Industrial Microscope Market Report Scope & Overview:

To get more information on Industrial Microscope Market - Request Free Sample Report

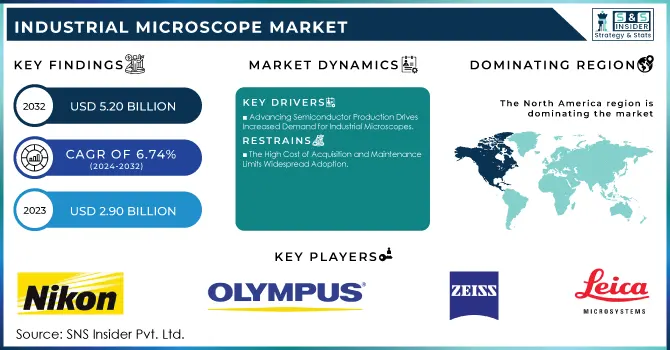

The Industrial Microscope Market Size was valued at USD 2.90 billion in 2023 and is expected to reach USD 5.20 billion by 2032 and grow at a CAGR of 6.74% over the forecast period 2024-2032.

Industrial Microscope Market has witnessed significant growth and development in technologies in Japan, China, USA, France, Germany, and India in 2023 and 2024. The countries have been in demand by investing in massive amounts of research, manufacturing, and government-initiated projects. For example, in the last two years, both Japan and Germany have also doubled funding into nanotechnology and materials science research, meaning advanced microscopy tools must be utilized to accurately analyze samples. Meanwhile, the USA's CHIPS Act, meant to boost semiconductor manufacturing, is triggering its use in even making electronic parts and in assessing quality.

The "Made in China 2025" strategy of China and the "Make in India" campaign by India have focused on local manufacturing, thus increasing the demand for microscopy solutions in healthcare, electronics, and other industries. France's thrust on sustainability in industrial processes and materials has also contributed to increased adoption of advanced microscopes. Governments are now encouraging manufacturers to introduce AI, machine learning, and IoT into microscopy technologies to increase efficiency and accuracy.

Recent technological innovations have further fueled market dynamics. For instance, China's development of a new core electron microscope for the semiconductor industry, reported in January 2024, underlines its commitment to leading the hi-tech imaging race. Similarly, Leica Microsystems introduced the MATEO FL AI-powered digital fluorescence microscope in August 2024, enhancing imaging capabilities with AI technology to meet advanced medical and industrial needs. In November 2024, ASH Technologies unveiled a 4K digital microscope with advanced imaging and measurement software that streamlines processes and improves measurement precision.

Electron microscopes have now added the advantage of AI-driven defect detection and atomic-level imaging. In 2023, high-resolution digital optical microscopes were launched and in turn opened new applications for segments like biotechnology, materials science, and semiconductor manufacturing. These advances go hand-in-hand with user-friendly interfaces and automation features reducing the operational complexities.

Industrial Microscope Market Dynamics

Key Drivers:

- Advancing Semiconductor Production Drives Increased Demand for Industrial Microscopes

Advances in semiconductor production have increased industrial microscope usage by 45% in 2023. The electronics and semiconductor industry heavily relies on industrial microscopes for defect analysis, failure testing, and quality assurance. Governments globally, including the USA’s $280 billion CHIPS Act, are driving local semiconductor manufacturing to reduce supply chain dependencies.

In Asia, China and Japan are leading investments in high-resolution microscopy technologies for cutting-edge electronics. With the miniaturization of components, demand for advanced imaging capabilities has grown by 45% year-over-year in 2023, per government and industry reports. This trend aligns with the rising use of 5G devices, IoT technology, and autonomous systems, all requiring precise component inspection. Industrial microscopes equipped with AI analytics further streamline defect detection, enhancing production efficiency.

- Biomedical Research Drives Growing Demand for Advanced Industrial Microscopes

Biomedical research applications increased microscopy usage by 38% from 2023 to 2024. Industrial microscopes are indispensable in medical research and diagnostics for cellular analysis, tissue imaging, and drug development. In 2023, Japan and Germany allocated 25% more funding to bioscience research compared to 2022, emphasizing microscopy for cancer and genetic studies. India’s National Health Mission has encouraged the integration of high-resolution microscopes in hospitals and laboratories.

Similarly, the USA’s National Institutes of Health (NIH) recorded a 20% rise in projects using advanced microscopy tools in 2023. These microscopes, featuring real-time imaging and automation, enhance disease detection and streamline pharmaceutical testing. As personalized medicine and genomic research expand, the biomedical field will remain a crucial driver for the industrial microscope market.

Restrain:

- The High Cost of Acquisition and Maintenance Limits Widespread Adoption.

Industrial microscopes, particularly electron and scanning probe microscopes, require significant financial investment, often exceeding $500,000 for high-end models. Moreover, their upkeep demands specialized technicians and costly replacement parts, further straining budgets for small- and medium-sized enterprises (SMEs). In countries like India and France, limited government subsidies for microscopy-related research hinder procurement, restricting market penetration in emerging sectors.

Additionally, the steep learning curve associated with advanced functionalities poses operational challenges, deterring potential buyers. While large corporations and research institutions in nations like the USA and Germany can accommodate these expenses, smaller organizations face barriers to entry. Addressing these concerns requires manufacturers to offer cost-effective, scalable solutions tailored to diverse user needs.

Industrial Microscope Market Segmentation

By Product Type

The Optical Microscopes segment dominated in 2023 with 42% market share, driven by their affordability and versatile applications in quality control and education. Innovations in digital optical microscopes with AI-powered image processing have enhanced their utility in materials science and life sciences.

The Electron Microscopes segment is projected to grow with the fastest CAGR of 7.40% during 2024-2032, owing to their unparalleled resolution and ability to analyze nanostructures. Scanning probe microscopes are gaining traction in research-intensive applications, including nanotechnology and molecular biology, due to their precision in surface characterization.

Other emerging categories, such as hybrid microscopes, are also contributing to the market by combining multiple imaging techniques, providing comprehensive solutions for complex analyses.

By Type

The Compound Microscope segment dominated in 2023 with 64% of the market share, reflecting its widespread use in academia, laboratories, and industrial inspection. Compound microscopes’ adaptability for both biological and material studies makes them indispensable across industries. The stereo microscopes segment is projected to grow with the fastest CAGR of 7.19% from 2024 to 2032, fueled by their application in 3D imaging, electronics assembly, and precision manufacturing.

Stereo Microscopes are increasingly integrated with digital interfaces for enhanced visualization and ease of data sharing. Other types, such as inverted and digital microscopes, are also gaining attention due to their ability to accommodate diverse samples and facilitate remote collaborations, particularly in post-pandemic research environments.

Industrial Microscope Market Regional Analysis

The industrial microscope market exhibits a strong regional footprint, with North America dominating in 2023 with 34% of the market share, largely due to technological advancements and robust investments in R&D. The USA, in particular, leads with widespread adoption in biotechnology and semiconductor industries.

Asia Pacific is projected to grow the fastest with a CAGR of 8.73% during 2024-2032, driven by rising industrialization in China and India. Government initiatives like “Made in China 2025” and India’s PLI Scheme support local manufacturing and innovation, bolstering demand for advanced microscopy solutions. Europe, with strongholds like Germany and France, continues to leverage industrial microscopes for research and precision engineering, maintaining its competitive edge.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Industrial Microscope Market

Some of the major players in the Industrial Microscope Market are

-

Nikon Corporation (Optical Microscopes, Digital Microscopes)

-

Olympus Corporation (Stereo Microscopes, Electron Microscopes)

-

Carl Zeiss AG (Scanning Electron Microscopes, Confocal Microscopes)

-

Leica Microsystems (Digital Microscopes, Optical Microscopes)

-

Hitachi High-Tech Corporation (Electron Microscopes, Scanning Probe Microscopes)

-

JEOL Ltd. (Transmission Electron Microscopes, Scanning Electron Microscopes)

-

Bruker Corporation (Scanning Probe Microscopes, Atomic Force Microscopes)

-

Thermo Fisher Scientific (Electron Microscopes, Cryo-Electron Microscopes)

-

Keyence Corporation (Digital Microscopes, Stereo Microscopes)

-

Meiji Techno Co., Ltd. (Compound Microscopes, Stereo Microscopes)

-

Motic Microscopes (Digital Microscopes, Laboratory Microscopes)

-

CAMECA Instruments (Electron Probe Microanalyzers, SIMS Microscopes)

-

TESCAN ORSAY HOLDING (Focused Ion Beam Microscopes, Scanning Electron Microscopes)

-

Rigaku Corporation (X-ray Microscopes, Scanning Electron Microscopes)

-

Ametek, Inc. (Surface Profiling Microscopes, Optical Microscopes)

-

Bausch + Lomb (Optical Microscopes, Lab Microscopes)

-

Veeco Instruments Inc. (Scanning Probe Microscopes, Atomic Force Microscopes)

-

Nanolive SA (3D Cell Explorers, Digital Microscopes)

-

Delong Instruments (Transmission Electron Microscopes, Low Voltage Electron Microscopes)

-

Horiba Ltd. (Raman Microscopes, Optical Microscopes)

MAJOR SUPPLIERS (Components, Technologies)

-

Schott AG (Optical Glass, Illumination Systems)

-

Edmund Optics (Lenses, Optical Components)

-

Hoya Corporation (Optical Filters, Optical Glass)

-

Asahi Glass Co., Ltd. (Specialized Glass, Optical Coatings)

-

Precision Micro-Optics (Optical Lenses, Prisms)

-

Newport Corporation (Optical Systems, Precision Components)

-

Lambda Research Optics (Infrared Optics, Mirrors)

-

Gooch & Housego (Acousto-Optic Devices, Optical Components)

-

OptoSigma Corporation (High-Precision Lenses, Optical Filters)

-

Ohara Corporation (Specialty Glass, Optical Materials)

MAJOR CLIENTS

-

Intel Corporation

-

Samsung Electronics

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Roche Diagnostics

-

Thermo Fisher Scientific (as a buyer for complementary products)

-

Johnson & Johnson

-

BASF SE

-

Pfizer Inc.

-

Harvard University (Research Laboratories)

-

Massachusetts Institute of Technology (MIT)

RECENT TRENDS

-

November 2024: To provide researchers with leading-edge microscopy technologies, the Indian Institute of Technology, Hyderabad and Nikon India on Monday have launched India's first-ever such centre of excellence at its campus. The centre will serve as a hub for innovation, that will enable researchers to explore various scales, from single cells right up to human tissues to understand biological systems.

-

May 2023: Olympus Corporation ("Olympus") has announced that it has finalized the separation of its Scientific Solutions business as a wholly-owned subsidiary called Evident Corporation ("Evident"). With this divestiture of the Imaging business completed, this further indicates the long-term strategy for the company in becoming a leading player in the medtech industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.90 Billion |

| Market Size by 2032 | US$ 5.20 Billion |

| CAGR | CAGR of 6.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Optical Microscopes, Electron Microscopes, Scanning Probe Microscopes, Others), • By End Use (Semiconductor & Microelectronics, Healthcare, General Manufacturing, Food Processing, Construction, Others) • By Application (Material Science, Semiconductor, Life Sciences, Nanotechnology, Others) • By Type (Compound, Stereo, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nikon Corporation, Olympus Corporation, Carl Zeiss AG, Leica Microsystems, Hitachi High-Tech Corporation, JEOL Ltd., Bruker Corporation, Thermo Fisher Scientific, Keyence Corporation, Meiji Techno Co., Ltd., Motic Microscopes, CAMECA Instruments, TESCAN ORSAY HOLDING, Rigaku Corporation, Ametek, Inc., Bausch + Lomb, Veeco Instruments Inc., Nanolive SA, Delong Instruments, Horiba Ltd.. |

| Key Drivers | • Advancing Semiconductor Production Drives Increased Demand for Industrial Microscopes • Biomedical Research Drives Growing Demand for Advanced Industrial Microscopes |

| Restraints | • The High Cost of Acquisition and Maintenance Limits Widespread Adoption. |