Get More Information on Industrial Gas Sensors Market - Request Sample Report

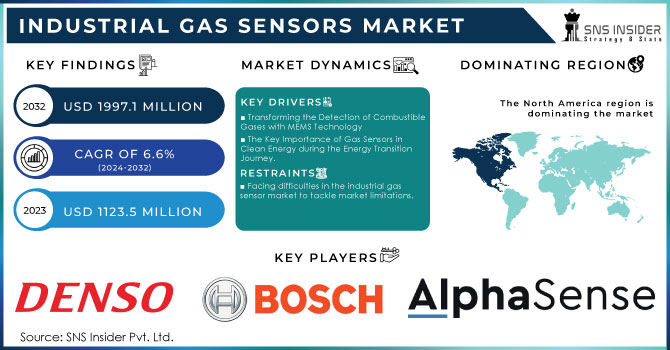

The Industrial Gas Sensors Market size was valued at USD 1123.5 million in 2023 and is expected to grow to USD 1997.1 million by 2032 and grow at a CAGR of 6.6 % over the forecast period of 2024-2032.

The Industrial Gas Sensors Market is seeing substantial growth due to rising need for improved safety protocols and environmental surveillance in sectors like manufacturing, oil & gas, mining, and chemical processing. Gas sensors used in industries are crucial for identifying dangerous gases such as carbon monoxide, methane, and volatile organic compounds (VOCs). They help prevent accidents, ensure worker safety, and adhere to strict environmental regulations. Major factors influencing the market include the increasing adoption of Industrial Internet of Things (IIoT) solutions that allow for real-time monitoring and data analytics, enhancing operational efficiency and safety. Furthermore, governments across the globe are implementing stricter regulations concerning emissions and workplace safety, which is increasing the need for gas sensing technologies. Electrochemical, infrared (IR), catalytic, and semiconductor gas sensors are the primary technologies leading the market. Electrochemical sensors are widely favored for their precision in identifying harmful gases. Additionally, the use of wireless and portable gas sensors is increasing because of their versatility and straightforward deployment in inaccessible or dangerous areas.

The rise in greenhouse gas (GHG) emissions, driven largely by fossil fuel combustion for electricity, heat, and transportation, highlights the critical need for technologies that can monitor and manage emissions. In 2022, U.S. greenhouse gas emissions totaled 6,343.2 million metric tons of CO₂ equivalent, reflecting a 0.2% increase compared to 2021 due to a post-pandemic rebound in economic activities. Notably, CO₂ emissions from natural gas rose by 5% relative to 2021, while emissions from coal dropped by 6%, primarily in the electric power sector. The industrial sector is the third largest source of GHG emissions, with significant contributions from fossil fuel combustion and certain chemical processes. As economic activity increases, the demand for accurate, real-time monitoring of emissions is rising, pushing the growth of the industrial gas sensors market. Gas sensors, particularly those integrated with Industrial Internet of Things (IIoT) solutions, play a vital role in monitoring gases like CO₂, methane, and volatile organic compounds (VOCs), ensuring compliance with environmental regulations and improving operational efficiency. As industries and power sectors work to curb emissions and transition towards cleaner energy, the adoption of gas sensors is crucial for tracking both direct and indirect emissions. These sensors help industries adhere to the strict regulatory standards set by bodies like the U.S. Environmental Protection Agency (EPA), which publishes the Inventory of U.S. Greenhouse Gas Emissions and Sinks. With industrial activities accounting for a significant share of GHG emissions, the market for gas sensors is expected to grow steadily as industries seek to reduce their carbon footprint and enhance air quality monitoring systems.

| Report Attributes | Details |

|---|---|

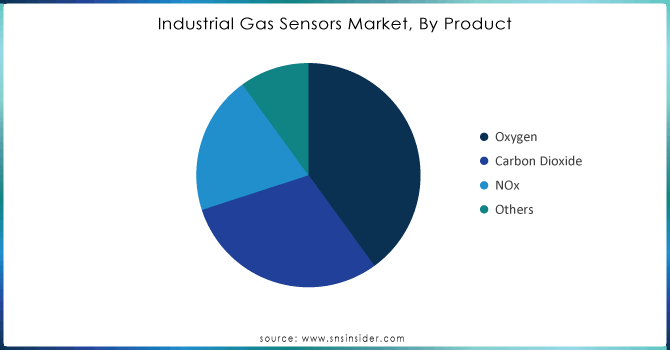

| Key Segments | • By Product (Oxygen, Carbon Dioxide, NOx, Others) • By Technology (Electrochemical, Semiconductor, Infrared, Others) • By End User (Healthcare, Building Automation & Domestic Appliances, Automotive, Petrochemical, Industrial, Others) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

City Technology Ltd. ,DENSO Europe B.V. ,Bosch Sensortec GmbH .Alphasense Figaro Engineering Inc. ,NGK Spark Plug ,Nemoto Sensor Engineering Co. Ltd. ,JJS Technical Services , Aeroqual Ltd. ,Techcomp Group,Honeywell Analytics,Emerson Electric Co. ,Siemens AG,Thermo Fisher ,Teledyne Gas and Flame Detection Msa Safety Incorporated ,RKI Instruments Inc. ,Industrial Scientific Corporation ,Ametek Sensirion AG ,Others |

Market Dynamics

Drivers

The growing need for advanced gas detection technologies in hazardous environments is a key factor driving the industrial gas sensor market. The trend is showcased with the introduction of advanced sensors such as Teledyne's OLCT 100-XP-MS, which integrates MEMS sensor technology. This new gas sensor gives precise measurements for various flammable gases, like hydrogen, methane, propane, and butane, and has benefits like resistance to sensor damage and longer lifespan in tough conditions. As industries look for greener options to natural gas, the need for efficient hydrogen detection solutions increases. MEMS technology enhances gas detection accuracy by providing precise measurements linked to particular gas levels, minimizing false alerts by adjusting for environmental factors such as temperature and humidity. The move towards modern, trustworthy gas detection systems is not only a reaction to regulations but also a proactive effort to increase workplace safety and decrease operational risks. As a result, there is a predicted substantial growth in the industrial gas sensor market due to the rising adoption of advanced technologies by businesses to protect their operations, particularly in industries like petrochemicals, oil and gas, and industrial manufacturing, where risks are elevated.

The shift towards renewable energy and electrical power is leading to a growing need for industrial gas sensors, necessary for tracking greenhouse gas (GHG) emissions and meeting requirements of climate initiatives such as the Paris Agreement. As sectors aim to monitor and decrease their carbon footprint, gas sensors are vital instruments in tracking emissions from natural gas extraction and processing plants. The increasing need for natural gas worldwide, especially in Asia, is amplified by a rise in gas usage in industries, with predictions showing a 2.5% growth in natural gas demand by 2024. The significance of gas sensors is highlighted in upholding safety standards through detecting leaks and ensuring efficient operations in gas facilities. The IEA observed that natural gas markets showed strong growth in early 2024, however, risks to the industry include geopolitical tensions and fluctuating prices. It is crucial to have improved monitoring systems, especially with the EPA showing an 8% rise in CO₂ emissions from fossil fuel burning from 2020 to 2022. These numbers emphasize the critical need for precise and dependable gas detection technologies to reduce environmental effects. The industrial gas sensor market is poised for significant growth as industries implement advanced gas monitoring systems to comply with regulations, improve operations, and support a sustainable energy future.

Restraints

Several major obstacles could impede the growth of the industrial gas sensor market. One of the main obstacles is the expensive nature of cutting-edge gas sensor technologies, such as MEMS and infrared sensors, making them unaffordable for small and medium-sized businesses (SMEs) with restricted budgets. Moreover, businesses may incur higher operational costs due to the requirement for routine maintenance and calibration of these sensors, which entails allocating resources for training and complying with safety regulations. Additionally, due to the fast rate of technological progress, companies might be reluctant to invest in new sensor technologies to avoid becoming outdated. Adding to these problems, regulatory obstacles may obstruct new market players from entering, as adhering to strict safety and environmental rules is frequently intricate and time-consuming. As per the International Energy Agency (IEA), uncertainties in geopolitics and shifts in energy market can impact investment in gas detection technologies, adding to the difficulties faced by manufacturers. Additionally, established players are under pressure to reduce prices without sacrificing quality due to rising competition from low-cost alternatives, mainly from developing markets, which impacts profit margins. It is essential for stakeholders to tackle these market limitations in order to improve the dependability and usage of industrial gas sensors, especially as safety and environmental adherence become top priorities for industries.

Segment Analysis

By Product

In the Industrial Gas Sensors Market, oxygen sensors hold the largest revenue share, accounting for 40% of the market in 2023. This dominance can be attributed to their critical role in various industries, including healthcare, petrochemical, and manufacturing, where monitoring oxygen levels is essential for safety and efficiency. Companies are actively investing in product development to enhance the performance and accuracy of oxygen sensors. For instance, recent innovations have focused on integrating advanced technologies such as Micro-ElectroMechanical Systems (MEMS) and optical sensing methods to improve sensitivity and reduce response times. Teledyne Gas and Flame Detection has launched the OLCT 100-XP-MS range, which incorporates MEMS technology for precise oxygen detection alongside multiple gas capabilities, enhancing reliability in challenging environments. Similarly, manufacturers like Honeywell and Siemens are continuously updating their oxygen sensor offerings, focusing on miniaturization and increased durability to meet the demands of various applications. As industries emphasize safety and compliance with environmental regulations, the need for accurate oxygen monitoring solutions will continue to drive advancements and growth in this segment of the industrial gas sensor market.

Need any customization research on Industrial Gas Sensors Market - Enquiry Now

By End User

In 2023, the Petrochemical segment dominated the Industrial Gas Sensors Market, capturing 32% of the total revenue. This significant share highlights the escalating demand for gas sensors across various industries, particularly in petrochemical, automotive, and healthcare sectors, where accurate monitoring of gas concentrations is critical for ensuring safety and adhering to regulatory standards. To meet this diverse demand, companies are actively investing in product development. For instance, Siemens has launched advanced gas monitoring solutions that integrate seamlessly with their building automation systems, significantly enhancing energy efficiency and safety in commercial applications. Additionally, Honeywell has introduced innovative gas sensor technologies equipped with wireless connectivity and IoT integration, allowing for real-time monitoring and predictive maintenance in industrial environments. Moreover, manufacturers like Dräger and MSA Safety are focusing on the development of portable gas detection devices designed for emergency response and confined space applications, emphasizing user-friendly interfaces and robust data logging capabilities. As industries increasingly prioritize safety and environmental compliance, the need for cutting-edge gas sensing solutions is expected to grow, driving further advancements in product offerings and overall market growth within the industrial gas sensor sector.

Regional Analysis

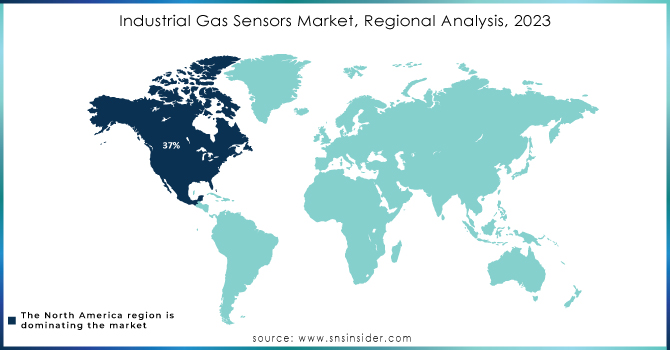

North America holds a dominant position in the Industrial Gas Sensor Market, accounting for 37% of the share in 2023. A robust industrial base, stringent safety regulations, and increasing awareness regarding environmental protection drive this leadership. The region's emphasis on workplace safety and compliance with health standards has propelled the demand for advanced gas sensing technologies across various sectors, including manufacturing, petrochemicals, and healthcare. Major companies are actively investing in product development and innovative solutions tailored for this market. For instance, Honeywell recently launched its Honeywell Analytics range of gas sensors, featuring improved sensitivity and integration capabilities, enabling real-time monitoring and data analysis. Siemens has also introduced cutting-edge gas detection solutions that support industrial automation and enhance safety protocols. Furthermore, Dräger has rolled out portable gas detection devices specifically designed for the North American market, focusing on user-friendliness and reliability in hazardous environments. The U.S. and Canada are witnessing significant advancements in the integration of IoT and AI technologies in gas monitoring systems, facilitating predictive maintenance and operational efficiency. With ongoing investments in infrastructure and the continuous expansion of industrial facilities, North America is poised for further growth in the industrial gas sensor market, ensuring enhanced safety standards and compliance with environmental regulations. This trend reflects the region's commitment to adopting innovative technologies that mitigate risks associated with gas leaks and emissions in various industrial applications.

Asia-Pacific is poised as the fastest-growing region in the Industrial Gas Sensor Market in 2023, driven by rapid industrialization, increasing urbanization, and stringent environmental regulations. Countries like China and India are leading this growth due to their expanding manufacturing sectors and a heightened focus on safety and pollution control. In China, the demand for advanced gas sensors is surging as industries strive to comply with government mandates aimed at reducing emissions and ensuring worker safety. Companies like Beijing Taiming Technology and Hubei Jiahua Gas Detection are introducing innovative gas sensor solutions tailored for hazardous environments, enhancing operational efficiency and safety protocols. In India, firms such as Acoem and Dwyer Instruments are launching new gas detection systems designed for industrial applications, addressing the need for real-time monitoring of toxic gases. For example, Acoem recently unveiled a new range of smart gas sensors that utilize IoT technology for enhanced connectivity and data analysis, enabling industries to better monitor and manage gas emissions. Additionally, advancements in MEMS (Micro-Electro-Mechanical Systems) technology are being integrated into gas sensors, offering improved accuracy and reduced maintenance needs.The overall growth in the Asia-Pacific region is further supported by government initiatives promoting clean energy and sustainable practices, which are expected to propel the adoption of industrial gas sensors across various sectors, including petrochemicals, manufacturing, and healthcare. As these developments unfold, Asia-Pacific is set to emerge as a key player in the global industrial gas sensor landscape.

Some of the Major players in Industrial Gas Sensor with Product and offering:

On January 16, 2024, Teledyne Gas and Flame Detection announced the launch of a new infrared (IR) sensor for its OLCT 100 XPIR fixed gas detector, enhancing stable and reliable methane detection measurements for industrial, utility, and laboratory markets, addressing the critical safety and environmental challenges posed by methane.

On January 13, 2023, RKI Instruments announced an extensive line of gas detection alarm systems for semiconductor manufacturing plants, featuring over 600 gas sensors developed in partnership with RIKEN KEIKI, including the GD-70D, which supports the detection of various gases and complies with TLV-TWA 5ppm COS.

| Report Attributes | Details |

|

Market Size in 2023 |

USD 1123.5 Million |

|

Market Size by 2032 |

USD 1997.1 Million |

|

CAGR |

CAGR of 6.6% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Market Drivers |

• Transforming the Detection of Combustible Gases with MEMS Technology • The Key Importance of Gas Sensors in Clean Energy during the Energy Transition Journey. |

|

Market Restraints |

• Facing difficulties in the industrial gas sensor market to tackle market limitations. |

Ans: The Industrial Gas Sensors Market size was valued at USD 1123.5 million in 2023 and is expected to grow to USD 1997.1 million by 2032

Ans: The major growth factor of the Industrial Gas Sensor Market is the increasing regulatory compliance and safety standards across various industries, driving the demand for advanced gas detection technologies.

Ans: The Oxygen segment dominated the Industrial Gas Sensor Market.

Ans: North America dominated the Industrial Gas Sensor Market in 2023.

Industrial Gas Sensors Market is anticipated to expand by 6.6% from 2024 to 2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Industrial Gas Sensor Market Segmentation, by Product

7.1 Chapter Overview

7.2 Oxygen

7.2.1 Oxygen Market Trends Analysis (2020-2032)

7.2.2 Oxygen Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Carbon Dioxide

7.3.1 Carbon Dioxide Market Trends Analysis (2020-2032)

7.3.2 Carbon Dioxide Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 NOx

7.4.1 NOx Market Trends Analysis (2020-2032)

7.4.2 NOx Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Industrial Gas Sensor Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Electrochemical

8.2.1 Electrochemical Market Trends Analysis (2020-2032)

8.2.2 Electrochemical Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Semiconductor

8.3.1 Semiconductor Market Trends Analysis (2020-2032)

8.3.2 Semiconductor Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Infrared

8.4.1 Infrared Market Trends Analysis (2020-2032)

8.4.2 Infrared Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Industrial Gas Sensor Market Segmentation, by End User

9.1 Chapter Overview

9.2 Healthcare

9.2.1 Healthcare Market Trends Analysis (2020-2032)

9.2.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Building Automation & Domestic Appliances

9.3.1 Building Automation & Domestic Appliances Market Trends Analysis (2020-2032)

9.3.2 Building Automation & Domestic Appliances Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Automotive

9.4.1 Automotive Market Trends Analysis (2020-2032)

9.4.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Petrochemical

9.5.1 Petrochemical Market Trends Analysis (2020-2032)

9.5.2 Petrochemical Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Industrial

9.6.1 Industrial Market Trends Analysis (2020-2032)

9.6.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Industrial Gas Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.4 North America Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.5 North America Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.6.2 USA Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.6.3 USA Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.7.2 Canada Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.7.3 Canada Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.8.2 Mexico Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.8.3 Mexico Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.6.2 Poland Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.6.3 Poland Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.7.2 Romania Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.7.3 Romania Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.8.2 Hungary Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.8.3 Hungary Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.9.2 Turkey Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.9.3 Turkey Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.4 Western Europe Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.5 Western Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.6.2 Germany Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.6.3 Germany Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.7.2 France Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.7.3 France Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.8.2 UK Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.8.3 UK Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.9.2 Italy Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.9.3 Italy Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.10.2 Spain Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.10.3 Spain Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.13.2 Austria Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.13.3 Austria Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Industrial Gas Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia-Pacific Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.4 Asia-Pacific Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.5 Asia-Pacific Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.6.2 China Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.6.3 China Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.7.2 India Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.7.3 India Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.8.2 Japan Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.8.3 Japan Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.9.2 South Korea Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.9.3 South Korea Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.10.2 Vietnam Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.10.3 Vietnam Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.11.2 Singapore Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.11.3 Singapore Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.12.2 Australia Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.12.3 Australia Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.13.2 Rest of Asia-Pacific Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.13.3 Rest of Asia-Pacific Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.4 Middle East Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.5 Middle East Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.6.2 UAE Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.6.3 UAE Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.7.2 Egypt Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.7.3 Egypt Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.9.2 Qatar Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.9.3 Qatar Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Capability Centers Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.4 Africa Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.5 Africa Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.6.2 South Africa Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.6.3 South Africa Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Capability Centers Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Capability Centers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Industrial Gas Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.4 Latin America Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.5 Latin America Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.6.2 Brazil Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.6.3 Brazil Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.7.2 Argentina Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.7.3 Argentina Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.8.2 Colombia Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.8.3 Colombia Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Industrial Gas Sensor Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Industrial Gas Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Industrial Gas Sensor Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 City Technology Ltd

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 DENSO Europe B.V.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Bosch Sensortec GmbH

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Alphasense

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Figaro Engineering Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 NGK Spark Plug

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Nemoto Sensor Engineering Co. Ltd.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 JJS Technical Services

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Aeroqual Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Techcomp Group

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Oxygen

Carbon Dioxide

NOx

Others

By Technology

Electrochemical

Semiconductor

Infrared

Others

By End User

Healthcare

Building Automation & Domestic Appliances

Automotive

Petrochemical

Industrial

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia-Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Ultrafast Laser Market Size was valued at USD 1.87 billion in 2023 and is expected to grow at a CAGR of 16.94% to reach USD 7.54 billion by 2032.

The Pet Wearable Market Size was valued at USD 3.27 billion in 2023 and is expected to grow at a CAGR of 14.77% to reach USD 11.25 billion by 2032.

The Architectural Lighting Market Size was valued at USD 9.39 Billion in 2023 and will reach USD 18.65 Bn by 2032 and grow at a CAGR of 7.96% by 2024-2032.

The Behavioral Biometrics Market Size was valued at USD 1.66 Billion in 2023 and is expected to grow at 26.77% CAGR to reach USD 14.00 Billion by 2032.

The Microwave Devices Market Size was valued at USD 7.16 billion in 2023 and is expected to grow at 6.05% CAGR to reach USD 12.14 billion by 2032.

The Indoor Air Quality Monitor Market was valued at USD 4.66 billion in 2023 and is projected to grow at 8.09% CAGR to reach USD 9.39 billion by 2032.

Hi! Click one of our member below to chat on Phone