Industrial Racking Systems Market Report Scope & Overview:

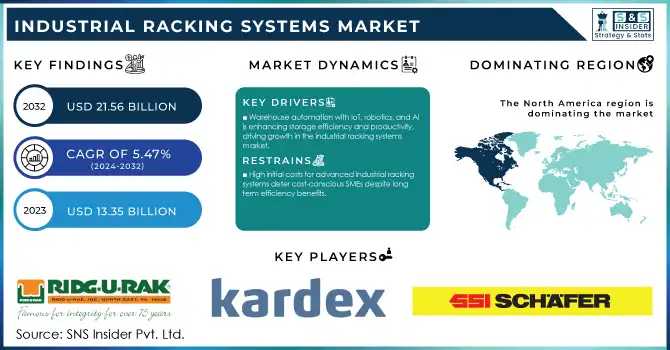

The Industrial Racking Systems Market size was valued at USD 14.08 billion in 2024 and is projected to reach USD 21.56 billion by 2032, growing at a CAGR of 5.47% during 2025-2032. The Industrial Racking Systems Market has been witnessing significant growth, driven by the rising demand for efficient storage and material handling solutions across various industries. With the rapid expansion of e-commerce, warehousing facilities are upgrading their storage infrastructure to accommodate higher inventory levels, fueling the adoption of advanced racking systems. Additionally, manufacturing and retail sectors are increasingly investing in optimized storage solutions to enhance operational efficiency, reduce costs, and improve workflow. Key market trends include the growing adoption of automated storage and retrieval systems (AS/RS) and the integration of IoT-enabled technologies to enable real-time inventory tracking and management. Industries are shifting towards modular and customizable racking solutions to adapt to changing business needs.

To Get More Information on Industrial Racking Systems Market - Request Sample Report

Key Industrial Racking Systems Market Trends

-

AI-enabled monitoring is being integrated to improve pattern recognition, enable real-time fault detection, and support predictive maintenance for racking system operations.

-

Energy-efficient control technologies are increasingly adopted to reduce operational costs while ensuring sustainable warehouse and storage management.

-

Smart safety frameworks are advancing to strengthen human-machine interaction, improving workplace safety in handling, inspections, and maintenance.

-

Modular racking system designs are gaining traction, offering scalability, faster installation, and sector-specific customization across industries.

-

Cloud-based platforms are expanding, enabling remote monitoring, data-driven asset tracking, and predictive analytics to boost racking system reliability.

Industrial Racking Systems Market Growth Drivers:

-

Warehouse automation, driven by advanced racking systems with IoT, robotics, and AI, is revolutionizing storage efficiency, boosting productivity, and fueling the growth of the industrial racking systems market

Warehouse automation is revolutionizing the logistics and storage industry, becoming a pivotal growth driver for the industrial racking systems market. The integration of automation technologies with racking systems significantly enhances storage efficiency, streamlining inventory management and boosting operational productivity. Automated racking systems, such as shuttle racks, pallet flow racks, and mobile racking systems, optimize warehouse space by utilizing vertical storage solutions while enabling faster retrieval of goods. This not only reduces human intervention but also minimizes errors, improves accuracy, and accelerates order fulfillment a critical requirement in industries such as e-commerce, retail, and manufacturing.

The adoption of automation in warehouses is further fueled by the increasing demand for faster supply chain operations and cost optimization. Smart racking systems equipped with IoT sensors, robotics, and AI-driven inventory tracking are gaining traction, allowing real-time monitoring and better decision-making. However, while automation offers significant benefits, the high initial investment required for implementation remains a challenge for small and medium-sized enterprises (SMEs). Despite this, the push for efficient and scalable storage solutions is driving widespread adoption across industries.

Industrial Racking Systems Market Restraints:

-

The high initial investment required for advanced industrial racking systems, including materials, technologies, and integration, often deters cost-conscious SMEs from adoption despite their long-term efficiency benefits

The installation of industrial racking systems, especially advanced solutions like automated or heavy-duty racking, requires substantial upfront investment. These costs include the procurement of high-quality materials, advanced technologies, and specialized installation services. Automated systems, in particular, often require integration with warehouse management software (WMS) and robotics, further driving up the overall expenditure. For small and medium-sized enterprises (SMEs), which typically operate on limited budgets, such high initial costs can be a significant barrier to adoption. While these systems offer long-term benefits such as increased storage efficiency and operational optimization, the immediate financial burden may outweigh these advantages for cost-conscious businesses. Additionally, the potential need for customization to suit specific operational requirements can add to the expense. This financial constraint often leads SMEs to rely on traditional, less efficient storage methods, slowing the widespread adoption of industrial racking systems in smaller-scale industries.

Industrial Racking Systems Market Segment Analysis

By System Type

The Selective Racking System segment dominated with a market share of over 38% in 2024, due to its unmatched versatility, simplicity, and ability to store a wide variety of products. This system allows for direct access to every individual storage location, which ensures maximum efficiency in inventory management. With its straightforward design, selective racking systems can be easily adapted to various warehouse sizes and configurations. They are ideal for businesses that require fast and efficient access to a diverse range of goods, such as retail, manufacturing, and distribution industries. The ability to store different types of products, from small parts to large items, further enhances its popularity. Additionally, its ease of installation and maintenance makes it a cost-effective solution for many businesses.

By industry vertical

The Manufacturing segment dominated with the market share of over 32% in 2024, as manufacturing industries rely heavily on efficient storage and retrieval of raw materials, components, and finished goods. With the increasing complexity of production processes and growing inventory levels, manufacturers require specialized racking systems to ensure smooth operations. These systems enable better organization and accessibility, which helps reduce downtime and improves operational efficiency. As production facilities expand, the demand for industrial racking systems has remained consistently strong. Manufacturers are focusing on optimizing space utilization to handle higher volumes of materials while maintaining safety and accessibility in the workplace. Racking systems help create organized storage spaces, enhance workflow, and minimize the risk of product damage.

Industrial Racking Systems Market Regional Outlook

North America Industrial Racking Systems Market Insights

North America region dominated with the market share over 35% in 2024, due to several factors, primarily the region's well-developed warehousing and logistics infrastructure. The demand for efficient storage solutions is driven by the growth of e-commerce, retail, and manufacturing industries. Additionally, North America's focus on advanced technologies and automation plays a significant role in enhancing the functionality of industrial racking systems. Key market players, including prominent manufacturers and technology providers, are based in this region, further bolstering its market leadership.

Asia-Pacific Industrial Racking Systems Market Insights

The Asia-Pacific region is witnessing the fastest growth in the Industrial Racking Systems Market, driven by several key factors. Rapid industrialization across countries such as China, India, and various Southeast Asian nations is creating a significant demand for efficient storage and material handling solutions. As manufacturing activities increase, businesses require advanced racking systems to streamline their warehousing and inventory management processes. Additionally, the booming e-commerce industry in the region is contributing to the rising need for automated storage solutions to manage the growing volume of goods and improve supply chain efficiency.

Europe Industrial Racking Systems Market Insights

Europe holds a substantial share in the Industrial Racking Systems Market, supported by its mature logistics, automotive, and retail sectors. Strict regulatory frameworks on workplace safety and sustainable storage solutions drive the adoption of modern racking systems. The region is also witnessing rising demand for automated and modular solutions, particularly in Germany, the UK, and France. Moreover, Europe’s commitment to Industry 4.0, along with investments in robotics and AI-driven warehousing, further strengthens market growth. The strong presence of established racking system manufacturers in the region continues to enhance innovation and competitive market offerings.

Middle East & Africa Industrial Racking Systems Market Insights

The Middle East & Africa region is experiencing steady growth in the Industrial Racking Systems Market, primarily fueled by infrastructure development, oil & gas, and expanding retail sectors. Countries such as the UAE and Saudi Arabia are investing heavily in logistics hubs and free trade zones, driving demand for advanced storage solutions. In Africa, the rise of industrialization and growing manufacturing bases are creating opportunities for warehouse optimization. However, challenges such as high initial investment costs and limited adoption of automation may slow growth. Nevertheless, ongoing government initiatives to diversify economies beyond oil support market expansion.

Latin America Industrial Racking Systems Market Insights

Latin America shows moderate growth in the Industrial Racking Systems Market, with demand mainly driven by the retail, food & beverage, and automotive industries. Countries like Brazil and Mexico are key markets, benefiting from growing e-commerce penetration and the need for cost-effective warehousing solutions. The region is gradually adopting modern storage and racking technologies to enhance operational efficiency and reduce space constraints in urban centers. However, economic instability and fluctuating trade policies in some countries may act as restraints. Despite this, increasing investment in logistics and supply chain infrastructure is expected to support long-term growth in the market.

Do You Need any Customization Research on Industrial Racking Systems Market - Inquire Now

Industrial Racking Systems Companies:

-

Kardex

-

Averys SA

-

SSI Schaefer

-

Gonvarri Material Handling

-

PROMAN S.r.

-

AR Racking

-

ARPAC

-

North American Steel Equipment Inc.

-

AK Material Handling Systems

-

Daifuku Co., Ltd.

-

Mecalux, S.A.

-

Constructor Group AS

-

Interroll Group

-

Dematic

-

Toyota Material Handling

-

Montel Inc.

-

EAB Group Oy

-

Beumer Group GmbH

Competitive Landscape for Industrial Racking Systems Market:

Founded in 1819 and headquartered in Atlanta, Georgia, USA, Dematic is a global leader in intelligent automation solutions for warehouses, distribution centers, and production facilities. The company specializes in material handling systems, software, and robotics, helping businesses improve logistics efficiency, productivity, and supply chain performance across industries.

-

In August 23, 2024: Dematic has unveiled its Vision Picking Solution in Australia and New Zealand, enhancing warehouse productivity by integrating vision-assisted picking with real-time logistics solutions. The hands-free technology includes a small heads-up display (HUD) that ensures accurate and efficient picking by providing visual confirmation of instructions, images, quantities, and locations.

Established in 1937 and headquartered in Neunkirchen, Germany, SSI SCHAEFER is a leading provider of modular warehousing and logistics solutions. The company delivers innovative storage, conveying, picking, and handling systems, including automated shuttle and robotics technologies, serving diverse industries with scalable, future-ready intralogistics systems worldwide.

-

In May 19, 2023: SSI SCHAEFER and Brands for Less introduced the first automated Roaming Shuttle at their Dubai distribution center. This innovative solution features a VNA selective storage system for 4,350 pallets and an automated bin storage system with 123,000 totes, optimizing storage and enhancing operational efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.08 Billion |

| Market Size by 2032 | USD 21.56 Billion |

| CAGR | CAGR of 5.47% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By system type (Cantilever racking system, Drive-in/drive-thru racking system, Selective racking system, push back racking system, Others) • By industry vertical (Retail, Manufacturing, Packaging, Food and beverages, Pharmaceuticals, Others) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles |

Ridg-U-Rak Inc., Kardex, Averys SA, SSI Schaefer, Gonvarri Material Handling, PROMAN S.r.l., AR Racking, ARPAC, North American Steel Equipment Inc., AK Material Handling Systems, Daifuku Co., Ltd., Mecalux S.A., Constructor Group AS, Jungheinrich AG, Interroll Group, Dematic, Toyota Material Handling, Montel Inc., EAB Group Oy, Beumer Group GmbH |