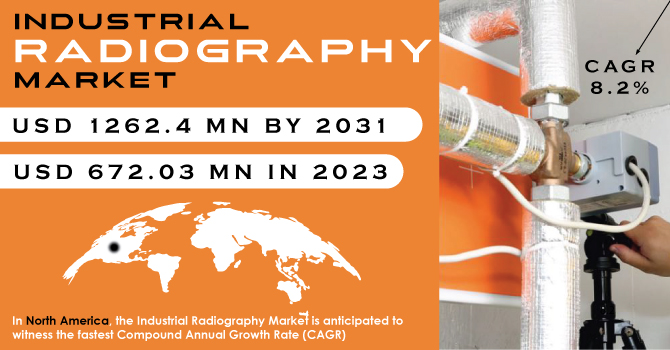

The Industrial Radiography Market Size was valued at USD 672.03 million in 2023 and is expected to reach USD 1262.4 million by 2031 and grow at a CAGR of 8.2% over the forecast period 2024-2031.

Industrial radiography is a technique that uses short-wavelength electromagnetic radiation to inspect materials for internal flaws. Industrial radiography is used to detect defects that are not visible to the naked eye. It is used in manufacturing plants to detect flaws, cracks, and surface contamination of products. In chemical plants, industrial radiography is used to inspect oil and gas pipelines as well as pressure vessels.

Get more information on Industrial Radiography Market - Request Sample Report

An anticipated surge in the size of commercial and military aircraft fleets is expected to generate significant opportunities within the industrial radiography market. Data from Boeing suggests a substantial increase in aircraft deliveries across key regions, with the Asia Pacific leading the way (17,645 deliveries projected between 2021-2040), followed by North America and Europe. This growth trajectory within the aviation sector is likely to translate into a heightened demand for industrial radiography services.

Furthermore, the International Energy Agency (IEA) forecasts a robust and accelerated growth in global electricity demand (approximately 3% annually) over the period 2023-2025, surpassing the growth rate observed in 2022. Additionally, the IEA estimates significant investments in the energy sector reaching USD 2.8 trillion in 2023. These trends are expected to fuel the industrial radiography market, as this technology plays a vital role in the petrochemical, gas, and energy & power sectors. Industrial radiography is extensively employed within the energy industry to identify and locate defects within critical infrastructure and equipment, ensuring their safety and reliability. In conclusion, the combined growth anticipated in the aviation and energy sectors is poised to propel the industrial radiography market forward.

MARKET DYNAMICS:

KEY DRIVERS:

Increased demand for improved and efficient productivity from manufacturing units, as well as increased adoption of testing technology by automotive and aerospace & defence manufacturing companies to correct defects and flaws

Strict government safety regulations and high-precision inspection by various manufacturers

RESTRAINTS:

Exposure to radiation and high implementation costs.

The growth of the industrial radiography market. The use of ionizing radiation in industrial radiography presents health risks, including cell damage and increased cancer risk without proper safety measures. Stringent government regulations mandate specialized training for workers, requiring adherence to radiation safety protocols and the use of expensive protective gear. Moreover, the high implementation costs stem from the expensive equipment, specialized disposal procedures for radioactive sources, and the need for dedicated facilities with radiation shielding. These factors collectively contribute to the perception of industrial radiography as a complex and costly process, deterring smaller companies from investing despite its undeniable benefits in ensuring product quality and safety. The growth of the industrial radiography market. The use of ionizing radiation in industrial radiography presents health risks, including cell damage and increased cancer risk without proper safety measures. Stringent government regulations mandate specialized training for workers, requiring adherence to radiation safety protocols and the use of expensive protective gear. Moreover, the high implementation costs stem from the expensive equipment, specialized disposal procedures for radioactive sources, and the need for dedicated facilities with radiation shielding. These factors collectively contribute to the perception of industrial radiography as a complex and costly process, deterring smaller companies from investing despite its undeniable benefits in ensuring product quality and safety.

OPPORTUNITIES:

Opportunities in the industry are created by the automation of testing and inspection processes, industrialization in developing economies, and the provision of customized solutions.

CHALLENGES:

Fluctuations in raw material prices directly influence the overall cost of radiography equipment manufacturing, thereby affecting the accessibility and affordability of the technology.

Radiography equipment requires various raw materials for its construction, including metals, electronic components, and specialized materials for radiation shielding. Any changes in the prices of these raw materials can significantly affect the overall production cost of the equipment. When raw material prices increase, manufacturers may face higher production expenses, leading to elevated prices for radiography equipment. This, in turn, can make the technology less accessible and affordable for potential buyers, including industrial facilities and inspection service providers. Conversely, when raw material prices decrease, manufacturers may be able to offer radiography equipment at lower costs, potentially increasing its accessibility and affordability. Therefore, fluctuations in raw material prices directly impact the economic feasibility of manufacturing radiography equipment and can influence market dynamics, including demand and competition within the industry.

IMPACT OF RUSSIA UKRAINE WAR

Sanctions and trade disruptions limit access to crucial equipment, potentially causing a 20% price increase for Cobalt-60 sources. Shortages of films and detectors could delay projects by months. The economic fallout in Ukraine and Russia is expected to decrease demand for these services by 10-15%. Disruptions also lead to price fluctuations, potentially inflating operational costs by 5-10% for service providers. Skilled worker displacement due to the war can exacerbate these issues by creating labor shortages and driving up labor costs. These combined effects create a challenging environment for the industrial radiography market in Eastern Europe.

IMPACT OF ECONOMIC SLOWDOWN

Budgets cuts could lead to a 15-20% drop in capital expenditure for projects, reducing demand for inspection services. Project delays and cancellations might further impact demand by up to 30%. Key sectors like oil & gas, which rely heavily on radiography, could see a 10-15% activity decline, translating to revenue losses for service providers. Increased competition in a sluggish market could force service providers to cut prices by 5-10%, squeezing their margins.

Companies might still prioritize essential maintenance and safety inspections (5-10% of demand) to avoid costly breakdowns. Additionally, the cost-effectiveness of industrial radiography in preventing accidents could see some companies (5-7%) continue utilizing these services at a reduced rate.

BY IMAGING TECHNIQUE

Digital Radiography

Film-based Radiography

The segmentation of the Industrial Radiography Market, based on technology, comprises film-based radiography and digital radiography. Within this segmentation, the digital radiography segment has emerged as the top revenue generator. Digital radiography, the latest non-destructive testing inspection technique, instantly produces digital images on a computer, eliminating the need for an intermediate cassette to transfer examinations. The adoption of digital radiography is on the rise due to its numerous advantages, including faster exposure times, real-time applications, advanced analysis and defect-recognition tools, enhanced detail detectability, improved SNR and linearity, portability, and rapid feedback.

BY RADIATION TYPE

Gamma Rays

X Rays

Segmentation of the Industrial Radiography Market based on radiation type includes X-rays and Gamma rays. Among these segments, the X-rays category has emerged as the top revenue generator, driven by ongoing technological advancements, intensified product development, and increased government funding and investment. The market's focus on enhancing and innovating X-ray units further fuels the growing adoption of this segment. Industrial radiography primarily employs industrial X-ray machines, which come in various sizes and capacities.

BY END USER

Petrochemicals & Gas

Power Generation

Aerospace

Consumer Electronics

Manufacturing

Automotive & Transportation

Others

The industrial radiography market is segmented into Petrochemicals & Gas, Power Generation, Aerospace, Consumer Electronics, Manufacturing, Automotive & Transportation, and Others. During the forecast period, the market for petrochemicals and gas end users is expected to grow at the fastest rate. In this end user, industrial radiography testing includes monitoring pipelines, storage tanks, and refining equipment to measure internal corrosion without externally damaging the material. The deep-sea oil and gas industry relies heavily on industrial radiography. Oil leaks or spills can occur over time in this industry if refinery infrastructure is not carefully monitored, resulting in extremely high cleanup costs.

