Get More Information on Industrial Wastewater Treatment Chemicals Market - Request Sample Report

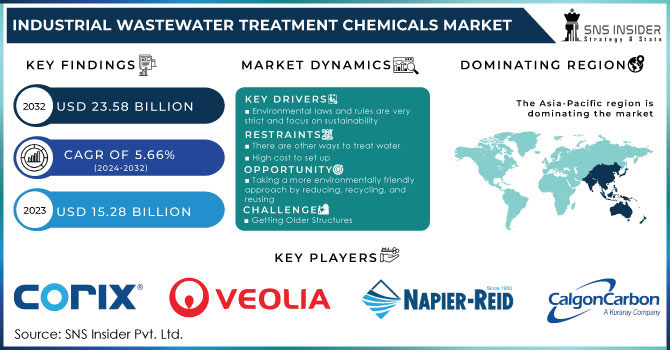

The Industrial Wastewater Treatment Chemicals Market Size was valued at USD 15.28 Billion in 2023 and is expected to reach USD 23.58 billion by 2032 and grow at a CAGR of 5.66% over the forecast period 2024-2032.

The growing shortage of clean water sources is a major factor contributing to the expansion of the industrial wastewater treatment chemicals market. Industries are pressured to find new solutions to meet their water needs as freshwater availability decreases because of factors such as population growth, climate change, and over-extraction of water sources. Utilizing advanced treatment technologies to recycle and reuse wastewater has become crucial.

Industries can use technologies like membrane filtration, reverse osmosis, and advanced oxidation processes to treat and purify wastewater produced during their operations. This processed water can be recycled for different industrial purposes, decreasing the need for new water sources. Utilizing these advanced treatment systems not only aids industries in meeting environmental regulations but also promotes sustainable water management practices. By reusing wastewater, industries can save precious water resources, reduce costs, and decrease their environmental impact, ultimately promoting sustainability and resource efficiency.

For instance, in 2023, the United Arab Emirates launched a large-scale desalination plant using advanced reverse osmosis technology, aiming to boost water supply while reducing energy consumption and environmental impact.

Moreover, Increased awareness within industries and the public about the environmental effects of untreated wastewater is causing an increase in the need for improved wastewater management procedures. Companies are placing more emphasis on sustainability and corporate social responsibility, particularly regarding adequate wastewater treatment.

In 2023, the U.S. Environmental Protection Agency partnered with private industries to launch the Water Reuse Action Plan, focusing on enhancing water reuse technologies and promoting sustainable water management practices across various sectors.

Market Dynamics:

Drivers

Increasing demand for chemical-treated water in various applications will drive market growth

The rising need for water treated with chemicals in different applications is a major factor driving market expansion. Chemical treatment plays a vital role in maintaining water quality in industrial processes, municipal water treatment, and agricultural uses. In industry, treated water is crucial for cooling, boiler feed, and manufacturing processes to avoid equipment corrosion, scaling, and fouling, which can lower operational efficiency and raise maintenance expenses.

Furthermore, the Water Framework Directive of the European Union enforces strict water quality standards, leading to the implementation of chemical treatment methods in member countries. In 2023, the European Commission indicated a 15% rise in investments for chemical treatment infrastructure in order to comply with these regulations.

Additionally, the companies are focused on launching new products in the market to increase their product portfolio in a particular line. Dow Chemical 2022 launched advanced ion exchange resins for industrial water treatment, enhancing the removal of contaminants and extending the lifespan of treatment systems.

Restrain

The high cost associated with water treatment hamper the market growth.

The considerable expense of water treatment is a major hindrance to market expansion. Sophisticated water treatment methods like membrane filtration, reverse osmosis, and chemical treatment demand significant financial commitment for equipment and maintenance. Small and medium-sized enterprises in less developed areas frequently face challenges in funding these technologies, which hinders their ability to utilize them effectively. In addition, the financial burden is increased by energy consumption costs, skilled labor expenses, and strict environmental regulations, making it difficult for numerous sectors to rationalize the investment. Government subsidies and financial incentives do not always provide enough support to cover these costs, which also limits market growth. The significant obstacle posed by the expensive water treatment costs particularly affects industries and regions with limited financial resources, which hinders the overall market growth.

By Type

The coagulants & flocculants held the largest market share in the type segment around 37.12% in 2023. These substances are vital for efficiently eliminating suspended solids, colloidal particles, and impurities from water, a crucial stage in municipal and industrial water treatment. Coagulants cancel out particle charges, making them stick together, while flocculants help clumps become bigger flocs that can be removed easily through sedimentation, filtration, or flotation. The prevalent use of coagulants and flocculants in different sectors such as municipal water treatment, industrial wastewater management, and process water treatment in industries like paper and pulp, mining, and food and beverages, contributes to their market dominance. Furthermore, the ongoing improvement of more effective and environmentally friendly formulations has increased their efficacy and expanded their range of uses, thus strengthening their position in the market.

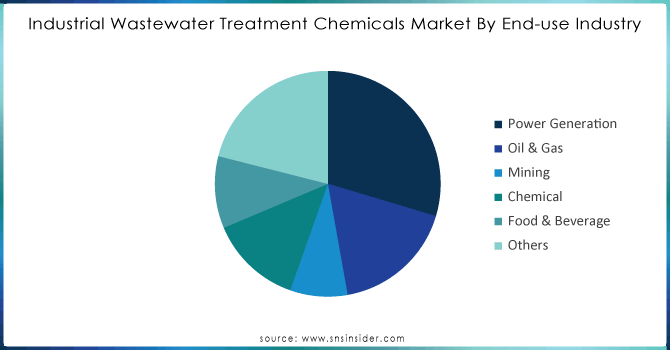

By End-User Industry

In the end-user industry segment power generation held the largest market share around 29.63% in 2023. Power plants, such as coal, nuclear, gas, or renewable ones, need significant amounts of water for different important activities like cooling, generating steam, and cleaning. The strong demand for water in these activities requires effective treatment options to guarantee that water quality complies with operational and regulatory requirements. Water is necessary for cooling systems in coal and nuclear power plants to regulate turbine heat and avoid overheating. The necessity of regular treatment is required for these plants to keep water clean and prevent issues like scaling, corrosion, and fouling, which can decrease efficiency and raise maintenance expenses.

Get Customized Report as per Your Business Requirement - Request For Customized Report

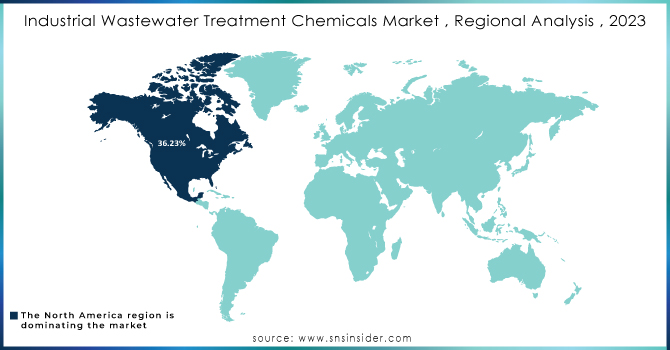

North America dominated the industrial wastewater treatment chemicals market with the highest revenue share of about 36.23% in 2023. Due to advanced infrastructure, strict regulations, and high industrial activity levels. The strong industrial foundation in the area, which consists of important industries like manufacturing, pharmaceuticals, and energy, generates a significant need for efficient wastewater treatment methods. Stringent environmental regulations in North America, like the U.S. Clean Water Act and Canada's similar regulations, require strict treatment standards and encourage the development of advanced technologies through investment. Furthermore, the region's emphasis on sustainability and innovation encourages the utilization of advanced treatment options such as smart technology and environmentally friendly chemicals. Major water treatment companies and continuous investments in infrastructure bolster North America's dominant status in the global industrial wastewater treatment chemicals market.

Corix Water System (Canada), Veolia Water Technologies (France), Calgon Carbon Corporation (U.S.), Napier Reid Ltd. (Canada), Aquatech International Corporation (U.S.), WPL Limited (U.K.), Kemira Oyj (Finland), Fluence Corporation Limited (U.S.), GE Water & Process Technologies (U.S.).

Recent Development:

In 2023, Veolia introduced its latest system, "Actiflo™ Turbo," in the Asia Pacific region. The system aims to improve water and wastewater treatment effectiveness through enhanced flocculation and sedimentation features. This technology is designed to enhance performance in situations with high turbidity levels and assist industries dealing with fast wastewater production.

In 2023, SUEZ launched the Actiflo Turbo, an advanced water treatment solution that integrates enhanced flocculation and filtration technologies to improve the efficiency of industrial wastewater treatment chemical processes.

In 2022, Pentair introduced the Everpure Claris Ultra, a new water filtration system designed for industrial applications, which offers enhanced filtration efficiency and cost savings in wastewater treatment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.28 Billion |

| Market Size by 2032 | US$ 23.58 Billion |

| CAGR | CAGR of 5.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Corrosion inhibitors, Scale inhibitors, Coagulants & flocculants, Biocides & disinfectants, Chelating agents, Anti-foaming agents, pH adjusters and stabilizers, Others) • By End-use industry (Power Generation, Oil & Gas, Mining, Chemical, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Corix Water System (Canada), Veolia Water Technologies (France), Calgon Carbon Corporation (U.S.), Napier Reid Ltd. (Canada), Aquatech International Corporation (U.S.), WPL Limited (U.K.), Kemira Oyj (Finland). , Fluence Corporation Limited (U.S.), GE Water & Process Technologies (U.S.) |

| DRIVERS | • Increasing demand for chemical-treated water in various applications will drive market growth. |

| Restraints | •The high cost associated with water treatment hamper the market growth |

Ans: Primary or secondary type of research done by this reports.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Corix Water System (Canada), Veolia Water Technologies (France), Calgon Carbon Corporation (U.S.), Napier Reid Ltd. (Canada), Aquatech International Corporation (U.S.), WPL Limited (U.K.), Kemira Oyj (Finland). , Fluence Corporation Limited (U.S.) and GE Water & Process Technologies (U.S.) are the major key players of Industrial Wastewater Treatment Chemicals Market

Ans: Increasing demand for chemical-treated water in various applications will drive market growth

Ans: Industrial Wastewater Treatment Chemicals Market Size was valued at USD 15.28 billion in 2023, and expected to reach USD 23.58 billion by 2032, and grow at a CAGR of 5.66% over the forecast period 2024-2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. ComFood & Beverageitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Industrial Wastewater Treatment Chemicals Market Segmentation, by Type

7.1 Chapter Overview

7.2 Corrosion inhibitors

7.2.1 Corrosion Inhibitors Market Trends Analysis (2020-2032)

7.2.2 Corrosion Inhibitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Scale inhibitors

7.3.1 Scale Inhibitors Market Trends Analysis (2020-2032)

7.3.2 Scale Inhibitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Coagulants & flocculants

7.4.1 Coagulants & flocculants Market Trends Analysis (2020-2032)

7.4.2 Coagulants & flocculants Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Biocides & disinfectants

7.5.1 Biocides & disinfectants Market Trends Analysis (2020-2032)

7.5.2 Biocides & disinfectants Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Chelating agents

7.6.1 Chelating agents Market Trends Analysis (2020-2032)

7.6.2 Chelating agents Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Anti-foaming agents

7.7.1 Anti-foaming agents Market Trends Analysis (2020-2032)

7.7.2 Anti-foaming agents Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 PH adjusters and stabilizers

7.8.1 PH adjusters and stabilizers Market Trends Analysis (2020-2032)

7.8.2 PH adjusters and stabilizers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Others

7.9.1 Others Market Trends Analysis (2020-2032)

7.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Industrial Wastewater Treatment Chemicals Market Segmentation, by End-use industry

8.1 Chapter Overview

8.2 Power Generation

8.2.1 Power Generation Market Trends Analysis (2020-2032)

8.2.2 Power Generation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Oil & Gas

8.3.1 Oil & Gas Market Trends Analysis (2020-2032)

8.3.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Mining

8.4.1 Mining Market Trends Analysis (2020-2032)

8.4.2 Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Chemical

8.5.1 Chemical Market Trends Analysis (2020-2032)

8.5.2 Chemical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Food & Beverage

8.6.1 Food & Beverage Market Trends Analysis (2020-2032)

8.6.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.2.6 USA

9.2.6.1 USA Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 USA Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.2.7 Canada

9.2.7.1 Canada Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Canada Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.2.8 Mexico

9.2.8.1 Mexico Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.8.2 Mexico Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.6 Poland

9.3.1.6.1 Poland Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Poland Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.7 Romania

9.3.1.7.1 Romania Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Romania Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.8 Hungary

9.3.1.8.1 Hungary Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Hungary Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.9 Turkey

9.3.1.9.1 Turkey Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Turkey Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.6 Germany

9.3.2.6.1 Germany Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 Germany Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.7 France

9.3.2.7.1 France Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 France Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.8 UK

9.3.2.8.1 UK Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 UK Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.9 Italy

9.3.2.9.1 Italy Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Italy Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.12 Switzerland

9.3.2.12.1 Switzerland Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Switzerland Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.13 Austria

9.3.2.13.1 Austria Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Austria Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.14 Rest of Western Europe

9.3.2.14.1 Rest of Western Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.14.2 Rest of Western Europe Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.6 China

9.4.6.1 China Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 China Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.7 India

9.4.7.1 India Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.7.2 India Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.8 Japan

9.4.8.1 Japan Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Japan Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.9 South Korea

9.4.9.1 South Korea Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 South Korea Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.9 Vietnam

9.4.9.1 Vietnam Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Vietnam Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.10 Singapore

9.4.10.1 Singapore Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Singapore Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.12 Australia

9.4.12.1 Australia Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.12.2 Australia Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.13 Rest of Asia Pacific

9.4.13.1 Rest of Asia Pacific Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.13.2 Rest of Asia Pacific Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.6 UAE

9.5.1.6.1 UAE Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 UAE Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.7 Egypt

9.5.1.7.1 Egypt Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Egypt Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.8 Saudi Arabia

9.5.1.8.1 Saudi Arabia Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Saudi Arabia Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.9 Qatar

9.5.1.9.1 Qatar Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Qatar Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2.6 South Africa

9.5.2.6.1 South Africa Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 South Africa Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2.7 Nigeria

9.5.2.7.1 Nigeria Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Nigeria Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2.8 Rest of Africa

9.5.2.8.1 Rest of Africa Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.8.2 Rest of Africa Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.6 Brazil

9.6.6.1 Brazil Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Brazil Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.7 Argentina

9.6.7.1 Argentina Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Argentina Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.8 Colombia

9.6.8.1 Colombia Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Colombia Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.9 Rest of Latin America

9.6.9.1 Rest of Latin America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.9.2 Rest of Latin America Industrial Wastewater Treatment Chemicals Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 Corix Water System

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Veolia Water Technologies

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Calgon Carbon Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Aquatech International Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 WPL Limited

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Fluence Corporation Limited

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Kemira Oyj

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Fluence Corporation Limited

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 GE Water & Process Technologies

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Dow

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Corrosion inhibitors

Scale inhibitors

Coagulants & flocculants

Biocides & disinfectants

Chelating agents

Anti-foaming agents

pH adjusters and stabilizers

Others

By End-use Industry

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Process Oil Market Size was valued at USD 4.9 billion in 2023 and is expected to reach USD 5.98 billion by 2032 and grow at a CAGR of 2.25% over the forecast period 2024-2032.

The Rigid Foam Market Size was valued at USD 72.1 Billion in 2023 and is expected to reach USD 155.2 Billion by 2032, at a CAGR of 8.9% from 2024 to 2032.

Gold Mining Market size was valued at USD 207.1 billion in 2023 and is expected to reach USD 281.7 billion by 2032, growing at a CAGR of 3.5% from 2024-2032.

Medical Device Coating Market Size was valued at USD 13.9 Billion in 2023 and is expected to reach USD 27.6 Billion by 2032 and grow at a CAGR of 7.9% over the forecast period 2024-2032.

Hollow Fiber Membranes Market was valued at USD 2.46 billion in 2023 and is expected to reach USD 8.52 billion by 2032, at a CAGR of 14.85% from 2024-2032.

Plain Bearing Market size was estimated at USD 12.88 billion in 2023 and is expected to reach USD 20.33 billion by 2032 at a CAGR of 5.20% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone