions, BAE Systems, ACI Worldwide, Shift Technology, Accertify, Inc. |

| Key Drivers | • The growing prevalence of insurance fraud across sectors like healthcare and motor insurance is prompting insurers to invest in advanced fraud detection solutions to safeguard against significant financial losses. • Stricter regulations such as KYC and AML necessitate robust fraud detection systems to avoid penalties and ensure compliance, driving demand in the market. |

| RESTRAINTS | • The significant expense associated with deploying sophisticated fraud detection technologies can be a barrier for smaller insurers, limiting their ability to adopt these solutions. • The need to access sensitive personal data raises privacy and security issues, potentially hindering the growth of the fraud detection market due to compliance challenges |

Ans. The projected market size for the Insurance Fraud Detection Market is USD 32.2 billion by 2032.

Ans: The North American region dominated the Insurance Fraud Detection Market in 2023.

Ans. The CAGR of the Insurance Fraud Detection Market is 24.6% During the forecast period of 2024-2032.

And: The solutions component segment dominated the Insurance Fraud Detection Market in 2023.

Ans:

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Insurance Fraud Detection Market Segmentation, By Component

7.1 Chapter Overview

7.2 Solutions

7.2.1 Solutions Market Trends Analysis (2020-2032)

7.2.2 Solutions Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Fraud Analytics

7.2.3.1 Fraud Analytics Market Trends Analysis (2020-2032)

7.2.3.2 Fraud Analytics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Authentication

7.2.4.1 Authentication Market Trends Analysis (2020-2032)

7.2.4.2 Authentication Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Governance, Risk, and Compliance

7.2.5.1 Governance, Risk, and Compliance Market Trends Analysis (2020-2032)

7.2.5.2 Governance, Risk, and Compliance Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Others

7.2.6.1 Others Market Trends Analysis (2020-2032)

7.2.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Professional Services

7.3.3.1 Professional Services Market Trends Analysis (2020-2032)

7.3.3.2 Professional Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Managed Services

7.3.4.1 Managed Services Market Trends Analysis (2020-2032)

7.3.4.2 Managed Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Insurance Fraud Detection Market Segmentation, By Organization

8.1 Chapter Overview

8.2 SMB

8.2.1 SMB Market Trends Analysis (2020-2032)

8.2.2 SMB Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Large Organization

8.3.1 Large Organization Market Trends Analysis (2020-2032)

8.3.2 Large Organization Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Insurance Fraud Detection Market Segmentation, By Deployment

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 On-Premise

9.3.1 Desktops Market Trends Analysis (2020-2032)

9.3.2 Desktops Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Digital Billboards

9.4.1 Digital Billboards Market Trends Analysis (2020-2032)

9.4.2 Digital Billboards Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Big Data & Analytics

9.5.1 Big Data & Analytics Market Trends Analysis (2020-2032)

9.5.2 Big Data & Analytics Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Insurance Fraud Detection Market Segmentation, By End-user Industry

10.1 Chapter Overview

10.2 Automotive

10.2.1 Automotive Market Trends Analysis (2020-2032)

10.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 BFSI

10.3.1 BFSI Market Trends Analysis (2020-2032)

10.3.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Healthcare

10.4.1 Healthcare Market Trends Analysis (2020-2032)

10.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Retail

10.5.1 Retail Market Trends Analysis (2020-2032)

10.5.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Insurance Fraud Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.2.5 North America Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.6 North America Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.2.7.3 USA Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7.4 USA Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Canada Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.2.8.3 Canada Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8.4 Canada Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.2.9.3 Mexico Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9.4 Mexico Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.1.7.3 Poland Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7.4 Poland Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.1.8.3 Romania Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8.4 Romania Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Insurance Fraud Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.5 Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.6 Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.7.3 Germany Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7.4 Germany Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 France Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.8.3 France Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8.4 France Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.9.3 UK Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9.4 UK Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.10.3 Italy Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10.4 Italy Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.11.3 Spain Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11.4 Spain Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.14.3 Austria Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14.4 Austria Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.5 Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.6 Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 China Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.7.3 China Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7.4 China Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 India Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.8.3 India Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8.4 India Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 Japan Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.9.3 Japan Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9.4 Japan Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.10.3 South Korea Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10.4 South Korea Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.11.3 Vietnam Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11.4 Vietnam Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.12.3 Singapore Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12.4 Singapore Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Australia Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.13.3 Australia Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13.4 Australia Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Insurance Fraud Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.1.5 Middle East Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.6 Middle East Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.1.7.3 UAE Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7.4 UAE Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Insurance Fraud Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.2.5 Africa Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.6 Africa Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Insurance Fraud Detection Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.6.5 Latin America Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.6 Latin America Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.6.7.3 Brazil Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7.4 Brazil Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.6.8.3 Argentina Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8.4 Argentina Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.6.9.3 Colombia Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9.4 Colombia Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Insurance Fraud Detection Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Insurance Fraud Detection Market Estimates and Forecasts, By Organization (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Insurance Fraud Detection Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Insurance Fraud Detection Market Estimates and Forecasts, By End-user Industry (2020-2032) (USD Billion)

12. Company Profiles

12.1 IBM Corporation

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 FICO (Fair Isaac Corporation)

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 SAS Institute Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Experian Information Solutions, Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 LexisNexis Risk Solutions

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 BAE Systems

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 ACI Worldwide

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Shift Technology

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 FRISS

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Accertify, Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Solutions

Fraud Analytics

Authentication

Governance, Risk, and Compliance

Others

Services

Professional Services

Managed Services

By Organization

SMB

Large Organization

By Deployment

Cloud

On-Premise

By End-user Industry

Automotive

BFSI

Healthcare

Retail

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Cloud Disaster Recovery Market was valued at USD 9.7 billion in 2023 and is expected to grow to USD 71.8 billion by 2032, at a CAGR of 24.94% over 2024-2032.

The Video Conferencing Systems Market was valued at USD 13.51 billion in 2023 and is expected to reach USD 66.13 billion by 2032, growing at a remarkable CAGR of 19.30% during the forecast period of 2024-2032.

Knowledge Process Outsourcing Market valued at USD 57.2 billion in 2023, is expected to grow to USD 238.7 billion by 2032, at a CAGR of 17.22% over 2024-2032.

The Insurance Fraud Detection Market Size was valued at USD 4.45 Billion in 2023 and is expected to reach USD 32.2 Billion by 2032, growing at a CAGR of 24.6% over the forecast period 2024-2032.

The Smart Transportation Market was valued at USD 121.0 Billion in 2023 and will reach USD 388.0 Billion by 2032, growing at a CAGR of 13.84% by 2032.

The Data Observability Market Size was valued at USD 2.33 Billion in 2023 and is expected to reach USD 6.23 Billion by 2032 and grow at a CAGR of 11.6% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone