To get more information on Industrial Pumps Market - Request Free Sample Report

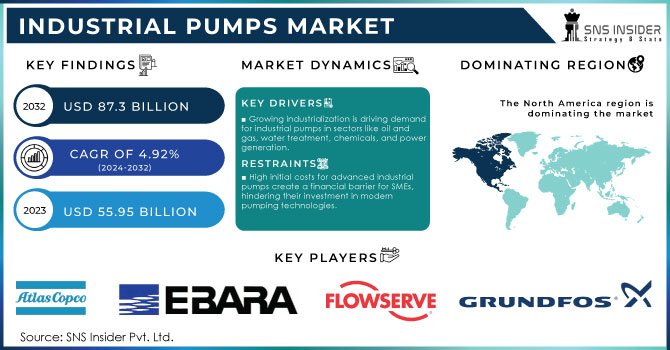

The Industrial Pumps Market Size was valued at USD 55.95 Billion in 2023 and is expected to reach USD 87.3 Billion by 2032 and grow at a CAGR of 4.92% over the forecast period 2024-2032.

The industrial pumps market is a critical component of various sectors, including oil and gas, water and wastewater treatment, chemical processing, and manufacturing. As industries strive for improved efficiency and sustainability, the demand for advanced pump technologies continues to rise. According to a study published in the Journal of Loss Prevention in the Process Industries, optimizing pump efficiency can significantly impact operational costs and energy consumption, which aligns with growing environmental regulations aimed at reducing greenhouse gas emissions. The new eco-regulations are set to reshape future pump designs, emphasizing the importance of compliance among manufacturers and users alike.

Recent advancements in technology have led to significant improvements in pump efficiency, with studies indicating that modern pumps can achieve efficiency ratings exceeding 90%. The U.S. Department of Energy (DOE) has implemented new pump efficiency standards, compelling manufacturers to adapt and innovate in response to these regulatory changes. These regulations are essential in ensuring that the industrial pumps market not only meets performance expectations but also aligns with the global push towards sustainability and energy conservation. As per Pumps & Systems, companies must prepare for compliance with these standards, which may affect product design and manufacturing processes. Furthermore, the integration of automation and IoT technologies in pump systems is on the rise, enhancing operational efficiency and allowing for real-time monitoring and predictive maintenance. The ability to gather data and analyze pump performance metrics has become increasingly valuable for industries, reducing downtime and operational costs. This shift towards smarter pump networks is supported by research from the American Institute of Chemical Engineers (AIChE), highlighting the importance of optimizing pump performance and system design to achieve greater reliability and efficiency.

Another critical aspect of the industrial pump market is the growing emphasis on user satisfaction. Companies are increasingly focused on the factors that influence their purchase decisions, including reliability, efficiency, and total cost of ownership. A shift towards more sustainable practices and eco-friendly technologies is driving companies to adopt pumps that align with their corporate sustainability goals. According to industry reports, the average lifespan of industrial pumps has improved, with users replacing pumps less frequently due to enhanced reliability and performance. Moreover, the market landscape is witnessing a surge in the development of advanced materials and designs that facilitate better energy transfer and reduce maintenance needs. Emerging markets are also playing a vital role in the growth of the industrial pump sector, as industrialization and infrastructure development drive demand for reliable pumping solutions. The integration of cutting-edge technologies and compliance with environmental standards is positioning manufacturers to capture market share in these expanding regions.

DRIVERS

Growing industrialization significantly fuels the demand for industrial pumps across multiple sectors. As countries, especially emerging economies, undergo rapid industrial growth, the need for efficient and reliable pumping systems becomes crucial. Industries such as oil and gas require robust pumps to handle the transportation of crude oil, natural gas, and refined products through pipelines and processing plants. Similarly, the water and wastewater treatment sector rely on industrial pumps to manage water supply and sewage treatment processes, ensuring safe and clean water for communities. The chemical industry also demands specialized pumps to transport corrosive and viscous fluids safely, which is essential for maintaining operational efficiency and safety standards.

Furthermore, the power generation sector utilizes various pumping systems for cooling, water supply, and fuel transport, emphasizing the critical role of pumps in sustaining energy production. Infrastructure development, such as the construction of roads, bridges, and residential complexes, contributes to this demand as new facilities require integrated pumping solutions for various applications. Additionally, advancements in industrial processes, aimed at increasing productivity and reducing costs, are further driving the adoption of sophisticated pumping technologies. As a result, the convergence of industrialization, infrastructure growth, and technological innovation creates a robust market environment for industrial pumps, fostering ongoing investment and expansion in this essential sector. This dynamic reinforces the pivotal role of industrial pumps in facilitating and sustaining economic growth across diverse industries.

Technological advancements in pump technologies are significantly transforming the industrial pumps market, particularly through innovations like smart pumps and energy-efficient designs. Smart pumps integrate advanced monitoring and control systems that allow for real-time data collection and analysis. This technology enables operators to optimize pump performance, detect anomalies, and predict maintenance needs, leading to reduced downtime and enhanced operational efficiency. Energy-efficient pump designs are also gaining traction as industries increasingly prioritize sustainability and cost savings. These pumps consume less energy compared to traditional models, which not only lowers operational costs but also aligns with global efforts to reduce carbon emissions. Innovations such as variable frequency drives (VFDs) allow pumps to adjust their speed based on demand, further enhancing energy efficiency.

Additionally, advancements in materials and coatings have led to more durable and corrosion-resistant pumps, which can operate effectively in harsh environments. This durability reduces maintenance frequency and prolongs the lifespan of the equipment, providing long-term savings for businesses. The combination of these technologies is attracting significant investments in new pump systems. Companies are recognizing the competitive advantage offered by adopting cutting-edge technologies, leading to a surge in demand for high-performance pumps across various sectors, including water treatment, oil and gas, and manufacturing. As industries continue to embrace digital transformation and sustainability initiatives, the role of advanced pumping technologies will become increasingly critical in driving operational efficiency and performance.

RESTRAIN

High initial costs represent a significant barrier to the adoption of advanced industrial pumps, particularly for small and medium-sized enterprises (SMEs). These businesses often operate under tight budget constraints, making large capital expenditures challenging. Advanced industrial pumps are typically designed with cutting-edge technology and materials, which enhance efficiency, reliability, and performance. However, this sophistication comes at a premium price, deterring SMEs from investing in these solutions. The financial strain associated with acquiring these pumps can lead SMEs to opt for less efficient, lower-cost alternatives that may not meet their operational needs or regulatory requirements. Consequently, these companies may miss out on potential long-term savings associated with energy-efficient pumps, as well as the improved operational efficiencies that come from modern technology. Additionally, the high initial costs can limit SMEs' ability to scale their operations or expand into new markets, as funds may be tied up in outdated equipment or repairs.

Moreover, the reluctance to invest in advanced pumping solutions may hinder SMEs from meeting the growing demands for sustainable practices in industries like water treatment and energy management. In this context, it becomes crucial for manufacturers and policymakers to explore financing options, such as leasing programs or subsidies, to help SMEs overcome these cost barriers. By addressing the financial challenges associated with acquiring advanced industrial pumps, stakeholders can promote wider adoption of innovative technologies and support the growth and competitiveness of SMEs in the market.

By Product Type

In 2023, the centrifugal pump dominated the market share over 68.02%. These pumps are employed for managing and overseeing the flow of gases, vapors, liquids, and other fluids. Because of their low maintenance needs and capability for increased fluid flow rates, these items are extensively used in various sectors such as water supply, food & beverage, pharmaceutical, and chemical industries. Moreover, these pumps are utilized in power generation plants to move the coolant.

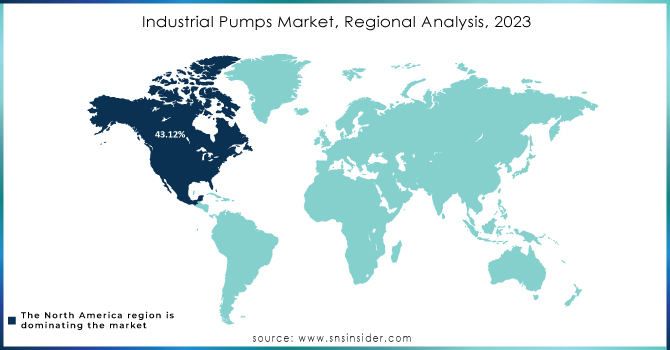

In 2023, North America region dominated the market share over 43.12% of the market share. Industrial pumps are utilized for precise dosing of catalysts in chemical production facilities. Additionally, they are utilized in oil production and refining plants to transfer both crude and processed oil between different locations.

Europe is projected to expand in the upcoming years as a result of its well-established industrial sector. These pumps are utilized across different sectors like chemical, power generation, and construction. Moreover, there has been a growing need for effective rotary pumps in order to lessen the environmental impact in industrial operations and enhance carbon credit, thus propelling the market in the area.

Do You Need any Customization Research on Industrial Pumps Market - Inquire Now

Some of the major key players of Industrial Pumps Market

Atlas Copco AB: (Industrial Equipment and Compressors)

Ebara Corporation: (Pumps and Fluid Systems)

Flowserve Corporation: (Pumps, Valves, and Seals)

Grundfos Holding A/S: (Pumps and Pump Systems)

ITT Inc.: (Pump Systems and Fluid Management)

KSB SE & Co. KGaA: (Pumps and Valves)

Sulzer Ltd.: (Pumps and Mixing Solutions)

The Gorman-Rupp Company: (Pumps and Pumping Systems)

The Weir Group Plc: (Mining and Oil & Gas Pumps)

Xylem Inc.: (Water and Wastewater Solutions)

Pentair plc: (Water Treatment and Filtration Systems)

Schneider Electric: (Pump Control Solutions)

SPX Flow: (Pumps and Fluid Handling)

National Oilwell Varco: (Oilfield Equipment and Pumps)

Honeywell International Inc.: (Fluid Control Solutions)

Kohler Co.: (Water and Wastewater Pumps)

Eaton Corporation: (Fluid Power and Pump Solutions)

Cameron International: (Schlumberger) (Pump Systems for Oil & Gas)

Tsurumi Manufacturing Co., Ltd.: (Submersible Pumps)

Baker Hughes: (Oilfield Equipment and Pump Systems)

In 11th April 2024: Sulzer has announced significant investments in its U.S. manufacturing and supply chain to enhance pump production capabilities. This initiative will include expanding its facilities and optimizing supply chain processes, aiming to improve efficiency and better serve the North American market.

In 25th April 2024: Netzsch will unveil an advanced Nemo progressing cavity pump at ACHEMA 2024 in Frankfurt. This new model targets the chemical sector, especially in battery production, designed to handle aggressive and abrasive media without costly mechanical seals. Attendees can explore the innovation at Netzsch's booth.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 55.95 Billion |

| Market Size by 2032 | USD 87.3 Billion |

| CAGR | CAGR of 4.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Centrifugal Pumps, Positive Displacement Pumps, Reciprocating Pumps, Rotary Pumps, Others) • By Application (Oil & Gas, Chemicals, Construction, Power Generation, Water & Wastewater Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco AB, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, ITT Inc., KSB SE & Co. KGaA, Sulzer Ltd., The Gorman-Rupp Company, The Weir Group Plc, Xylem Inc., Pentair plc, Schneider Electric, SPX Flow, National Oilwell Varco, Honeywell International Inc., Kohler Co., Eaton Corporation, Cameron International (Schlumberger), Tsurumi Manufacturing Co., Ltd., Baker Hughes. |

| Key Drivers | •Growing industrialization is fueling demand for industrial pumps across sectors like oil and gas, water treatment, chemicals, and power generation due to enhanced infrastructure development and the need for efficient fluid management. •Technological advancements in pump systems, including smart pumps and energy-efficient designs, are improving operational efficiency and performance, driving increased investment in innovative pumping solutions. |

| RESTRAINTS | • High initial costs for advanced industrial pumps create a financial barrier for small and medium-sized enterprises (SMEs), hindering their ability to invest in modern pumping technologies. |

Ans: The Industrial Pumps Market is expected to grow at a CAGR of 4.92% during 2024-2032.

Ans: The Industrial Pumps Market was USD 55.95 Billion in 2023 and is expected to Reach USD 87.3 Billion by 2032.

Ans: Growing industrialization is fueling demand for industrial pumps across sectors like oil and gas, water treatment, chemicals, and power generation due to enhanced infrastructure development and the need for efficient fluid management.

Ans: The “centrifugal pump” segment dominated the Industrial Pumps Market.

Ans: North America dominated the Industrial Pumps Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Utilization Rates, by Region, (2020-2023)

5.2 Maintenance and Downtime Metrix

5.3 Manufacturing Output, by Region, (2020-2023)

5.5 Spending on Industrial Pumps, by Industry (Oil & Gas, Water & Wastewater, Chemical, etc.), 2023

5.6 Technological Advancements and Trends in Smart and Energy-efficient Industrial Pumps (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Industrial Pumps Market Segmentation, By Product Type

7.1 Chapter Overview

7.2 Centrifugal Pumps

7.2.1 Centrifugal Pumps Market Trends Analysis (2020-2032)

7.2.2 Centrifugal Pumps Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Axial Flow Pump

7.2.3.1 Axial Flow Pump Market Trends Analysis (2020-2032)

7.2.3.2 Axial Flow Pump Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Radial Flow Pump

7.2.4.1 Radial Flow Pump Market Trends Analysis (2020-2032)

7.2.4.2 Radial Flow Pump Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Mixed Flow Pump

7.2.5.1 Mixed Flow Pump Market Trends Analysis (2020-2032)

7.2.5.2 Mixed Flow Pump Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Positive Displacement Pumps

7.3.1 Positive Displacement Pumps Market Trends Analysis (2020-2032)

7.3.2 Positive Displacement Pumps Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Reciprocating Pumps

7.4.1 Reciprocating Pumps Market Trends Analysis (2020-2032)

7.4.2 Reciprocating Pumps Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Rotary Pumps

7.5.1 Rotary Pumps Market Trends Analysis (2020-2032)

7.5.2 Rotary Pumps Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Industrial Pumps Market Segmentation, by Application

8.1 Chapter Overview

8.2 Oil & Gas

8.2.1 Oil & Gas Market Trends Analysis (2020-2032)

8.2.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Chemicals

8.3.1 Chemicals Market Trends Analysis (2020-2032)

8.3.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Construction

8.4.1 Construction Market Trends Analysis (2020-2032)

8.4.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Power Generation

8.5.1 Power Generation Market Trends Analysis (2020-2032)

8.5.2 Power Generation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Water & Wastewater Treatment

8.6.1 Water & Wastewater Treatment Market Trends Analysis (2020-2032)

8.6.2 Water & Wastewater Treatment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Industrial Pumps Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.4 North America Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.5.2 USA Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.6.2 Canada Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Industrial Pumps Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Industrial Pumps Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.6.2 France Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Industrial Pumps Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.5.2 China Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.5.2 India Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.5.2 Japan Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.9.2 Australia Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Industrial Pumps Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Industrial Pumps Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.2.4 Africa Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Industrial Pumps Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.4 Latin America Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Industrial Pumps Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Industrial Pumps Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Atlas Copco Ab

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Ebara Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Flowserve Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Grundfos Holding A/S

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Itt Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Ksb Se & Co. Kgaa

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Sulzer Ltd.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 The Gorman-Rupp Company

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 The Weir Group Plc

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Xylem Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Product Type

Centrifugal Pumps

Axial Flow Pump

Radial Flow Pump

Mixed Flow Pump

Positive Displacement Pumps

Reciprocating Pumps

Rotary Pumps

Others

By Application

Oil & Gas

Chemicals

Construction

Power Generation

Water & Wastewater Treatment

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Compressor Control System Market was estimated at USD 5.56 billion in 2023 and is expected to reach USD 8.46 billion by 2032, with a growing CAGR of 4.78% over the forecast period 2024-2032.

Earthmoving Equipment Market size was USD 63.10 billion in 2023 and is expected to reach USD 108.53 billion by 2032, growing at a CAGR of 6.21% from 2024-2032.

The Coordinate Measuring Machine (CMM) Market size was valued at USD 4.13 Billion in 2023 and is anticipated to grow to USD 8.25 Billion by 2032, displaying a compound annual growth rate (CAGR) of 8.00% during the forecast Period 2024-2032.

The Electrical Equipment Market was valued at USD 276.89 Billion in 2023, and it is expected to reach USD 312.40 Billion by 2032, registering a CAGR 1.35% of from 2024 to 2032.

The Hydronic Control Market was estimated at USD 37.45 billion in 2023 and is expected to reach USD 49.25 billion by 2032, with a growing CAGR of 3.09% over the forecast period 2024-2032.

The Aerial Work Platform Market size was estimated at USD 11.34 Billion in 2023 and is expected to reach USD 23.81 Billion by 2032 at a CAGR of 8.59% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone