Insecticides Market Report Scope & Overview:

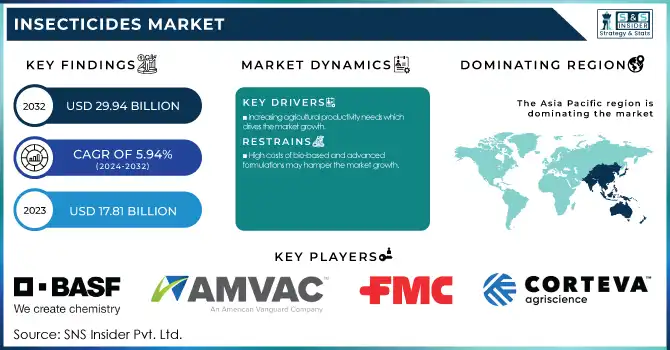

The Insecticides Market size was USD 17.81 Billion in 2023 and is expected to reach USD 29.94 Billion by 2032 and grow at a CAGR of 5.94 % over the forecast period of 2024-2032. This report provides statistical insights and trends in the Insecticides Market, covering production volume and utilization by country and type in 2023 and active ingredient pricing trends across key regions. It examines the regulatory landscape, highlighting bans and regional restrictions on specific insecticides. Additionally, the report explores environmental and toxicity metrics, including residue levels, soil and water contamination, and sustainability efforts. It delves into innovation and R&D investments in bio-based and synthetic insecticides, reflecting the industry's shift toward eco-friendly solutions. The study also evaluates the adoption of precision application technologies and digital pest management systems by region. These insights help stakeholders understand market dynamics, regulatory changes, and technological advancements shaping the insecticide sector.

To Get more information on Insecticides Market - Request Free Sample Report

Insecticides Market Dynamics

Drivers

-

Increasing agricultural productivity needs which drives the market growth.

The world population increasing, there is a need to increase the agricultural productivity to meet the food security. Facing challenges like land degradation, loss of soil fertility and unpredictability of climate elements, farmers are compelled to produce maximum yield from every inch of land. Insect pests are one of the great enemies of the health of crops, and, if they are not controlled in an adequate way, they can cause very significant losses for farmers. This has led to a high demand for insecticides (to protect crops from pests) in order to keep agricultural production at a high rate. Also, with natural scarcity of arable land the farmers are adopting intensive farming practices where insecticides perform a decisive role in productivity augmentation by facilitating effective pest control. In parallel, governments and agricultural organizations are advocating the utilization of novel chemistries and integrated pest management approaches as a pathway to increasing food production and security.

Restraint

-

High costs of bio-based and advanced formulations may hamper the market growth.

Increasing environmental concerns and stringent regulations on chemical pesticides have led to the increasing shift towards eco-friendly and bio-based insecticides. The major roadblock to the widespread use of these custom formulations – especially for small- and medium-scale farmers is the expense. Manufacturing costs are more expensive and because of this, the production of bio-based insecticides involves extraction, fermentation, and stabilization processes as well. Furthermore, the development of new insecticide products, including nano insecticides and microencapsulation technologies, sets high financial costs, significantly influencing product pricing. The more limited production scale and distribution difficulty over pricing issues also make the bio-based alternatives not as competitive as traditional synthetic insecticides.

Opportunity

- Growing demand for stored product protection creates an opportunity in the market.

A growing international trade of agricultural products, coupled with a growing recognition of the need for food security, is fueling the demand for effective insecticides for stored product protection. Insect pests on grains, cereals, pulses, and other storage commodities often lead to post-harvest losses, which in turn cause huge economic losses to farmers, food processors, and supply chain operators. Increasing urbanization and new specifications regarding methods of assault are probably to lead to the maximization of the pest control market for wholesalers, silos, and storage progress facilities. Moreover, strict food safety regulations and quality standards are driving the adoption of insecticides which give long-lasting protection against pests without compromising the integrity of the products. Emerging fumigant, IGR, and residue-free formulations are paving the way for market players to develop better-fit solutions for post-harvest pest control.

Challenges

- Fluctuations in raw material prices and supply chain disruptions may create a challenge for the market.

The market for insecticides and insect pest control is invariably linked with the availability and price of materials such as active ingredients, solvents, and stabilizers, Production costs of manufacturers are highly impacted by price volatility in key raw materials, which can be attributed to multitude of factors including geopolitical tensions, trade restrictions, and fluctuations in crude oil prices. Supply chain disruptions due to shipping delays, labor shortages, and even government actions like bans on transporting certain chemicals can also make it difficult for products to get to market in the first place. Thus, the insecticide market players are combating these uncertainties through alternative sourcing, optimized inventory, and localized production to overcome risks from raw material price and supply chain fluctuations.

Insecticides Market Segmentation Analysis

By Type

Organophosphate segment held the largest market share around 28% in 2023. owing to the broad-spectrum efficacy of these products and their cost-effectiveness, which makes them popular among farmers worldwide. They disrupt the nervous system of the pest, making them effective against many insects including aphids, caterpillars, and beetles. Due to its inherent ability to act fast and the quick environmental degradation compared to organochlorines this agricultural pesticide the widely used in crop protection. In addition to that, organophosphates are useful pre-harvest and post-harvest based on their wide application, which is essential to obtain the maximum yield & food security.

By Application

The cereals and grains segment held the largest market share around 40% in 2023. It is a widely cultivated and economically important crop, also susceptible to pest infestations globally. Wheat, rice, maize, and barley are major crops that serve as staple foods for much of the world's population, thus protection of these traits is important for food security. Crops are also vulnerable to many insect stem borers, aphids, armyworms, and weevils are the commonest, and yields withstand the widespread application of insecticides to avert loss. The demand for cereals and grains in industrialized countries has been further accelerated by the growing needs of animal feed, biofuel production, and processed food industries thus, increasing the growth of pest control market value addition.

Insecticides Market Regional Outlook

Asia Pacific held the largest market share around 48% in 2023. It is due to the vast agricultural land with multiple crops cultivated in a single season and increasing people attracts the region in producing a large quantity of edible food. Being some of the largest producers of rice, wheat, and maize globally, countries such as China, India, and Indonesia require effective pest control solutions to limit crop losses. The climate of the region is predominantly tropical and subtropical, which provides an ideal environment for the occurrence of insects, thereby, driving the growth of the insecticide market. Meanwhile, a growing population coupled with an increasing demand for food has encouraged governments to adopt measures to improve agricultural output through increased subsidies and pest management programs. The strength of the region is complemented by the presence of large agrochemical companies along with lower production costs and increasing agricultural exports. In addition, continuous development of bio-based and bio-degradable insecticides is being examined which seem to be facilitating and maintaining the market growth in the future.

The insecticide market in North America is prominent due to large commercial farms, advanced technology practiced in crop cultivation, and the government implementing strict guidelines for protecting crops in the region. Due to the high vulnerability of crops like corn, soybeans, and wheat, high demand for pest control solutions is generated with the USA and Canada being high producers of such crops. Further adding strength to this market are lagging agrochemical companies like Corteva Agriscience, FMC Corporation, and Bayer CropScience, who are relentless in developing innovative insecticide formulations, bio-based and precision-targeted solutions to stay competitive in insecticide formulations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AMVAC Chemical Corp. (Orthene, Naled)

-

UPL Ltd. (Phoskill, Ulala)

-

Bayer AG (Confidor, Decis)

-

BASF SE (Nealta, Alverde)

-

FMC Corp. (Brigade, Talstar)

-

Corteva Agriscience (Intrepid, Radiant)

-

Nufarm Ltd. (Assail, Triadimefon)

-

Bioworks, Inc. (BotaniGard, Mycotrol)

-

Syngenta Group (Actara, Karate)

-

Sumitomo Chemical (Sumithion, Danitol)

-

Adama Agricultural Solutions (Mavrik, Pyrinex)

-

Valent BioSciences (DiPel, XenTari)

-

Mitsui Chemicals Agro, Inc. (Trebon, Albarin)

-

Gowan Company (Ecozin, PyGanic)

-

Nippon Soda Co., Ltd. (Mospilan, Nichino)

-

Helm AG (Helmstar, HelmForce)

-

Isagro S.p.A. (Azatin, Domark)

-

Rotam Global AgroSciences (Lambda, Bifenthrin)

-

Rallis India Ltd. (Asataf, Nova)

-

PI Industries Ltd. (Osheen, Nominee Gold)

Recent Development:

-

In 2024, Bayer CropScience AG announced its plan to launch the world’s first bioinsecticide for arable crops, developed in partnership with AlphaBio Control. This innovative solution aims to help farmers manage pests sustainably while reducing environmental impact.

-

In 2023, ADAMA introduced Almada, a fungicide formulated with fluxapyroxade, mancozeb, and prothioconazole to combat soybean diseases in Brazil. This innovative solution offers broad-spectrum disease control, enhancing crop protection and yield.

-

In 2023, BASF began the registration process for Prexio Active, a new insecticide designed to control all four rice hopper species effectively. This development aims to enhance pest management in rice cultivation, improving yield protection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.81 Billion |

| Market Size by 2032 | USD 29.94 Billion |

| CAGR | CAGR of5.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pyrethroids, Organophosphates, Carbamates, Chlorinated Hydrocarbons, Botanical, Others) • By Application, (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AMVAC Chemical Corp., UPL Ltd., Bayer AG, BASF SE, FMC Corp., Corteva Agriscience, Nufarm Ltd., Bioworks, Inc., Syngenta Group, Sumitomo Chemical, Adama Agricultural Solutions, Valent BioSciences, Mitsui Chemicals Agro, Inc., Gowan Company, Nippon Soda Co., Ltd., Helm AG, Isagro S.p.A., Rotam Global AgroSciences, Rallis India Ltd., PI Industries Ltd.. |