Industrial Filtration Market Report Scope & Overview

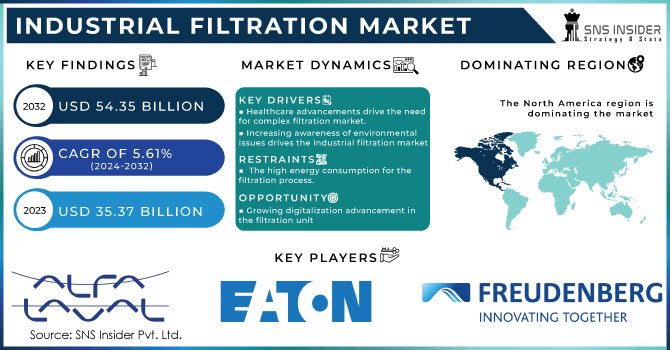

The Industrial Filtration Market size was USD 35.37 billion in 2023 and is expected to Reach USD 54.35 billion by 2032 and grow at a CAGR of 5.61% over the forecast period of 2024-2032.

The industrial filtration market is driven by rising urbanization and industrialization. The market's growth and demand for these products are fueled by the development of new advanced-technology solutions, the expansion of industrial operations, financial support for industrial filtration enterprises, and more.

Get E-PDF Sample Report on Industrial Filtration Market - Request Sample Report

For instance, Metso, improved the machining procedure at its Filtration Technology Center in Lappeenranta, Finland, in 2023. The purpose of the recently constructed facility is to quickly machine filter plate pack frames, which are essential parts of pressure filters used in mining and other industrial settings. It is planned for the new machining unit to begin operations in 2024.

In addition, there will be a future demand for energy to power technologically advanced equipment which drive the industrial filtration market growth. Due to the market players are constantly enhancing their current products and funding the development of cutting-edge media as enabling technology for these sectors in order to satisfy the demands of higher capacity and better filtration performance. Filtration systems are utilized in industries such as pharmaceuticals, liquid waste management, metal & mining, Chemical & Petrochemicals, research, food and beverage packaging, water treatment, and renewable energy generation.

Market Dynamics

Drivers

-

Healthcare advancements drive the need for complex filtration market.

Transformative advancements in the life sciences and pharmaceutical industries have increased human life expectancy while also providing a productive and healthy living. As a result, industries that use this filtering technology, such as medicine research and diagnostics, have increased their use of filtration, such as ultrafiltration and microfiltration, rather than chemical methods to maintain product safety and purity. The expansion of the healthcare business is projected to boost market growth.

The most popular filtering techniques utilized in the pharmaceutical sector are cake, ultra, cross-flow, horizontal, surface, and ultra-filtration. Because of this, sectors like medical research and diagnostics have been using filtration technologies like ultrafiltration and microfiltration more often than chemical methods to maintain the safety and purity of their goods. The growth of the pharmaceutical business is therefore anticipated to propel market expansion.

-

Increasing awareness of environmental issues drives the industrial filtration market growth.

Restraint

-

The high energy consumption for the filtration process.

The significant use of energy in industrial filtering processes can indeed pose difficulties to market growth, especially in light of growing environmental concerns, rising energy costs, and a push for more sustainable and efficient industrial practices. Some sectors may not completely comprehend the advantages and possible cost savings of investing in modern filtering technology. Economic ups and downs can have an impact on industrial spending on filtration systems, hence impacting market growth.

Opportunities

-

Growing digitalization advancement in the filtration unit

The ability to track industrial filters continuously is made possible by the digitalization of filtration systems, which represents a large growth opportunity. The filters are outfitted with sensors that monitor the operational status of the air cleaners and send service-related data to the plant operator. The use of digital technology and the Internet of Things (IoT) can result in predictive maintenance and real-time monitoring of filtration systems, hence increasing operational efficiency.

Market segmentation

By Type

-

Air

-

Liquid

Based on type segment air industrial filtration type held the largest market share around 64% in 2023. Due to the rising health consciousness people and improved better standard of living rise the market demand. In a similar way, major global players and governments are collaborating with environmental groups to create regulations aimed at reducing harmful emissions. Government and industry initiatives to combat air pollution have given the air and gas filtration market more momentum. Additionally, a lot of businesses like chemicals, food & beverage, metals & mining, and healthcare need to treat their air outputs in order to lower the amount of hazardous gases and fumes that are released into the atmosphere. This is anticipated to support the segment's expansion in air and gas filtration. However, during the course of the projected period, the liquid filtration segment is anticipated to hold a bigger proportion. Since almost all industries must treat wastewater, including those that process water, the liquid filtration market has taken the lead.

By Filter Media

-

Metal

-

Filter Papers

-

Fiberglass

-

Nonwovens Fabric

-

Activated Charcoal

The activated carbon segment held the highest revenue share of more than 42.54% in 2023. Heat and chemical treatment can readily regenerate activated carbon in-situ, making it a desirable material for use in applications requiring continuous filtration. The section of the market that deals with activated carbon is anticipated to grow significantly due to the growing emphasis on employing reused media. Additionally, a combination filters are in demand since many filter media are not able to handle all of the pollutants found in effluents on their own. Additionally, the need for materials that do not hurt the environment has spurred the development of various unique renewable media, such nutshells and plant fibers, which has led to the growth of combination filters.

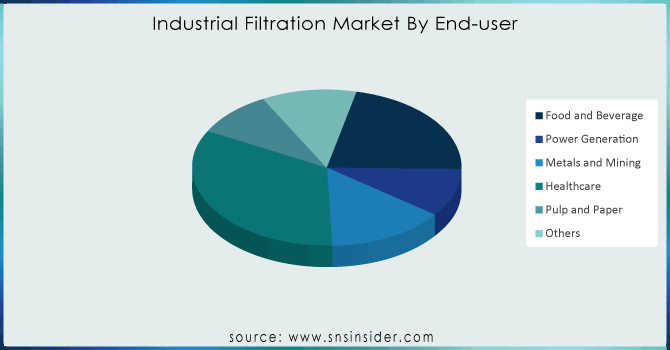

By End-User

-

Chemical and Petrochemicals

-

Food and Beverage

-

Power Generation

-

Metals and Mining

-

Healthcare

-

Pulp and Paper

-

Others

Based on the end-user healthcare industry held the largest market share around 32.24%. Due to the growing need for high purity raw materials in both liquid and gaseous forms, the healthcare sector is anticipated to occupy the greatest share of the market. Additionally, the current Covid-19 pandemic is expected to significantly increase attention to healthcare throughout the projection period, which will propel the growth of this market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

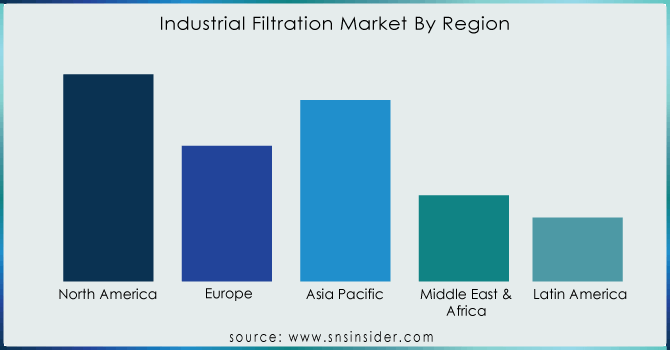

Regional Analysis

North America led the industrial filtration market with the highest revenue share of around 32.45% in 2023. The need for industrial filtration in North America is rising as a result of significant investments made by local businesses to comply with regulations imposed by organizations like the EPA and WHO. Additionally, the growing healthcare and power generation sectors in the area support market expansion. Global demand for semiconductors and microelectronics has surged due to rapid digitization.

Due to its central location in the mining, pharmaceutical, food and beverage, and electronics sectors, Asia Pacific held the second largest share in the market. Growing environmental concerns are fueling the demand for industrial filtration as a result of the rapid industrialization occurring in developing nations such as China, Japan, India, and others.

The market in the European region is characterized by the region's expanding automotive, food and beverage, and pharmaceutical industries. European government's stringent policies and regulations to minimize the reduction of greenhouse gases, pollution, and environmental concerns have driven opportunity for industrial filtration.

On the other hand, the markets in Latin America, the Middle East, and Africa are still developing and will have steady expansion. Growing manufacturing industry migration from developed regions will open up lucrative market opportunities.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Alfa Laval, Freudenberg Group, Cummins Inc., Eaton Corporation, Filtration Group Corporation, Sidco Filter Corporation, Donaldson Company Inc., Camfil, Pall Corporation, MANN+HUMMEL, and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

-

In 2023 MANN+HUMMEL offered solutions for clean air in buildings at the ISH in Frankfurt. One focus is on A+ energy-rated energy-efficient air filters, which help building managers cut energy expenses. In the Eurovent filter classes, MANN+HUMMEL provides more air filters with an A+ rating than any other vendor.

-

In 2023 At SEMICON West, Pall Corporation will present its advanced filtration and purification technology. The need for more sophisticated chips with higher performance and energy efficiency is increasing along with the need for 5G networks, artificial intelligence, and IoT devices.

-

In 2022 Global Filter opened a new manufacturing facility in Cedar Rapids, Iowa, to increase capacity and improve customer service. The expansion will consolidate two existing production sites and offices into a single location. The new headquarters will help Global Filter to expand and expand its production capacity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 35.37 billion |

| Market Size by 2032 | US$ 54.35 Billion |

| CAGR | CAGR of 5.61 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Air, Liquid) •By Filter Media (Metal, Filter Papers, Fiberglass, Nonwovens Fabric, Activated Charcoal)By End-User, (Chemical and Petrochemicals, Food and Beverage, Power Generation, Metals And Mining, Healthcare, Pulp And Paper, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alfa Laval, Freudenberg Group, Cummins Inc., Eaton Corporation, Filtration Group Corporation, Sidco Filter Corporation, Donaldson Company Inc., Camfil, Pall Corporation, 3M, MANN+HUMMEL |

| Key Drivers | • Healthcare advancements drive the need for complex filtration market |

| RESTRAINTS | • The high energy consumption for the filtration process |