Industrial Part Feeders Market Report Scope & Overview:

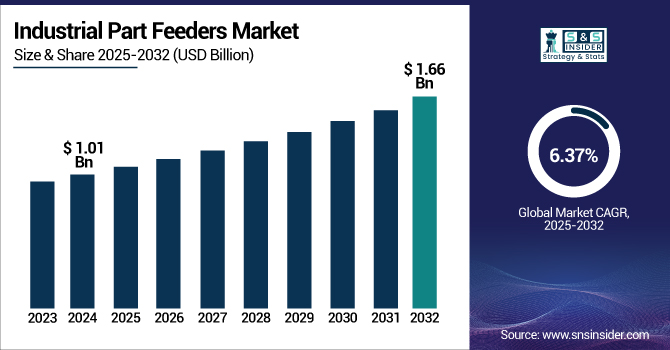

The Industrial Part Feeders Market size was valued at USD 1.01 billion in 2024 and is expected to reach USD 1.66 billion by 2032, with a growing CAGR of 6.37% over the forecast period 2025-2032.

To Get more information on Industrial Part Feeders Market - Request Free Sample Report

The industrial part feeders market is experiencing robust growth, mainly due to the rising adoption of automation in multiple industries. Especially, the vibratory feeder segment is very important for applications such as pharmaceuticals, electronics, and food processing, where material handling requires precise control and efficiency.

Growing demand for belt feeders is witnessed in the market as they are used in heavy-duty applications in mineral processing, such as mining & bulk material handling. This feeder is useful for bulk handling and has continuous material flow output in industries that require it. The rise in innovation towards energy-efficient and environment-friendly properties is further propelling the demand for belt feeders, in conjunction with the need to reduce the cost of operations and enhance the safety standards across the industry.

Although relatively few, opportunities in the industrial part feeders market are getting broader with the development of technology and gradual industrial automation. Smart, connected vibratory feeders designed with principles of Industry 4.0 are gaining momentum. Real-time monitoring, predictive maintenance, and self-optimization capabilities provided by these feeders enable manufacturers to enhance overall equipment effectiveness and minimize downtime. Furthermore, the increased focus on sustainability and energy efficiency is prompting a new wave of green feeder innovations, which is further expanding their market penetration across industries.

In March 2025: Coperion K-Tron provided high-precision feeders to Pfizer’s newly established high-containment manufacturing facility in Freiburg, Germany. These feeders play a crucial role in the facility’s automated production line, boosting both efficiency and productivity in pharmaceutical manufacturing.

Industrial Part Feeders Market Dynamics

Drivers

-

Rising Automation Across Industries Drives Demand for Smarter and More Efficient Industrial Part Feeders

Growing manufacturing automation one of the significant factors which is projected to boost growth of the industrial part feeder’s market. With more automation in the automotive, electronics, and consumer goods industries, the demand for reliable and efficient part feeders increases. They provide continuous flow of components to assembly lines for maximum production efficiency. Part feeders are also an integral part of the automation that provides higher operational efficiency, lowers labor costs, and improves product quality, helping manufacturers easily maintain operations. Similarly, Part feeders are also becoming smarter as part feeders are also advancing with the pace of evolution of key robotic systems and Industry 4.0 technologies, integrating new features such as AI and IoT for real-time monitoring and predictive maintenance. Such need is encouraging requirement for automation as manufacturers aim to create edge over each other, thus driving the market. This will lead to increased market demand in the next few years with optimum requirement for more flexible feeders, custom metal feeders, and efficient metal feeders.

-

Demand for Precision and Miniaturization Fuels Advancement and Adoption of Smart Industrial Part Feeders

Industries such as electronics, aerospace, and automotive, which require high precision and likewise ever-increasing consistency, have driven the demand for accuracy in industrial part feeders. Part feeders have to be accurate and reliable in feeding parts, especially small or sensitive ones, as the manufacturers are driving to higher efficiency and quality. Miniaturization and intricacy are the directions of parts, which is why complex feeders are designed with improved feeding systems alongside sensors and controls. Such systems ensure that very few parts are fed with errors lavishly leading to minimal downtime and thus leading to higher productivity. The growing accuracy efforts are improving the product, thereby bringing the industrial part feeders market growth, where manufacturers are looking to buy more feeders as assembly accuracy can no longer be compromised. Hence, this requirement is augmenting the need for an advanced, adaptable, and smart feeding systems, thus fuel the growth of the market.

In 2024: Schenck Process FPM rebranded to Coperion, consolidating their presence in the market. This merger aimed to combine strengths and offer enhanced system solutions to customers worldwide.

Restraint

-

High integration complexity to hinder the adoption of industrial part feeders

Incorporating these feeders to existing manufacturing systems often presents challenges for businesses as it requires special expertise and custom configurations. Automatic feeders for parts have to get in sync with other automation equipment such as robotic arms, conveyors or even sorting machines, hence production line adjustments might be needed. While integration can include complex technical work like coding, calibration, and testing – the design process often needs external consulting or in-house specialists with specialized expertise. For companies with limited technical resources, that complexity translates into lengthy implementation cycles, increased costs and disruption to operations. Moreover, integration can be made even more complex by the requirement to work with legacy or out-of-date equipment or systems. This causes hesitation for businesses to use part feeders in the first place if they believe there will be very high upfront costs and interruptions in how the machines work before they are transformed.

-

Rapid Technological Advancements and Upgrade Costs Restrain Industrial Part Feeders Market

These are significant restraints to the industrial part feeder’s market such as technological obsolescence. IT lags borne out of technological progression as it has rendered out-of-date systems and components almost obsolete, and can propel companies towards paying for high-end upgrades to ensure they remain updated and functional. This pressure of improved technologies may lead the companies, especially small and medium enterprises, to a financial crisis. Considering the repeated need to upgrade to stay in tune with the latest advancements, at times, dissuades organizations from exploring automated part feeding solutions. Moreover, the risk of investing in something that could be quickly outdated further discourages people from thinking longer-term about these technologies, thereby limiting the overall market expansion. This results in businesses remaining on legacy or archaic and poorly optimized systems, stifling market growth by preventing the rollout of new part feeder systems.

Industrial Part Feeders Market Segmentation Outlook

By Type

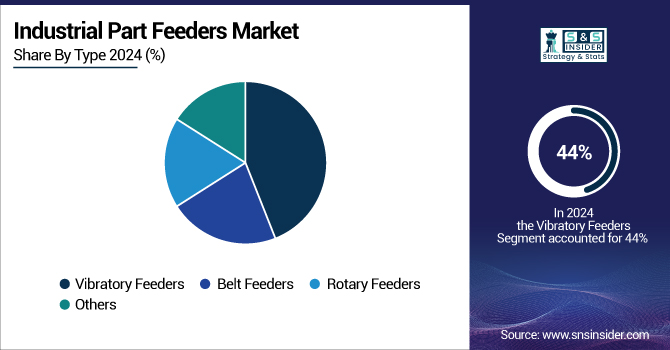

The vibratory feeders segment dominated with a market share of over 44% in 2024, as vibratory feeders are widely known for their accuracy, versatility, and ability to perform with various materials. Such feeders are popular in industries like pharmaceuticals, electronics, and food processing. They, for one, provide gentle handling of sensitive products, which helps reduce product damage during processing. Coupled with continuous innovation that has made them more efficient and better integrated into our automated systems, this has spurred a rising demand for them. Due to their ability to provide an accurate and consistent feed rate, they are a reliable and preferred solution for various industrial applications with low maintenance needs.

Belt feeders are emerging as the fastest-growing segment in the industrial part feeders market, owing to the ongoing demand for heavy-duty applications such as mining and bulk material handling. Known for their robust and reliable performance, these feeders can handle large volumes with little to no fluctuation to provide a steady flow of material to processing systems. The strong body, operational stability, and safe construction make it a suitable product for industries where continuous material flow is needed. In addition, continued innovations that will facilitate energy efficiency, dust emission reduction, and worker safety are propelling the demand for this equipment/ attachments. With industries looking towards the future in operational safety and sustainability, belt feeders will become more prevalent as a suitable and practical solution to cope with arduous industrial conditions.

By Application

The General manufacturing segment dominated the industrial part feeders market share of over 42% in 2024, owing to the widespread use of automation and assembly technologies in a wide range of industries. Integrating hundreds of thousands of pieces of a single part in a piece of equipment into a comprehensive assembly or fabrication process is a key factor in streamlining operations, supporting production efficiencies, and driving down required manual operations. Whether you need electronics or machinery, feeders are necessary to provide components regularly with accuracy to robotic arms or assembly stations. It helps to improve the efficiency and decrease downtime and error rates. This is to be credited to the wide-ranging applications of this sector as well as firm demand for high-speed, high-precision production. In addition, the growing demand for global quality standards conciliation and cost-effective processes is compelling manufacturers to deploy automated part feeding systems in their manufacturing units.

The automotive industry is the fastest-growing segment, owing to the automotive industry adopting advanced manufacturing and automation solutions at a fast pace. With an increase in the complexity of vehicle designs, coupled with an increase in production volumes, component assemblers are investing in part feeders to ensure accuracy, speed, and reliability in assembling vehicle components. A prominent example of this trend is the electric vehicle (EV) space, where sensitive electronic and battery components need to be carefully managed. Additionally, automotive manufacturers are focused on lowering production costs while achieving world-class quality, which part feeders assist with by allowing for automation. The demand for automotive grows globally, coupled with technological innovation and the transition to Industry 4.0, further pushing growth in this vertical.

Industrial Part Feeders Market Regional Analysis

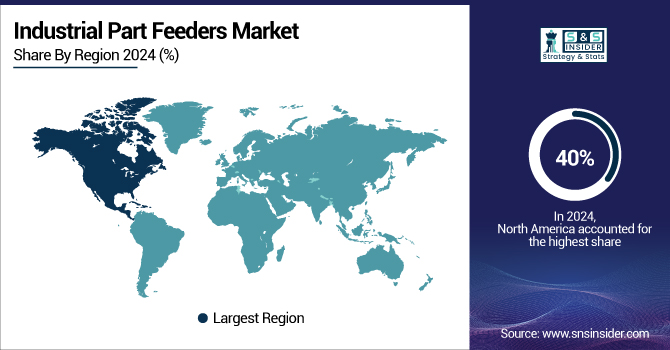

North America region dominated with a market share of over 40% in 2024, due to the manufacturing infrastructure in the region, along with an early uptake of automation in various industries such as automotive, electronics, and aerospace. Regional growth is attributed mainly to the presence of large manufacturers and technology providers located in the U.S. and Canada. The growth is also being enhanced due to government support of smart manufacturing initiatives and industrial IoT (IIoT) integration.

In 2024, the U.S. industrial part feeders market is valued at USD 0.29 billion and is projected to reach USD 0.47 billion by 2032, registering a CAGR of 5.97%. during the forecast period. This is mainly due to the growing adoption of automation and robotics in manufacturing, particularly in automotive and electronics manufacturing. While the U.S. is sort of at the bottom of that pyramid, it has a huge industrial base and continuing technological upgrades going on in it.

Canada’s market is witnessing steady growth, with a CAGR of 6.74%, driven by increasing food processing and packaging automation across the country. The expansion of the market is being supported by the Government's drive toward smart manufacturing along with increasing investments in industrial automation.

Mexico’s market is expanding gradually with a CAGR of 5.96% due to an increase in manufacturing activities in automotive and consumer electronics.

Asia-Pacific is experiencing the fastest growth over the forecast period, due to swift industrialization and expansion of the manufacturing sector in China, India, South Korea, and Japan. The area capitalizes on affordable production, a sizeable workforce, and foreign investment inflows; Asian or Asia-Pacific governments are actively promoting automation and Smart Factory programs, aided by “Make in India”, “Made in China 2025” type initiatives and incentives. With industries looking to increase productivity and looking to reduce the dependency on manual labor, there is an increase in the adoption of automation tools, which in turn includes the industrial part feeders.

India is expected to witness the fastest growth in the Industrial Part Feeders Market, with a projected CAGR of 7.2%. The major forces that are driving this growth are the rapidly rising industrial automation in manufacturing industries, growing demand for a large number of efficient material handling systems along with increasing adoption of automated material handling systems that are used to reduce operational costs and to improve production efficiency.

Europe held a significant share in 2024, due to the presence of key industries such as automotive, pharmaceuticals, electronics, etc. Germany, Italy, and France are also major contributors, with a strong history of engineering and industrial automation. High product quality, precision as well as safety standards, make the region a big demand for highly reliable and efficient part feeding technology. Additionally, Europe’s emphasis on sustainability and energy efficiency in manufacturing promotes the adoption of a modern feeder system with minimal waste and energy consumption.

Germany is a leading country in Europe region. It ranks highly across Europe for industrial robot density with 429 robots per 10,000 employees, emphasizing its commitment to increasing automation in production. The focus on robotics gives it an edge in optimizing the efficiency and precision of manufacturing operations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Industrial Part Feeders Companies are:

Meyer Industries, Inc., Syntron Material Handling, AViTEQ Vibrationstechnik GmbH, Acrison, Inc., JÖST GmbH + Co. KG, Coperion K-Tron, Schenck Process, Eriez Manufacturing Co., Graco Inc., Weber Schraubautomaten GmbH

Recent Development

-

In April 2024: Coperion K-Tron launched the ProRate Plus-MT twin-screw feeder, specifically engineered for handling challenging powders such as talc and calcium carbonate. The design includes a horizontal agitator that ensures consistent and optimal screw filling, making it ideal for processing difficult materials.

-

In March 2024: During NPE 2024, Coperion, in collaboration with Schenck Process Food and Performance Materials (FPM), showcased integrated system solutions, featuring the new ProRate PLUS-MT feeder. This joint presentation was aimed at delivering comprehensive and efficient solutions to plastic processors.

-

In July 2023: Coperion K-Tron upgraded its feeders by replacing traditional DC motors with advanced servo motors. This shift significantly improves the feeders’ flexibility, boosts energy efficiency, and extends their operational lifespan.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.01Billion |

| Market Size by 2032 | USD 1.66 Billion |

| CAGR | CAGR of 6.37% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Vibratory Feeders, Belt Feeders, Rotary Feeders, Others) • By Application (General Manufacturing, Automotive, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Meyer Industries, Inc., Syntron Material Handling, AViTEQ Vibrationstechnik GmbH, Acrison, Inc., JÖST GmbH + Co. KG, Coperion K-Tron, Schenck Process, Eriez Manufacturing Co., Graco Inc., Weber Schraubautomaten GmbH |