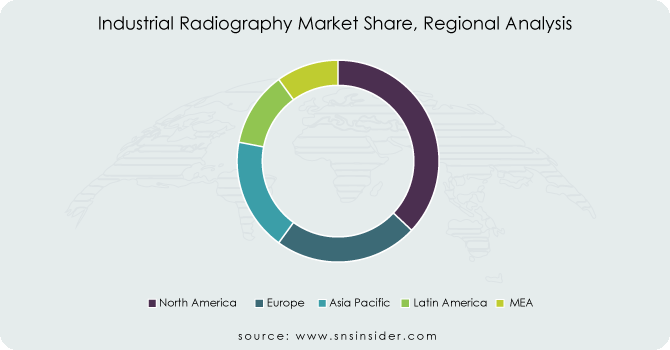

The Asia-Pacific Industrial Radiography market is poised to dominate, driven by stringent government safety regulations, which have spurred significant demand for industrial radiography equipment. In Europe, the Industrial Radiography market holds the second-largest market share, attributed to the region's prominent aerospace industry. Within Europe, the German Industrial Radiography market commands the largest market share, while the UK Industrial Radiography market exhibits the highest growth rate.

In North America, the Industrial Radiography Market is anticipated to witness the fastest Compound Annual Growth Rate (CAGR), fueled by advancements in the automotive, aerospace, manufacturing, and oil sectors. These industries extensively utilize industrial radiography techniques for maintenance, inspection, and dimensional measurement purposes.

Get Customized Report as per Your Business Requirement - Request Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The key players in the industrial radiography market are 3DX-RAY Ltd., Anritsu Corporation, PerkinElmer Inc., Shimadzu Corporation, Nikon Corporation, COMET Holding AG, Bosello High Technology SRL, General Electric, FUJIFILM Holdings Corporation, Mettler-Toledo International Inc & Other Players.

PerkinElmer Inc-Company Financial Analysis

RECENT DEVELOPMENT

In February 2023: Carestream Health India introduced The DRX Compass, a precise, straightforward, and flexible digital radiography solution designed to elevate radiologists' productivity to a new level.

In March 2023: Fujifilm Medical Systems USA announced the official launch of the Fujifilm FCR Vixera G300D. This groundbreaking digital radiography system offers top-notch image quality, rapid acquisition rates, and improved workflow efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 672.03 million |

| Market Size by 2031 | US$ 1262.4 million |

| CAGR | CAGR of 8.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Imaging Technique (Digital Radiography, Film-Based Radiography) • By Radiation Type (Gamma Rays, X Rays) • By End-User (Petrochemicals & Gas, Power Generation, Aerospace, Consumer Electronics, Manufacturing, Automotive & Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3DX-RAY Ltd., Anritsu Corporation, PerkinElmer Inc., Shimadzu Corporation, Nikon Corporation, COMET Holding AG, Bosello High Technology SRL, General Electric, FUJIFILM Holdings Corporation, and Mettler-Toledo International Inc. |

| Key Drivers | • Strict government safety regulations and high-precision inspection by various manufacturers |

| RESTRAINTS | • Exposure to radiation and high implementation costs. |

The Industrial Radiography Market was valued at USD 672.03 million in 2023.

The expected CAGR of the global Industrial Radiography Market during the forecast period is 8.2%

The North America region is anticipated to record the Fastest Growing in the Industrial Radiography Market.

The X-Rays segment is leading in the market revenue share in 2023.

The Asia-Pacific region with the Highest Revenue share in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Industrial Radiography Market Segmentation, By Imaging Technique

9.1 Introduction

9.2 Trend Analysis

9.3 Digital Radiography

9.4 Film-based Radiography

10. Industrial Radiography Market Segmentation, By Radiation Type

10.1 Introduction

10.2 Trend Analysis

10.3 Gamma Rays

10.4 X Rays

11. Industrial Radiography Market Segmentation, By End User

11.1 Introduction

11.2 Trend Analysis

11.3 Petrochemicals & Gas

11.4 Power Generation

11.5 Aerospace

11.6 Consumer Electronics

11.7 Manufacturing

11.8 Automotive & Transportation

11.9 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Industrial Radiography Market by Country

12.2.3 North America Industrial Radiography Market By Imaging Technique

12.2.4 North America Industrial Radiography Market By Radiation Type

12.2.5 North America Industrial Radiography Market By End User

12.2.6 USA

12.2.6.1 USA Industrial Radiography Market By Imaging Technique

12.2.6.2 USA Industrial Radiography Market By Radiation Type

12.2.6.3 USA Industrial Radiography Market By End User

12.2.7 Canada

12.2.7.1 Canada Industrial Radiography Market By Imaging Technique

12.2.7.2 Canada Industrial Radiography Market By Radiation Type

12.2.7.3 Canada Industrial Radiography Market By End User

12.2.8 Mexico

12.2.8.1 Mexico Industrial Radiography Market By Imaging Technique

12.2.8.2 Mexico Industrial Radiography Market By Radiation Type

12.2.8.3 Mexico Industrial Radiography Market By End User

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Industrial Radiography Market by Country

12.3.2.2 Eastern Europe Industrial Radiography Market By Imaging Technique

12.3.2.3 Eastern Europe Industrial Radiography Market By Radiation Type

12.3.2.4 Eastern Europe Industrial Radiography Market By End User

12.3.2.5 Poland

12.3.2.5.1 Poland Industrial Radiography Market By Imaging Technique

12.3.2.5.2 Poland Industrial Radiography Market By Radiation Type

12.3.2.5.3 Poland Industrial Radiography Market By End User

12.3.2.6 Romania

12.3.2.6.1 Romania Industrial Radiography Market By Imaging Technique

12.3.2.6.2 Romania Industrial Radiography Market By Radiation Type

12.3.2.6.4 Romania Industrial Radiography Market By End User

12.3.2.7 Hungary

12.3.2.7.1 Hungary Industrial Radiography Market By Imaging Technique

12.3.2.7.2 Hungary Industrial Radiography Market By Radiation Type

12.3.2.7.3 Hungary Industrial Radiography Market By End User

12.3.2.8 Turkey

12.3.2.8.1 Turkey Industrial Radiography Market By Imaging Technique

12.3.2.8.2 Turkey Industrial Radiography Market By Radiation Type

12.3.2.8.3 Turkey Industrial Radiography Market By End User

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Industrial Radiography Market By Imaging Technique

12.3.2.9.2 Rest of Eastern Europe Industrial Radiography Market By Radiation Type

12.3.2.9.3 Rest of Eastern Europe Industrial Radiography Market By End User

12.3.3 Western Europe

12.3.3.1 Western Europe Industrial Radiography Market by Country

12.3.3.2 Western Europe Industrial Radiography Market By Imaging Technique

12.3.3.3 Western Europe Industrial Radiography Market By Radiation Type

12.3.3.4 Western Europe Industrial Radiography Market By End User

12.3.3.5 Germany

12.3.3.5.1 Germany Industrial Radiography Market By Imaging Technique

12.3.3.5.2 Germany Industrial Radiography Market By Radiation Type

12.3.3.5.3 Germany Industrial Radiography Market By End User

12.3.3.6 France

12.3.3.6.1 France Industrial Radiography Market By Imaging Technique

12.3.3.6.2 France Industrial Radiography Market By Radiation Type

12.3.3.6.3 France Industrial Radiography Market By End User

12.3.3.7 UK

12.3.3.7.1 UK Industrial Radiography Market By Imaging Technique

12.3.3.7.2 UK Industrial Radiography Market By Radiation Type

12.3.3.7.3 UK Industrial Radiography Market By End User

12.3.3.8 Italy

12.3.3.8.1 Italy Industrial Radiography Market By Imaging Technique

12.3.3.8.2 Italy Industrial Radiography Market By Radiation Type

12.3.3.8.3 Italy Industrial Radiography Market By End User

12.3.3.9 Spain

12.3.3.9.1 Spain Industrial Radiography Market By Imaging Technique

12.3.3.9.2 Spain Industrial Radiography Market By Radiation Type

12.3.3.9.3 Spain Industrial Radiography Market By End User

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Industrial Radiography Market By Imaging Technique

12.3.3.10.2 Netherlands Industrial Radiography Market By Radiation Type

12.3.3.10.3 Netherlands Industrial Radiography Market By End User

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Industrial Radiography Market By Imaging Technique

12.3.3.11.2 Switzerland Industrial Radiography Market By Radiation Type

12.3.3.11.3 Switzerland Industrial Radiography Market By End User

12.3.3.1.12 Austria

12.3.3.12.1 Austria Industrial Radiography Market By Imaging Technique

12.3.3.12.2 Austria Industrial Radiography Market By Radiation Type

12.3.3.12.3 Austria Industrial Radiography Market By End User

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Industrial Radiography Market By Imaging Technique

12.3.3.13.2 Rest of Western Europe Industrial Radiography Market By Radiation Type

12.3.3.13.3 Rest of Western Europe Industrial Radiography Market By End User

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Industrial Radiography Market by Country

12.4.3 Asia-Pacific Industrial Radiography Market By Imaging Technique

12.4.4 Asia-Pacific Industrial Radiography Market By Radiation Type

12.4.5 Asia-Pacific Industrial Radiography Market By End User

12.4.6 China

12.4.6.1 China Industrial Radiography Market By Imaging Technique

12.4.6.2 China Industrial Radiography Market By Radiation Type

12.4.6.3 China Industrial Radiography Market By End User

12.4.7 India

12.4.7.1 India Industrial Radiography Market By Imaging Technique

12.4.7.2 India Industrial Radiography Market By Radiation Type

12.4.7.3 India Industrial Radiography Market By End User

12.4.8 Japan

12.4.8.1 Japan Industrial Radiography Market By Imaging Technique

12.4.8.2 Japan Industrial Radiography Market By Radiation Type

12.4.8.3 Japan Industrial Radiography Market By End User

12.4.9 South Korea

12.4.9.1 South Korea Industrial Radiography Market By Imaging Technique

12.4.9.2 South Korea Industrial Radiography Market By Radiation Type

12.4.9.3 South Korea Industrial Radiography Market By End User

12.4.10 Vietnam

12.4.10.1 Vietnam Industrial Radiography Market By Imaging Technique

12.4.10.2 Vietnam Industrial Radiography Market By Radiation Type

12.4.10.3 Vietnam Industrial Radiography Market By End User

12.4.11 Singapore

12.4.11.1 Singapore Industrial Radiography Market By Imaging Technique

12.4.11.2 Singapore Industrial Radiography Market By Radiation Type

12.4.11.3 Singapore Industrial Radiography Market By End User

12.4.12 Australia

12.4.12.1 Australia Industrial Radiography Market By Imaging Technique

12.4.12.2 Australia Industrial Radiography Market By Radiation Type

12.4.12.3 Australia Industrial Radiography Market By End User

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Industrial Radiography Market By Imaging Technique

12.4.13.2 Rest of Asia-Pacific Industrial Radiography Market By Radiation Type

12.4.13.3 Rest of Asia-Pacific Industrial Radiography Market By End User

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Industrial Radiography Market by Country

12.5.2.2 Middle East Industrial Radiography Market By Imaging Technique

12.5.2.3 Middle East Industrial Radiography Market By Radiation Type

12.5.2.4 Middle East Industrial Radiography Market By End User

12.5.2.5 UAE

12.5.2.5.1 UAE Industrial Radiography Market By Imaging Technique

12.5.2.5.2 UAE Industrial Radiography Market By Radiation Type

12.5.2.5.3 UAE Industrial Radiography Market By End User

12.5.2.6 Egypt

12.5.2.6.1 Egypt Industrial Radiography Market By Imaging Technique

12.5.2.6.2 Egypt Industrial Radiography Market By Radiation Type

12.5.2.6.3 Egypt Industrial Radiography Market By End User

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Industrial Radiography Market By Imaging Technique

12.5.2.7.2 Saudi Arabia Industrial Radiography Market By Radiation Type

12.5.2.7.3 Saudi Arabia Industrial Radiography Market By End User

12.5.2.8 Qatar

12.5.2.8.1 Qatar Industrial Radiography Market By Imaging Technique

12.5.2.8.2 Qatar Industrial Radiography Market By Radiation Type

12.5.2.8.3 Qatar Industrial Radiography Market By End User

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Industrial Radiography Market By Imaging Technique

12.5.2.9.2 Rest of Middle East Industrial Radiography Market By Radiation Type

12.5.2.9.3 Rest of Middle East Industrial Radiography Market By End User

12.5.3 Africa

12.5.3.1 Africa Industrial Radiography Market by Country

12.5.3.2 Africa Industrial Radiography Market By Imaging Technique

12.5.3.3 Africa Industrial Radiography Market By Radiation Type

12.5.3.4 Africa Industrial Radiography Market By End User

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Industrial Radiography Market By Imaging Technique

12.5.3.5.2 Nigeria Industrial Radiography Market By Radiation Type

12.5.3.5.3 Nigeria Industrial Radiography Market By End User

12.5.3.6 South Africa

12.5.3.6.1 South Africa Industrial Radiography Market By Imaging Technique

12.5.3.6.2 South Africa Industrial Radiography Market By Radiation Type

12.5.3.6.3 South Africa Industrial Radiography Market By End User

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Industrial Radiography Market By Imaging Technique

12.5.3.7.2 Rest of Africa Industrial Radiography Market By Radiation Type

12.5.3.7.3 Rest of Africa Industrial Radiography Market By End User

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Industrial Radiography Market by country

12.6.3 Latin America Industrial Radiography Market By Imaging Technique

12.6.4 Latin America Industrial Radiography Market By Radiation Type

12.6.5 Latin America Industrial Radiography Market By End User

12.6.6 Brazil

12.6.6.1 Brazil Industrial Radiography Market By Imaging Technique

12.6.6.2 Brazil Industrial Radiography Market By Radiation Type

12.6.6.3 Brazil Industrial Radiography Market By End User

12.6.7 Argentina

12.6.7.1 Argentina Industrial Radiography Market By Imaging Technique

12.6.7.2 Argentina Industrial Radiography Market By Radiation Type

12.6.7.3 Argentina Industrial Radiography Market By End User

12.6.8 Colombia

12.6.8.1 Colombia Industrial Radiography Market By Imaging Technique

12.6.8.2 Colombia Industrial Radiography Market By Radiation Type

12.6.8.3 Colombia Industrial Radiography Market By End User

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Industrial Radiography Market By Imaging Technique

12.6.9.2 Rest of Latin America Industrial Radiography Market By Radiation Type

12.6.9.3 Rest of Latin America Industrial Radiography Market By End User

13. Company Profiles

13.1 3DX-RAY Ltd

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Anritsu Corporation

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 PerkinElmer Inc

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Shimadzu Corporation

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Nikon Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 COMET Holding AG

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Bosello High Technology SRL

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 General Electric

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 FUJIFILM Holdings Corporation

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Mettler-Toledo International Inc

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The CMOS and sCMOS Image Sensor Market was valued at USD 22.8 Billion in 2023 and is expected to reach USD 39.7 Billion by 2032, growing at a CAGR of 6.39% from 2024-2032.

The Data Acquisition (DAQ) System Market size is expected to be valued at USD 8.84 Billion in 2023. It is estimated to reach USD 17.37 Billion by 2032, growing at a CAGR of 7.8% during 2024-2032.

The Speech and Voice Recognition Market Size was valued at USD 12.63 billion in 2023 and is expected to reach USD 92.08 billion by 2032 and grow at a CAGR of 24.7% over the forecast period 2024-2032.

The Hybrid Memory Cube (HMC) and High-bandwidth Memory (HBM) Market was valued at USD 3.37 billion in 2023 and is projected to reach USD 32.30 billion by 2032, growing at a CAGR of 28.55% from 2024 to 2032.

The Machine Automation Controller Market was valued at USD 42.08 billion in 2023 and is expected to reach USD 61.66 billion by 2032, growing at a CAGR of 4.39% over the forecast period 2024-2032

Ultrasonic Sensor Market size was valued at USD 5.96 billion in 2023 and is expected to grow to USD 13.17 billion by 2032 and grow at a CAGR of 9.21 % over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone