Get more information on Industry 4.0 Market - Request Free Sample Report

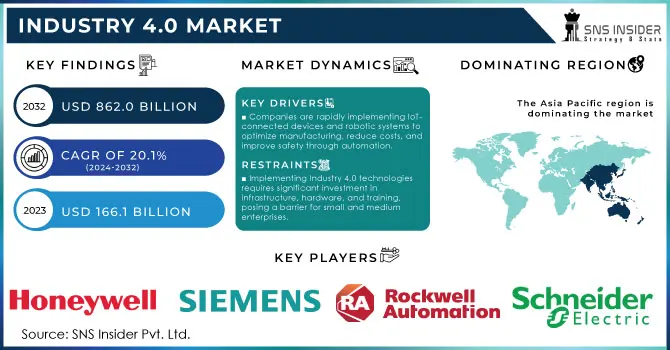

Industry 4.0 Market size was valued at USD 166.1 Billion in 2023 and is expected to grow to USD 862.0 Billion by 2032 and grow at a CAGR of 20.1% over the forecast period of 2024-2032.

The global Industry 4.0 market witnessed significant growth in recent years, mainly due to a rise in digital transformation projects across various industries, government and regulatory supports, as well as growing demand for advanced manufacturing technologies. Policymakers around the globe are investing heavily in Industry 4.0 initiatives to drive productivity, improve global competitiveness, and generate sustainable growth within their nation's manufacturing sector. The U.S. Department of Commerce announced over $500 million to be spent on the development and deployment of Industry 4.0 technologies for all key industries in 2023. Similarly, the European Union allocated nearly €1 billion to support Industry 4.0 adoption within the EU member states as they looking to achieve a 20% reduction in production costs and carbon emissions by 2030. In many nations where manufacturing dominates national economic policy like Germany and Japan, state-backed programs encourage enterprises to augment production through the implementation of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and robotics. Efforts to streamline production lines have been the backbone of efficiency improvements in the global supply chain, laying a solid foundation for Industry 4.0 growth. Furthermore, the more than $300 billion "Made in China 2025" plan of China is a prime example of how countries are committed to strengthening the digital landscape. In summary, government programs across the countries are a key driver for the growth of the Industry 4.0 market.

There are also rigorous quality, safety, and environmental protection regulations on product standards which vary across industries. Real-time tracking, traceability, and quality control allow companies to meet process- and product-compliance standards without incurring delay or long-term costs of poor compliance due to poor process controls, which can easily happen in organizations that do not use Industry 4.0 technologies. Digitization helps in engineering changes, risk assessment, and process improvements, which enable better visibility and improved on-demand data making compliance a competitive edge. The rise of Industrial IoT (IIoT) presents another great opportunity. With the Internet of Things, companies can connect equipment and sensors to get real-time data, recommending machine-to-machine communication which enhances production capability, reduces downtime, and improves operational efficiency. To protect industrial networks from cyber threats, comprehensive cybersecurity solutions are key; this opens a window of opportunity for companies to build secure frameworks and protocols as connectivity increases.

Drivers

Companies are rapidly implementing IoT-connected devices and robotic systems to optimize manufacturing, reduce costs, and improve safety through automation.

Digital twins help create accurate simulations of physical assets, allowing companies to improve quality and reduce downtime, thus accelerating adoption in smart manufacturing environments.

The increased adoption of IoT (Internet of Things) and industrial robots that have transformed manufacturing processes over the past decade through automation, productivity, and precision improvement is one of the major drivers for the Industry 4.0 market. New studies show that industrial manufacturing IoT adoption globally has greatly increased, with almost 68% of global manufacturers utilizing some level of devices powered by IoT technology to track operations and reduce waste or energy use. This has made IoT one of the fastest-growing sectors within Industry 4.0, underscoring its value in optimizing factory operations and reducing machine downtime.

The rapid deployment of industrial robots on production lines As per the International Federation of Robotics report, industrial robots reached a record global installation of 5170000 new units in 2023, with automotive and electronics sectors accounting for significant share growth 12% increase from the previous year. General Motors and Tesla have been early adopters of robotics along with IoT technologies leading to a production line that is heavily automated and works largely autonomously. These robots have now been able to weld and assemble with extreme precision allowing for better throughput and product quality. The combined use of IoT and robots in Industry 4.0 showcases a pathway toward "smart factories," enabling real-time data monitoring and predictive maintenance, ultimately pushing the industry closer to full automation and heightened productivity.

Restraints

Implementing Industry 4.0 technologies requires significant investment in infrastructure, hardware, and training, posing a barrier for small and medium enterprises.

As more industrial systems become interconnected, the threat of cyber-attacks increases, which can lead to production disruptions and data breaches, making companies cautious about widespread adoption.

Intensifying cybersecurity risk due to inter-connected solutions is one of the significant restraints that the Industry 4.0 market is expected to face in the coming years. With more manufacturers and industries using IoT, cloud computing, and big data, the number of connected devices and points of data exchange increases dramatically. The interconnectivity also creates many vulnerabilities, exposing systems to cyberattacks that can result in data breaches and production disruptions or even impact physical assets in critical operations. With Industry 4.0, cyber threats can attack any aspect of the business from machinery controls, and robotics to customer data posing severe financial and reputational risks for companies. Securing these networks involves safeguarding multiple devices, sensors, and data transmission protocols, and requires specialized cybersecurity measures. This need for robust security infrastructure makes it challenging for small and medium enterprises to implement Industry 4.0 technologies safely, as they often lack the resources and expertise to mitigate these risks effectively.

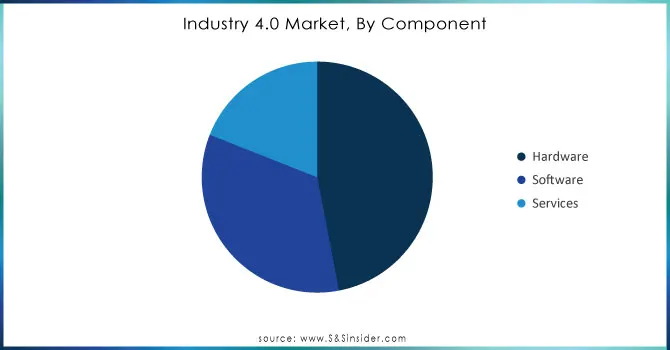

By Component

The hardware segment accounted for a significant share of about 48.0% in terms of revenue in 2023, owing to the growing demand for Industry 4.0 technology implementation coupled with advanced manufacturing machinery and IoT devices. While industries become more modernized, the physical infrastructure that supports these digital infrastructures has been and will continue to be heavily invested in. In 2023, China invested USD 65 billion into industrial hardware for automation and connectivity a 15% increase from the previous year. according to data from the National Bureau of Statistics of China. This segment consists of robotic systems, control devices, and several IoT sensors; these have become part and parcel of real-time monitoring and data collection. Government support in the form of subsidies and tax incentives for companies buying new equipment has been a driver here, especially in North America and Europe. Hardware remains in high demand within Industry 4.0, driven by the rising adoption of smart manufacturing systems and a growing desire to upgrade aging machines with digitally capable counterparts/solutions.

Need any customization research on Industry 4.0 Market - Enquiry Now

By Technology

In 2023, the Industrial Internet of Things (IIoT) accounted for an extensive scale share of more than 26%, attributable to its transformative capacity to interconnect machines, systems & devices in the Industry ecosystem. Department of Energy report from 2023 pointed to a USD 300M federal effort targeting IIOT infrastructure on connected factories for increased efficiency. Data exchange across systems is facilitated through the IIoT, therefore predictive maintenance can be executed while also reducing downtime. The growth of this segment is also attributed to the rising focus on data-driven decision-making, in industrial environments. As an illustration, Germany's Industry 4.0 effort ranks IIoT adoption within its high-tech strategy and has resulted in government-supported research and pilot programs to deploy smart sensors and IoT modules throughout German production plants. The IIoT segment is only expected to further expand in light of increasing governmental ideals for data integration along with real-time analytics, ensuring its status as a foundational technology in Industry 4.0.

By Industry Vertical

In 2023, the manufacturing segment captured a significant share of more than 30.0% of the market as firms are heavily investing in digitally transforming production processes. This vertical is crucial to economies around the world, and many governments have implemented programs directed at using digital transformation in manufacturing. The European Union showered Industry 4.0 projects in the manufacturing sector with over €500 million worth of funds in 2023 to bring down energy consumption and boost resource efficiencies. Likewise, the U.S. government says it spent USD 250 million last year on its Advanced Manufacturing Technology program designed to help manufacturing firms incorporate smart technologies to increase productivity and regulatory compliance. Such initiatives help drive the adoption of Industry 4.0 technologies, making manufacturing the primary beneficiary of this digital transformation.

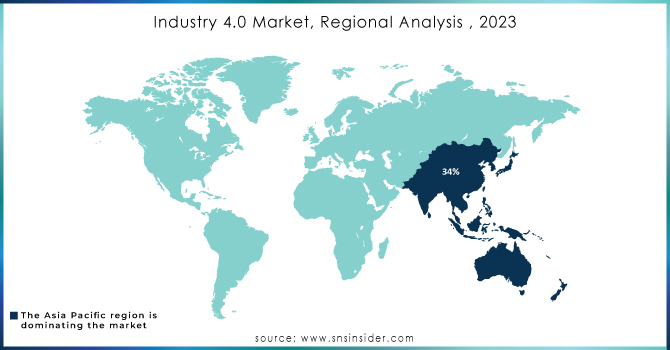

In 2023, the Asia-Pacific (APAC) region accounted for a 36% revenue share of the global Industry 4.0 market because of effective government initiatives and the presence of significant manufacturing bases across China, Japan, South Korea, etc. For example, China has retained this position and is even pushing it forward with the “Made in China 2025” plan which associates digital innovation in manufacturing with an investment of approximately $300 billion. China has the largest share which is approximately 35% in the global Industry 4.0 market in 2023, due to large amounts of IoT and AI implementations in factories as well.

By region, North America is projected to grow with a significant compound annual growth rate (CAGR) from 2024 to 2032. This growth is fueled by the U.S. government’s increased focus on reshoring manufacturing, with strategic investments in Industry 4.0 infrastructure aimed at reducing reliance on foreign production. North America is a prominent Industry 4.0 market with the presence of maintain substantial digital ecosystem and government incentives to raise adoption levels.

The U.S. Department of Commerce unveiled a $100 million program to boost smart manufacturing for small- and medium-sized enterprises with an emphasis on bringing IoT and AI-driven solutions into traditional low-tech sectors in March 2024.

Honeywell Digital Prime is a cloud-based digital twin platform for process control and system modification monitoring, management, and testing released under the Honeywell brand in June 2023. With its inexpensive cost, it allows for regular testing which enhances accuracy and also reduces reactive maintenance requirements drastically.

Key Service Providers/Manufacturers:

Siemens AG (Product: MindSphere, Simatic PCS 7)

Honeywell International Inc. (Product: Honeywell Forge, Digital Prime)

Rockwell Automation (Product: FactoryTalk, LogixAI)

Schneider Electric (Product: EcoStruxure, Modicon)

General Electric (GE Digital) (Product: Predix, Asset Performance Management)

ABB Ltd. (Product: Ability, RobotStudio)

IBM Corporation (Product: Watson IoT, Maximo)

Microsoft Corporation (Product: Azure IoT, Dynamics 365)

SAP SE (Product: SAP Leonardo, Digital Manufacturing Cloud)

Cisco Systems, Inc. (Product: Edge Intelligence)

Key Users Services/Products

Ford Motor Company

Bosch

Volkswagen Group

Nestlé

Procter & Gamble

Caterpillar Inc.

Airbus

Unilever

BASF SE

Siemens Energy

| Report Attributes | Details |

| Market Size in 2023 | USD 166.1 Bn |

| Market Size by 2032 | USD 862.0 Bn |

| CAGR | CAGR of 20.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology (Industrial Internet of Things, Robotics & Automation, Artificial Intelligence & Machine Learning, Big Data & Advanced Analytics, Additive Manufacturing, Augmented Reality & Virtual Reality, Digital Twin & Simulation, Blockchain & Secure Data Exchange, Others) • By Industry Vertical (Manufacturing, Petrochemicals, Automotive, Energy & Utilities, Oil & Gas, Food & Beverage, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, Honeywell International Inc., Rockwell Automation, Schneider Electric, General Electric (GE Digital), ABB Ltd., IBM Corporation, Microsoft Corporation, SAP SE, Cisco Systems Inc. |

| Key Drivers | • Companies are rapidly implementing IoT-connected devices and robotic systems to optimize manufacturing, reduce costs, and improve safety through automation. • Digital twins help create accurate simulations of physical assets, allowing companies to improve quality and reduce downtime, thus accelerating adoption in smart manufacturing environments. |

| Market Restraints | • Implementing Industry 4.0 technologies requires significant investment in infrastructure, hardware, and training, posing a barrier for small and medium enterprises. • As more industrial systems become interconnected, the threat of cyber-attacks increases, which can lead to production disruptions and data breaches, making companies cautious about widespread adoption. |

Ans: The Industry 4.0 Market is projected to reach USD 862.0 Billion by 2032.

Ans: The Industry 4.0 Market is expected to grow at a CAGR of 20.1% over the forecast period of 2024-2032.

Ans: Some of the major key players in the Industry 4.0 Market are Siemens AG, Honeywell International Inc., Rockwell Automation, Schneider Electric, and General Electric, among others.

Ans: The Asia-Pacific region dominated the Industry 4.0 Market in 2023.

Ans: Some of the major growth drivers of the Industry 4.0 Market are:

Companies are rapidly implementing IoT-connected devices and robotic systems to optimize manufacturing, reduce costs, and improve safety through automation.

Digital twins help create accurate simulations of physical assets, allowing companies to improve quality and reduce downtime, thus accelerating adoption in smart manufacturing environments.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Industry 4.0 Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Industry 4.0 Market Segmentation, By Technology

8.1 Chapter Overview

8.2 Industrial Internet of Things (IIoT)

8.2.1 Industrial Internet of Things (IIoT) Market Trends Analysis (2020-2032)

8.2.2 Industrial Internet of Things (IIoT) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Robotics & Automation

8.3.1 Robotics & Automation Market Trends Analysis (2020-2032)

8.3.2 Robotics & Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Artificial Intelligence & Machine Learning (AI & ML)

8.4.1 Artificial Intelligence & Machine Learning (AI & ML) Market Trends Analysis (2020-2032)

8.4.2 Artificial Intelligence & Machine Learning (AI & ML) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Big Data & Advanced Analytics

8.5.1 Big Data & Advanced Analytics Market Trends Analysis (2020-2032)

8.5.2 Big Data & Advanced Analytics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Additive Manufacturing

8.6.1 Additive Manufacturing Market Trends Analysis (2020-2032)

8.6.2 Additive Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Augmented Reality & Virtual Reality (AR & VR)

8.7.1 Augmented Reality & Virtual Reality (AR & VR) Market Trends Analysis (2020-2032)

8.7.2 Augmented Reality & Virtual Reality (AR & VR) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Digital Twin & Simulation

8.8.1 Digital Twin & Simulation Market Trends Analysis (2020-2032)

8.8.2 Digital Twin & Simulation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Blockchain & Secure Data Exchange

8.9.1 Blockchain & Secure Data Exchange Market Trends Analysis (2020-2032)

8.9.2 Blockchain & Secure Data Exchange Market Size Estimates and Forecasts to 2032 (USD Billion)

8.10 Others

8.10.1 Others Market Trends Analysis (2020-2032)

8.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Industry 4.0 Market Segmentation, By Industry Vertical

9.1 Chapter Overview

9.2 Manufacturing

9.2.1 Manufacturing Market Trends Analysis (2020-2032)

9.2.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Petrochemicals

9.3.1 Petrochemicals Market Trends Analysis (2020-2032)

9.3.2 Petrochemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Automotive

9.4.1 Automotive Market Trends Analysis (2020-2032)

9.4.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Energy & Utilities

9.5.1 Energy & Utilities Market Trends Analysis (2020-2032)

9.5.2 Energy & Utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Oil & Gas

9.6.1 Oil & Gas Market Trends Analysis (2020-2032)

9.6.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Food & Beverage

9.7.1 Food & Beverage Market Trends Analysis (2020-2032)

9.7.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Aerospace & Defense

9.8.1 Aerospace & Defense Market Trends Analysis (2020-2032)

9.8.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Others

9.9.1 Others Market Trends Analysis (2020-2032)

9.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Industry 4.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.4 North America Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.5 North America Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.6.2 USA Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.6.3 USA Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.7.2 Canada Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.8.2 Mexico Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Industry 4.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Industry 4.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.7.2 France Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.8.2 UK Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Industry 4.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.4 Asia Pacific Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.6.2 China Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.6.3 China Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.7.2 India Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.7.3 India Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.8.2 Japan Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.9.2 South Korea Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.11.2 Singapore Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.12.2 Australia Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Industry 4.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.4 Middle East Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Industry 4.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.4 Africa Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Industry 4.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.4 Latin America Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.5 Latin America Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.6.2 Brazil Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.7.2 Argentina Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.8.2 Colombia Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Industry 4.0 Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Industry 4.0 Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Industry 4.0 Market Estimates and Forecasts, By Industry Vertical (2020-2032) (USD Billion)

11. Company Profiles

11.1 Siemens AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Honeywell International Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Rockwell Automation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Schneider Electric

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 General Electric (GE Digital)

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 ABB Ltd.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 IBM Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Microsoft Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 SAP SE

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Cisco Systems Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

Services

By Technology

Industrial Internet of Things (IIoT)

Robotics & Automation

Artificial Intelligence & Machine Learning (AI & ML)

Big Data & Advanced Analytics

Additive Manufacturing

Augmented Reality & Virtual Reality (AR & VR)

Digital Twin & Simulation

Blockchain & Secure Data Exchange

Others

By Industry Vertical

Manufacturing

Petrochemicals

Automotive

Energy & Utilities

Oil & Gas

Food & Beverage

Aerospace & Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Sports Analytics Market Size was valued at USD 3.53 billion in 2023 and is witnessed to reach USD 20.48 billion by 2032 and grow at a CAGR of 22.51% over the forecast period 2024-2032.

The Fog Computing Market Size was valued at USD 282.59 Million in 2023 and is expected to reach USD 11537.48 Million by 2032 and grow at a CAGR of 51.0% over the forecast period 2024-2032.

Online Survey Software Market was valued at USD 5.57 billion in 2023 and is expected to reach USD 17.03 billion by 2032, growing at a CAGR of 13.27% by 2032

Edge-to-Cloud Architectures Market was valued at XX Bn in 2023 and will reach XX Bn with the CAGR at xx % cagr, over the forecast period by 2032.

Data Analytics Outsourcing Market Size was valued at USD 11.49 Billion in 2023 and is expected to reach USD 164.33 Billion by 2032 and grow at a CAGR of 34.43% over the forecast period 2024-2032.

The Enterprise Networking Market Size was valued at USD 153.51 Billion in 2023 and will reach USD 284.44 Billion by 2032 and grow at a CAGR of 7.1% by 2032.

Hi! Click one of our member below to chat on Phone