Industrial Vending Machine Market Key Insights:

To Get More Information on Industrial Vending Machine Market - Request Sample Report

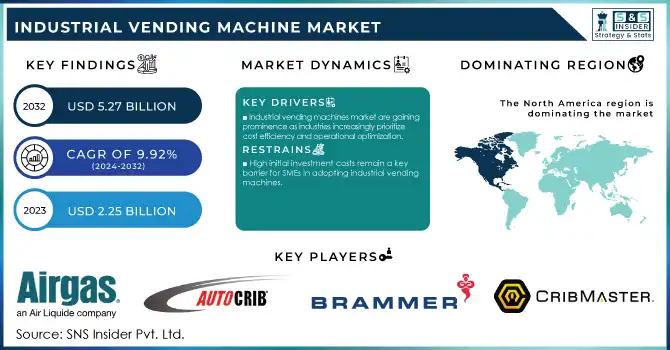

The Industrial Vending Machine Market size was valued at USD 2.25 Billion in 2023 and is expected to reach USD 5.27 Billion by 2032 with a growing CAGR of 9.92% over the forecast period 2024-2032.

The industrial vending machine market is driven by the increasing need for efficient inventory management and cost reduction in industries such as manufacturing, healthcare, and construction. Industrial vending machines are revolutionizing how organizations manage tools, personal protective equipment (PPE), and other consumables, offering a streamlined approach to reducing wastage and improving productivity. Businesses are increasingly adopting these systems to minimize downtime caused by inventory shortages and to enhance operational efficiency through real-time tracking and automated replenishment.

The market is experiencing growth fueled by the integration of advanced technologies like IoT and AI. Smart vending solutions are enabling real-time data analytics, predictive maintenance, and better decision-making for inventory control. The trend of automation and digital transformation across industries is further propelling the adoption of these solutions. Additionally, the increasing emphasis on worker safety and compliance with regulatory standards, particularly in sectors like mining and oil & gas, is boosting demand for vending machines that dispense PPE and other safety equipment.

Industries are prioritizing cost control and sustainability. Companies are opting for vending machines that help in inventory optimization, reduce excessive ordering, and cut down on material waste, aligning with broader ESG goals. Industry reports indicate a significant increase in the adoption of cloud-connected and software-enabled vending machines, reflecting the shift toward data-driven operations. Furthermore, with rising labor costs and supply chain challenges, organizations are looking to vending machines as a solution to maintain productivity while addressing logistical inefficiencies.

MARKET DYNAMICS

DRIVERS

- Industrial vending machines market are gaining prominence as industries increasingly prioritize cost efficiency and operational optimization.

Industrial vending machines enable organizations to minimize wastage, streamline inventory management, and reduce downtime by offering precise control over consumables, tools, and safety equipment. The automation of inventory processes eliminates manual errors and enhances productivity, making vending solutions particularly attractive for cost-sensitive sectors like manufacturing and construction.

The market is witnessing growth fueled by trends such as the integration of IoT and AI, which enable real-time tracking, predictive analytics, and automated restocking. This technological advancement aligns with the broader adoption of Industry 4.0 and digital transformation strategies. Additionally, the focus on workplace safety and regulatory compliance is driving the demand for vending machines that dispense personal protective equipment (PPE). The shift toward sustainable practices, including inventory optimization and waste reduction, further underscores the growing relevance of industrial vending machines across diverse industries.

RESTRAIN

- High initial investment costs remain a key barrier for SMEs in adopting industrial vending machines.

High initial investment costs pose a challenge, particularly for small and medium-sized enterprises (SMEs). The upfront expenses for hardware, software, and installation can deter SMEs from adopting these solutions, even as larger enterprises benefit from enhanced productivity and reduced waste. Despite this, market trends like subscription-based or pay-as-you-go models are emerging as alternatives, offering businesses greater affordability and flexibility. Furthermore, the growing emphasis on worker safety, sustainability, and regulatory compliance is driving demand for vending machines designed to dispense personal protective equipment (PPE). As industries prioritize digital transformation and cost efficiency, the market is expected to continue its upward trajectory, overcoming adoption barriers through innovative models.

KEY SEGMENTATION

By Type

The Coil Vending Machine segment dominated with the market share over 38% in 2023. This widespread use can be attributed to the machine's ability to handle a wide range of parts, including fasteners, tools, and consumables, which are essential in industrial settings. Coil vending machines are particularly favored for their flexibility in accommodating various item sizes and types, allowing businesses to manage inventory effectively. The efficiency of these machines in dispensing items on-demand helps reduce downtime, ensuring smoother operations and enhanced productivity. Furthermore, their ability to maintain an organized inventory and streamline part retrieval processes leads to cost savings, minimizing the need for manual stock management.

By Product

The PPE (Personal Protective Equipment) segment dominated with the market share over 42% in 2023, driven by the essential need for safety in various industries, particularly manufacturing, construction, and healthcare. PPE vending machines provide workers with quick, easy access to vital safety gear, including gloves, helmets, goggles, and masks, ensuring compliance with safety regulations and reducing the risk of workplace injuries. These machines improve efficiency by minimizing downtime associated with locating and distributing safety equipment, while also enhancing inventory management. The convenience of on-demand access to PPE directly at the worksite boosts worker productivity and safety, making it an essential solution for companies with high-risk environments.

KEY REGIONAL ANALYSIS

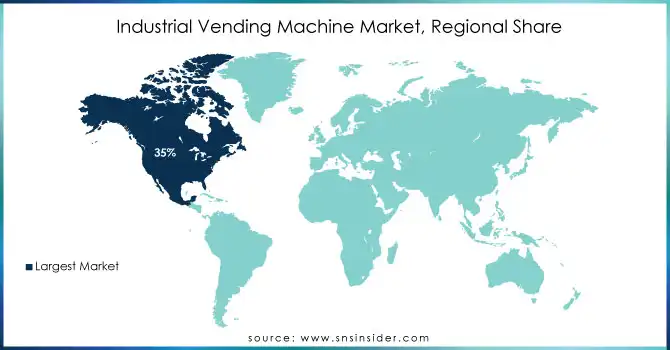

North America region dominated with the market share over 35% in 2023. This dominance is driven by the increasing demand for automated vending solutions across key sectors such as manufacturing, warehousing, and distribution centers. These solutions offer efficient inventory management, reduce downtime, and streamline operations, making them highly attractive to industries seeking automation and cost-effective processes. Additionally, North America benefits from the presence of leading market players, such as Crane Payment Innovations, Versa Vending, and Vending Solutions, who provide advanced and reliable vending solutions. The region's strong infrastructure, well-established industrial base, and ongoing technological advancements also contribute to its leadership.

Asia-Pacific is the fastest-growing region in the Industrial Vending Machine Market, driven by rapid industrialization and increasing automation across various sectors. As manufacturing facilities strive for higher efficiency, the adoption of industrial vending machines offers a streamlined solution for inventory management, reducing labor costs and optimizing stock control. In countries like China, Japan, and India, the demand for automated systems is rising rapidly due to expanding industrial bases and a push for smart factories. These vending machines are increasingly being integrated into warehouses, factories, and retail environments to manage tools, parts, and supplies more efficiently. The region's rapid urbanization and technological advancements also contribute to the growing interest in automated vending systems.

Do You Need any Customization Research on Industrial Vending Machine Market - Inquire Now

Some of the major key players of Industrial Vending Machine Market

-

Airgas, Inc. (Gas cylinders, welding supplies, safety equipment)

-

Apex Industrial Technologies LLC (Industrial vending machines, cloud-based inventory control systems)

-

AutoCrib, Inc. (Tool vending machines, automated dispensing systems)

-

Brammer (Industrial tools, maintenance equipment vending machines)

-

CMT Industrial Solutions (Industrial supply vending systems, tool management solutions)

-

CribMaster (Automated tool cribs, RFID-enabled vending machines)

-

Fastenal Company (Industrial supply vending machines, personal protective equipment dispensers)

-

MSC Industrial Direct Co., Inc. (Tool management vending machines, safety equipment dispensers)

-

IVM Ltd. (Automated inventory control vending machines, IT asset tracking systems)

-

Silkron (Smart vending platforms, IoT-enabled vending machines)

-

SupplyPoint W.W. (Industrial vending systems, secure inventory storage machines)

-

Grainger, Inc. (Industrial supply vending machines, maintenance product dispensers)

-

SupplyPro, Inc. (Automated supply management vending systems, inventory tracking machines)

-

VendNovation (Secure dispensing systems, asset control vending machines)

-

SecuraStock (Customizable vending machines, inventory control systems)

-

EWS Vending (Specialized vending machines for industrial supplies and equipment)

-

Fujitsu Frontech North America (Automated retail and vending solutions, industrial kiosks)

-

SandenVendo America (High-capacity vending systems for tools and equipment)

-

PYRAMID Time Systems (Vending machines for consumables and time management products)

-

Omnicell, Inc. (Vending solutions for hospital supplies, cross-over industrial applications)

RECENT DEVELOPMENTS

-

In August 2024: Omnicell, Inc. a leader in revolutionizing pharmacy care delivery, unveiled the Central Med Automation Service. This subscription-based solution is designed to assist health systems in establishing and continuously optimizing centralized medication management for Consolidated Pharmacy Services Centers (CPSCs) and similar operations. The service aims to streamline medication dispensing from a central fulfillment area across the entire health system, enhancing inventory visibility, scalability, and patient safety.

-

In October 2023: Fujitsu Frontech North America Inc., a provider of retail technology and front-end solutions, announced the launch of U-Scan Venture. Built on the upgraded Fujitsu Cash Automated Solution SmartCash SE cash box module, this new solution offers full currency and coin recycling, now incorporating bulk coin acceptance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.25 Billion |

| Market Size by 2032 | USD 5.27 Billion |

| CAGR | CAGR of 9.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Carousel Vending Machine, Coil Vending Machine, Cabinet Vending Machine, Others) • By Product (MRO Tools, PPE, Others) • By End-use (Manufacturing, Oil & Gas, Construction, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Airgas, Inc., Apex Industrial Technologies LLC, AutoCrib, Inc., Brammer, CMT Industrial Solutions, CribMaster, Fastenal Company, MSC Industrial Direct Co., Inc., IVM Ltd., Silkron, SupplyPoint W.W., Grainger, Inc., SupplyPro, Inc., VendNovation, SecuraStock, EWS Vending, Fujitsu Frontech North America, SandenVendo America, PYRAMID Time Systems, Omnicell, Inc. |

| Key Drivers | • Industrial vending machines enhance cost efficiency by minimizing waste, optimizing inventory, reducing downtime, and improving control over consumables and tools, driving operational productivity. |

| RESTRAINTS | • Despite the market's robust growth driven by automation and efficiency trends, high initial investment costs remain a key barrier for SMEs in adopting industrial vending machines. |