Get More Information on Industrial Separator Market - Request Sample Report

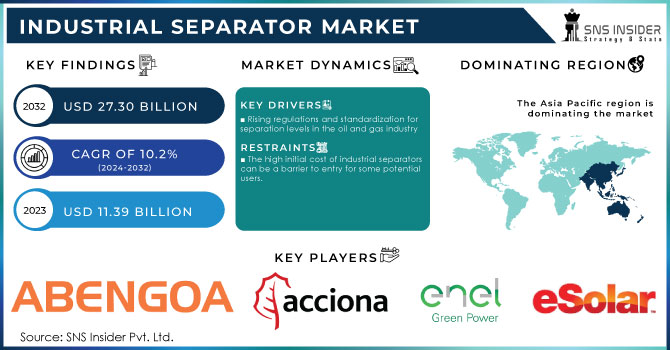

The Industrial Separator Market size was USD 11.39 billion in 2023 and is expected to reach USD 27.30 billion by 2032, growing at a CAGR of 10.2% over the forecast period of 2024-2032.

The industrial separator market is experiencing growth, fueled by a confluence of factors. the resurgence of oil and gas exploration and production, with activity expanding to deep sea and ultra-deepwater locations, as well as targeting unconventional resources like tight gas and shale gas. This translates to a growing demand for oil and gas separation equipment, as these processes require efficient separation of valuable hydrocarbons from unwanted materials. i3 Energy PLC awarded Baker Hughes an oilfield contract to conduct drilling in the North Sea, reflecting this trend. environmental concerns are playing a significant role. Stringent regulations and a growing focus on safe water disposal and reuse are pushing the adoption of industrial separators in oil and gas production. This ensures environmentally responsible practices and minimizes potential pollution. the rising consumption of natural gas, As a cleaner-burning fuel with applications in power generation, cooking, and electricity production, the demand for natural gas is rapidly increasing. According to the Energy Information Administration, the US alone consumed approximately 89.1 billion cubic feet per day of natural gas in 2023.

KEY DRIVERS:

Rising regulations and standardization for separation levels in the oil and gas industry

Stricter regulations demanding cleaner production processes necessitate efficient oil and water separation. This translates directly to a greater need for industrial separators within oil and gas facilities. Secondly, standardization ensures consistent separation levels across the industry. This creates a predictable demand for separators that meet these newly established performance benchmarks. Essentially, these regulations and standards act in tandem, pushing and pulling on the demand lever simultaneously, resulting in a robust growth trajectory for the industrial separator market.

RESTRAIN:

The high initial cost of industrial separators can be a barrier to entry for some potential users.

Fluctuations in oil prices can cause oil and gas companies to tighten or loosen their exploration project budgets

The upfront investment for industrial separators can be a hurdle for some potential buyers. Setting up these systems can be expensive, encompassing not just the separator itself but also any necessary installation equipment and ongoing maintenance. The price tag can be particularly daunting for larger or more complex separators. While the long-term benefits are undeniable, including improved efficiency and environmental compliance, the initial financial outlay can be a significant obstacle for some companies. These benefits might involve reduced waste, lower operating costs, and a more environmentally responsible production process.

OPPORTUNITY:

Natural gas is experiencing surging demand across the market.

Technological advancements in separators are making them more energy-efficient, attracting new investments to the market.

Natural gas is experiencing a rise in demand, driven by its versatility across power generation, heating, and industrial applications. Compared to traditional fuels like coal or oil, natural gas offers a significant environmental benefit: lower emissions, which aligns perfectly with growing concerns about sustainability. Beyond its environmental advantages, natural gas boasts exceptional efficiency, delivering impressive energy output relative to the amount used. This surging demand for natural gas presents a golden opportunity for the industrial separator market. These separators are essential for processing natural gas by removing unwanted impurities like water and oil before they enter pipelines or get used.

CHALLENGES:

The rising demand for industrial separators fuels competition, potentially squeezing profit margins for manufacturers.

As more players enter the market to capitalize on the growth, competition for contracts and market share heats up. This increasingly competitive landscape can put pressure on profit margins. Manufacturers might resort to price reductions to win contracts, potentially leading to lower profits per unit sold. To navigate this competitive environment, companies will likely focus on strategies like product differentiation, innovation, and optimizing production efficiency to maintain profitability. Those who can effectively balance these factors will be best positioned to thrive in the flourishing industrial separator market.

The impact of Russia-Ukraine has created uncertainty in the industrial separator market. Russia the major oil and gas producer, could dampen demand for separators used in those industries. Disruptions in the global supply chain further complicate matters, potentially causing shortages of raw materials and components needed for separator production, leading to price hikes and delays. the war has also triggered a focus on energy security. This could lead to a rise in investment in alternative energy sources like biofuels, which require industrial separators during processing. Rising oil and gas prices due to the war might incentivize increased exploration and production activities, creating a continued demand for separators in these sectors. The interplay of these opposing forces makes the market outlook difficult to predict.

IMPACT OF ECONOMIC DOWNTURN

Economic downturns have slowed down the overall industrial separator market. Companies reduce their spending, leading to delays or cancellations of capital projects that often rely on industrial separators. This led to a decline in demand. Economic slumps often trigger a decrease in oil and gas prices, causing a domino effect. Lower prices incentivize less exploration and production, reducing the need for separators used in these processes. Environmental regulations, another driver for separators in areas like water treatment, might also see reduced spending as governments and companies prioritize immediate economic concerns. Existing facilities still require maintenance and repairs, creating a baseline demand for replacement separators.

By Application

Centrifugal Separators

Cyclone Separators

Gas-Liquid Separators

Liquid-Liquid Separators

Others

The centrifugal separators segment dominated the industrial separator market in 2023. Their effectiveness in removing liquid mist from oil or gas makes them a valuable tool. Centrifugal separators work by utilizing centrifugal force. As the gas stream spins at high velocity within the separator, the liquid mist is forced outwards against the container walls. This heavier liquid then falls due to gravity and collects in a designated section below, while the purified gas remains in the center of the vortex. This efficient separation process is widely used across industries, and the continued demand for cleaner oil and gas products is expected to propel the growth of the centrifugal separator segment within the industrial separator market.

By End-User

Chemical

Mining

Power

The oil and gas segment is leading the industrial separators market in 2023. due to its exceptional ability to separate oil from water and waste products. This demand is fueled by the dramatic rise in global crude oil production, particularly in countries like Saudi Arabia, Iran, and China. This trend is expected to continue, creating a strong market for industrial separators within the oil and gas sector. Beyond oil and gas, industrial separators play a vital role in the power industry as well. Here, they are used to separate various fluids like boiler feed water, turbine discharge, and even gasses like nitrogen and carbon dioxide produced during desulfurization processes. This versatility ensures continued demand for industrial separators across numerous applications.

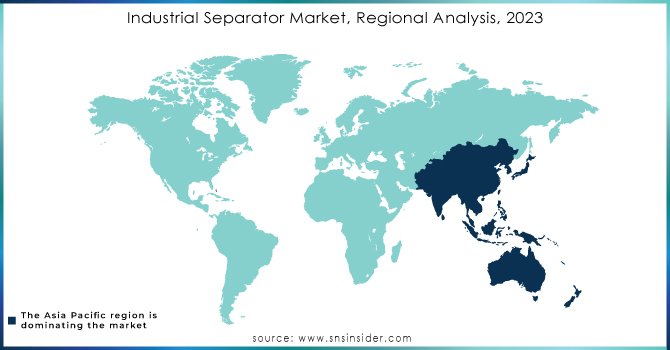

The Asia Pacific region dominated the industrial separator market in 2023, driven by a powerful combination of factors. increased investments in industrial infrastructure are fueling the need for efficient separation technologies. Growing environmental concerns are prompting stricter regulations and a focus on sustainable practices, creating a favorable environment for industrial separators. This region boasts a well-established industrial sector with a growing emphasis on energy efficiency, further propelling market growth. China holds the largest market share due to its massive industrial base. India is experiencing the fastest market growth as it rapidly expands its industrial capabilities. Europe is the second-largest market share, driven by rapid industrialization in emerging Eastern European nations.

Do You Need any Customization Research on Industrial Separator Market - Enquire Now

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The Major Players are Abengoa Solar SA (Spain), Acciona Energy (Spain), GE Renewable Energy (France), TSK Flagsol Engineering GmbH (Germany), Enel Green Power (Italy), BrightSource Energy (US), Attantica Yield PLO (UK), eSolar inc. (US), SolarReserve (US), ACWA Power (Saudi Arabia), Chiyoda Corporation (Japan), Alsolen (Morocco), Soligua (Italy), and other players.

RECENT DEVELOPMENTS

In April 2024: The power and renewable energy businesses created the independent public company GE Vernova, focused on electricity, wind, and electrification. GE itself transitioned to become GE Aerospace, concentrating on aviation. Both companies, along with GE Healthcare (separated in 2023), are now independent publicly traded entities.

In January 2023: Alfa Laval, a frontrunner in separator technology, launched the industry's first biofuel-ready separators. This innovation addresses the growing demand for sustainable solutions in the marine industry, as biofuels offer a way to reduce carbon emissions from ships.

In May 2023: GEA, another key player, announced a significant investment. By the end of 2024, they plan to invest €50 million to upgrade their German centrifuge production facilities. This expansion suggests they anticipate a rise in demand for separators, potentially driven by the increasing use of biofuels.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.39 Bn |

| Market Size by 2032 | US$ 27.30 Bn |

| CAGR | CAGR of 10.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Magnetic Separators, Centrifugal Separators, Cyclone Separators, Gas-Liquid Separators, Liquid-Liquid Separators, And Others) • By End-User (Power, Chemical, Oil & Gas, Mining, And Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Abengoa Solar, SA (Spain), Acciona Energy (Spain), GE Renewable Energy (France), TSK Flagsol Engineering GmbH (Germany), Enel Green Power (Italy), BrightSource Energy (US), Attantica Yield PLO (UK), eSolar inc. (US), SolarReserve (US), ACWA Power (Saudi Arabia), Chiyoda Corporation (Japan), Alsolen (Morocco), Soligua (Italy), |

| Key Drivers | • Rising regulations and standardization for separation levels in the oil and gas industry |

| Key Restraints | • The high initial cost of industrial separators can be a barrier to entry for some potential users. • Fluctuations in oil prices can cause oil and gas companies to tighten or loosen their exploration project budgets |

Ans: The Industrial Separator Market is expected to grow at a CAGR of 10.2%.

Ans: Industrial Separator Market size was USD 11.39 Billion in 2023 and is expected to Reach USD 24.77 billion by 2031

Ans: Increasing awareness of safe water disposal and reuse is enhancing demand for separators in oil and gas production, promoting environmentally responsible practices.

Ans: Setting up an industrial separator can be an expensive endeavor. This initial cost can be a task for potential buyers, particularly for larger or more complex systems. The cost can include the separator itself, any necessary installation equipment, and ongoing maintenance requirements.

Ans Asia Pacific dominated in the Industrial Separator Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact Of Russia Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Industrial Separator Market Segmentation, By Application

9.1 Introduction

9.2 Trend Analysis

9.3 Magnetic Separators,

9.4 Centrifugal Separators

9.5 Cyclone Separators

9.6 Gas-Liquid Separators

9.7 Liquid-Liquid Separators

9.8 Others

10. Industrial Separator Market Segmentation, By End-User

10.1 Introduction

10.2 Trend Analysis

10.3 Chemical

10.4 Oil & Gas

10.5 Mining

10.6 Power

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Industrial Separator Market by Country

11.2.3 North America Industrial Separator Market By Application

11.2.4 North America Industrial Separator Market By End-User

11.2.5 USA

11.2.5.1 USA Industrial Separator Market By Application

11.2.5.2 USA Industrial Separator Market By End-User

11.2.6 Canada

11.2.6.1 Canada Industrial Separator Market By Application

11.2.6.2 Canada Industrial Separator Market By End-User

11.2.7 Mexico

11.2.7.1 Mexico Industrial Separator Market By Application

11.2.7.2 Mexico Industrial Separator Market By End-User

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Industrial Separator Market by Country

11.3.2.2 Eastern Europe Industrial Separator Market By Application

11.3.2.3 Eastern Europe Industrial Separator Market By End-User

11.3.2.4 Poland

11.3.2.4.1 Poland Industrial Separator Market By Application

11.3.2.4.2 Poland Industrial Separator Market By End-User

11.3.2.5 Romania

11.3.2.5.1 Romania Industrial Separator Market By Application

11.3.2.5.2 Romania Industrial Separator Market By End-User

11.3.2.6 Hungary

11.3.2.6.1 Hungary Industrial Separator Market By Application

11.3.2.6.2 Hungary Industrial Separator Market By End-User

11.3.2.7 Turkey

11.3.2.7.1 Turkey Industrial Separator Market By Application

11.3.2.7.2 Turkey Industrial Separator Market By End-User

11.3.2.8 Rest of Eastern Europe

11.3.2.8.1 Rest of Eastern Europe Industrial Separator Market By Application

11.3.2.8.2 Rest of Eastern Europe Industrial Separator Market By End-User

11.3.3 Western Europe

11.3.3.1 Western Europe Industrial Separator Market by Country

11.3.3.2 Western Europe Industrial Separator Market By Application

11.3.3.3 Western Europe Industrial Separator Market By End-User

11.3.3.4 Germany

11.3.3.4.1 Germany Industrial Separator Market By Application

11.3.3.4.2 Germany Industrial Separator Market By End-User

11.3.3.5 France

11.3.3.5.1 France Industrial Separator Market By Application

11.3.3.5.2 France Industrial Separator Market By End-User

11.3.3.6 UK

11.3.3.6.1 UK Industrial Separator Market By Application

11.3.3.6.2 UK Industrial Separator Market By End-User

11.3.3.7 Italy

11.3.3.7.1 Italy Industrial Separator Market By Application

11.3.3.7.2 Italy Industrial Separator Market By End-User

11.3.3.8 Spain

11.3.3.8.1 Spain Industrial Separator Market By Application

11.3.3.8.2 Spain Industrial Separator Market By End-User

11.3.3.9 Netherlands

11.3.3.9.1 Netherlands Industrial Separator Market By Application

11.3.3.9.2 Netherlands Industrial Separator Market By End-User

11.3.3.10 Switzerland

11.3.3.10.1 Switzerland Industrial Separator Market By Application

11.3.3.10.2 Switzerland Industrial Separator Market By End-User

11.3.3.11 Austria

11.3.3.11.1 Austria Industrial Separator Market By Application

11.3.3.11.2 Austria Industrial Separator Market By End-User

11.3.3.12 Rest of Western Europe

11.3.3.12.1 Rest of Western Europe Industrial Separator Market By Application

11.3.2.12.2 Rest of Western Europe Industrial Separator Market By End-User

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia Pacific Industrial Separator Market by Country

11.4.3 Asia Pacific Industrial Separator Market By Application

11.4.4 Asia Pacific Industrial Separator Market By End-User

11.4.5 China

11.4.5.1 China Industrial Separator Market By Application

11.4.5.2 China Industrial Separator Market By End-User

11.4.6 India

11.4.6.1 India Industrial Separator Market By Application

11.4.6.2 India Industrial Separator Market By End-User

11.4.7 Japan

11.4.7.1 Japan Industrial Separator Market By Application

11.4.7.2 Japan Industrial Separator Market By End-User

11.4.8 South Korea

11.4.8.1 South Korea Industrial Separator Market By Application

11.4.8.2 South Korea Industrial Separator Market By End-User

11.4.9 Vietnam

11.4.9.1 Vietnam Industrial Separator Market By Application

11.4.9.2 Vietnam Industrial Separator Market By End-User

11.4.10 Singapore

11.4.10.1 Singapore Industrial Separator Market By Application

11.4.10.2 Singapore Industrial Separator Market By End-User

11.4.11 Australia

11.4.11.1 Australia Industrial Separator Market By Application

11.4.11.2 Australia Industrial Separator Market By End-User

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Industrial Separator Market By Application

11.4.12.2 Rest of Asia-Pacific Industrial Separator Market By End-User

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Industrial Separator Market by Country

11.5.2.2 Middle East Industrial Separator Market By Application

11.5.2.3 Middle East Industrial Separator Market By End-User

11.5.2.4 UAE

11.5.2.4.1 UAE Industrial Separator Market By Application

11.5.2.4.2 UAE Industrial Separator Market By End-User

11.5.2.5 Egypt

11.5.2.5.1 Egypt Industrial Separator Market By Application

11.5.2.5.2 Egypt Industrial Separator Market By End-User

11.5.2.6 Saudi Arabia

11.5.2.6.1 Saudi Arabia Industrial Separator Market By Application

11.5.2.6.2 Saudi Arabia Industrial Separator Market By End-User

11.5.2.7 Qatar

11.5.2.7.1 Qatar Industrial Separator Market By Application

11.5.2.7.2 Qatar Industrial Separator Market By End-User

11.5.2.8 Rest of Middle East

11.5.2.8.1 Rest of Middle East Industrial Separator Market By Application

11.5.2.8.2 Rest of Middle East Industrial Separator Market By End-User

11.5.3 Africa

11.5.3.1 Africa Industrial Separator Market by Country

11.5.3.2 Africa Industrial Separator Market By Application

11.5.3.3 Africa Industrial Separator Market By End-User

11.5.2.4 Nigeria

11.5.2.4.1 Nigeria Industrial Separator Market By Application

11.5.2.4.2 Nigeria Industrial Separator Market By End-User

11.5.2.5 South Africa

11.5.2.5.1 South Africa Industrial Separator Market By Application

11.5.2.5.2 South Africa Industrial Separator Market By End-User

11.5.2.6 Rest of Africa

11.5.2.6.1 Rest of Africa Industrial Separator Market By Application

11.5.2.6.2 Rest of Africa Industrial Separator Market By End-User

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Industrial Separator Market by Country

11.6.3 Latin America Industrial Separator Market By Application

11.6.4 Latin America Industrial Separator Market By End-User

11.6.5 Brazil

11.6.5.1 Brazil Industrial Separator Market By Application

11.6.5.2 Brazil Industrial Separator Market By End-User

11.6.6 Argentina

11.6.6.1 Argentina Industrial Separator Market By Application

11.6.6.2 Argentina Industrial Separator Market By End-User

11.6.7 Colombia

11.6.7.1 Colombia Industrial Separator Market By Application

11.6.7.2 Colombia Industrial Separator Market By End-User

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Industrial Separator Market By Application

11.6.8.2 Rest of Latin America Industrial Separator Market By End-User

12. Company Profiles

12.1 Abengoa Solar, SA (Spain)

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Acciona Energy (Spain)

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 GE Renewable Energy (France)

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 TSK Flagsol Engineering GmbH (Germany)

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Enel Green Power (Italy)

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 BrightSource Energy (US)

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Attantica Yield PLO (UK)

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 eSolar inc. (US)

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 SolarReserve (US)

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 ACWA Power (Saudi Arabia)

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Chiyoda Corporation (Japan)

12.11.1 Company Overview

12.11.2 Financial

12.11.3 Products/ Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 Alsolen (Morocco)

12.12.1 Company Overview

12.12.2 Financial

12.12.3 Products/ Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

12.13 Soligua (Italy)

12.13.1 Company Overview

12.13.2 Financial

12.13.3 Products/ Services Offered

12.13.4 SWOT Analysis

12.13.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. USE Cases And Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Carbon Offset/Carbon Credit Market size was valued at USD 428.80 billion in 2023 and is expected to grow to USD 3541.13 billion by 2031 and grow at a CAGR of 30.2% over the forecast period of 2024-2031.

The Waste Heat Recovery System Market was estimated at USD 66.26 billion in 2023 and is expected to reach USD 137.40 billion by 2032, with a growing CAGR of 8.44% over the forecast period 2024-2032.

The Battery Contract Manufacturing Market size was valued at USD 4.6 billion in 2022 and is expected to grow to USD 14.90 billion by 2030 with an emerging CAGR of 15.8% over the forecast period of 2023-2030.

The Hydrogen Fueling Station Market size was valued at USD 385 million in 2023 and is expected to grow to USD 1394.1 million by 2032 and grow at a CAGR of 15.37% over the forecast period of 2024-2032.

The Oil & Gas Fabrication Market was valued at USD 5.29 Billion in 2023 and will reach to USD 8.23 Billion by 2032, growing at a CAGR of 5.10% by 2032.

The Solar Air-Conditioner Market size was valued at USD 2.22 billion in 2022 and is expected to grow to USD 6.15 billion by 2030 and grow at a CAGR of 13.6 % over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone