Get more information on Industrial Sensors Market - Request Sample Report

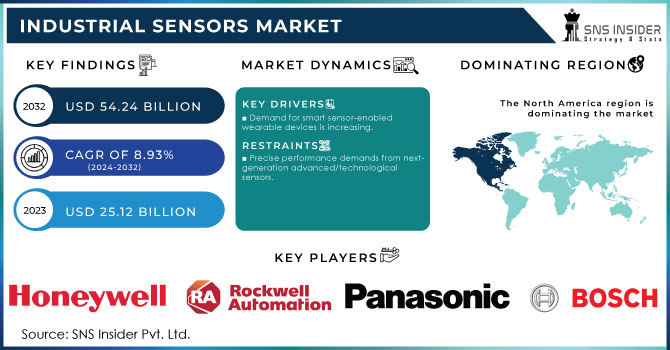

The Industrial Sensors Market size was valued at USD 25.12 billion in 2023 and is expected to reach USD 54.24 billion by 2032 and grow at a CAGR of 8.93% over the forecast period 2024-2032.

The industrial sensors market has witnessed prominent growth and development facilitated by progress in technology and the increasing adoption of automation. As industries become more and more supportive of digital transformation, the need for industrial sensors, which play a critical role in monitoring and optimizing activity, is rapidly increasing. The rapid adoption of Industry 4.0 with its reliance on the use of sensors for smart production processes, predictive maintenance, and other applications. In 2020, the Trump administration has recently called for more than USD 1 billion in U.S. funding to be invested into the creation of 12 newly established research and development facilities for the development of Industry 4.0. The funding is allegedly provided by the White House, the National Science Foundation, and the Department of Energy over five years, with the twelve new hubs set to act as AI and QIS R&D institutes.

Industrial sensors are highly used in the automotive Industry and they serve as a key component in today’s car safety systems and autonomous vehicle driving facilities. The United States was the world’s second country by car production in 2022, with 10 million cars produced, which was 5% more than in 2021. However, China had 30 million vehicles produced, and it still led the global statistics. The purchase of cars and related industries made up around 5% of the US economy. The number of vehicles registered was over 290.8 million, and 13.75 million new automobiles were bought in 2022. The Industrial Sensors Market is still developing, offering great chances for progress and expansion, and tackling challenges with new technology and strategic investments.

Drivers

Demand for smart sensor-enabled wearable devices is increasing.

The increasing need for wearable devices with smart sensors is greatly boosting the Industrial Sensors Market. The fast progress in technology and growing consumer desire for health and fitness monitoring are the main drivers of this trend. Smart sensors, found in wearable gadgets like fitness trackers and smartwatches, provide advanced features for collecting and analyzing real-time data. These sensors can assess a range of bodily functions such as heart rate, body temperature, and activity levels, giving individuals valuable information about their overall health and fitness. The use of these intelligent sensors in wearables has grown from just personal fitness to also include medical tracking, where they are vital in handling chronic diseases and enhancing patient treatment. The increase in health consciousness and the rising popularity of individualized health management options are driving the need for these technologies even more. Furthermore, progress in sensor technology has resulted in increased accuracy, affordability, and energy efficiency of these devices, expanding their availability to a wider range of consumers.

Automobile manufacturers are increasing their demand for smart sensors to provide improved safety and comfort.

As more and more automobiles are becoming automated, more products that are used in them are also becoming automated. Today, an entire range of smart sensors is widely utilized within both driver and passenger scopes. The first and largest group of applications includes smart sensors used to ensure safety as they help to run advanced driver-assistance systems. Such systems as adaptive cruise control, lane-keeping assistance, automatic emergency braking, and collision avoidance, use the data provided by proximity sensors. Finally, let us not overlook the growing popularity of such technologies as night-vision and fatigue-recognition systems. Overall, these sensors help reduce accidents and make driving safer as they inform drivers about the on-road situation, with automatic emergency braking and collision avoidance systems preventing or lowering the impact of any potential crash. The second group of smart sensors applies to higher levels of comfort as they trigger such functions as automatic climate control, adjustable seating positions, and even infotainment system personalization.

Restraints

Precise performance demands from next-generation advanced/technological sensors.

The advancements in technology utilized in various industries have heavily increased the precision, performance, and functionality these sensors are expected to deliver. It means that sensors are needed to perform in high-temperature environments, high pressures, or be resistant to corrosion, all while providing exceptional precision and stability. The demand for integrating advanced sensors meant that many of these requirements could only be achieved by using advanced materials and technology. It, in turn, increases the cost of production. The slow growth of many applications in the market further increases the overall cost since these next-generation sensors must have advanced features such as real-time processing of obtained data, high-resolution measurements, and connectivity. The latter requires a substantial level of technical knowledge to implement, and the long development cycle increases manufacturing costs. What is more, their implementation into design also grows more complex, further increasing the cost of design and development.

by Sensor Type

The level sensors held a market share of around 35% in 2023 and dominated the industrial sensors market. Level sensors comprise a significant part of industrial sensors as they can provide the measurement of liquid and solid levels stored in tanks and containers by offering the opportunity to perform more reliable and accurate results. Therefore, these types of sensors are closely related to numerous other industrial applications as they serve as a guarantee of the growth of the market by being involved in the stability of the following industries: oil and gas, chemical processing, food and beverage, pharmaceuticals, and water treatment.

The gas sensors are to grow at a faster rate during the forecast period 2024-2032. Gas sensors are included in the list of the industrial sensors market and they perform one of the most important functions in monitoring and ensuring safety in industrial applications. The main purpose of the sensors is the measurement of gas concentration in the given environment to be confident that the levels of gases in this application are appropriate and regulated.

By Type

The contact sensors led the market in 2023, with a market share of over 58%. Such sensors must be in direct contact with the measured product, and as a rule, they allow obtaining an accurate measurement. They are used where accurate data is required and there is no possibility to use remote control. Limit switches, potentiometers, and tactile sensors belong to the type of contact sensors. For instance, a limit switch is usually included in the production process to determine whether objects are present and whether they are correctly positioned. It is used in conveyor systems, robotic applications, and other manufacturing/assembly lines to control the operation of machinery.

The non-contact sensor is registered to show potential growth during 2024-2032. They are used extensively across various applications and the rising efforts by the industrial sector to move towards automation and increase precision. These sensors are widely used in a range of applications in different industry verticals; namely, automotive, manufacturing, aerospace, and healthcare. In automotive, non-contact sensors are used for monitoring and controlling varied applications. It assists in the detection of the position, speed, and distance of a moving part from the sensors.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End User

The discrete segment dominated the market in 2023 with a market share of over 59%. Discrete industrial sensors are a growing and lively market, integral to multiple industrial applications. Discrete sensors, which include proximity, photoelectric, and capacitive sensors, help to detect and assess physical properties and changes in industrial environments. Discrete sensors can be found in automotive, aerospace & defense, consumer electronics, and other sectors. The main application of discrete industrial sensors is in automatic manufacturing systems. In these systems, sensors are involved in monitoring and regulating the manufacturing process, which guarantees high precision and efficiency.

The process segment is going to retain the fastest-growing CAGR during 2023-2032. The process industrial sensors market is booming as industries are automating as well as making them more efficient. Thus, being integral instruments in industrial automation systems, these sensors avail real-time data and insights that help to control and monitor processes more precisely. As such, different industries such as oil and gas, chemical, pharmaceuticals, food and beverage, and manufacturing make use of the sensors in various applications. For instance, people in the oil and gas industry would use sensors to measure the borehole and mud temperature.

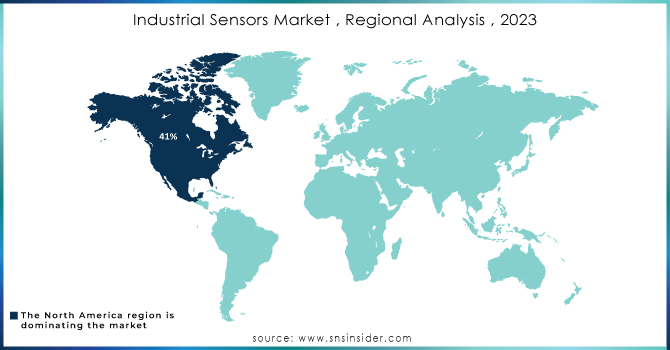

North America dominated the industrial sensors market in 2023 with a market share of over 40%, due to increasing technological progress and the development of technology. A great part of the growth can be attributed to the growing demand for the optimization, automation, and control of processes across different industries, requiring the use of sensors that monitor the situation on the site. Predictive maintenance, quality control, optimal energy consumption, and establishing favorable working conditions by monitoring temperature, humidity, dustiness, and other conditions are only some of the applications of sensors in manufacturing, energy, transportation, and other industries. Also, with the trend toward Industry 4.0, increasing numbers of companies are learning to make robust decisions based on the data about the situation on the sites and track the operation of machines and equipment in real-time.

The Asia Pacific region is to grow at a faster CAGR during the forecast period 2024-2032, as various economies in the region, such as China, India, and Japan, are making significant investments in smart technologies to improve operational efficiency and productivity. Specifically, the automotive sector greatly benefits from this expansion. Industrial sensors are important for improving vehicle safety, performance, and efficiency by monitoring key factors like engine temperature, tire pressure, and fuel levels. The increasing use of electric vehicles and advanced driver-assistance systems (ADAS) is also driving up the demand for these sensors.

The key players in the Industrial sensor market are Honeywell International, Rockwell Automation, Texas Instruments, Panasonic Corporation, TE Connectivity, Amphenol Corporation, Bosch Sensortec, STMicroelectronics, Siemens, Dwyer Instruments & Other Players.

In February 2024, Bosch Sensortec launched the BME688 Gas Sensor. This sensor provides enhanced gas detection features, such as VOCs and CO2, to enhance safety and monitor air quality.

In May 2024, the MS5803-14BA Pressure Sensor was introduced by TE Connectivity. Created for high-performance uses, this sensor provides outstanding precision and reliability when measuring pressure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.12 billion |

| Market Size by 2032 | USD 54.24 billion |

| CAGR | CAGR of 8.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Position Sensors, Gas Sensors, Pressure Sensors, Level Sensors, Temperature Sensors, Humidity & Moisture Sensors, Flow Sensors, Image Sensors, Force Sensors) • By Type (Contact, Non-Contact) • By Industry (Process, Discrete) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International, Rockwell Automation, Texas Instruments, Panasonic Corporation, TE Connectivity, Amphenol Corporation, Bosch Sensortec, STMicroelectronics, Siemens, Dwyer Instruments |

| Key Drivers | • Demand for smart sensor-enabled wearable devices is increasing. • Automobile manufacturers are increasing their demand for smart sensors to provide improved safety and comfort. |

| RESTRAINTS | • Precise performance demands from next-generation advanced/technological sensors. |

Ans: The Industrial Sensors Market is expected to grow at a CAGR of 8.93% during 2024-2032.

Ans: Industrial Sensors Market size was USD 25.12 billion in 2023 and is expected to Reach USD 54.24 billion by 2032.

Ans: Automobile manufacturers are increasing their demand for smart sensors to provide improved safety and comfort which is a major growth factor for the Industrial Sensors Market.

Ans: The level sensors segment dominated the Industrial Sensors Market.

Ans: North America dominated the Industrial Sensors Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Gas Sensors

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Industrial Sensors Market Segmentation, by Sensor Type

7.1 Chapter Overview

7.2 Position Sensors

7.2.1 Position Sensors Market Trends Analysis (2020-2032)

7.2.2 Position Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Gas Sensors

7.3.1 Gas Sensors Market Trends Analysis (2020-2032)

7.3.2 Gas Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Pressure Sensors

7.4.1 Pressure Sensors Market Trends Analysis (2020-2032)

7.4.2 Pressure Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Level Sensors

7.5.1 Level Sensors Market Trends Analysis (2020-2032)

7.5.2 Level Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Temperature Sensors

7.6.1 Temperature Sensors Market Trends Analysis (2020-2032)

7.6.2 Temperature Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Humidity & Moisture Sensors

7.7.1 Humidity & Moisture Sensors Market Trends Analysis (2020-2032)

7.7.2 Humidity & Moisture Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Flow Sensors

7.8.1 Flow Sensors Market Trends Analysis (2020-2032)

7.8.2 Flow Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Image Sensors

7.9.1 Image Sensors Market Trends Analysis (2020-2032)

7.9.2 Image Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.10 Force Sensors

7.10.1 Force Sensors Market Trends Analysis (2020-2032)

7.10.2 Force Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Industrial Sensors Market Segmentation, by Type

8.1 Chapter Overview

8.2 Contact

8.2.1 Contact Market Trends Analysis (2020-2032)

8.2.2 Contact Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Non-Contact

8.3.1 Non-Contact Market Trends Analysis (2020-2032)

8.3.2 Non-Contact Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Industrial Sensors Market Segmentation, by End User

9.1 Chapter Overview

9.2 Process

9.2.1 Process Market Trends Analysis (2020-2032)

9.2.2 Process Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.2.1 Oil and Gas Market Trends Analysis (2020-2032)

9.2.2.2 Oil and Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.2.3 Energy and Power Market Trends Analysis (2020-2032)

9.2.2.4 Energy and Power Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.2.5 Chemical Market Trends Analysis (2020-2032)

9.2.2.6 Chemical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.2.7 Mining Market Trends Analysis (2020-2032)

9.2.2.8 Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.2.9 Pharmaceutical Market Trends Analysis (2020-2032)

9.2.2.10 Pharmaceutical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.2.11 Food and Beverages Market Trends Analysis (2020-2032)

9.2.2.12 Food and Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.2.13 Others Market Trends Analysis (2020-2032)

9.2.2.14 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Discrete

9.3.1 Discrete Market Trends Analysis (2020-2032)

9.3.2 Discrete Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.2.1 Automotive Market Trends Analysis (2020-2032)

9.3.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.2.3 Consumer Electronics Market Trends Analysis (2020-2032)

9.3.2.4 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.2.5 Aerospace and Defense Market Trends Analysis (2020-2032)

9.3.2.6 Aerospace and Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.2.7 Others Market Trends Analysis (2020-2032)

9.3.2.8 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Industrial Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.2.4 North America Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.5 North America Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.2.6.2 USA Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.3 USA Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.2.7.2 Canada Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.3 Canada Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Industrial Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Industrial Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.7.2 France Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.3 France Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Industrial Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.6.2 China Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.3 China Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.7.2 India Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.3 India Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.8.2 Japan Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.3 Japan Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.12.2 Australia Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.3 Australia Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Industrial Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Industrial Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.2.4 Africa Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.5 Africa Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Industrial Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.6.4 Latin America Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.5 Latin America Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Industrial Sensors Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Industrial Sensors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Industrial Sensors Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Honeywell International

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Rockwell Automation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Texas Instruments

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Panasonic Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 TE Connectivity

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Amphenol Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Bosch Sensortec

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 STMicroelectronics

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Siemens

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Dwyer Instruments

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Sensor Type

Position Sensors

Flow Sensors

Image Sensors

Force Sensors

By Type

Contact

Non-contact

By Industry

Process

Oil and Gas

Energy and Power

Chemical

Mining

Pharmaceutical

Food and Beverages

Others

Discrete

Automotive

Consumer Electronics

Aerospace and Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The AI in Networks Market Size was valued at USD 8.33 Billion in 2023 and is expected to reach USD 101.29 Billion by 2032, at 32.14% CAGR, during 2024-2032

The Building Automation System Market Size was valued at USD 81.75 billion in 2023 and is expected to grow at 9.92% CAGR to reach USD 190.99 billion by 2032.

The Hearth Market was valued at USD 15.31 billion in 2023 and is expected to reach USD 22.73 billion by 2032, growing at a CAGR of 4.52% over the forecast period 2024-2032.

The Semiconductor Assembly and Packaging Services Market size was valued at USD 18.78 Billion in 2023 and expected to reach USD 35.04 Billion by 2032 with a growing CAGR of 7.19% over the forecast period 2024-2032.

The Volumetric Video Market was valued at USD 2.4 Billion in 2023 and is expected to reach USD 21.5 Billion by 2032, growing at a CAGR of 27.74% from 2024-2032.

The Smart Card Market was valued at USD 15.01 billion in 2023 and is projected to reach USD 22.55 billion by 2032, growing at a CAGR of 4.63% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone