Get more information on InGaAs Photodiode Sensor Market - Request Sample Report

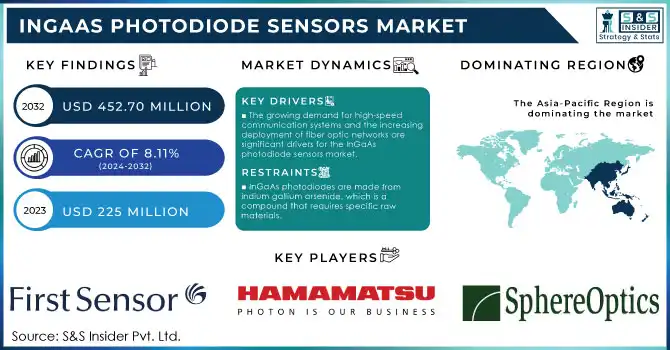

The InGaAs Photodiode Sensors Market Size was valued at USD 225 Million in 2023 and is expected to reach USD 452.70 Million by 2032 and grow at a CAGR of 8.11% over the forecast period 2024-2032.

The InGaAs photodiode sensor market is experiencing significant growth, driven by its unique capabilities and diverse applications across industries. These sensors, renowned for their ability to operate in the infrared spectrum, play a pivotal role in telecommunications, particularly in fiber-optic networks. They excel in detecting and converting optical signals into electrical ones with high precision, which is critical for high-speed data transmission in long-haul and metro networks. With the global surge in 5G infrastructure, the demand for InGaAs photodiodes in this sector is expanding rapidly. As of 2023, there were approximately 1.9 billion 5G subscriptions worldwide, with North America leading with a 32% 5G adoption rate double the global average. This growth underscores the increasing need for broadband connectivity and reinforces the role of InGaAs photodiodes in the evolution of next-generation networks.

In the defense and aerospace sectors, InGaAs photodiode sensors are vital for advanced technologies such as laser range finding, missile guidance, and target tracking. Their sensitivity to faint light signals in the SWIR spectrum makes them indispensable for night vision systems, surveillance, and reconnaissance operations. Additionally, these sensors are widely used in satellite systems for Earth observation, enhancing imaging capabilities for environmental monitoring and disaster management.

Drivers

The growing demand for high-speed communication systems and the increasing deployment of fiber optic networks are significant drivers for the InGaAs photodiode sensors market.

InGaAs photodiodes are extensively utilized in fiber optic communication for their outstanding performance in the infrared spectrum, allowing for high-speed data transmission across long distances. These sensors can detect light between 900 and 1700 nm, making them perfect for fiber optic communications using these wavelengths for fast data transmission. The increasing worldwide need for fast internet and mobile data, combined with the emergence of 5G technology, has increased the demand for advanced photodetectors like InGaAs photodiodes. With the expansion of telecommunication networks, InGaAs photodiodes play a crucial role in maintaining the strength and effectiveness of optical communication systems. The demand for fiber optics in telecommunications is constantly growing due to their superior performance compared to copper cables in terms of bandwidth and distance. InGaAs photodiodes assist in transforming optical signals to electrical signals, facilitating efficient data transmission via fiber optic cables. The rise in fiber optic network installations, fueled by the demand for faster internet, better connectivity, and the introduction of 5G networks, is anticipated to drive an increase in the need for InGaAs photodiodes. Moreover, fiber optic communication plays a vital role in linking distant regions and enabling the widespread availability of internet services worldwide, a major trend in developed and developing countries.

The healthcare sector is more and more embracing InGaAs photodiodes for their capacity to sense light in the near-infrared range, which proves valuable in medical tasks.

These sensors are crucial for advanced imaging systems used in different medical procedures, improving diagnostic precision and patient results. InGaAs photodiodes are perfect for non-invasive imaging as they can operate in the near-infrared spectrum, a feature that is becoming more popular for its ability to lower the risks linked to traditional diagnostic approaches. In OCT, high-resolution imaging of tissues is made possible by InGaAs photodiodes, assisting doctors in early disease diagnosis. These sensors are essential to devices that monitor blood oxygen levels, playing a vital role in continuously monitoring patient health, especially in critical care settings. With advancements in healthcare, there is a growing trend towards non-invasive and more accurate diagnostic technologies, in which InGaAs photodiodes are essential. The rise in personalized medicine, the growing number of chronic diseases, and progress in medical research are increasing the need for high-performance photodiodes such as InGaAs in medical imaging technologies.

Restraints

InGaAs photodiodes are made from indium gallium arsenide, which is a compound that requires specific raw materials.

The availability of these materials can sometimes be limited due to geopolitical factors, supply chain disruptions, or fluctuations in market demand. In regions where these raw materials are scarce, the cost of production for InGaAs photodiodes may rise, further hindering their widespread use. The dependence on rare earth elements and specific raw materials for the production of InGaAs photodiodes makes the supply chain susceptible to disruptions. Any shortage or price increase in raw materials could significantly impact the cost and availability of these photodiodes. This constraint is particularly concerning for manufacturers that rely on stable supply chains and affordable raw materials to keep production costs under control.

by Type

The single-element segment dominated the market in 2023 with over 30% market share, due to their simplicity, high sensitivity, and broad utility across the near-infrared (NIR) spectrum (900–1700 nm). These photodiodes are highly effective in converting light into electrical signals with minimal noise, making them indispensable in applications such as optical communication, spectroscopy, and laser rangefinding. Their reliability and cost-effectiveness drive adoption in industrial and scientific fields. For instance, companies like Thorlabs utilize single-element PIN photodiodes in spectroscopy systems for material analysis, while Finisar Corporation employs them in optical communication systems for high-speed data transmission.

The avalanche segment is projected to become the fastest-growing segment during 2024-2032, due to its ability to amplify weak optical signals with internal gain, providing exceptional sensitivity for demanding applications. These photodiodes are increasingly utilized in high-speed optical networks, quantum communication, and low-light imaging, as well as in emerging technologies like LiDAR systems and 3D mapping. For example, First Sensor integrates APDs in medical imaging systems for advanced diagnostics, Excelitas Technologies uses them in LiDAR for autonomous vehicles, and Sony incorporates them into high-resolution 3D cameras for AR/VR applications.

by Application

The telecommunication segment led the market with over 40% market share in 2023 in the InGaAs photodiode sensors market. InGaAs photodiodes are very efficient in optical communication systems because they can detect infrared light, which is crucial for transmitting large amounts of data over long distances. These sensors are essential for efficient high-speed data transmission in both long-haul and metropolitan area networks (MANs), minimizing signal loss. For instance, II-VI Incorporated offers photodiodes for use in telecommunication applications, specifically for high-speed communication systems, optical fiber networks, and wavelength-division multiplexing (WDM) systems.

The security segment is expected to experience rapid growth rate during 2024-2032 in the InGaAs photodiode sensors market, especially in night-vision systems, surveillance cameras, and infrared imaging technologies. The sensitivity of InGaAs photodiodes to infrared light makes them perfect for detecting low-light situations and improving security in areas with poor visibility. For example, FLIR Systems, which is now part of Teledyne, is a top firm that utilizes InGaAs photodiodes in its infrared cameras for security and surveillance purposes, such as perimeter surveillance and border security.

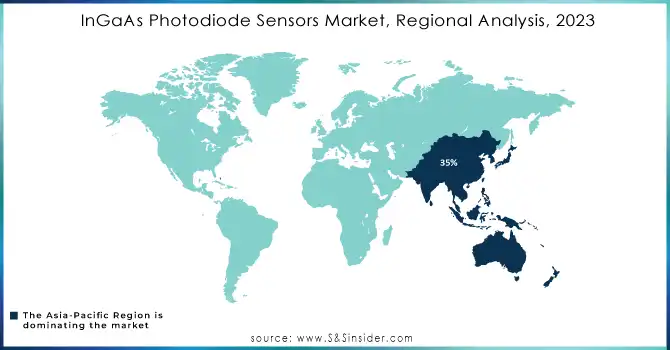

Asia-Pacific dominated in 2023, holding a 35% market share in the InGaAs photodiode sensors market. This dominance can be attributed to the strong manufacturing base in countries like China, Japan, and South Korea, which are leaders in electronics, telecommunications, and semiconductor production. The demand for InGaAs photodiodes in APAC is fueled by the region's growing industrial automation, telecommunications infrastructure, and research sectors. Companies such as Hamamatsu Photonics, Toshiba, and ON Semiconductor have a significant presence in APAC, driving the market’s growth.

North America is expected to be the fastest-growing region in the InGaAs photodiode sensors market during 2024-2032. The region is experiencing rapid technological advancements and increasing investments in research and development. This is driven by the expanding demand for InGaAs photodiodes in diverse sectors, including telecommunications, aerospace, healthcare, and industrial applications. North America also benefits from the presence of key market players, such as Hamamatsu Photonics, Excelitas Technologies, and First Sensor, which are contributing to innovation and the development of new applications.

Need any customization research on InGaAs Photodiode Sensor Market - Enquiry Now

Key Players

The major players in the InGaAs Photodiode Sensors Market are:

First Sensor (InGaAs PIN Photodiode, InGaAs APD)

Hamamatsu Photonics K.K. (S1226-18BQ, G11159-01)

Kyoto Semiconductor Co., Ltd. (PSX-1000, PSX-1500)

Laser Components GmbH (PDA12-IR, PDB-C-L)

OSI LaserDiode (SLD-3030, SLD-4010)

SphereOptics GmbH (InGaAs Diode, Multi-Pin InGaAs Photodiode)

Teledyne Judson Technologies (TJT) (InGaAs APD, InGaAs PIN Photodiode)

Voxtel, Inc. (Voxtel APD-100, InGaAs Photodiode)

Centronic (IR Photodiodes, PIN Photodiodes)

Edmund Optics Inc. (InGaAs Photodiode, InGaAs PIN Photodiode)

Everlight Americas Inc. (IR Photodiodes, APD Arrays)

Excelitas Technologies Corp. (Photon Counting Module, InGaAs Photodiode)

CMC Electronics (InGaAs Avalanche Photodiode (APD))

Suppliers of Raw Materials/Components:

II-VI Incorporated

Osram Opto Semiconductors

JDS Uniphase

Mitsubishi Electric

Sumitomo Electric

Sharp Corporation

Samsung Electronics

Nihon Inter Electronics Corporation

Philips

Infineon Technologies

Recent Development

October 2023: Hamamatsu Photonics created and produced a novel near-infrared area image sensor. It enhances speed and dynamic range significantly, being up to twice as high as current hyperspectral camera products.

January 2024: CMC Electronics, a pioneering leader in advanced sensing solutions, is proud to announce the debut of its revolutionary InGaAs Avalanche Photodiode (APD). Expertly designed to elevate sensing and ranging capabilities, our latest APD is tailor-made for eye-safe laser range finding and scanning LiDAR applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 225 Million |

| Market Size by 2032 | USD 452.70 Million |

| CAGR | CAGR of 8.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Multi-Element Array, PN, PIN, Avalanche, Single-Element InGaAs PIN) • By Application (Telecommunication, Security Segments, Research Segments) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | First Sensor, Hamamatsu Photonics K.K., Kyoto Semiconductor Co., Ltd., Laser Components GmbH, OSI LaserDiode, SphereOptics GmbH, Teledyne Judson Technologies (TJT), Voxtel, Inc., Centronic, Edmund Optics Inc., Everlight Americas Inc., Excelitas Technologies Corp. |

| Key Drivers | • The growing demand for high-speed communication systems and the increasing deployment of fiber optic networks are significant drivers for the InGaAs photodiode sensors market. • The healthcare sector is more and more embracing InGaAs photodiodes for their capacity to sense light in the near-infrared range, which proves valuable in medical tasks. |

| RESTRAINTS | • InGaAs photodiodes are made from indium gallium arsenide, which is a compound that requires specific raw materials. |

Ans: The InGaAs Photodiode Sensors Market is expected to grow at a CAGR of 8.11% during 2024-2032.

Ans: InGaAs Photodiode Sensors Market size was USD 225.00 Million in 2023 and is expected to Reach USD 452.70 Million by 2032.

Ans: The growing demand for high-speed communication systems and the increasing deployment of fiber optic networks are significant drivers for the InGaAs photodiode sensors market.

Ans: APAC dominated the InGaAs Photodiode Sensors Market in 2023.

Ans: First Sensor, Hamamatsu Photonics K.K., Kyoto Semiconductor Co., Ltd., Laser Components GmbH, OSI LaserDiode, SphereOptics GmbH, Teledyne Judson Technologies (TJT), Voxtel, Inc., Centronic, Edmund Optics Inc., Everlight Americas Inc., Excelitas Technologies Corp.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 InGaAs Photodiode Sensors Production Volumes, by Region (2023)

5.2 InGaAs Photodiode Sensors Design Trends (Historic and Future)

5.3 InGaAs Photodiode Sensors Adoption Metrics (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. InGaAs Photodiode Sensors Market Segmentation, by Type

7.1 Chapter Overview

7.2 Multi-Element Array

7.2.1 Multi-Element Array Market Trends Analysis (2020-2032)

7.2.2 Multi-Element Array Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 PN

7.3.1 PN Market Trends Analysis (2020-2032)

7.3.2 PN Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 PIN

7.4.1 PIN Market Trends Analysis (2020-2032)

7.4.2 PIN Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Avalanche

7.5.1 Avalanche Market Trends Analysis (2020-2032)

7.5.2 Avalanche Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Single-Element InGaAs PIN

7.6.1 Single-Element InGaAs PIN Market Trends Analysis (2020-2032)

7.6.2 Single-Element InGaAs PIN Market Size Estimates and Forecasts to 2032 (USD Million)

8. InGaAs Photodiode Sensors Market Segmentation, by Application

8.1 Chapter Overview

8.2 Telecommunication

8.2.1 Telecommunication Market Trends Analysis (2020-2032)

8.2.2 Telecommunication Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Security Segments

8.3.1 Security Segments Market Trends Analysis (2020-2032)

8.3.2 Security Segments Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Research Segments

8.4.1 Research Segments Market Trends Analysis (2020-2032)

8.4.2 Research Segments Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.4 North America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.5.2 USA InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.6.2 Canada InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Mexico InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.5.2 Poland InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.6.2 Romania InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.4 Western Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.5.2 Germany InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.6.2 France InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.7.2 UK InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.8.2 Italy InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.9.2 Spain InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.12.2 Austria InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific InGaAs Photodiode Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia-Pacific InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.4 Asia-Pacific InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 China InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 India InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 Japan InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.6.2 South Korea InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Vietnam InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.8.2 Singapore InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.9.2 Australia InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia-Pacific InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East InGaAs Photodiode Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.4 Middle East InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.5.2 UAE InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa InGaAs Photodiode Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.4 Africa InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.7.2 Rest of Africa InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.4 Latin America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.5.2 Brazil InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.6.2 Argentina InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.7.2 Colombia InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America InGaAs Photodiode Sensors Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10. Company Profiles

10.1 First Sensor

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Hamamatsu Photonics K.K.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Kyoto Semiconductor Co., Ltd.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Laser Components GmbH

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 OSI LaserDiode

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 SphereOptics GmbH

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Teledyne Judson Technologies

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Voxtel, Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Centronic

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Excelitas Technologies Corp.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Multi-Element Array

PN

PIN

Avalanche

Single-Element InGaAs PIN

By Application

Telecommunication

Security Segments

Research Segments

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Analog Integrated Circuit Market Size was valued at USD 79.33 billion in 2023 and is expected to reach USD 147.74 Billion by 2032 and grow at a CAGR of 7.16% over the forecast period 2024-2032.

The Thyristor Protectors Market size was Valued at USD 0.7 billion in 2023 and is estimated to Reach USD 1.006 billion by 2032 and grow at a CAGR of 4.11% over the forecast period of 2024-2032.

The Float Level Switches Market Size was valued at USD 691.54 million in 2023 and is expected to grow at 4.29% CAGR to reach USD 1006.73 million by 2032.

The Smart Beacons Market was valued at USD 6.97 billion in 2023 and is expected to reach USD 71.77 billion by 2032, growing at a CAGR of 29.61% over the forecast period 2024-2032.

The Battery Energy Storage System Market size was valued at USD 6.50 Billion in 2023. It is estimated to reach USD 54.28 Billion by 2032, growing at a CAGR of 26.61% during 2024-2032.

The Satellite Modem Market Size was valued at USD 507.2 million in 2023, and is expected to reach USD 1391.88 million by 2032, and grow at a CAGR of 11.87% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone